Last update 18/09/2019

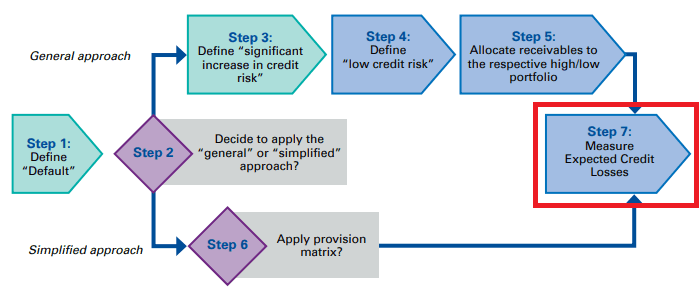

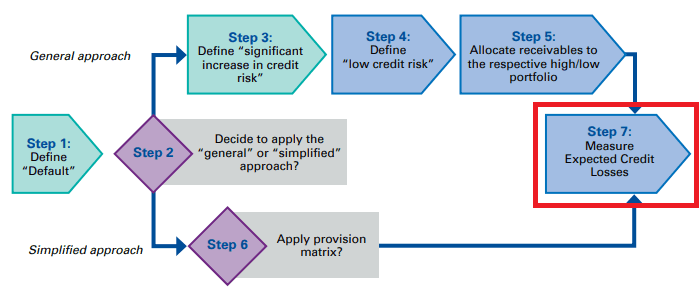

Although the focus for IFRS 9 Financial Instruments is on financial institutions such as banks and insurance companies, ‘normal’ operating entities are also affected by IFRS 9. Maybe their investment and loan portfolios are less complex but in operating a business and as part of the internal credit risk management practice policy making it is still important to implement the impairment model under IFRS 9 Financial Instruments. This is step 7 which started with an introduction in Impairment of investments and loans.

The measurement of Expected Credit Losses is inherently difficult, subjective and judgmental, in particular if the receivable is not rated or no market observable information is available. The measurement of Expected credit losses has to be carefully documented in the (period) financial close, which includes working sheets on each step in this process. The content may look as follows:

The measurement of Expected Credit Losses is inherently difficult, subjective and judgmental, in particular if the receivable is not rated or no market observable information is available. The measurement of Expected credit losses has to be carefully documented in the (period) financial close, which includes working sheets on each step in this process. The content may look as follows:

- Introduction

- Measurement date and purpose (Annual Financial Statements financial close, Interim period financial close, Consolidation return financial close or ….)

- Industry characteristics, Step 7 Measure expected credit losses

- Relevant historical data (updated each year),

- The measurement of expected credit losses Step 7 Measure expected credit losses

- Definition of default, substantiated with industry and/or company data,

- Decision on using the general or simplified approach (or both) including data analysis of the recent history to-date and outlook for the near future,

- The simplified approach – Provision matrix calculation including two or three years/periods of comparable calculations,

- The general approach – Definition of significant increase in credit risks including data analysis of the recent history to-date, outlook for the near future, and previous definitions (or if the same definition but only updated data, state the latest revision date),

- Definition of low risk receivables/financial assets including data analysis of the recent history to-date, outlook for the near future, and previous definitions (or if the same definition but only updated data, state the latest revision date),

- Allocation of low and higher risk receivables, data build up with comparison of latest revision (including latest revision date),

- Measurement of expected credit losses for the higher than low risk receivables/financial assets including data analysis of the recent history to-date and outlook for the near future,

- Review and conclude Step 7 Measure expected credit losses

- on the correctness of the documentation in the previous chapters and

- on the reflection on the below considerations.

- Sign offs and date of completion Step 7 Measure expected credit losses

The measurement model should reflect the following considerations:

|

Key considerations |

Possible actions |

|

|

An unbiased and probability-weighted amount |

Estimate should reflect at least two scenarios:

|

Consider using average historical credit losses for a large group of similar financial assets or historical default rates implied by credit default spreads, bond spreads of the counterpart or a comparative peer group exposure as a reasonable estimate of the probability-weighted amounts. |

|

The time value of money |

Apply an appropriate discount rate:

|

Consider estimating an average rate that would approximate the EIR to discount the expected losses.

|

|

Reasonable and supportable information that is available without undue costs or effort |

|

|

Jump to:

Step 1 Define Default, Step 2 Decide to use the general or simplified approach, Step 3 Define significant increase in credit risk, Step 4 Define low credit risk, Step 5 Allocate receivables to high and low credit risk, Step 6 Apply the provision matrix