Performance obligations at a point in time

or in full ‘Performance obligations satisfied at a point in time’) and Performance obligations satisfied over time are the two choices in IFRS 15. Performance obligations at a point in time

Determine over time

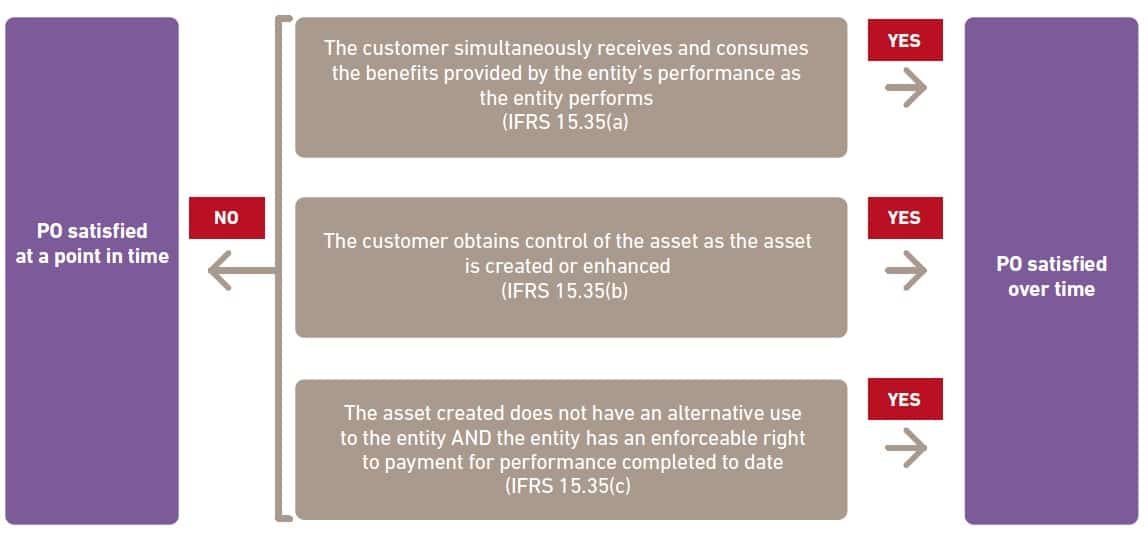

To determine whether revenue allocated to a performance obligation should be recognised over time, IFRS 15 requires an entity to consider three criteria. If any one of them is met, this means that control is transferred to the customer over time, and thus revenue shall likewise be recognised over time. The entity shall assess this at contract inception. Performance obligations at a point in time

In summary: Performance obligations at a point in time

These criteria shall be applied to all goods and services sold by the entity, irrespective of sector. Performance obligations at a point in time

However, the Basis for Conclusions suggests that these criteria are likely to be more relevant in certain situations (cf. IFRS 15.BC125, IFRS 15.BC129 and IFRS 15.BC132): Performance obligations at a point in time

- “typical” (i.e. relatively simple) service provisions should generally be accounted for over time under criterion IFRS 15.35(a);

- the second criterion (IFRS 15.35(b)) applies when the customer clearly controls work in progress;

- the last criterion (IFRS 15.35(c)) should be considered, by default, when the two previous criteria are not met (for example, services tailored to a customer that ultimately result in the delivery of a report, or the construction of a complex industrial asset on the entity’s premises).

If a performance obligation is not satisfied over time, then an entity recognises revenue at the point in time at which it transfers control of the good or service to the customer. Performance obligations at a point in time

Performance obligations satisfied at a point in time

An entity has ‘control’ of a good or service when it has the ability to direct the use of, and obtain substantially all of the remaining benefits from, the good or service (IFRS 15.32–33). Performance obligations at a point in time

The standard includes indicators of when the transfer of control occurs in case of performance obligations satisfied at a point in time (IFRS 15.38).

IFRS 15 defines control of an asset (whether a good or a service) as the ability to direct the use of the asset (i.e. it has a present right) and to obtain substantially all of the remaining benefits of it (i.e. potential cash flows, whether inflows or savings in outflows, that can be obtained directly or indirectly by using, reselling, exchanging or holding the asset, or pledging it to secure a loan). Control includes the ability to prevent other entities from directing the use of, and obtaining the benefits from, an asset. Performance obligations at a point in time

The IFRS 15 Basis for Conclusions states that control should be assessed from the perspective of the customer (even though assessing control from the perspective of the entity would lead to the same conclusion in many situations – cf. IFRS 15.BC121). This perspective minimises the risk of an entity recognising revenue that does not coincide with the transfer of goods or services to the customer. Performance obligations at a point in time

In addition to the definition of control, the Standard also includes a list of indicators to help an entity to determine the point in time at which control is transferred to the customer (when it is not transferred over time). These indicators represent attributes of control that may be more or less relevant in different situations. Performance obligations at a point in time

As a result an entity should indicators of the transfer of control which include, but are not limited to, the following ([IFRS 15.38, IFRS 15.B83-B86) (see above table): Performance obligations at a point in time

