Ordinary shares issued and EPS

Ordinary shares issued and EPS summarises the effects of three events involving share issued on EPS calculations including comprehensive examples:

Ordinary shares issued to settle liabilities

This chapter deals with ordinary shares issued to fully or partially extinguish a financial or non-financial liability, as a result of a renegotiation of the terms of the liabilities.

This chapter does not deal with:

- the issuance of ordinary shares to settle financial liabilities that have an option of conversion to shares. For further discussion of this scenario, see the following chapters:

EPS implications

Generally, ordinary shares issued to settle liabilities impact only basic EPS.

|

Potential impact on basic EPS

|

Potential impact on diluted EPS

|

|

The numerator and the denominator are not affected.

|

The numerator and the denominator are not affected.

|

|

Generally, ordinary shares issued are included in the denominator from the date on which consideration is receivable. Therefore:

- ordinary shares issued in place of interest or principal on debt or other financial instruments are included from the date on which the interest ceases to accrue; and

- ordinary shares issued in exchange for the settlement of a liability are included from the settlement date. [IAS 33.21(d)–(e)]

|

Ordinary shares issued to settle liabilities are not POSs. Accordingly, there are no additional diluted EPS implications.

|

Case – Ordinary shares issued to settle liabilities

|

|

The following basic facts relate to Company P.

- Net profit for Year 1 is 4,600,000.

- The number of ordinary shares outstanding on 1 January Year 1 is 3,000,000.

The following facts are also relevant for Year 1.

- On 1 July, P agrees with certain shareholders to issue 200,000 ordinary shares in settlement of non-interest-bearing loans from these shareholders of 350,000. The loans are settled and the shares are issued on this date.

- On 1 October, P agrees with certain third party creditors to issue 250,000 ordinary shares in settlement of interest-bearing loan notes of 450,000. Based on the terms of the agreement, the loan notes cease to bear interest from this date. The shares are issued on 15 October.

- Assume that the carrying amount of the liabilities equals the fair value of the shares issued.

Workings

The EPS computations for Year 1 are as follows.

|

Basic EPS

|

Diluted EPS

|

|

1. Determine the numerator

No adjustment is necessary. The numerator is 4,600,000.

|

1. Identify POSs

The shares issued to settle liabilities are not POSs. Therefore, Steps 2–4 do not apply.

|

|

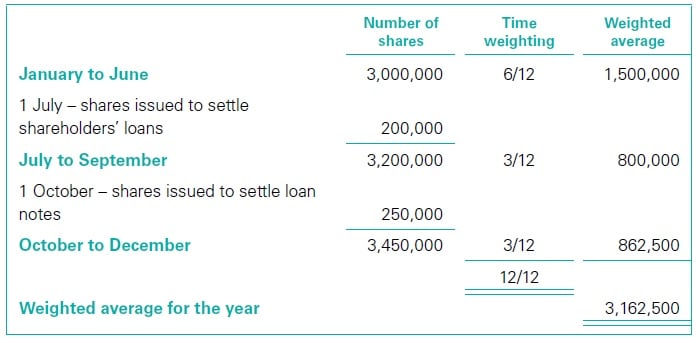

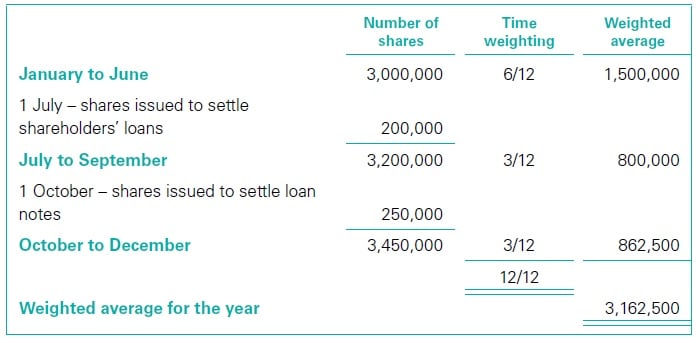

2. Determine the denominator

The shares issued in settlement of the shareholders’ loans are included in the denominator from the settlement date – i.e. 1 July. In contrast, the shares issued in settlement of the third party loan notes are treated as outstanding from the date on which interest ceases to accrue – i.e. 1 October.

Accordingly, P calculates the denominator as follows.

The denominator is therefore 3,162,500.

|

2. For each POS, calculate EPIS

Not applicable.

|

|

3. Determine basic EPS

Basic EPS = 4,600,000 / 3,162,500 = 1.45

|

3. Rank the POSs

Not applicable.

|

|

4. Determine basic EPS from continuing operations

Not applicable.

|

|

5. Identify dilutive POSs and determine diluted EPS

Because there are no POSs, diluted EPS is the same as basic EPS.

