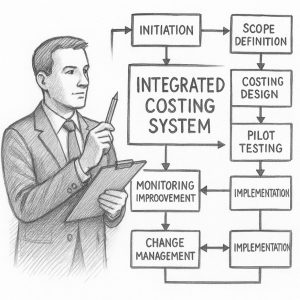

Project Plan for an Integrated Costing System in an International B2B Industrial Company

An integrated costing system is the backbone of any industrial company: it shows where money is earned and where it leaks away. Such a system is never static; it must be periodically updated because products, processes and markets change. With IFRS 18 (new presentation of the income statement) and the CSRD (mandatory sustainability reporting) raising the bar for transparency and allocation, the need to keep your costing system under review is stronger than ever.

This project plan does not offer a one-size-fits-all recipe, but a framework you can adapt to your own reality. Each step presents two alternatives – a top-down and a bottom-up route – that your project group can use to decide: what works here, what should we avoid, and where are our opportunities? In that way, this plan becomes not a paper exercise but a practical guide that you translate together into daily practice. (See also Step 9 on the importance of continuous updates and external triggers.)

Project Plan as a Roadmap: From Start to Result

A project plan is not a straitjacket but a roadmap. The steps follow each other logically, but in practice you will sometimes jump ahead or loop back. The point is not to follow the plan to the letter, but to keep direction and regularly ask: where are we now, and what is the next step?

Step 1 – Initiation and Sponsorship

Goal: Secure ownership and formal sponsorship so the costing system is not seen as a finance-only initiative but as a strategic project.

Intro:

No project succeeds without mandate. Costing affects the heart of the business – margins, investments, pricing – and requires explicit top-level support or smart grassroots momentum.

Alternatives:

- Top-down: CEO or CFO appoints a project manager, making it a board priority.

- Bottom-up: A plant controller runs a pilot, wins buy-in through visible results.

Resistances:

- Executives fear “just another IT project.”

- Controllers fear extra workload or losing autonomy.

Solutions:

- Make urgency tangible with concrete margin losses.

- Link to external drivers (IFRS 18, CSRD, customer claims).

Story (anecdote):

In a multinational I worked with, the CEO shrugged: “Don’t we already have SAP? Why another project?” Finance seemed stuck—until a €1.2m claim arrived after an underestimated quotation. The post-calculation showed costs were 7% higher than expected. That painful fact flipped the conversation. The project was renamed “Margin Control” instead of “Costing Model Update”. Suddenly managers recognized themselves in the issue. Later, AI analysis of historical bids revealed recurring underestimation patterns—evidence we could have used much earlier to win top-level sponsorship.

Read more to this very difficult but most important Step 1, from the Association of Project Management – A guide to project sponsorship. And read from our blog on COSO ERM/ICF – Step 1 COSO Control Environment

Step 2 – Scope and Objectives

Goal: Define the project’s scope and ambition without drowning in complexity.

Intro:

Too broad a scope leads to paralysis; too narrow a scope triggers skepticism. The balance is crucial: ambitious enough to matter, manageable enough to succeed.

Alternatives:

- Broad: Roll out a global standard across all factories.

- Narrow: Pilot in one plant or one product family.

Resistances:

- Broad → endless discussions.

- Narrow → “not representative.”

Solutions:

- Use a hybrid approach: a pilot that can scale.

Story (dialogue):

- Head office: “We need all 14 factories in scope, otherwise we’ll never get uniformity.”

- Plant director: “If I can start here tomorrow, I’ll have margin visibility in three weeks. Why wait until 2026?”

That clash was resolved when one Polish plant became the test bed. Within weeks the director had his first product-margin dashboard. Other plants soon asked to join. AI later accelerated scaling by recognizing BOM patterns across plants. The lesson? Don’t debate for months; prove value in one place and let demand spread.

Step 3 – Data Inventory and Quality

Goal: Establish a clear view of the current data and ensure a solid basis for costing.

Intro:

A costing system is only as good as its data. Yet BOMs often contain duplicates, errors, or inconsistent codes. Facing this reality is the first hurdle.

Alternatives:

- ERP-driven: Full mapping and cleanup in SAP/Dynamics.

- Pragmatic: Start with Excel-based calculations and post-calculations.

Resistances:

- BOMs full of errors.

- IT departments protective of their domain.

Solutions:

- Quick wins with Power BI Copilot dashboards.

- AI for BOM cleansing and duplicate detection.

Story (metaphor):

Think of a BOM like a pantry with three jars of sugar, all labeled differently. You keep buying new bags while the cupboard overflows. In one metalworking company I saw exactly this: the same bolt had three codes, three stock lines, and three cost prices. The purchasing director joked: “I’m not buying bolts, I’m buying Excel errors.”

The breakthrough came by exporting SAP data into Power BI and letting Copilot scan for duplicates. Within a week, the errors were visualized in a dashboard. An operator exclaimed: “If I’d known this ten years ago, we’d have saved 20% on procurement.” Resistance melted when people saw this wasn’t about blame but about joint savings.

Read more from the Association of Project Management – 5 ways to make the most of project data.

Step 4 – Costing Design

Goal: Develop a practical model that is understandable and usable across finance and operations.