- the entity has a present right to payment for the asset; Performance obligations at a point in time

- the customer has obtained legal title to the asset. If an entity retains legal title solely as protection against the customer’s failure to pay, those rights of the entity would not preclude the customer from obtaining control of an asset; Performance obligations at a point in time

- the entity has transferred physical possession of the asset. However, physical possession does not necessarily coincide with control of an asset. For example, in some repurchase agreements and in some consignment arrangements, a customer or consignee may have physical possession of an asset that the entity controls (see ‘Consignment arrangements‘). Conversely, in some bill-and- hold arrangements (see ‘Bill-and-hold arrangements’), the entity may have physical possession of an asset that the customer controls;

- the customer has the significant risks and rewards of ownership of the asset. An entity shall exclude any risks that give rise to a distinct performance obligation in addition to the performance obligation to transfer the asset (for example, an entity may have transferred control of an asset to a customer but not yet satisfied an additional performance obligation to provide maintenance services related to the transferred asset);

- the customer has accepted the asset (see contractual customer acceptance clauses allowing a customer to cancel a contract or require an entity to take remedial action if a good or service does not meet agreed-upon specifications.). If customer acceptance is not purely formal, the entity cannot conclude that the customer has obtained control until the entity receives the customer’s acceptance.

In practice, it can be difficult to assess control where the asset transferred is a service. IFRS 15 includes a number of criteria that can be used to determine whether control is transferred to the customer over time (see ‘Determine over time‘ above). The Standard notes that one of these criteria is typical of many service contracts: the asset created by the entity’s performance is immediately consumed by the customer.

Finally, when evaluating whether a customer obtains control of an asset, an entity shall consider any agreement to repurchase the asset (see ‘Repurchase agreement‘). Performance obligations at a point in time

The ‘benefits’ of an asset are the potential cash flows – inflows or savings in outflows – that can be obtained directly or indirectly, including by using the asset to: Performance obligations at a point in time

- produce goods or provide services (including public services); Performance obligations at a point in time

- enhance the value of other assets; and Performance obligations at a point in time

- settle liabilities or reduce expenses; Performance obligations at a point in time

- selling or exchanging the asset; Performance obligations at a point in time

- pledging the asset to secure a loan; and Performance obligations at a point in time

- holding the asset. Performance obligations at a point in time

Relevant considerations in case of performance obligations satisfied at a point in time include the following.

- In some cases, possession of legal title is a protective right and may not coincide with the transfer of control of the goods or services to a customer – e.g. when a seller retains title solely as protection against the customer’s failure to pay.

- In consignment arrangements (see ‘Consignment arrangements‘) and some repurchase arrangements (see ‘Repurchase agreements‘), an entity may have transferred physical possession but still retain control. Conversely, in bill-and-hold arrangements

- (see ‘Bill-and-hold arrangements‘) an entity may have physical possession of an asset that the customer controls.

- In some arrangements, a customer may obtain control of an asset before it has physical possession – e.g. a bank purchasing a fixed amount of gold from a mine may be able to sell the gold for immediate physical settlement before the refinement process is completed.

- When evaluating the risks and rewards of ownership, an entity excludes any risks that give rise to a separate performance obligation in addition to the performance obligation to transfer the asset. In some cases, the customer may have the rewards of ownership, but not the risks. This does not necessarily preclude the customer from having control. An entity considers whether the other indicators are more relevant and the customer’s ability to direct the use of and obtain substantially all of the benefits from the asset.

- An entity needs to assess whether it can objectively determine that a good or service provided to a customer conforms to the specifications agreed in a contract (see ‘Customer acceptance (Step 1 IFRS 15 Contracts with customers)‘).

Food for thought – Judgement may be required to determine the point in time at which control transfers |

|

The indicators of transfer of control are factors that are often present if a customer has control of an asset; however, they are not individually determinative, nor are they a list of conditions that have to be met. The standard does not suggest that certain indicators should be weighted more heavily than others, nor does it establish a hierarchy that applies if only some of the indicators are present. However, it remains possible that in some facts and circumstances certain indicators will be more relevant than others and so carry greater weight in the analysis. Judgement may be required to determine the point in time at which control transfers. This determination may be particularly challenging when there are indicators that control has transferred alongside ‘negative’ indicators suggesting that the entity has not satisfied its performance obligation. IFRS 15.BC155 |

