Stock dividends

Stock dividends are dividends paid to the ordinary shareholders of an entity in the form of additional ordinary shares rather than in cash. They may also be referred to as ‘scrip dividends’, or ‘share dividends’, and they may or may not have a cash alternative. IAS 33 EPS Calculations

This narrative builds on the basic principles introduced in the narrative EPS, and sets out the specific basic and diluted EPS implications of the following types of instrument(s). IAS 33 EPS Calculations

EPS implications

Generally, how stock dividends are dealt with in EPS depends on whether the investor has a cash alternative.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The instrument does not impact the numerator of EPS calculations. The instrument does impact the denominator of EPS calculations. For basic EPS, this means the instrument may impact the calculation before ordinary shares are actually issued. |

The instrument impacts the numerator and the denominator of EPS calculations. For diluted EPS, this means the instrument is taken into account, although whether adjustments are actually required depends on whether the instrument is dilutive or anti-dilutive. |

|

IAS 33 indicates that ordinary shares issued on the voluntary reinvestment of dividends are included in the denominator for EPS calculations from the date on which the dividends are reinvested. However, the standard provides ‘stock dividend’ as an example of a bonus issue in which ordinary shares are issued without a corresponding change in resources, which suggests that some stock dividends require retrospective adjustment to the denominator. [IAS 33.21(b), IAS 33.27(a)] In general, the treatment of stock dividends in the EPS calculation depends on whether the shareholders have an option to receive cash and whether there is an inherent bonus element.

|

Ordinary shares issued as stock dividends are not POSs. Accordingly, there are no additional diluted EPS implications.

|

Stock dividends with bonus element

Under some dividend reinvestment programs, the fair value of the stock alternative exceeds that of the cash alternative (often referred to as ‘enhanced’ stock dividends). In this case, there is a bonus element that requires retrospective adjustments to EPS amounts. In general, the bonus element in stock dividends should be determined using the same formula as for determining a bonus element in a rights issue. [IAS 33.A2]

Case – Stock dividends with cash alternative – Without bonus element |

|

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

Workings The EPS computations for Year 1 are as follows. |

|

|

Basic EPS |

Diluted EPS |

|

1. Determine the numerator No adjustment is necessary. The numerator is 4,600,000. |

1. Identify POSs The shares issued as stock dividends are not POSs. Therefore, Steps 2–4 do not apply. |

|

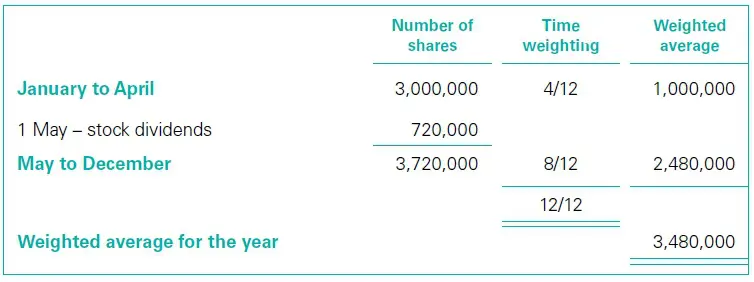

2. Determine the denominator Because the stock alternative and the cash alternative are of equal value, we believe that the 720,000 shares issued on 1 May increase the number of shares with a corresponding change in resources, and do not have any bonus element. P therefore includes 720,000 shares in the denominator prospectively from the date on which the dividends are reinvested, and does not restate prior-period EPS amounts.

The denominator is therefore 3,480,000. |

2. For each POS, calculate EPIS Not applicable. |

|

3. Rank the POSs Not applicable. |

|

|

4. Determine basic EPS from continuing operations Not applicable. |

|

|

3. Determine the EPS Basic EPS = 4,600,000 / 3,480,000 = 1.32 |

5. Identify dilutive POSs and determine diluted EPS Because there are no POSs, diluted EPS is the same as basic EPS. Diluted EPS = 1.32 |

Case – Stock dividends with cash alternative – With bonus element |

|

|

The basic facts are the same as in Stock dividends with cash alternative – Without bonus element. The following facts are also relevant for Year 1.

Workings The EPS computations for Year 1 are as follows. |

|

|

Basic EPS |

Diluted EPS |

|

1. Determine the numerator No adjustment is required. The numerator is 4,600,000. |

1. Identify POSs The shares issued as stock dividends are not POSs. Therefore, Steps 2–4 do not apply. |

|

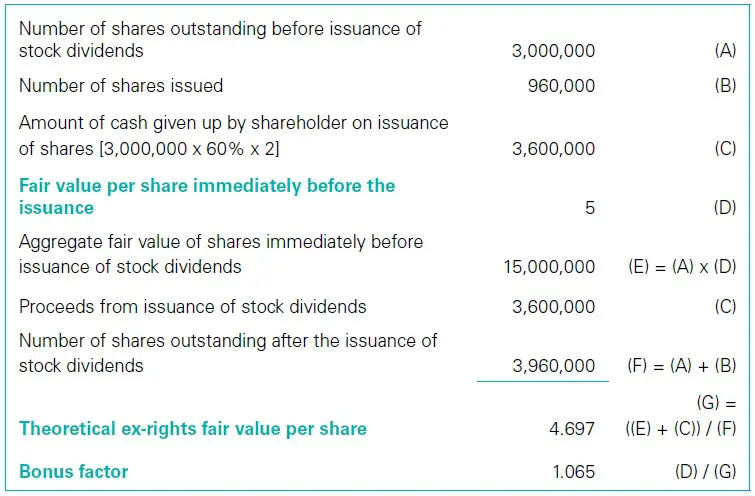

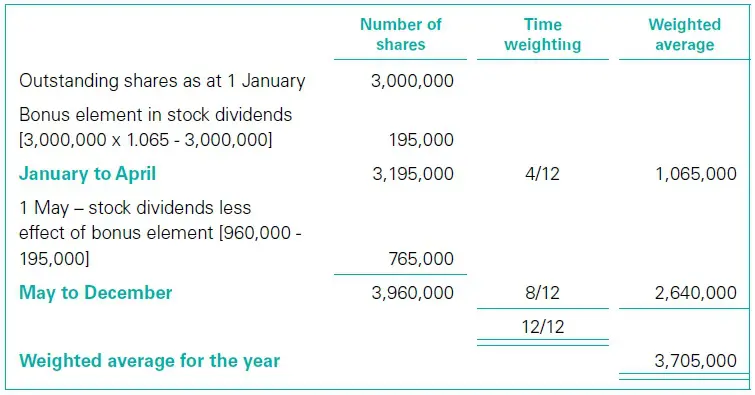

2. Determine the denominator Because the value of the stock alternative exceeds that of the cash alternative, part of the shares issued as stock dividends was for no consideration. This represents the bonus element and is calculated as follows (see Stock dividends with bonus element above).

Accordingly, the adjustment factor for the bonus element in the stock dividends is multiplied by the outstanding shares before the stock dividend (i.e. 1 May) to determine the retrospective adjustment.

The bonus element also impacts prior-period EPS amounts. The denominator is therefore 3,705,000. |

2. For each POS, calculate EPIS Not applicable. |

|

3. Rank the POSs Not applicable. |

|

|

4. Determine basic EPS from continuing operations Not applicable. |

|

|

3. Determine the EPS Basic EPS = 4,600,000 / 3,705,000 = 1.24 |

5. Identify dilutive POSs and determine diluted EPS Because there are no POSs, diluted EPS is the same as basic EPS. Diluted EPS = 1.24 |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.