Options in EPS Calculations, warrants and their equivalents

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

For EPS purposes, ‘options, warrants and their equivalents’ (collectively, ‘options’ in this chapter) are financial instruments that give holders the right to purchase ordinary shares. Options in this chapter are generally written calls that give holders the right, but not the obligation, to acquire an entity’s ordinary shares with cash and/or by providing goods or services. If an entity receives goods or services in exchange for the options, then the transaction generally falls in the scope of IFRS 2 Share-based Payment; other options are generally in the scope of IAS 32 Financial Instruments: Presentation. [IFRS 2.2, IAS 33.5]

In addition, the options discussed in this chapter are those that may require settlement in ordinary shares. An option that is always settled net in cash does not entitle its holder to ordinary shares; this option is therefore not a POS and is ignored in diluted EPS. [IAS 33.5]

This chapter covers the EPS implications for options in general. Some instruments may require additional consideration, which are set out in the following chapters:

- written put options and forwards: Written puts and forwards, as discussed here, are those that may require an entity to purchase its ordinary shares. Typically, these instruments are in the scope of IAS 32 Financial Instruments: Presentation. Generally, shares that are subject to written puts or forwards are not regarded as outstanding in basic EPS but do impact diluted EPS. Understanding the accounting for these instruments is also relevant, because it determines whether their assumed conversion would have a consequential effect on profit or loss. Generally, written puts or forwards are dilutive if they are in-the-money – i.e. the exercise or settlement price is higher than the average market price of the ordinary shares. [IAS 33.63] However, if these instruments are accounted for as liabilities under IAS 32, then the numerator adjustment could vary and could therefore affect whether the instruments are dilutive.

- purchased puts and calls held by an entity over its own ordinary shares. Purchased puts and calls are ignored in both basic and diluted EPS.

- options embedded in other financial instruments: see Convertible instruments;

- options subject to performance conditions other than service conditions: see Contingently issuable ordinary shares; and

- options to purchase convertible instruments: Options or warrants to purchase convertible instruments – e.g. an option to purchase convertible preference shares – may also be considered POSs. In many cases, these options do not meet the requirements for classification as equity instruments under IAS 32 and are accounted for as derivatives under IFRS 9 Financial instruments. In such cases, the options are assumed to be exercised to purchase the convertible instrument in diluted EPS only when:

- the average price of the convertible instrument is above the exercise price of the option;

- the average price of the ordinary shares obtainable on conversion is above the exercise price of the option; and

- the conversion of similar outstanding convertible instruments, if there are any, is also assumed. [IAS 33.A6]However, IAS 33 is not clear on how to calculate the impact of these instruments in diluted EPS. Because they are options, in general one acceptable approach is to use the treasury share method in determining the impact on the denominator, assuming that the options would be exercised directly to obtain shares on conversion (see 5.9.40). The post-tax consequential changes in income or expense would be adjusted in the numerator.

Additional considerations in the context of share-based payment arrangements are set out in EPS Impact of share-based payments.

EPS implications

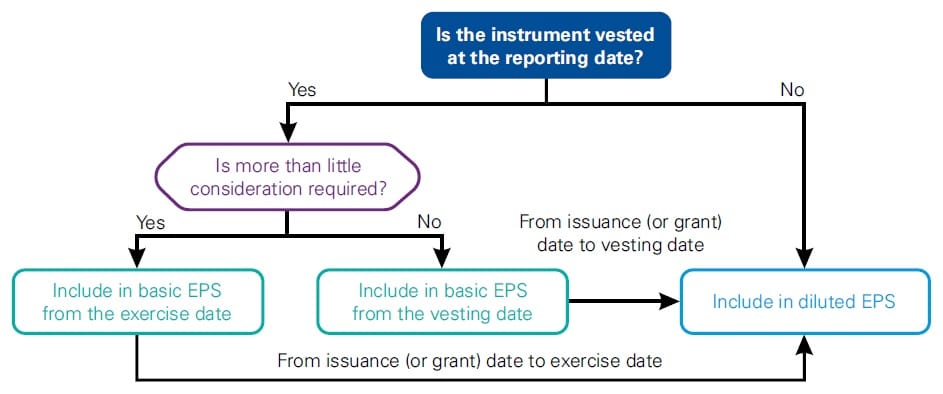

Generally, options impact only diluted EPS. If the options are vested and require little or no further consideration to be exercised, then in our view they should be included in basic EPS. Understanding the accounting for these options is also relevant, because it determines whether their assumed conversion would have a consequential effect on profit or loss.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator is not affected, the denominator might or might not be affected. |