Food for thought – Potential challenges may exist in determining the accounting for some delivery arrangements |

|

When evaluating at which point in time control transfers to the customer, the shipping terms of the arrangement are a relevant consideration. Shipping terms alone do not determine when control transfers – i.e. an entity considers them along with other indicators of control to assess when the customer has the ability to direct the use of, and obtain substantially all of the benefits from, the asset. However, shipping terms often indicate the point in time when the customer has legal title, the risks and rewards of ownership a The Incoterms of the International Chamber of Commerce are used frequently in international purchase-and-sales contracts. They include standard trade terms such as ‘free on board’ (FOB), ‘cost, insurance and freight’ (CIF) and ‘ex works’ (EXW). In the case of FOB, when the goods are loaded onto the ship the customer usually receives the bill of lading and takes over the risk of loss or damage to the goods. This may indicate that the customer obtains control when the goods are loaded onto the ship and the bill of lading has been transferred to the customer. If control of the goods transfers to the customer before delivery to the final destination, then an entity considers whether the transportation service is a distinct performance obligation and, if so, whether it acts as a principal or an agent for the shipping service (see ‘Principal vs agent principals‘). When goods are shipped, the risk of loss may often be transferred to a third party while the goods are in transit. The fact that the seller transfers its risk of loss to another party (i.e. the third party shipping company or insurance company) does not mean that the customer has the ability to direct the use or obtain substantially all of the benefits from the goods or services. An entity needs to consider this when assessing at which point in time control transfers to the customer. If the entity concludes that transfer of control has occurred when the product is shipped, then it also considers whether its business practices give rise to a separate performance obligation in addition to the performance obligation to transfer the product itself – i.e. a stand-ready obligation to cover the risk of loss if goods are damaged in transit. If a separate performance obligation is identified, then only the revenue allocated to the sale of the goods is recognised at the shipping date. |

Food for thought – Indirect channels and sell-in vs sell-through

|

|

Many entities sell through distributors and resellers. These transactions will require judgement to determine if the transfer of control occurs on delivery to the intermediary (sell-in model) or when the good is resold to the end customer (sell-through model). Entities need to consider the guidance on consignment sales (see ‘Consignment arrangements‘) and variable consideration (see ‘Variable consideration (and the constraint)‘) to determine which model is appropriate. |

Also read: Performance obligations at a point in time

Performance obligations at a point in time

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

Performance obligations at a point in time Determine over time point in time at which control transfers transfer of control of the goods or services

