Last update 02/12/2019

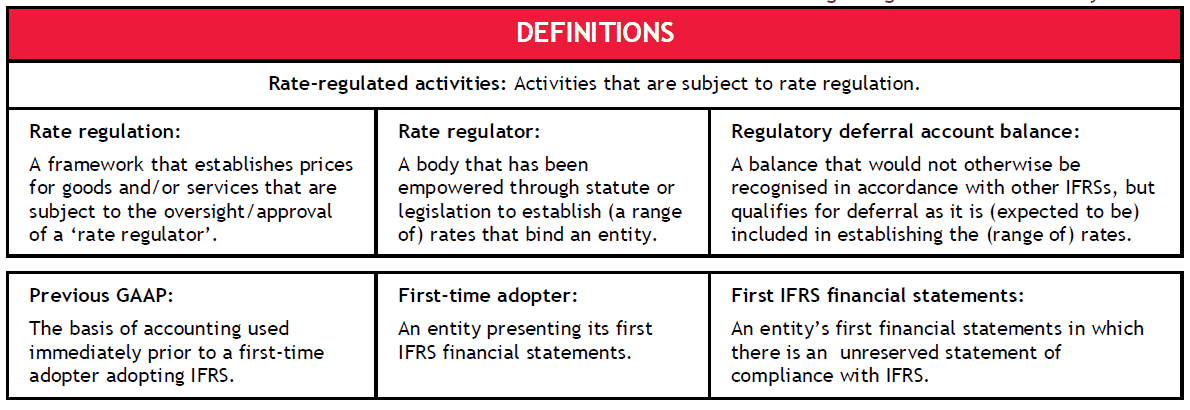

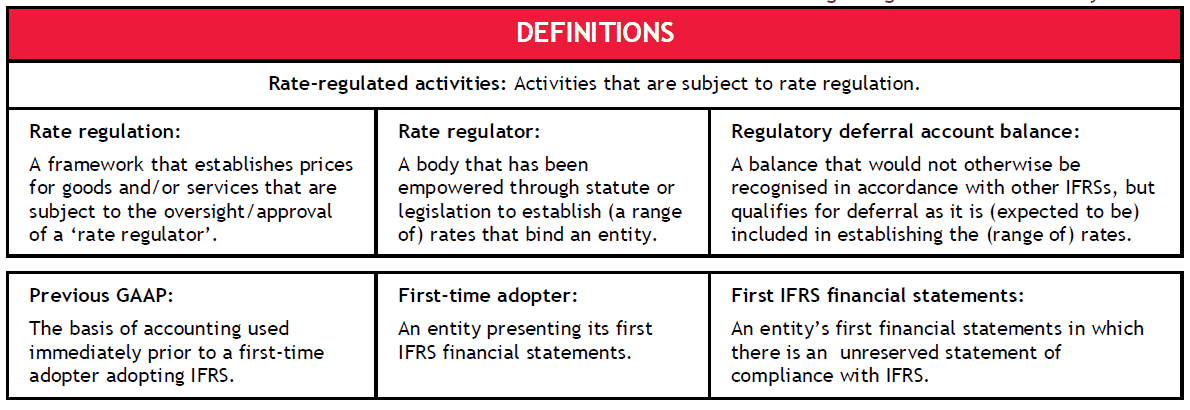

A regulatory deferral account is an amount recognised by a price-regulated entity, for example an electricity supplier. Rate regulations allow the supplier to recover specified costs and other amounts through the prices charged to retail customers, subject to the approval of a rate regulator.

To protect the interests of customers, rate regulation may defer the recovery of these amounts, in order to reduce retail price volatility. The regulatory deferral amount is the balance of any expense (or income) account that would not otherwise be recognised as an asset or a liability in accordance with general Financial Standards, but qualifies for recognition because it is included, or is expected to be included, by a rate regulator in establishing the rate (s) that can be charged to customers in the future.

The supplier usually keeps track of these deferred amounts in separate regulatory deferral accounts until they are recovered through future sales of the regulated goods or services.

OBJECTIVE

The objective of IFRS 14 is to specify the financial reporting requirements for regulatory deferral account balances that arise when an entity provides goods or services to customers at a price or rate that is subject to rate regulation.

The following are examples of the types of costs that rate regulators might allow in rate-setting decisions and that an entity might, therefore, recognise in regulatory deferral account balances:

- Volume or purchase price variances.