The numerator might or might not be affected, the denominator is affected. |

|

Options are generally ignored in basic EPS because they are not ordinary shares. However, if options are exercisable for little or no further consideration after vesting, then in our view they should be included in the denominator from the vesting date. |

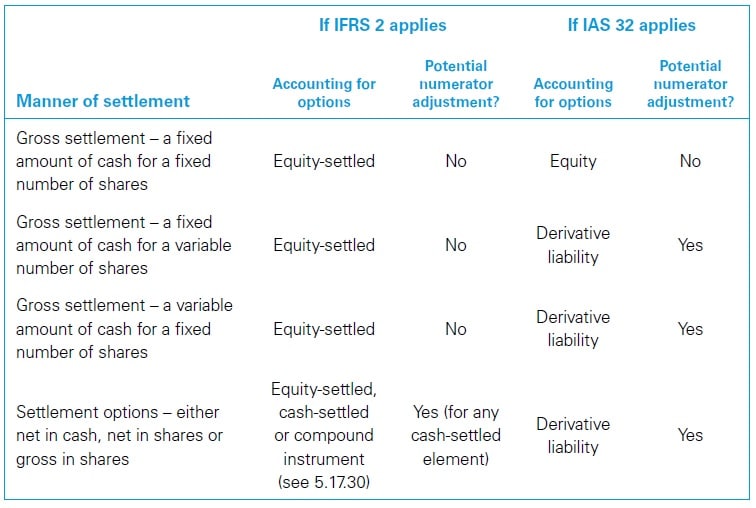

To the extent that they are not yet taken into account in basic EPS, options are POSs. The potential adjustment to the numerator depends on the accounting for the options under IFRS 2 or IAS 32, which is driven by their manner of settlement, as follows.

For an example of options that require numerator adjustments, see the case – Share-based payment – Counterparty has the settlement choice. The potential adjustment to the denominator is determined using the treasury share method. The potential adjustment is included from the beginning of the period, or from the date on which the options are issued or granted if this is later. |

Dilutive or anti-dilutive?

Generally, options are dilutive if they are in-the-money – i.e. the exercise price (including the fair value of any goods or services to be supplied to the entity in the future) is lower than the average market price of the ordinary shares. However, for options that are accounted for as liabilities under IFRS 2 or IAS 32, the numerator adjustment could vary (see above) and could therefore affect whether the options are regarded as dilutive. [IAS 33.47]

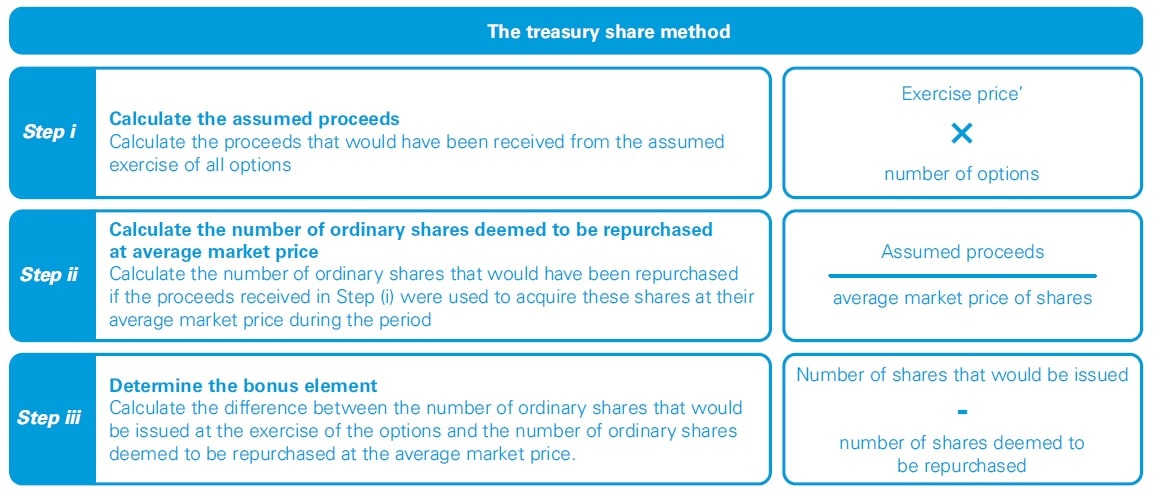

Generally, the denominator for diluted EPS (IAS 33 Earnings per share) assumes that all dilutive POSs have been converted into ordinary shares at the beginning of the period or, if later, the date of issue of the POSs; in addition, they are included in the denominator only for the period during which they are outstanding (see 4.3.20). In the context of options, rather than simply adding to the denominator the weighted-average number of ordinary shares that would be issued from the assumed conversion of options, IAS 33 prescribes a specific method, commonly referred to as the ‘treasury share method’. [IAS 33.45–46]

The treasury share method is different from that prescribed for options that are ‘embedded’ in other financial instruments – e.g. convertible debt (see Chapter 5.11). This is irrespective of the fact that IAS 32 and IAS 39 usually require split accounting for options embedded in another host instrument and therefore stand-alone and embedded options are generally treated in the same way under those standards.

