This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

This narrative deals with ordinary shares that are only partly paid-up in cash, with the balance of the subscription price required to be paid only as and when it is called for by the issuing entity. The rights of the holders of such shares to dividends, on winding-up or liquidation of the entity, and the rights of the entity if the balance is not paid when it is required, will differ depending on the applicable laws and/or the entity’s constitutional documents.

EPS implications

Generally, how partly paid ordinary shares are dealt with in EPS depends on their dividend participation relative to fully paid ordinary shares. This may not be the same as the percentage of the subscription price paid.

In short: the numerator is not affected, the denominator is

|

Consider the entitlement to dividends during the period |

|

|

↓ |

↓ |

|

Include in basic EPS the fraction entitled to dividends |

Include as equivalent of options in diluted EPS the fraction not entitled to dividends |

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

To the extent that a partly paid ordinary share is entitled to participate in dividends during the period relative to a fully paid ordinary share, it is treated as a fraction of an ordinary share in the denominator. [IAS 33.A15] |

To the extent that a partly paid ordinary share is not entitled to participate in dividends during the period, it is treated as the equivalent of an option or warrant (see Options, warrants and their equivalents). [IAS 33.A16] No adjustment is necessary in the numerator because the payment of the remaining balance has no consequential effect in income or expense. The potential adjustment to the denominator is determined by applying the treasury share method to the fraction of partly paid ordinary shares that is not entitled to participate in dividends. The unpaid balance is assumed to be the proceeds used to hypothetically purchase ordinary shares at the average market price for the period (or the period for which the partly paid ordinary shares are outstanding if this is shorter). The potential adjustment to the denominator is the number of incremental shares that are assumed to be issued and is the difference between:

|

Dilutive or anti-dilutive?

Generally, partly paid ordinary shares are dilutive when the unpaid balance per share is lower than the average market price of an ordinary share during the period.

|

|

|

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

Accordingly, P receives 8 per share on that date.

|

|

|

The EPS computations for Year 1 are as follows. |

|

|

Basic EPS |

Diluted EPS |

|

1. Determine the numerator No adjustment is necessary. The numerator is 4,600,000. |

1. Identify POSs The partly paid ordinary shares are POSs from 1 April Year 1, because they are treated as the equivalent of warrants or options to the extent that they are not entitled to dividends relative to fully paid ordinary shares. |

|

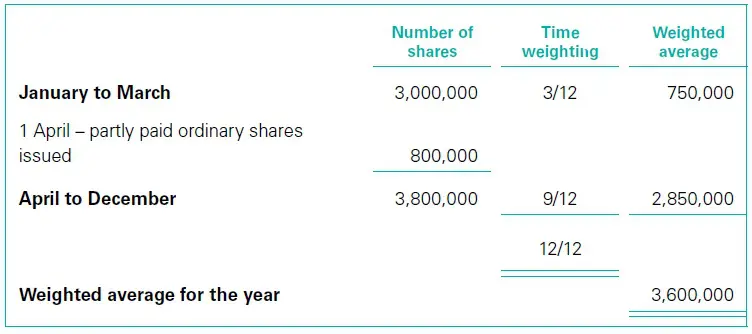

2. Determine the denominator Partly paid ordinary shares are treated as fractions of ordinary shares to the extent of their dividend rights. Accordingly, each of the 1,000,000 partly paid ordinary shares is treated as 80% of an ordinary share when determining the denominator. Accordingly, P calculates the denominator as follows.

The denominator is therefore 3,600,000. |

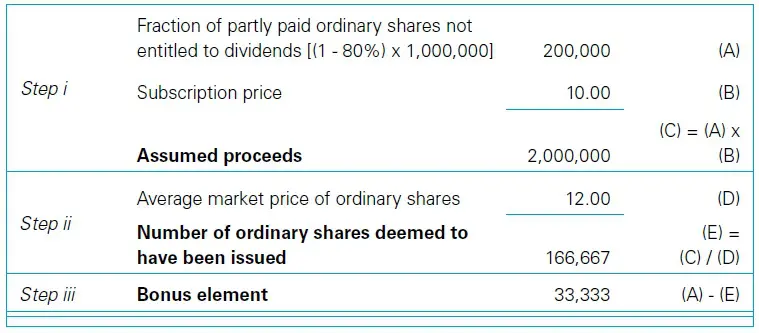

2. For each POS, calculate EPIS Potential adjustment to the numerator for EPIS: No adjustment is required. Potential adjustment to the denominator for EPIS: The adjustment is determined using the treasury share method, as follows.

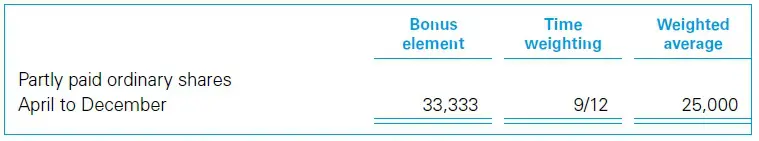

The bonus element is weighted for the period the ordinary shares are not fully paid.

|

|

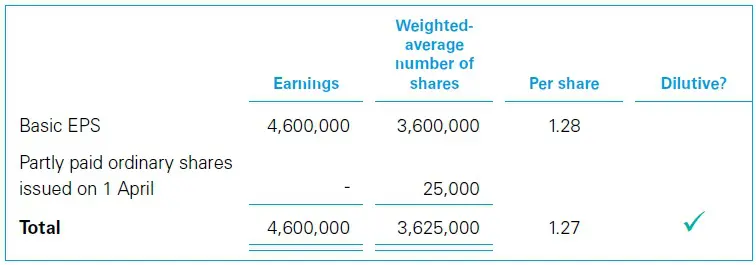

3. Determine basic EPS Basic EPS = 4,600,000 / 3,600,000 = 1.28. |

3. Rank the POSs This step does not apply, because there is only one class of POSs. |

|

4. Determine basic EPS from continuing operations Basic EPS is 1.28 (see Step 3 of basic EPS computation on the right side). |

|

|

5. Identify dilutive POSs and determine diluted EPS The partly paid ordinary shares are dilutive because no adjustment to the numerator for EPIS is required and the unpaid balance per share is lower than the average market price of an ordinary share during the period.

Accordingly, P includes the impact of the partly paid ordinary shares in diluted EPS. Diluted EPS = 1.27 |

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.