Diluted EPS = 1.45

|

|

Ordinary shares issued to acquire assets

This narrative deals with ordinary shares issued to acquire an asset or a group of assets that does not constitute a ‘business’ as defined in IFRS 3 Business Combinations. Generally, if an entity receives goods – e.g. inventories, property, plant and equipment, intangible assets or other non-financial assets – or services as consideration for its own equity instruments, then IFRS 2 Share-based Payment applies. [IFRS 2.2(c)]

This narrative does not deal with:

EPS implications

Generally, ordinary shares issued to acquire assets impact only basic EPS.

|

Potential impact on basic EPS

|

Potential impact on diluted EPS

|

|

The numerator is not affected and the denominator is not affected.

|

The numerator and the denominator are not affected.

|

|

Generally, ordinary shares issued for the acquisition of an asset other than cash are included in the denominator as of the date on which the acquisition is recognised, as long as the issue is not subject to conditions other than the passage of time. This is irrespective of whether the ordinary shares may be issued at a later date. [IAS 33.21(f)]

|

Ordinary shares issued to acquire assets are not POSs as long as the issue is not subject to conditions other than the passage of time. Accordingly, there are no additional diluted EPS implications.

|

.u46f14ed9c86ca8da5d0b4f0b01c01ab4 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .u46f14ed9c86ca8da5d0b4f0b01c01ab4:active, .u46f14ed9c86ca8da5d0b4f0b01c01ab4:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .u46f14ed9c86ca8da5d0b4f0b01c01ab4 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .u46f14ed9c86ca8da5d0b4f0b01c01ab4 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .u46f14ed9c86ca8da5d0b4f0b01c01ab4 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .u46f14ed9c86ca8da5d0b4f0b01c01ab4:hover .postTitle { text-decoration: underline!important; }

Something else – IFRS 16 Assets of low value

Case – Ordinary shares issued to acquire an asset

|

|

The following basic facts relate to Company P.

- Net profit for Year 1 is 4,600,000.

- The number of ordinary shares outstanding on 1 January Year 1 is 3,000,000.

The following facts are also relevant for this example.

- On 1 May Year 1, P acquires a building, which it recognises in its financial statements on that date. The consideration is to be satisfied by the issue of 150,000 ordinary shares.

- On 31 May Year 1, 150,000 shares are issued to settle the consideration payable.

- Assume that the fair value of the assets equals the fair value of the shares issued.

Workings

The EPS computations for Year 1 are as follows.

|

Basic EPS

|

Diluted EPS

|

|

1. Determine the numerator

No adjustment is necessary. The numerator is 4,600,000.

|

1. Identify POSs

The shares issued to settle liabilities are not POSs. Therefore, Steps 2–4 do not apply.

|

|

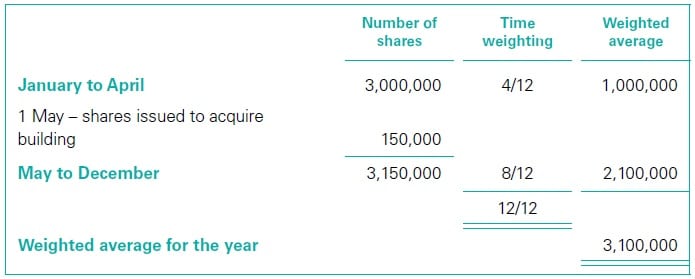

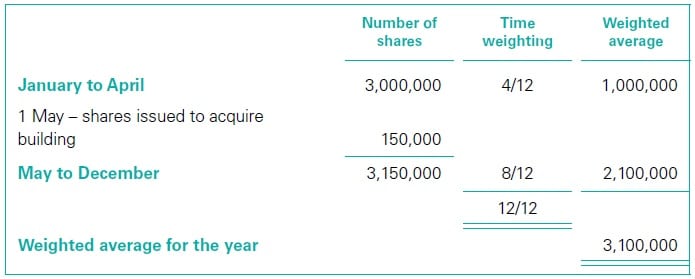

2. Determine the denominator

The shares issued to acquire the building are included in the denominator from the date on which the acquisition is recognised in the financial statements – i.e. 1 May. Accordingly, P calculates the denominator as follows.