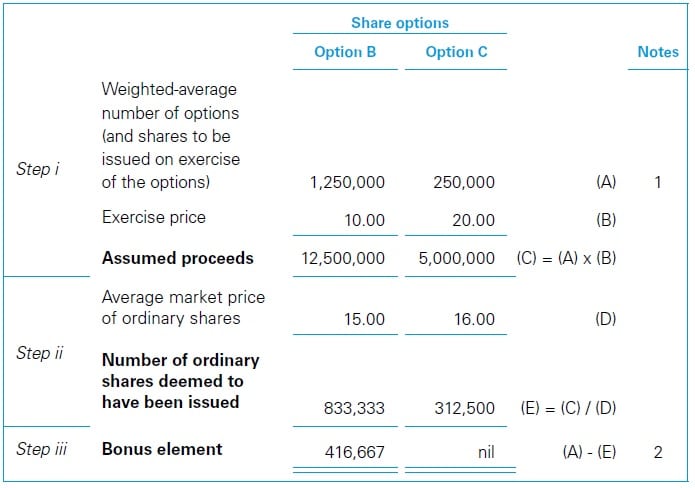

The treasury share method assumes that the proceeds (exercise price) from exercising the option are used to repurchase shares at the average market price of a share during the period. The bonus element is the difference between the number of ordinary shares that would be issued at the exercise price and the number of ordinary shares that would have been repurchased at the average market price. Only the bonus element of the options – i.e. the number calculated under Step (iii) below – is reflected in diluted EPS. The following diagram summarises the treasury share method. [IAS 33.45–46]

Some of the key inputs in the above formulas are further explained below.

Assumed proceeds

The ‘exercise price’ includes the fair value (measured in accordance with IFRS 2) of any goods or services to be supplied to the entity in the future under the share-based payment arrangement (see Chapter 5.17). [IAS 33.47A]

The average market price is determined based on the full reporting period or, in our view, the period for which the options are outstanding if this is shorter (see below). For example, if the options are outstanding only for six months of the reporting period, then in determining the bonus element the average market price should be based on the average market price during that six-month period.

When determining the average market price for a period, in theory every market transaction could be included. However, as a practical matter the application guidance of IAS 33 notes that a simple average of weekly or monthly prices is usually adequate.

The guidance adds that although closing market prices are generally adequate for calculating the average market price, when prices fluctuate widely an average of the high and low prices usually produces a more representative price. The method used to calculate the average market price is used consistently unless it is no longer representative because of changed conditions.

For example, an entity that uses closing market prices to calculate the average market price for several years of relatively stable prices might change to an average of high and low prices if prices start fluctuating greatly and the closing market prices no longer produce a representative average price. [IAS 33.A4–A5]

In some cases, there may not be a quoted market price for the ordinary shares for the full period. This may be the case if, for example, the entity does not have ordinary shares or POSs that are publicly traded and the entity elects to disclose EPS, or if the entity’s ordinary shares or POSs were not listed for the full period.

For example, an entity with an annual reporting period ending on 31 December Year 1 lists its ordinary shares on 7 November Year 1, so that it has a quoted market price for its shares only during the period from 7 November to 31 December Year 1.

In general, if the average market price of the shares is necessary to calculate diluted EPS – e.g. because the entity has outstanding warrants or options – then the average market price used should be a meaningful average for the full reporting period, or the period for which the POSs are outstanding if this is shorter. We do not believe that an average market price for approximately two months, as in the example, would be meaningful for POSs outstanding for the full year.

In general, if there is no active market for ordinary shares, then an entity should determine fair value using valuation techniques. We believe that an entity should apply the guidance for measuring the fair value of financial instruments to determine the fair value of unquoted equity instruments to estimate the average market price for the ordinary shares. Specialist expertise may be required in this assessment. The method used to determine the average market price should be disclosed in the notes to the financial statements. [IFRS 13]

Exercise price settled (or partially settled) by other instruments

Some options may permit or require an entity to tender a debt or another instrument issued by the entity itself or its subsidiary in payment of all or a portion of the exercise price of the option.

These options may be dilutive if (a) the average market price of the ordinary shares for the period exceeds the exercise price or (b) the selling price of the instrument to be tendered is below that at which the instrument may be tendered under the option and the resulting discount establishes an effective exercise price that is below the market price of the ordinary shares obtainable on exercise.