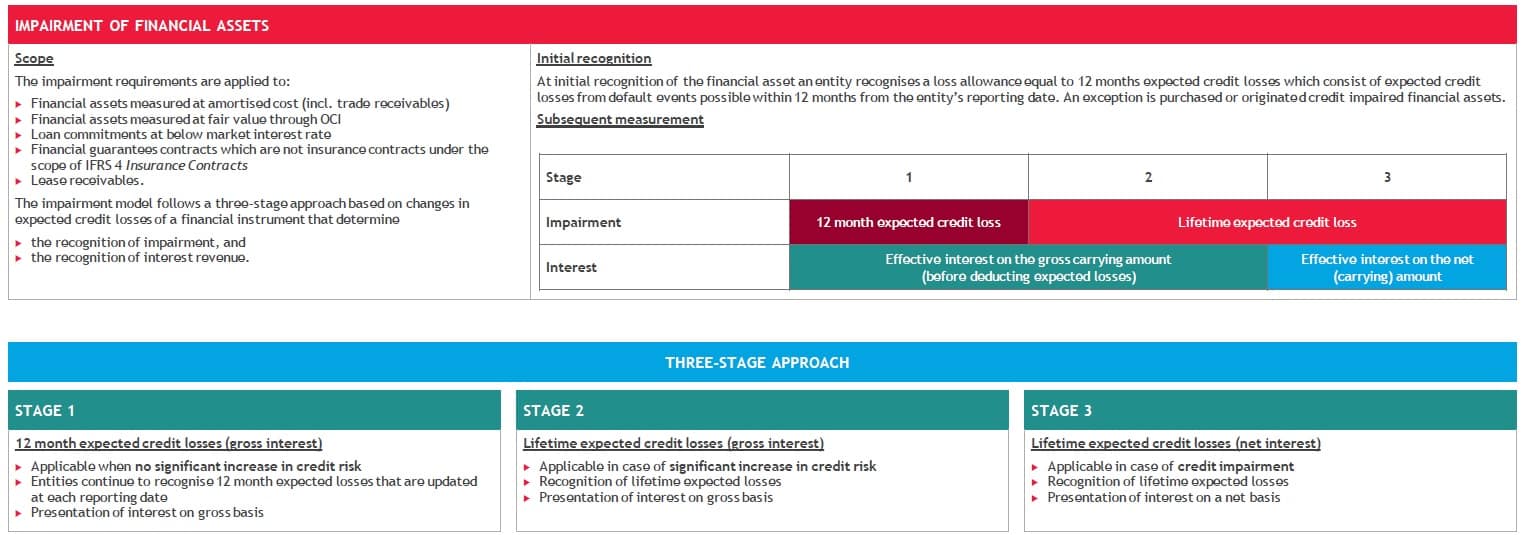

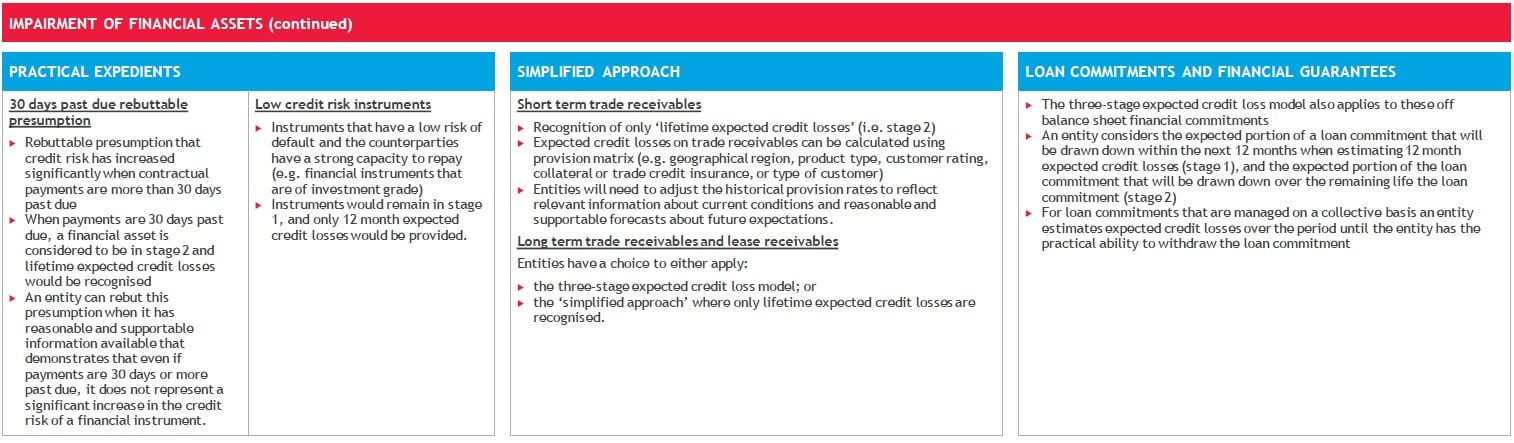

the Expected Credit Losses model

Setting the scene the Expected Credit Losses model, start here to get a good understanding of ECL loss allowances or continue, you decide……

The Expected Credit Losses model (ECL) should be applied to:

- investments in measured at amortized cost;

- investments in debt instruments measured at fair value through other comprehensive

IFRS 9 Eligible Hedged items

the insured items of business risk exposures

Although the popular definition of hedging is an investment taken out to limit the risk of another investment, insurance is an example of a real-world hedge.

Every entity is exposed to business risks from its daily operations. Many of those risks have an impact on the cash flows or the value of assets and liabilities, and therefore, ultimately affect profit or loss. In order to manage these risk exposures, companies often enter into derivative contracts (or, less commonly, other financial instruments) to hedge them. Hedging can, therefore, be seen as a risk management activity in order to change an entity’s risk profile.

The idea of hedge accounting is to reduce (insure) this mismatch by changing either the measurement or (in the case of certain firm commitments)

recognition of the hedged exposure, or the accounting for the hedging instrument.

The definition of a Hedged item

A hedged item is an asset, liability, firm commitment, highly probable forecast transaction or net investment in a foreign operation that

- exposes the entity to risk of changes in fair value or future cash flows and

- is designated as being hedged

The hedge item can be:

- a single item, or

- a group of items (provided the specific requirements are met).

Only assets, liabilities, firm commitments and forecast transactions with an external party qualify for hedge accounting. As an exception, a hedge of the foreign currency risk of an intragroup monetary item qualifies for hedge accounting if that foreign currency risk affects consolidated profit or loss. In addition, the foreign currency risk of a highly probable forecast intragroup transaction would also qualify as a hedged item if that transaction affects consolidated profit or loss. These requirements are unchanged from IAS 39.

IFRS 15 Measuring progress to completion

– how to do it, what to use, learn it all

Introduction

For each performance obligation satisfied over time, revenue must be recognised over time (IFRS 15.39-45 & IFRS 15.B14-B19). To do so, an entity shall measure the progress towards complete satisfaction of the performance obligation.

The measurement of progress has the objective of faithfully depicting an entity’s performance in transferring control of the goods or services promised to the customer (that is, the extent to which the performance obligation is satisfied).

An entity shall apply a single method of measuring progress for each performance obligation satisfied over time, and shall apply that method consistently to similar performance obligations and in similar circumstances.

At the end of each reporting period, an entity shall remeasure its progress towards complete satisfaction of each performance obligation satisfied over time.

In July 2015 the Joint Transition Resource Group (TRG a combined effort by IASB and FASB to detect problems raised by the implementation of the revenue recognition standards) clarified that the principle of applying a single method of measuring progress for a given performance obligation is also applicable to a combined performance obligation, i.e. one that contains multiple non-distinct goods or services.

Hence, it is not appropriate to apply several methods depending on the stage of performance, even if these methods all belong to one of the two major categories of methods presented below (output methods vs input methods), for example a method measuring progress on the basis of hours expended, and a method measuring progress on the basis of labour costs incurred.

