Last update 27/11/2019

The sub-LIBOR issue (see further below) related to contractually specified risk components: Purchase or sales agreements sometimes contain clauses that link the contract price via a specified formula to a benchmark price of a commodity. Examples of contractually specified risk components are each of the price links and indexations in the contracts below:

- Price of natural gas contractually linked in part to a gas oil benchmark price and in part to a fuel oil benchmark price

- Price of electricity contractually linked in part to a coal benchmark price and in part to transmission charges that include an inflation indexation

- Price of wires contractually linked in part to a copper benchmark price and in part to a variable tolling charge reflecting energy costs

- Price of coffee contractually linked in part to a benchmark price of Arabica coffee and in part to transportation charges that include a diesel price indexation

In each case, it is assumed that the pricing component would not require separation as an embedded derivative . When contractually specified, a risk component would usually be considered separately identifiable. Further, the risk component element of a price formula would usually be referenced to observable data, such as a published price index. Therefore, the risk component would usually also be considered reliably measurable. However, entities would still have to consider what has become termed the ‘sub-LIBOR issue’.

Some financial institutions are able to raise funding at interest rates that are below a benchmark interest rate (e.g., LIBOR minus 15 basis points (bps)). In such a scenario, the entity may wish to remove the variability in future cash flows caused by movements in LIBOR benchmark interest rates. However, IFRS 9, like IAS 39, does not allow the designation of a ‘full’ LIBOR risk component (i.e., LIBOR flat), as a component cannot be more than the total cash flows of the entire item. This is often referred to as the ‘sub-LIBOR issue’.

The reason for this restriction is that a contractual interest rate cannot normally be less than zero. Hence, for a borrowing at, say, LIBOR minus 15bps, if benchmark interest rates fall below 15bps, any further reduction in the benchmark would not cause any cash flow variability for the hedged item. The sub-LIBOR issue

Consequently, any designated component has to be less than or equal to the cash flows of the entire item. The sub-LIBOR issue

In the above scenario, where the interest rate is at LIBOR minus 15bps, the entity could instead designate, as the hedged item, the variability in cash flows of the entire liability (or a proportion of it) that is attributable to LIBOR changes.

This would result in some ineffectiveness for financial instruments that have an interest rate ‘floor’ of zero in situations in which the forward curve for a part of the remaining hedged term is below 15bps because the hedged item will have less variability in cash flows as a result of interest rate changes than a swap without such a floor.

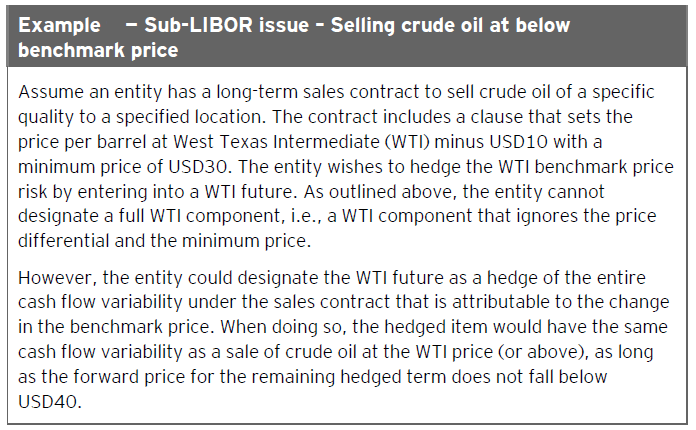

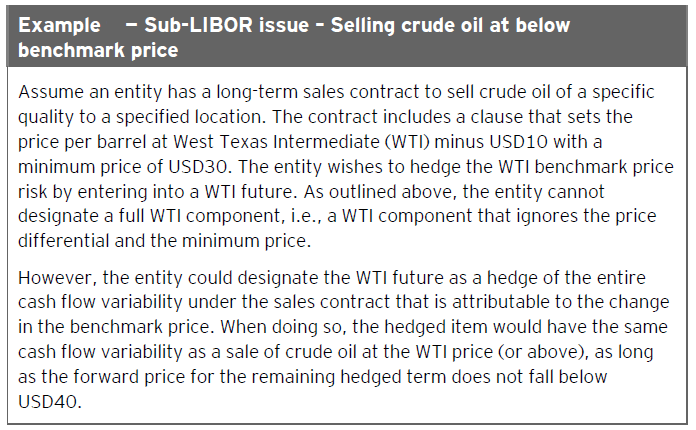

The sub-LIBOR issue is also applicable to non-financial items where the contract price is linked to a benchmark price minus a differential. This is best demonstrated using an example derived from the application guidance of IFRS 9. The sub-LIBOR issue

Background from IASb meeting 12-15 April 2011

Sub-LIBOR issue

The hedge accounting exposure draft carried forward the existing hedge accounting guidance from IAS 39 related to designation of portions of items that are larger than the cash flows of the hedged item (commonly referred to as the ‘sub-LIBOR issue’).

While the issue is not limited only to hedging of interest rate risk, this is where the issue primarily arises; specifically because certain instruments are priced sub-LIBOR and therefore have cash flows less than the benchmark interest rate.

During the comment letter process and Board’s outreach activities, the staff recognised there was some level of confusion around the guidance included in the exposure draft. Some respondents requested that the Board differentiate between sub-LIBOR instruments with a floor at zero per cent and instruments without a floor as the original agenda paper prepared by the staff noted the issue only arises when the interest-bearing instrument has a floor.

Additionally, respondents requested the Board reconsider the restriction with respect to 1) hedging a net exposure where the aim is to lock in a fixed interest margin, 2) hedging a non-financial item priced below the benchmark, and 3) hedging of core deposits and macro hedge accounting. The sub-LIBOR issue The sub-LIBOR issue

For the discussions today, the staff asked the Board to focus solely on the issue of using a hedging instrument based on a benchmark risk to hedge an item with total cash flows less than those associated with that benchmark, and the purpose is to hedge a fixed margin between an interest-bearing financial asset and an interest-bearing financial liability.

The staff proposed retaining the restriction from the exposure draft for portions of items larger than the cash flows of the hedged item when an interest rate floor is in place. Their belief that doing so avoids counter-intuitive results such as paying interest on an asset and deferral of hedge ineffectiveness while illustrating that a fixed’ margin does in fact become variable when LIBOR drops below a critical range (i.e., the range of the negative spread to LIBOR). The sub-LIBOR issue

The discussion began with one Board member asking a question that since the guidance from IAS 39 was carried in to the exposure draft, whether it was possible to get hedge accounting today for these issues. The staff responded that hedge accounting was possible, but because of the 80-125% effectiveness threshold, entities may have experienced issues with failing hedge accounting, particularly in today’s current low interest rate environment.

One Board member suggested that taking a second look at the wording in the exposure draft may help to resolve a lot of the questions around the issue. The Board tentatively decided to retain the restriction in the exposure draft when an interest rate floor is in place but to consider ways to further clarify the guidance.

Read more on FAQ | IFRS:

Hedge Risk components General requirements

Contractually specified risk components

Non-contractually specified risk components

Inflation as a risk component

See also this external site: The IFRS Foundation