Last update 08/12/2019

The Acquisition Method illustrated – a little history of acquisitions, mergers, purchase accounting, pooling of interests, goodwill, intangible assets acquired and the current end to this IFRS 3 Business Combinations. This is a developing story I will add stuff to end with a complete overview.

The short case: The Acquisition Method illustrated

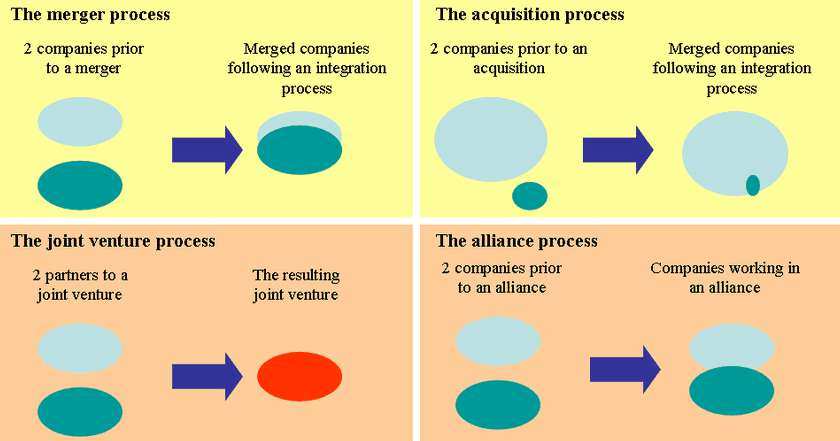

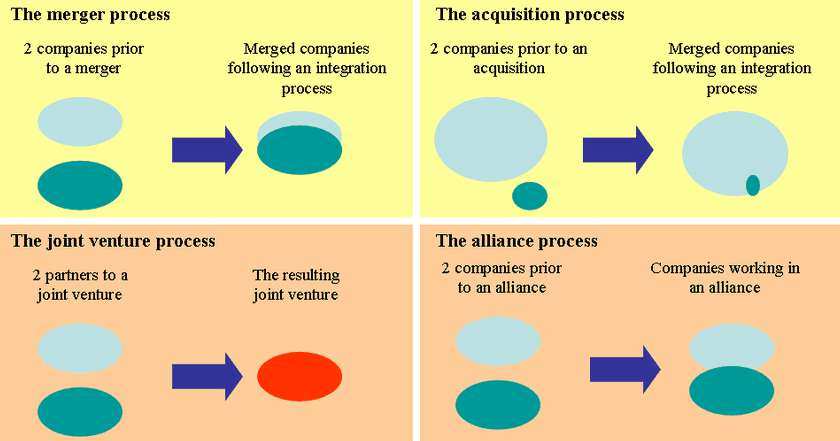

The company A Corp is purchasing all shares in B Corp. Control is acquired by A Corp, B Corp disappears from the economic entity, and B or B’s shareholders receive either A Corp stock or other property. This will result in a business combination which means A Corp’s acquisition of control over the business of B Corp.

The acquisition will be accounted for as a ‘purchase’, this means that the acquired assets will be entered on the acquirer’s (A Corp’s) books at their current cost to it and liabilities will be credited at their current values; i.e., the total purchase price will be allocated among the individual assets and liabilities acquired to the extent of their fair market values. This is one of the two most important consequences of accounting for the combination as a purchase, for it means that, in the usual case, where current cost is higher than the seller’s book carrying value, the buyer’s future income statements will be charged with greater expenses than the seller’s statements would have shown as these assets are depreciated or amortized. The result is that the increment in the buyer’s income’resulting from the acquisition usually will be less than the seller’s income would have been without the combination. The Acquisition Method illustrated The Acquisition Method illustrated

In the past ‘pooling of interest’ was allowed, the accounting for such a pooling of interests is radically different from purchase accounting and rests on the notion that when two entities come together, with the interests in rights and rewards of the owners of each continuing, the old basis of accounting for each should continue. This means that the book carrying values of the assets and liabilities of each entity are continued on the books of the new or surviving entity and the earned surpluses of the two were combined, with potentially significant differences in accounting policies chosen, valuations allowed and equity and earnings retained combined is like adding oranges and apples, it simply adds up but it does not add up to consistent useful information.

But that is the past!!