Impairment of investments and loans

is about impairment in a ‘normal’ business not complicated accounting but straightforward accounting calculations.

Normal operations

Although the focus for IFRS 9 Financial Instruments is on financial institutions such as banks and insurance companies, ‘normal’ operating entities are also affected by IFRS 9. Maybe their investment and loan portfolios are less complex but in operating a business and as part of the internal credit risk management practice policy making it is still important to implement the impairment model under IFRS 9 Financial Instruments.

The objective of these approaches to expected credit losses or timely recording of impairments/loss allowances is to provide approaches that result in a situation in which very different reporting entities all … Read more

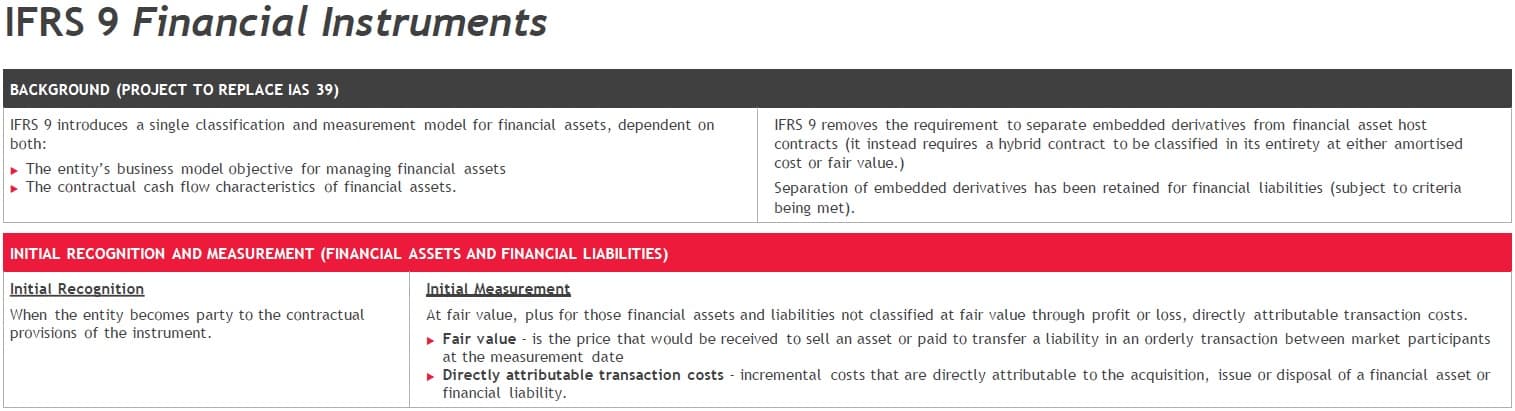

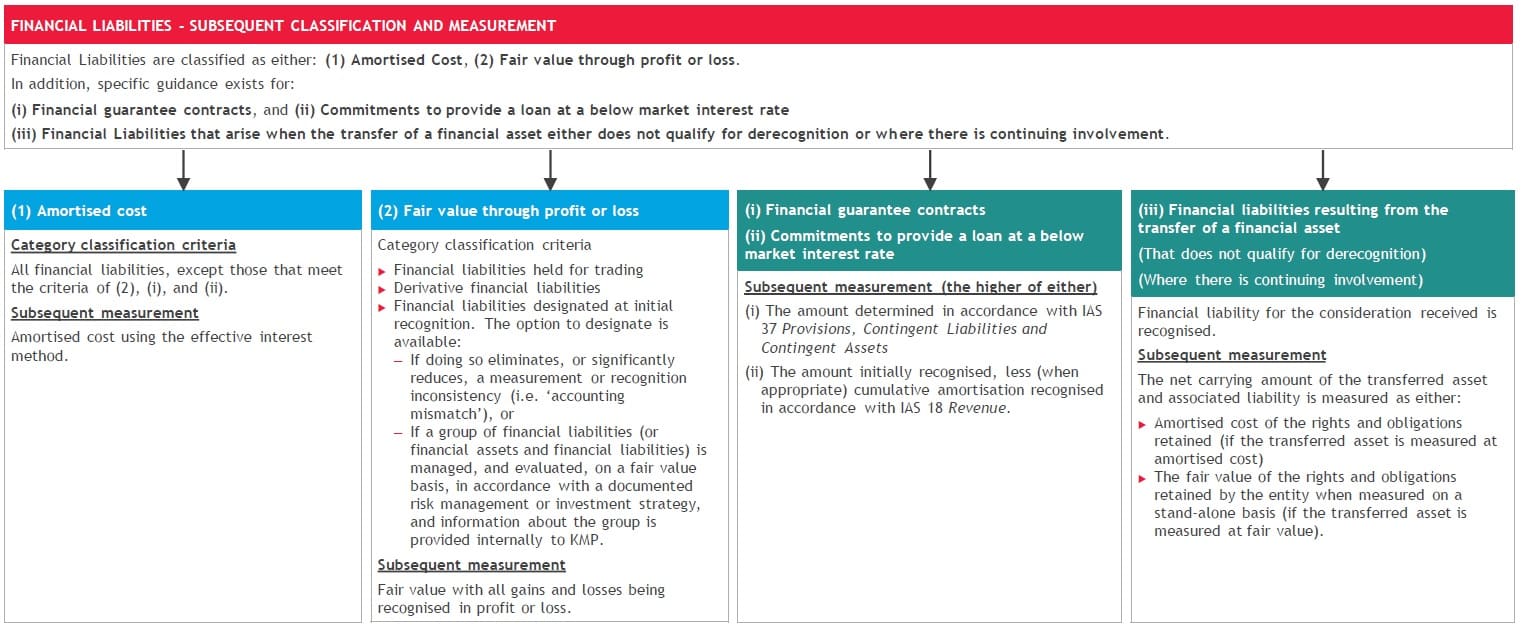

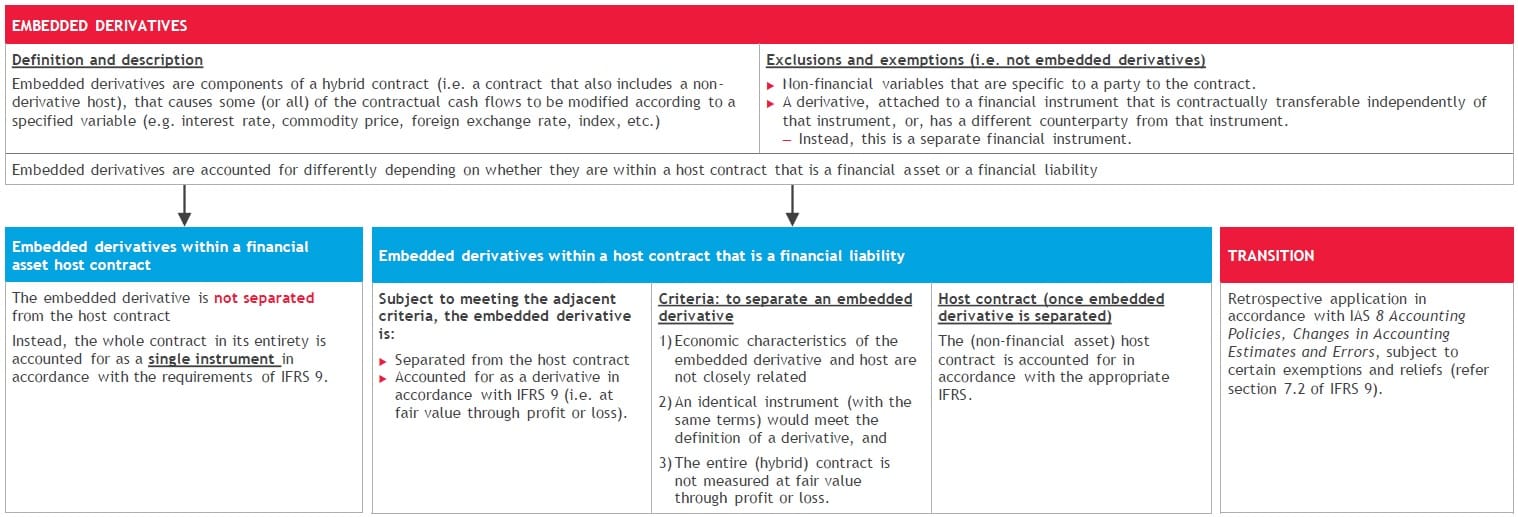

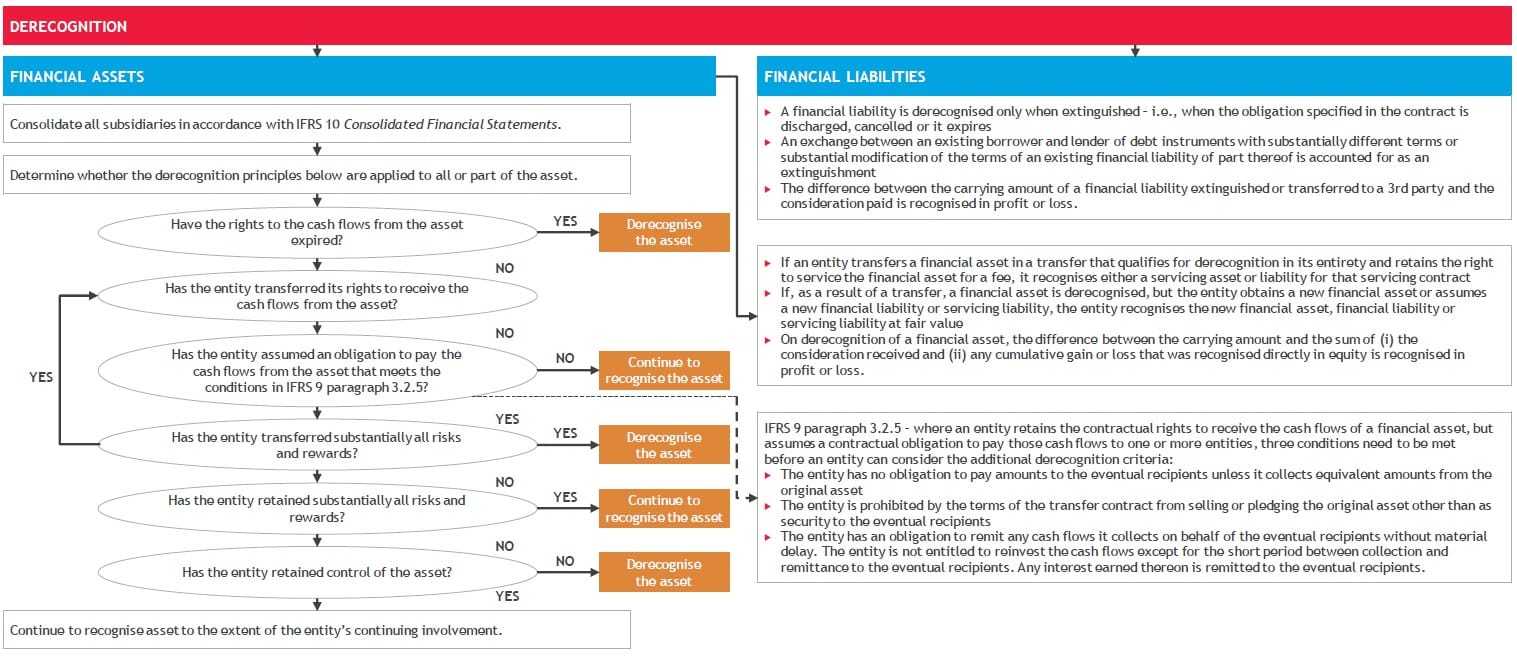

IFRS 9 Financial instruments quick and best snapshot – no hedge accounting