Intro:

Too many costing projects fail at the design stage: too complex, too academic, or disconnected from reality. The key is a model robust enough for reporting yet simple enough for daily use.

Alternatives:

- Consultants: Deliver a sophisticated design (e.g. activity-based costing).

- Internal team: Build a prototype in Power BI/Excel.

Resistances:

- Consultants: expensive, overengineered.

- Internal: risk of “Excel 2.0.”

Solutions:

- Start with 2–3 drivers.

- Use AI for scenario testing.

Reflection:

I’ve seen million-euro consultancy models that ended up shelved because no one could maintain them. Meanwhile, small internal teams with a prototype in Power BI made real impact in weeks. Ownership beats sophistication. AI here is a design assistant: running scenarios, testing drivers. The lesson: choose simplicity and evolve.

Step 5 – Pilot and Validation

Goal: Prove that the model works and creates real value.

Intro:

No boardroom slide deck will convince people—only a pilot that shows reality and money on the table.

Alternatives:

- Global pilot: One product family across sites.

- Local pilot: One plant or line.

Resistances:

- Operations: “Too much effort.”

- Finance: “Not representative.”

Solutions:

- Validate against 12 months’ post-calculations.

- Highlight quick wins.

Comparison (Carillion case):

The collapse of Carillion in the UK illustrated the danger of unreliable costing. Projects were consistently underpriced, costs underestimated, and there was no feedback loop from actuals. The company looked profitable on paper, until reality struck.

Contrast that with a German factory where we piloted AI-based analysis of post-calculations. Energy consumption per product varied 15% due to machine settings. Fixing this saved €1.5m in a year. The pilot convinced even skeptics: this wasn’t theory—it was money.

Step 6 – Implementation in ERP/BI

Goal: Embed the system structurally in ERP and BI for ongoing use.

Intro:

As long as costing lives in Excel, it’s fragile. Embedding into ERP and BI ensures continuity and real-time usage.

Alternatives:

- ERP integration: SAP S/4HANA, Dynamics 365.

- Parallel reporting: Power BI, Celonis.

Resistances:

- CFOs fear big bang risk.

- Licenses too costly.

Solutions:

- Phased rollout.

- Use Quick Scan tools first.

Mini-case (with numbers):

In one German plant, scrap was 8% higher than standards. Celonis revealed 70% of scrap occurred during product changeovers. Adjusting planning cut scrap to 3%, saving €2m annually. The gain wasn’t from the system itself but from insights it enabled.

Step 7 – Governance and Assurance

Goal: Ensure ownership, accountability, and sustainability of the costing system.

Intro:

Without governance, costing data quickly erodes. Clear roles, controls, and links to reporting are essential.

Alternatives:

- Top-down: Make costing part of corporate KPIs.

- Control-driven: Internal audit sampling.

Resistances:

- Seen as “more bureaucracy.”

- Unclear roles.

Solutions:

- RACI matrices.

- Link to IFRS/CSRD reporting.

Lessons learned:

- No owner = no accountability. Appoint cost data owners.

- Only finance reviewing = blind spots. Share dashboards with operations.

- No link to external reporting = gaps. Tie costing to IFRS/CSRD.

AI helps quietly: auto-checks, alerts, audit trails.

Step 8 – Change Management and Training

Goal: Overcome resistance and build a culture of joint ownership.

Intro:

People, not systems, make or break costing projects. Culture change is often harder than technology.

Alternatives:

- Top-down: Townhalls, corporate programs.

- Bottom-up: Workshops and training.

Resistances:

- “Finance doesn’t understand production.”

- “Another training…”

Solutions:

- Floor-level workshops.

- Gamified simulations.

Emotional anecdote:

During one workshop, an operator realized his machine’s scrap cost €300k annually. He asked: “So it’s me costing that much?” The room fell silent. But the moment turned into empowerment: “What can we do to fix this?” Within weeks, operators were suggesting improvements. AI dashboards made the data visible, but the human connection drove change.

Step 9 – Monitoring & Continuous Improvement

Goal: Keep the costing system alive and adaptive.

Intro:

Markets, products, and regulations change. Costing must evolve too.

Alternatives:

- Strategic dashboards: Monthly for Board/Audit Committee.

- Operational dashboards: Daily for plants.

Resistances:

- “Too many numbers.”

- “We already know this.”

Solutions:

- Focus on 5 key KPIs.

- Link dashboards to incentives.

Future outlook:

Costing is shifting from hindsight to foresight. AI now links external signals—commodity prices, energy costs—to internal data. A spike in aluminum prices at night shows up in product costing by morning. Finance transforms from reporter to navigator. Costing becomes a real-time steering tool, not just compliance.

Read more on good Corporate Governance in our blog – The COSO Framework: Origins and Purpose.

Conclusion

An integrated costing system is not just a tool but an organizational discipline. Every step has resistance, but each resistance hides the seed of improvement. By combining top-down sponsorship and bottom-up proof, governance and culture, human insight and AI support, a system emerges that truly works.

It becomes the fuel gauge and navigation system of the company: preventing breakdowns, guiding direction, and building trust.

Integrated costing system

Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system Integrated costing system