The denominator is therefore 3,100,000.

|

2. For each POS, calculate EPIS

Not applicable.

|

|

3. Determine basic EPS

Basic EPS = 4,600,000 / 3,100,000 = 1.48

|

3. Rank the POSs

Not applicable.

|

|

4. Determine basic EPS from continuing operations

Not applicable.

|

|

5. Identify dilutive POSs and determine diluted EPS

Because there are no POSs, diluted EPS is the same as basic EPS.

Diluted EPS = 1.48

|

|

Ordinary shares issued to acquire a business

This narrative deals with ordinary shares issued by an acquirer in a business combination in exchange for control of an acquiree.

Share consideration in a business combination can be broadly classified into the following three categories:

- shares issued at the date of acquisition;

- shares that will be issued at a future date but whose issue is not subject to any conditions other than the passage of time (deferred consideration); and

- shares that may be issued (or returned) if specified future events occur or conditions are met (contingent consideration).

An acquirer presents contingent consideration settleable in ordinary shares as a liability or as equity in accordance with IAS 32 Financial Instruments: Presentation. For example, if the acquirer may be required to issue additional ordinary shares to the value of a specified monetary amount, then the contingent consideration is presented as a financial liability that is subsequently measured at fair value. [IFRS 3.40, IFRS 3.58, IAS 32.11]

In some business combinations, the entity that issues shares to acquire the interest in another entity is identified as the acquiree for accounting purposes. Such business combinations – referred to as ‘reverse acquisitions’ – present a specific challenge in determining EPS amounts.

EPS implications

Generally, ordinary shares issued to acquire a business impact only basic EPS. This would be the case for the first two categories mentioned above. However, the third category, contingent consideration settleable in ordinary shares, can impact diluted EPS.

|

Potential impact on basic EPS

|

Potential impact on diluted EPS

|

|

The numerator is not affected and the denominator is affected.

|

The numerator is not affected and the denominator is affected.

|

|

With the exception of contingent consideration settleable in shares (see contingent consideration below), ordinary shares issued or issuable are generally included in the denominator from the date of acquisition, which is the date on which the acquirer obtains control of the acquiree. [IFRS 3 definitions, IAS 33.22]

The above applies irrespective of whether the ordinary shares may be issued at a date later than the date of acquisition. Accordingly, deferred consideration settleable in shares is included in the denominator from the date of acquisition, and not from the date on which the shares are actually issued.

|

With the exception of contingent consideration settleable in shares (see contingent consideration below), ordinary shares issued or issuable to acquire a business are not POSs. This includes deferred consideration settleable in shares because they have been included in the denominator for basic EPS from the date of acquisition. Accordingly, there are no additional diluted EPS implications.

|

.ub1bb361bffe72feeb7254bbfe20cf215 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .ub1bb361bffe72feeb7254bbfe20cf215:active, .ub1bb361bffe72feeb7254bbfe20cf215:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .ub1bb361bffe72feeb7254bbfe20cf215 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .ub1bb361bffe72feeb7254bbfe20cf215 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .ub1bb361bffe72feeb7254bbfe20cf215 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .ub1bb361bffe72feeb7254bbfe20cf215:hover .postTitle { text-decoration: underline!important; }

Something else – Convertible instruments in EPS calculations – 2 good to read

Contingent consideration

An exception to the general principle on the potential impact on basic EPS in EPS Implications above applies to shares that form part of contingent consideration. IAS 33 generally regards these shares as contingently issuable ordinary shares, because they are typically issued for little or no further cash or other consideration on satisfying specified conditions in addition to the passage of time. In general, these shares are not considered outstanding and are not included in the denominator of basic EPS until all of the specified conditions (other than the passage of time) have been satisfied – i.e. until the date on which their issuance is no longer contingent.

Before then, these shares are POSs that are taken into account when determining diluted EPS. For further details on the EPS implications of contingently issuable ordinary shares, see contingently issuable ordinary shares and EPS. [IAS 33.5, IAS 33.24, IAS 33.52]

Acquisitions of associates and joint arrangements

An entity may issue ordinary shares to acquire an associate or a joint arrangement. Because these acquisitions are not business combinations, they are not specifically addressed by paragraph 22 of IAS 33. However, paragraph 21(f) of IAS 33 contains a general requirement that ordinary shares issued as consideration for the acquisition of an asset other than cash are included as of the date on which the acquisition is recognised. Therefore, the entity includes the shares in the denominator for basic EPS from the date on which it initially accounts for the associate or joint arrangement. [IAS 33.21(f)]

Case – Ordinary shares issued to acquire a business – No contingency

|

|

The following basic facts relate to Company P.