IFRS 9 Financial instruments

And in some more detail….

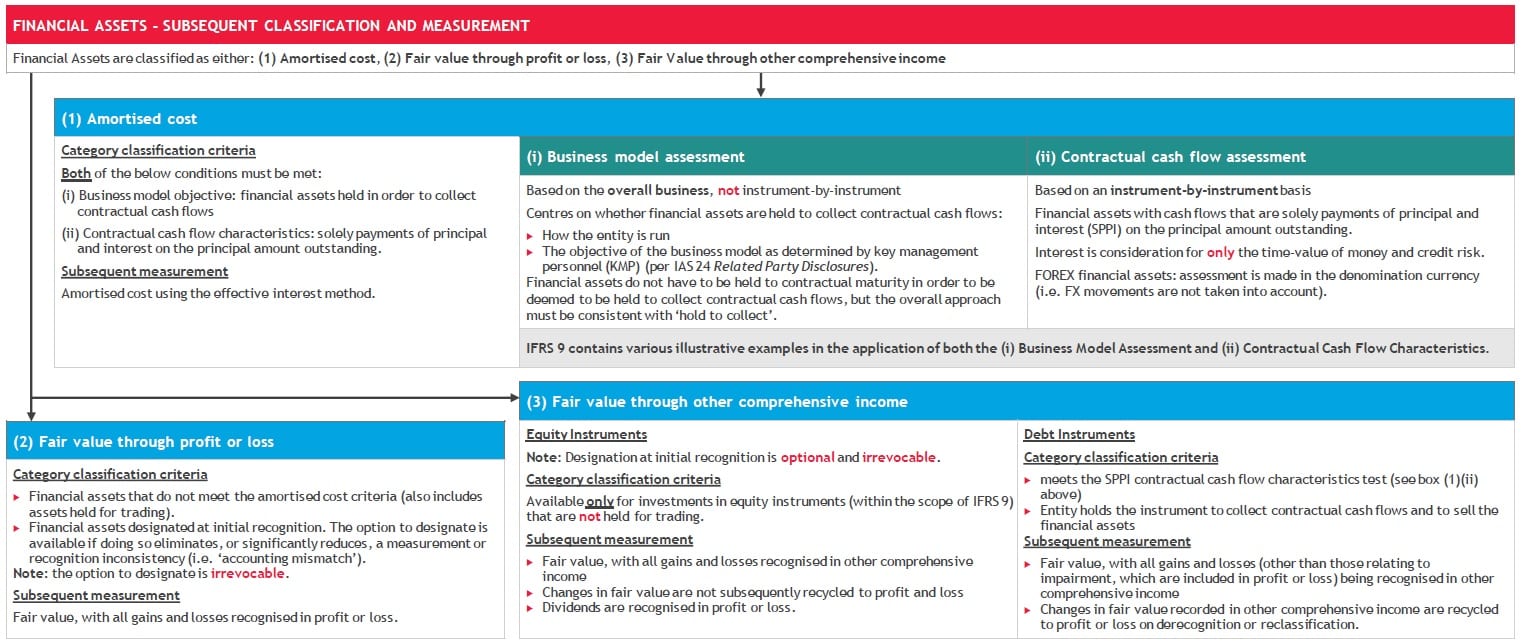

Important to remember, where does IFRS 9 come from – the International Accounting Standards Board (IASB) developed if as a response to the financial crisis and it was issued on 24 July 2014. The standard includes the requirements previously issued and introduces limited amendments to the classification and measurement requirements for financial assets as well as the expected loss impairment model. It includes:

