Last update 06/12/2019

Value-at-risk – Over the past 20 years the value-at-risk (VAR) analysis has become established as the industry and regulatory standard in measuring market risk. The demands placed on VAR and other similar techniques have grown tremendously, driven by new products such as correlation trading, multi-asset options, power-reverse dual currency swaps, swaps whose notional value amortizes unpredictably, and dozens of other such innovations. To keep up, the tools have evolved. For example, the number of risk factors required to price the trading book at a global institution has now grown to several thousand, and sometimes as many as 10,000. Valuation models have become increasingly complex. And most banks are now in the process of integrating new stress-testing analytics that can anticipate a broad spectrum of macroeconomic changes.

Despite these accomplishments, VAR and other risk models have continually come up short. The 1998 crisis at Long Term Capital Management demonstrated the limitations of risk modeling. In the violent market upheavals of 2007–08, many banks reported more than 30 days when losses exceeded VAR, a span in which 3 to 5 such days would be the norm. In 2011, just before the European sovereign crisis got under way, many banks’ risk models treated eurozone government bonds as virtually risk free.

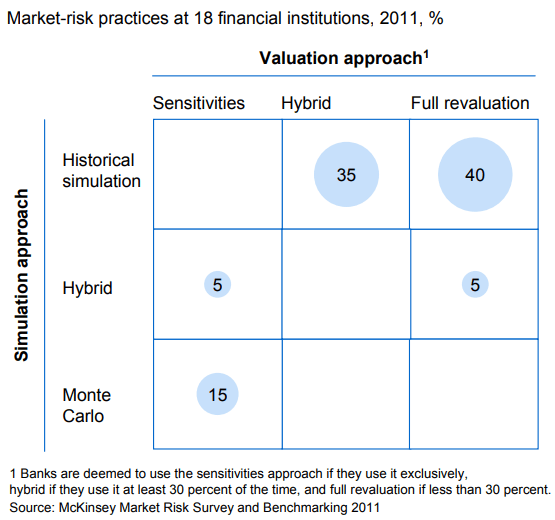

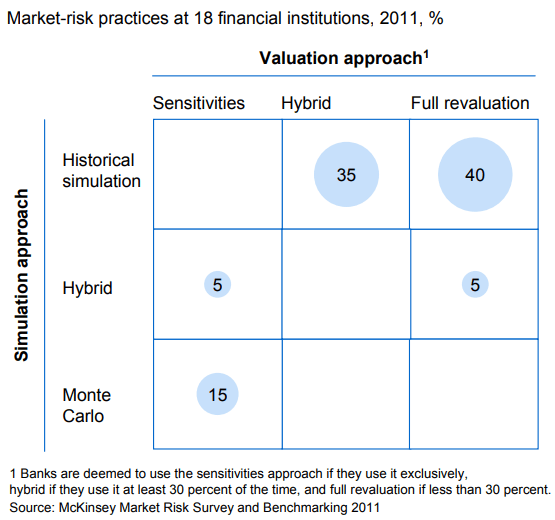

The essential choices in VAR design are the approach used to generate simulation scenarios (Monte Carlo versus historical simulation) and the valuation approach (full

revaluation versus sensitivities). In the following sections, we explore the choices banks are making today, followed by a brief discussion of the growing importance of understanding VAR and the individual risks it comprises.

revaluation versus sensitivities). In the following sections, we explore the choices banks are making today, followed by a brief discussion of the growing importance of understanding VAR and the individual risks it comprises.

Monte Carlo versus historical simulation The Monte Carlo method is widely considered the better theoretical approach to simulation of risk. Its chief advantage is that it provides a more comprehensive picture of potential risks embedded in the “tail” of the distribution. Moreover, it allows the bank to modify individual risk factors and correlation assumptions with some precision, making it a quite flexible approach. Proponents also argue for its greater consistency and synergies with other trading-book modeling approaches, such as the expected-potential-exposure (EPE) approach used for counterparty risk modeling.

But Monte Carlo, which typically requires about 10,000 simulations per risk factor, places a burden of complexity on the bank. Especially when used in combination with full revaluation, the result is often a computational bottleneck that leads to much longer reaction times compared with the easier but less accurate historical simulation. In addition, many complain that it is a “black box,” which is not easily understood by either the businesses or management. As a result, only about 15 percent of banks surveyed use it as their main approach.

See also: https://www.ifrs.org

Value-at-risk

Value-at-risk

Value-at-risk Value-at-risk Value-at-risk Value-at-risk Value-at-risk Value-at-risk

But Monte Carlo, which typically requires about 10,000 simulations per risk factor, places a burden of complexity on the bank. Especially when used in combination with full revaluation, the result is often a computational bottleneck that leads to much longer reaction times compared with the easier but less accurate historical simulation. In addition, many complain that it is a “black box,” which is not easily understood by either the businesses or management. As a result, only about 15 percent of banks surveyed use it as their main approach. But Monte Carlo, which typically requires about 10,000 simulations per risk factor, places a burden of complexity on the bank. Especially when used in combination with full revaluation, the result is often a computational bottleneck that leads to much longer reaction times compared with the easier but less accurate historical simulation. In addition, many complain that it is a “black box,” which is not easily understood by either the businesses or management. As a result, only about 15 percent of banks surveyed use it as their main approach.