- Costs of approved ‘green energy’ initiatives (in excess of amounts that are capitalised as part of the cost of property, plant and equipment in accordance with IAS 116 Property, Plant and Equipment).

- Non-directly-attributable overhead costs that are treated as capital costs for rate regulation purposes (but are not permitted, in accordance with IAS 116, to be included in the cost of an item of property, plant and equipment).

- Project cancellation costs.

- Storm damage costs.

- Deemed interest (including amounts allowed for funds that are used during construction that provide the entity with a return on the owner’s equity capital as well as borrowings).

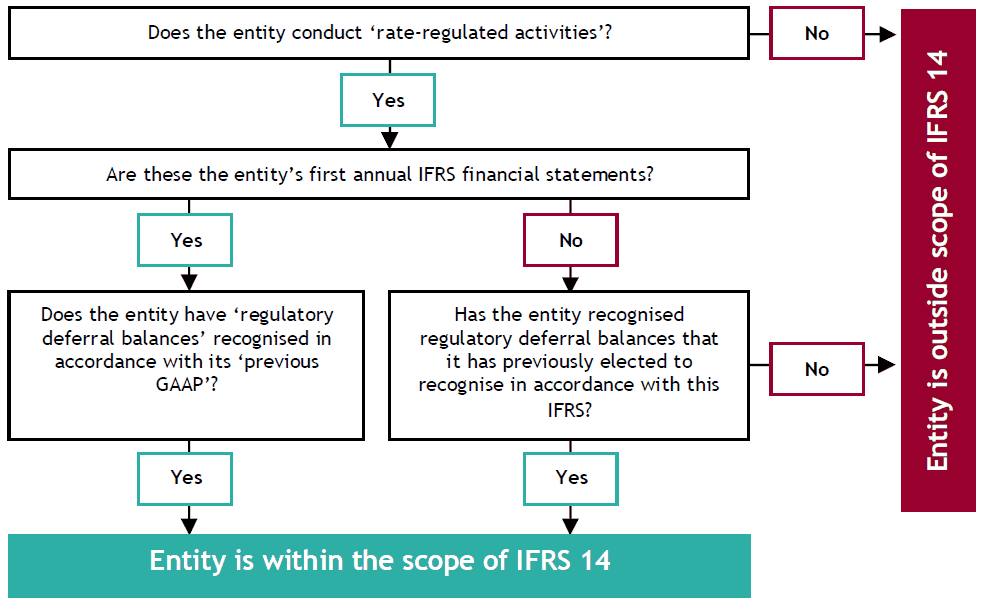

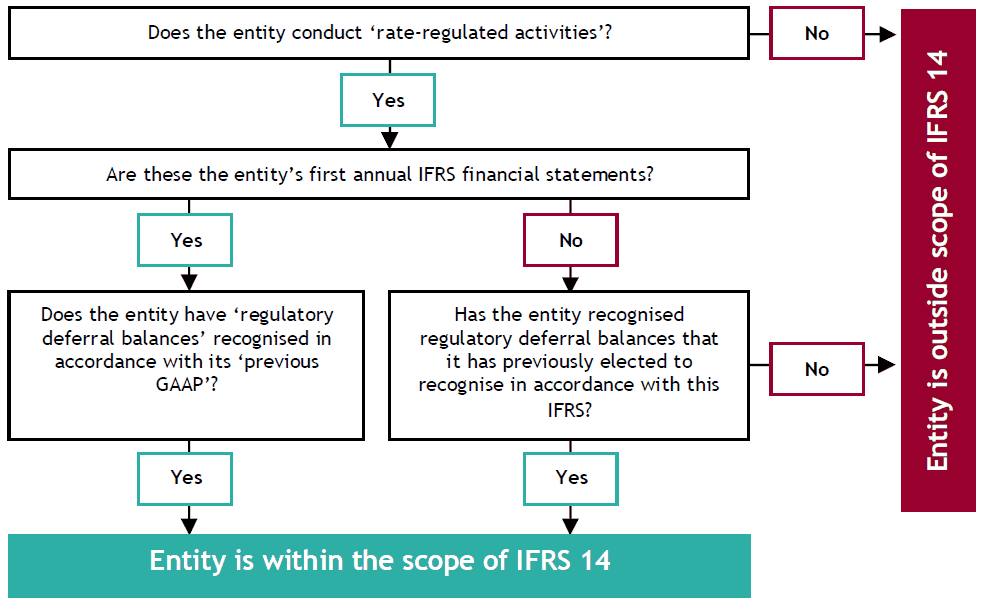

SCOPE

RECOGNITION, MEASUREMENT, IMPAIRMENT AND DERECOGNITION

An entity that has rate-regulated activities and that is within the scope of, and elects to apply, IFRS 14 shall apply paragraphs 10 and 12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors when developing its accounting policies for the recognition, measurement, impairment, and derecognition of regulatory deferral account balances.