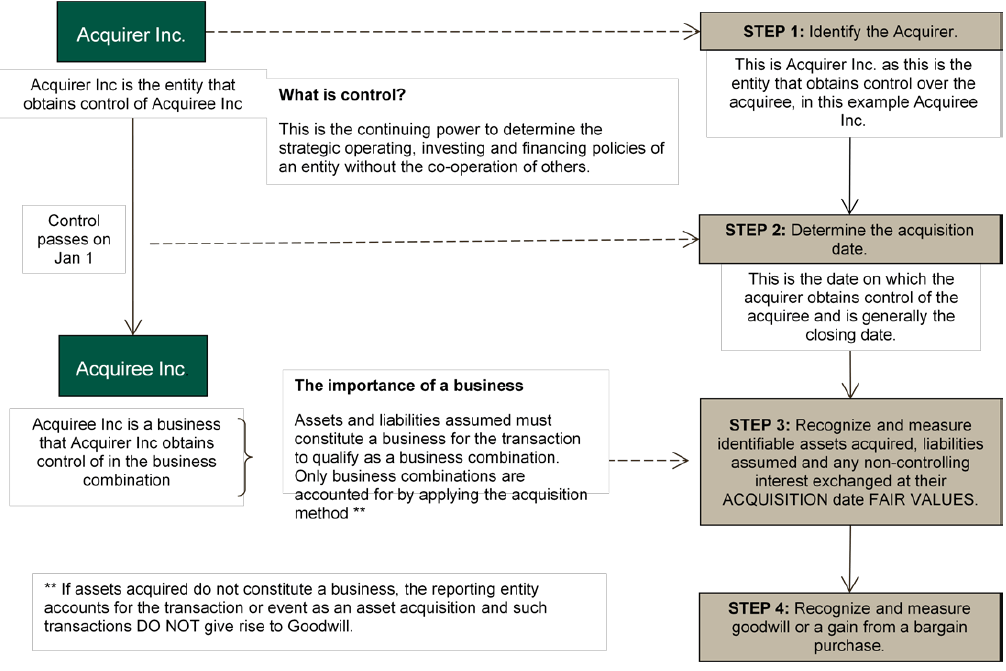

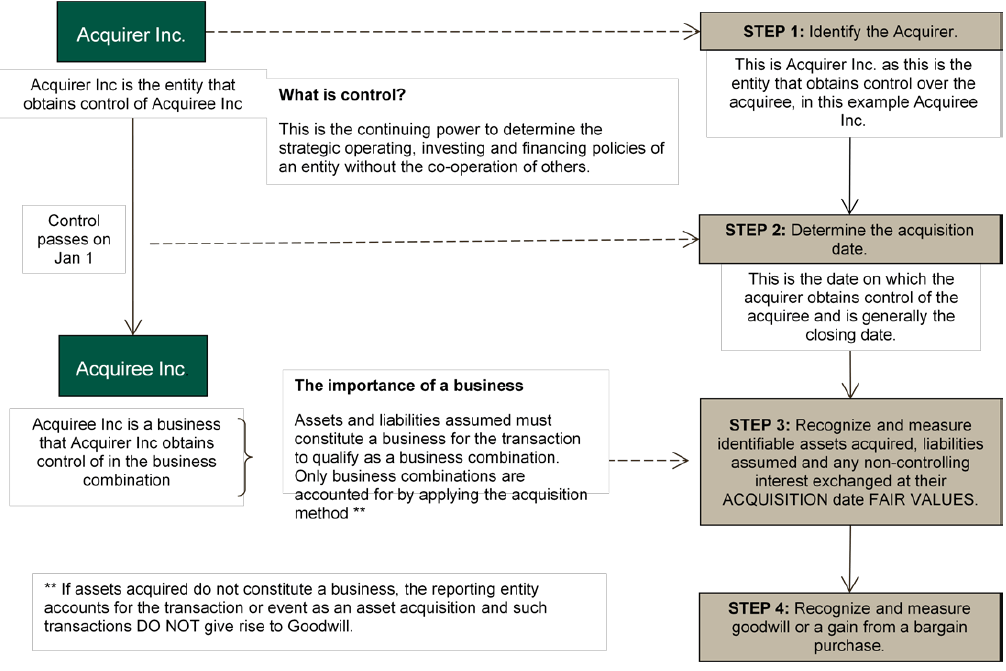

Here is in one picture the current state of affairs regarding the acquisition method: The Acquisition Method illustrated

OVERVIEW

– Business combinations are accounted for under the acquisition method, with limited exceptions.

– A ‘business combination’ is a transaction or other event in which an acquirer obtains control of one or more businesses.

– The acquirer in a business combination is the combining entity that obtains control of the other combining business or businesses.

– In some cases, the legal acquiree is identified as the acquirer for accounting purposes (reverse acquisition).

– The ‘date of acquisition’ is the date on which the acquirer obtains control of the acquiree.

– Consideration transferred by the acquirer, which is generally measured at fair value at the date of acquisition, may include assets transferred, liabilities incurred by the acquirer to the previous owners of the acquiree and equity interests issued by the acquirer.

– Contingent consideration transferred is initially recognised at fair value. Contingent consideration classified as a liability or an asset is remeasured to fair value each period until settlement, with changes recognised in profit or loss. Contingent consideration classified as equity is not remeasured.

– Any items that are not part of the business combination transaction are accounted for outside the acquisition accounting.

See more details on the current IFRS 3 Business Combinations – Acquisition method.

See also: The IFRS Foundation