Sometimes a share-based payment is granted as a replacement for another share-based payment that is cancelled. In this case, the principles of modification accounting are applied. The basis for conclusions to IFRS 2 explains that the reason for permitting a cancellation and a new grant to be accounted for as a modification is that the Board could not see a difference between those two transactions and a re-pricing, being a change in the exercise price.

To apply modification accounting, the entity identifies the new equity instruments granted as a replacement for cancelled equity instruments on the date on which the new equity instruments are granted. (IFRS 2.28(c))

If the entity does not identify a new equity-settled plan as a replacement for a cancelled equity-settled plan, then the two plans are accounted for separately. For example, if a new equity-settled share-based payment is offered and an old equity-settled share-based payment is cancelled, but the new plan is not identified as a replacement plan for the cancelled plan, then the new grant is recognised at its grant-date fair value and the original grant is accounted for as a cancellation. (IFRS 2.28(c))

IFRS 2 specifies that identification of a new grant as a replacement award is required on the date of the new grant. However, the standard is silent on the question of whether the cancellation should also be on the same date as the new grant. Judgement is required to determine whether the facts and circumstances demonstrate that the arrangement is a modification if time has passed between the cancellation and the identification of a new grant.

When modification accounting is applied, the entity accounts for any incremental fair value in addition to the grant-date fair value of the original award. In the case of a replacement, the incremental fair value is the difference between the fair value of the replacement award and the net fair value of the cancelled award, both measured at the date on which the replacement award is issued.

The ‘net fair value’ is the fair value of the cancelled award measured immediately before the cancellation, less any payment made to the employees on cancellation.

Case – Replacement award with incremental fair value |

|

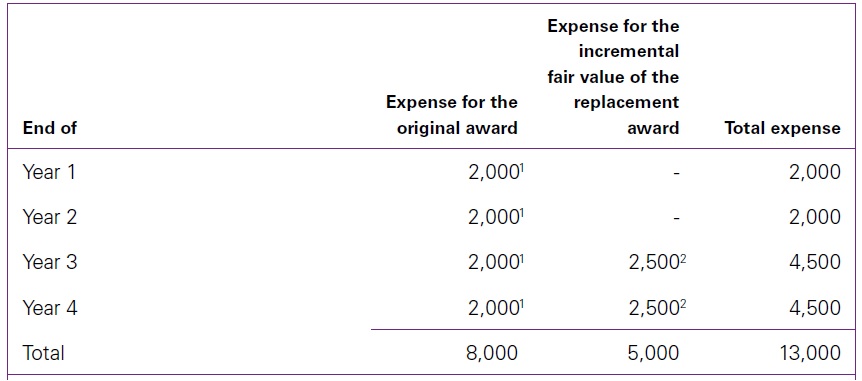

On 1 January Year 1, Company R grants 1,000 share options to its CEO, subject to a four-year service condition. The grant-date fair value of a share option is 8; the total grant-date fair value of the award is 8,000. At the end of Year 2, the fair value of the share options has decreased to 3. To restore the economic position of the employee, R cancels the original award and grants a new award: 1,000 share options with a fair value at the date of replacement of 8, subject to a remaining service period until 31 December Year 4 (i.e. two years of service after the replacement date are required). R identifies the new award as a replacement award for the original award. The incremental fair value per equity instrument is 5 (8 – 3). R accounts for the transaction based on the following amounts.

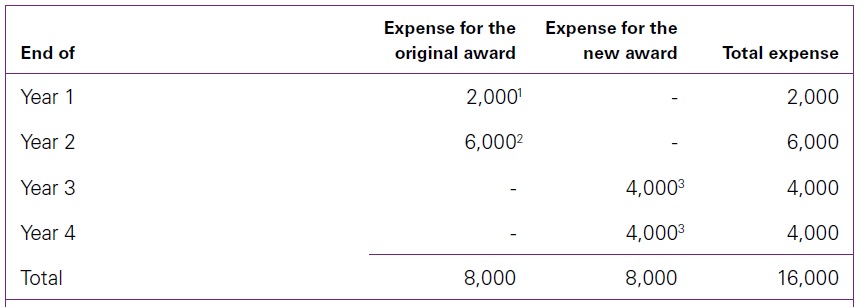

Notes 1. 1,000 x 8 x 1/4, 2. 1,000 x 5 x 1/2. The total expense reflects the grant-date fair value of the original award of 8,000 plus the incremental fair value of the replacement award of 5,000. If R does not identify the new grant as a replacement award, then it would apply cancellation accounting for the original award in Year 2 and the normal requirements for equity-settled share-based payments for the new award.

Notes 1. 1,000 x 8 x 1/4, 2. 1,000 x 8 x 3/4, 3. 1,000 x 8 x 1/2. The total expense reflects the grant-date fair value of the original award of 8,000 plus the grant-date fair value of the second award of 8,000. |

An entity may create a new, more beneficial share-based payment plan as a replacement for an old plan, but not formally cancel the old plan – e.g. because it would be disadvantageous for tax purposes to do so. Employees are expected to, and do, cancel their participation in the old plan and join the new one.

Together, the entity and the employees are able to identify the new plan as a replacement, but the issue is whether it is eligible to be accounted for as a replacement if the old plan continues to exist.

If there is sufficient evidence to establish a clear link between the employees’ cancellation of participation in the old plan and acceptance of the share-based payment under the new plan and of the entity’s expectation and intent for the new plan to replace the old plan, then in our view it is acceptable to apply replacement accounting.

If the new plan is not identified as a replacement of the old plan, then cancellation accounting for the old plan would be applied.

Case – New plan without cancelling old plan |

|

Company S establishes a plan on 1 January Year 1. Under the plan, an employee is required to participate in a savings plan to be eligible to buy shares at a discount to the grant-date price of the share. The share-based payment is in substance a share option with a non-vesting condition, being the requirement to save. In April Year 2, due to a decrease in the fair value of the equity instruments granted, S establishes a new more beneficial plan offered to the employees participating in the old plan and indicates to employees that this is intended to be a replacement. S does not close or cancel the old plan because otherwise the employees would lose tax benefits related to amounts already saved in the old savings plan. Employees can participate in either of the plans up to a cumulative savings amount of 200 per month. In April Year 2, Employee E notifies S that it has stopped contributing to the old plan and will start contributing to the new plan from May Year 2. In this case, we believe that it is appropriate to account for the share-based payment for this employee applying the principles of replacement accounting, even though the employer did not cancel the old plan because in a single communication the employee has cancelled their participation in the old scheme and identified the new scheme as a replacement. |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments

Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments Replacements of employee share-based payments