On initial application of IFRS 14, an entity can continue to apply its previous GAAP accounting policies for regulatory deferral account balances, subject to the presentation requirements of IFRS 14, which may require changes to the entity’s previous GAAP presentation policies.

Changes in accounting policies

An entity shall not change its accounting policies in order to start to recognise regulatory deferral account balances. An entity may only change its accounting policies for regulatory deferral account balances if the change makes the financial statements more relevant to the economic decision-making needs of users and no less reliable, or more reliable and no less relevant to those needs. An entity shall judge relevance and reliability using the criteria in paragraph 10 of IAS 8.

PRESENTATION

An entity needs to present separate line items in the statement of financial position for:

- the total of all regulatory deferral account debit balances; and

- the total of all regulatory deferral account credit balances.

An entity should not classify the totals of regulatory deferral account balances as current or non-current in the statement of financial position. It needs to separately disclose the separate line items required by IFRS 14 by the use of sub-totals.

An entity should present, in the other comprehensive income section of the statement of profit or loss and other comprehensive income, the net movement in all regulatory deferral account balances for the reporting period that relate to items recognised in other comprehensive income. Separate line items should be used for the net movement related to items that, in accordance with other standards:

- will not be reclassified subsequently to profit or loss; and

- will be reclassified subsequently to profit or loss when specific conditions are met.

Similarly, an entity should present a separate line item in the profit or loss section of the statement of profit or loss and other comprehensive income, or in the separate statement of profit or loss, for the remaining net movement in all regulatory deferral account balances for the reporting period, excluding movements that are not reflected in profit or loss, such as amounts acquired.

This separate line item should be distinguished from the income and expenses that are presented in accordance with other standards by the use of a sub-total, which is drawn before the net movement in regulatory deferral account balances.

DISCLOSURES

|

IFRS |

Disclosure requirements |

|

What is regulatory deferral account balances? |

The entity shall elect to apply IFRS 14 disclosed information that enables users to assess:

|

|

If the disclosures provided in accordance with IFRS 14 30 – IFRS 14 36 are insufficient to meet the objective in IFRS 14 27 above, the entity shall disclose additional information that is necessary to meet that objective |

|

|

What is regulatory deferral account balances? What is regulatory deferral account balances? What is regulatory deferral account balances? |

The entity shall disclose for each type of rate-regulated activity:

|

|

The disclosures required by IFRS 14 30 in the financial statements shall be given either directly in the notes or incorporated by cross reference from the financial statements to some other statement, such as a management commentary or risk report, that is available to users of the financial statements on the same terms as the financial statements and at the same time |

|

|

The entity shall disclose the basis on which regulatory deferral account balances are recognised and derecognised, and how they are measured initially and subsequently, including how regulatory deferral account balances are assessed for recoverability and how any impairment loss is allocated |

|

|

What is regulatory deferral account balances? What is regulatory deferral account balances? What is regulatory deferral account balances? What is regulatory deferral account balances? |

For each type of rate-regulated activity, the entity shall discloses the following information for each class of regulatory deferral account balance:

|

|

When rate regulation affects the amount and timing of an entity’s income tax expense (income), the entity shall disclose the impact of the rate regulation on the amounts of current and deferred tax recognised The entity shall separately disclose any regulatory deferral account balance that relates to taxation and the related movement in that balance |

|

|

What is regulatory deferral account balances? |

When an entity provides disclosures in accordance with IFRS 12 Disclosure of Interests in Other Entities for an interest in a subsidiary, associate or joint venture that has rate-regulated activities and for which regulatory deferral account balances are recognised in accordance with IFRS 14, the entity shall disclose the amounts that are included for the regulatory deferral account debit and credit balances and the net movement in those balances for the interests disclosed (see paragraphs IFRS 14 B25 – B28) |

|

When an entity concludes that a regulatory deferral account balance is no longer fully recoverable or reversible, the entity shall disclose that fact, the reason why it is not recoverable or reversible and the amount by which the regulatory deferral account balance has been reduced |

See also: The IFRS Foundation