In such cases, the exercise of the options and the tendering of the instruments are assumed for diluted EPS. Post-tax interest on any debt assumed to be tendered is added to the numerator. IAS 33 is not clear on how to calculate the impact of such options on the denominator for diluted EPS. In our view, one acceptable approach is to use a similar approach to that for convertible instruments (see Chapter 5.11) – i.e. not the treasury share method.

This means that, for the portion for which the exercise price may be paid up by tendering debt or other instruments, the denominator should be adjusted for the total number of shares assumed to be issued. [IAS 33.A7]

However, if the option may be settled in cash, then the cash alternative should be assumed if it is more advantageous to the option holder. In such cases, the treasury share method should be used to determine the impact on the denominator for the diluted EPS. [IAS 33.A7]

Similar treatment is given to preference shares or other instruments that have conversion options that permit the investor to pay cash for a more favorable conversion rate. [IAS 33.A8]

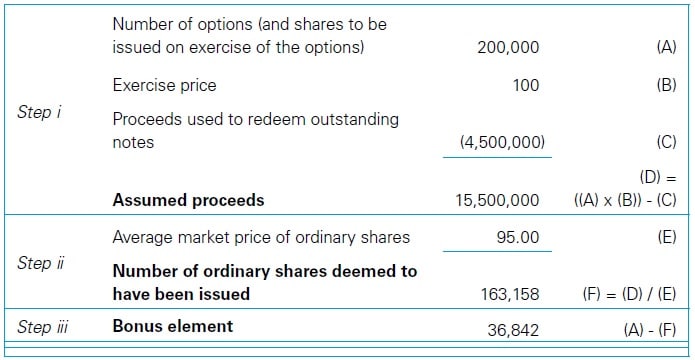

Proceeds used to redeem other instruments

In some cases, the terms of options require the proceeds received from exercise to be used to redeem debt or other instruments of the entity (or its parent or a subsidiary). In determining diluted EPS, it is assumed that the proceeds are used first to purchase these other instruments at their average market price, and the numerator is adjusted by the post-tax interest saving on the assumed redemption. If the proceeds to be received exceed the redemption amount, then the excess is assumed to be used to purchase ordinary shares under the treasury share method. [IAS 33.A9]

|

|

||||||||||||||||||||||||||||||||||

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

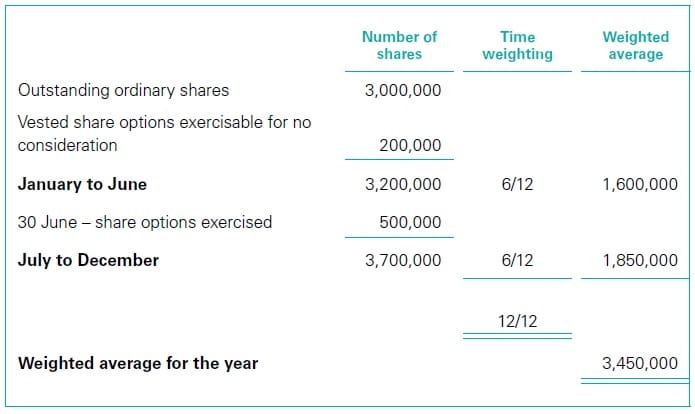

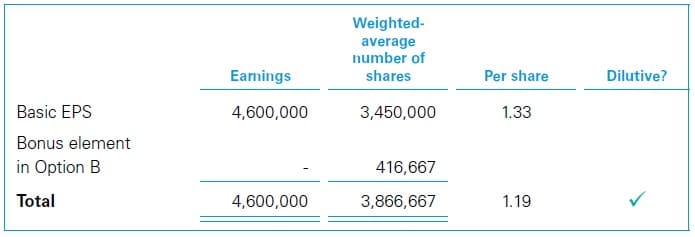

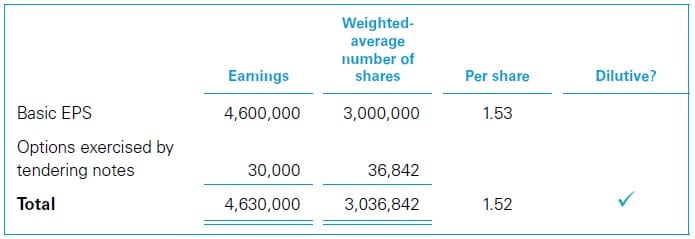

WorkingsThe EPS computations for Year 1 are as follows.

|

Case – Options – Proceeds used to redeem debt or other instruments of the entity |

||||||||||

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

WorkingsThe EPS computations for Year 1 are as follows.

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations Options in EPS Calculations