Last update 04/08/2019

An enhancing qualitative characteristic that enables different knowledgeable and independent observers to reach consensus, although not necessarily complete agreement, that a particular depiction is a faithful representation.

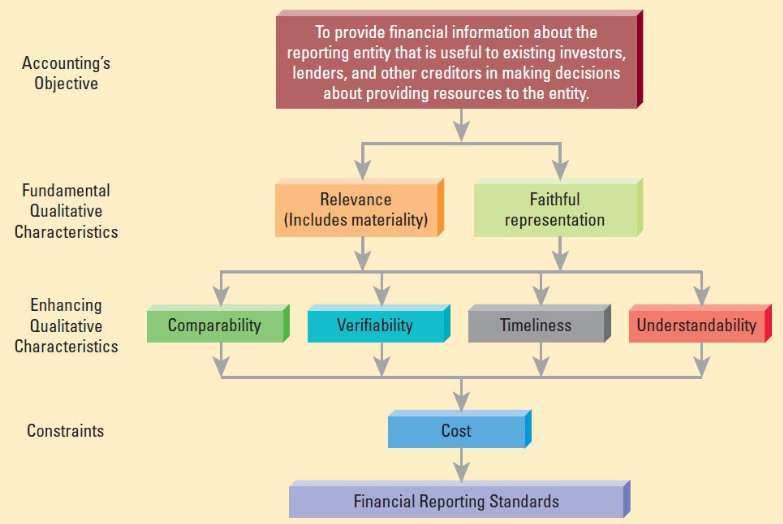

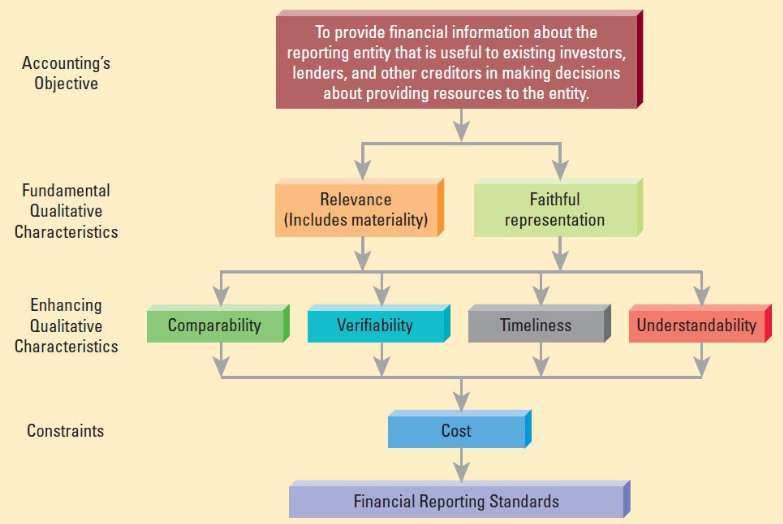

The Conceptual Framework provides the following guidance [Conceptual Framework 2.30 – 2.32]:

Verifiability helps assure users that information faithfully represents the economic phenomena it purports to represent. Verifiability means that different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement, that a particular depiction is a faithful representation. Quantified information need not be a single point estimate to be verifiable. A range of possible amounts and the related probabilities can also be verified.

Verification can be direct or indirect. Direct verification means verifying an amount or other representation through direct observation, for example, by counting cash. Indirect verification means checking the inputs to a model, formula or other technique and recalculating the outputs using the same methodology. An example is verifying the carrying amount of inventory by checking the inputs (quantities and costs) and recalculating the ending inventory using the same cost flow assumption (for example, using the first-in, first-out method).

It may not be possible to verify some explanations and forward-looking financial information until a future period, if at all. To help users decide whether they want to use that information, it would normally be necessary to disclose the underlying assumptions, the methods of compiling the information and other factors and circumstances that support the information.

Discussion on Market value in IFRS

Unless a perfect market exists and all assets possess available market values, fair value measurement introduces aspects of subjectivity and lack of verifiability and accountability to an extent beyond what is generally perceived to be a problem in terms of historical cost accounting. Perhaps, that explains why the FASB prefer to take a cautious stance especially on the revaluation of non-financial items, although, the IASB implements the fair value paradigm in a more consequent and progressive manner than the FASB.

The immense variation in the level and structure of prices and interest rates constitute some of the factors which cause distortions to the financial statements when fair value is used. According to Fisher (2009) management is happy to mark-to-market when markets are rising, but when the market declines there is usually an outcry that the market values do not, necessarily, represent intrinsic fair value. The Nobel prize-winning economist, Joseph Stiglitz (HCTC 2009:8), argues that the fair value system may be used to manipulate compensation.

While commenting on the way in which fair value had contributed to the global financial crisis, Stiglitz notes that fair value should encourage risk-taking and not gambling. Managers tend to take excessive risks because, when things turn out well, they receive huge bonuses. However, when things go badly, they do not share in the losses and, even if they lose their jobs, they do leave with large sums of money (HCTC 2009:9).

Verifiability

Verifiability

Verifiability Verifiability Verifiability Verifiability Verifiability Verifiability Verifiability Verifiability