- Classification and measurement of financial assets – principle-based, as opposed to rule-based, classification and measurement categories for financial assets;

- Classification and measurement of financial liabilities – new requirements for handling changes in the fair value

High level overview IFRS 9 Hedge accounting

IFRS 9 Hedge accounting

Source: BDO IFRS at a glance

Or in some more detail…..

|

OBJECTIVE The objective of hedge accounting is to represent, in the financial statements, the effect of an entity’s risk management activities that use financial instruments to manage exposures arising from particular risks that could affect profit or loss (or other comprehensive income, in the case of investments in equity instruments for which an entity has elected to present changes in fair value in other comprehensive income). SCOPE A hedging relationship qualifies for hedge accounting only if all the following criteria are met:

|

IFRS 15 Revenue disclosure requirements

provides the disclosure requirements for IFRS 15 Revenue from Contracts with Customers in 8 Questions & Answers

Check the answers to these 8 questions:

DISCLOSURES IN THE NOTES TO THE FINANCIAL STATEMENTS

1. What are the cross-cutting issues in the preparation of the notes to the annual financial statements?

IFRS References: IFRS 15.110-112

The answers is made in three parts:

A Consider the objective of the disclosure requirements

In IFRS 15, consistently with other Standards, the disclosure requirements rely on a primary objective, accompanied by a list of the minimum information to be presented (subject to materiality).

This primary objective is to enable users of financial statements to understand the nature, amount, timing and uncertainty of revenue from ordinary activities and the cash flows arising from contracts with customers.

The objective concerns not only the revenue recognised, but also its translation in terms of cash flows. Explaining the timing differences between revenue accounted for and the corresponding cash flows – in other words, the impacts on balances (for which the minimum disclosure requirements have been strengthened by comparison with previous revenue recognition Standards) – is also a significant issue.

To assess whether the disclosures are sufficient and relevant, an entity should consider this objective and provide additional information not listed in the Standard if necessary (that is, entities must avoid a “check- list” approach).

Need for accounting measurement

Need for accounting measurement provides a summary of the measurement bases in use in Financial Reporting

and the concepts behind these measurement bases.

The measurement bases that will be considered here are:

All these bases are forms of accrual accounting – that is, they are intended to measure income as it is earned and costs as they are incurred, as opposed to simply recording cash flows. The last four are all forms of current value measurement.

In forming a judgment on the appropriateness of measurement bases, in literature, the overriding tests has been identified to be their cost-effectiveness and fitness for purpose. However, in the absence of direct evidence on these matters, it is usual to argue in terms of various secondary characteristics that ought to be relevant in assessing the quality of information (see the key indicators in What is useful information?).

The most important of these characteristics are generally considered to be relevance and faithful representation / reliability (older term).

For each basis, an outline is given of how it works and the relevance and faithful representation of the resulting measurements. The question of measurement costs is also considered briefly. In reading the analyses that follow, the following comments should be borne in mind.

Bases of measurement in financial reporting are not carved in stone. Different people have different views on how each basis should work, and meanings evolve as practice changes. Some readers may therefore find that the way a particular basis is described does not match how they understand it.

This does not mean either that their understanding is wrong or that the description in the report is wrong; views on these things simply differ.

Best guide IFRS 16 Lessee modifications

summarises the process surrounding changes in lease contracts that identify as lease modification.

A lessee that chooses not to apply the practical expedient (IFRS 16 option for rent concessions arising directly from the COVID-19 pandemic that are not going to be accounted for as lease modifications), or agrees changes to its lease contracts that do not qualify for the practical expedient, assesses whether there is a lease modification.

Overview

A change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions meets the standard’s definition of a lease modification.

A lessee accounts for a lease modification as a separate lease if both of the following conditions exist:

- the modification increases the scope of the lease by adding the right to use one or more underlying assets; and

- the consideration for the lease increases by an amount equivalent to the stand- alone price for the increase in scope and any appropriate adjustments to that stand-alone price to reflect the circumstances of the particular contract.

For a modification that is not a separate lease, at the effective date of the modification the lessee accounts for it by remeasuring the lease liability using a discount rate determined at that date and:

- for modifications that decrease the scope of the lease: decreasing the carrying amount of the right-of-use asset to reflect the partial or full termination of the lease, and recognising a gain or loss that reflects the proportionate decrease in scope; and

- for all other modifications: making a corresponding adjustment to the right-of- use asset.