- Net profit for Year 1 is 4,600,000.

- The number of ordinary shares outstanding on 1 January Year 1 is 3,000,000.

The following additional facts are also relevant for Year 1.

- On 1 May, P agrees with the shareholders of Company S to acquire the entire interests in S for a combination of cash and share consideration. The acquisition, when it is completed, will be a business combination under IFRS 3 Business Combinations with P as the acquirer.

- On 1 June, P settles the cash consideration and acquires control over S in accordance with the acquisition agreement and IFRS 3.

- P settles the balance of the consideration as follows:

- on 1 August, 300,000 ordinary shares are issued; and

- on 1 November, another 100,000 shares are issued, being the remainder of the deferred consideration.

The issue of these shares is not subject to any conditions.

Workings

The EPS computations for Year 1 are as follows.

|

Basic EPS

|

Diluted EPS

|

|

1. Determine the numerator

No adjustment is necessary. The numerator is 4,600,000.

|

1. Identify POSs

The shares issued to acquire S are not POSs. Therefore, Steps 2–4 do not apply.

|

|

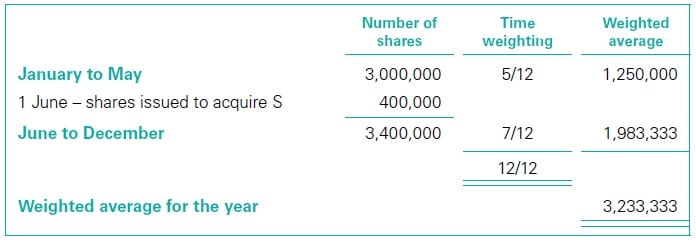

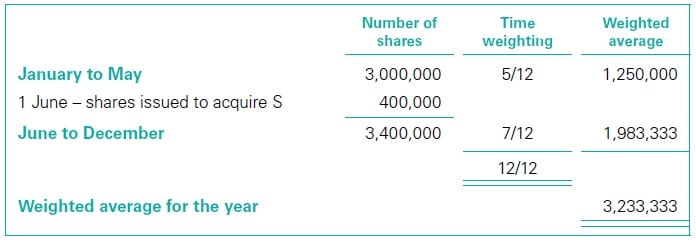

2. Determine the denominator

The shares issued by P to acquire S are treated as outstanding in the denominator from the date of acquisition of 1 June, although they are actually issued on 1 August and 1 November. Accordingly, P calculates the denominator as follows.

The denominator is therefore 3,233,333.

|

2. For each POS, calculate EPIS

Not applicable.

|

|

3. Determine basic EPS

Basic EPS = 4,600,000 / 3,233,333 = 1.42

Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS

|

3. Rank the POSs

Not applicable.

|

|

4. Determine basic EPS from continuing operations

Not applicable.

|

|

5. Identify dilutive POSs and determine diluted EPS

Because there are no POSs, diluted EPS is the same as basic EPS.

Diluted EPS = 1.42

|

|

.ub0076caaa508e36a63b0d5cb2358c1b0 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .ub0076caaa508e36a63b0d5cb2358c1b0:active, .ub0076caaa508e36a63b0d5cb2358c1b0:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .ub0076caaa508e36a63b0d5cb2358c1b0 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .ub0076caaa508e36a63b0d5cb2358c1b0 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .ub0076caaa508e36a63b0d5cb2358c1b0 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .ub0076caaa508e36a63b0d5cb2358c1b0:hover .postTitle { text-decoration: underline!important; }

Something else – Cash flow hedge reserve

Case – Ordinary shares issued to acquire a business – Contingent consideration

|

|

The basic facts are the same as in the Case – Ordinary shares issued to acquire a business – No contingency.

The following facts are also relevant for this example.

- On 1 May Year 1, Company P agrees with the shareholders of Company S to acquire the entire interests in S. The acquisition, when it is completed, will be a business combination under IFRS 3 with P as the acquirer.

- The consideration for the acquisition of S is:

- cash consideration, settled by P on 1 June Year 1. P acquires control over S on that date, in accordance with the acquisition agreement and IFRS 3; and

- 500,000 of P’s ordinary shares if S’s profit for a 12-month period ending at 31 May Year 2 is greater than 750,000, or 600,000 of P’s ordinary shares if S’s profit for the same period is greater than 1,500,000. The contingent consideration is recognised as a financial liability.

- S’s profit for the period from 1 June to 31 December Year 1 is 800,000.

- The expense for the change in the fair value of the contingent consideration, recognised in profit or loss in Year 1, is 100,000.

- The expense for the change in the fair value is tax-deductible. The applicable income tax rate is 40%.

Workings

The EPS computations for Year 1 are as follows.

|

Basic EPS

|

Diluted EPS

|

|

1. Determine the numerator

No adjustment is necessary. The numerator is 4,600,000.

|

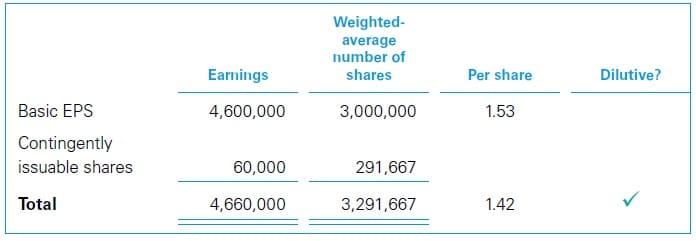

1. Identify POSs

To the extent that the contingently issuable ordinary shares are ignored in basic EPS, they are POSs.

Although the cumulative earnings target is not tested until the end of the 12-month period, if the end of Year 1 were the end of the contingency period, then the target would be met, because S’s cumulative earnings up to the end of Year 1 amount to 800,000, which exceeds 750,000 but is less than 1,500,000. Accordingly, 500,000 shares are included in the denominator (see Chapter 5.10).

|

|

2. Determine the denominator

No adjustment is necessary before the end of the contingent period for the contingently issuable shares and the satisfaction of the conditions. The denominator is therefore 3,000,000.

|

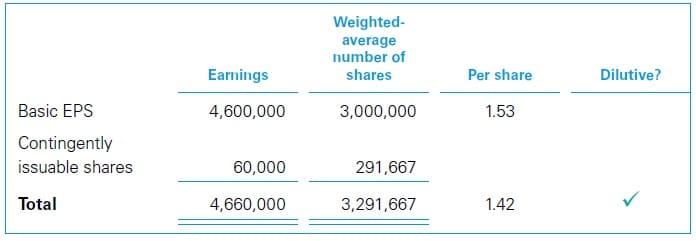

2. For each POS, calculate EPIS

Potential adjustment to the numerator for EPIS: The contingently issuable shares, if they are issued, would increase the profit or loss by the post-tax amount of the expenses for changes in the fair value of the liability:

(expenses for changes in fair value) x (1 – income tax rate) = (100,000) x (1 – 40%) = 60,000

Potential adjustment to the denominator for EPIS: The weighted-average number of shares is included in the denominator from 1 June: (500,000) x (7/12) = 291,667.

EPIS is calculated as follows.

EPIS = 60,000 / 291,667 = 0.21

|

|

3. Determine basic EPS

Basic EPS = 4,600,000 / 3,000,000 = 1.53

Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS Ordinary shares issued and EPS

|

3. Rank the POSs

This step does not apply, because the contingently issuable shares are the only POSs.

|

|

4. Determine basic EPS from continuing operations

Basic EPS is 1.53 (see Step 3 of basic EPS computation).

|

|

5. Identify dilutive POSs and determine diluted EPS

The potential impact of the contingently issuable ordinary shares is determined as follows.

Accordingly, P includes the contingently issuable shares in diluted EPS.

Diluted EPS = 1.42

|

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

.ude4f961378311aa2acc07ab6ab84c4f2 { padding:0px; margin: 0; padding-top:1em!important; padding-bottom:1em!important; width:100%; display: block; font-weight:bold; background-color:#ECF0F1; border:0!important; border-left:4px solid #141414!important; box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -moz-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -o-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); -webkit-box-shadow: 0 1px 2px rgba(0, 0, 0, 0.17); text-decoration:none; } .ude4f961378311aa2acc07ab6ab84c4f2:active, .ude4f961378311aa2acc07ab6ab84c4f2:hover { opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; text-decoration:none; } .ude4f961378311aa2acc07ab6ab84c4f2 { transition: background-color 250ms; webkit-transition: background-color 250ms; opacity: 1; transition: opacity 250ms; webkit-transition: opacity 250ms; } .ude4f961378311aa2acc07ab6ab84c4f2 .ctaText { font-weight:bold; color:#8E44AD; text-decoration:none; font-size: 16px; } .ude4f961378311aa2acc07ab6ab84c4f2 .postTitle { color:#7F8C8D; text-decoration: underline!important; font-size: 16px; } .ude4f961378311aa2acc07ab6ab84c4f2:hover .postTitle { text-decoration: underline!important; }

Something else – IAS 33 EPS Impact of share-based payments