Operating cash flows

Cash flows must be analysed between operating, investing and financing activities.

For operating cash flows, the direct method of presentation is preferred, but the indirect method is acceptable.

Here are the differences and similarities between the direct and indirect method. Note the subtotals for operating, investing and financing activities are the same amount in both methods!

Indirect method cash flow statement |

Direct method cash flow statement |

|

Starts with: |

Starts with: |

|

|

|

Cash Flows from Operating activities |

Cash Flows from Operating activities |

|

|

|

Cash Flows from Investing activities |

Cash Flows from Investing activities |

|

|

|

Cash Flows from Financing activities |

Cash Flows from Financing activities |

Common cash flow classification errors in practice

Although the definitions of operating, financing and investing activities may appear straightforward, in practice a number of classification errors are frequently made. These include:

- Cash outflows related to the acquisition of intangible assets and items of property, plant and equipment incorrectly included within operating activities. Some items of property, plant and equipment are purchased from suppliers on standard credit terms that are similar to those for inventory and for amounts payable to other creditors. Because of this, the transactions for property, plant and equipment may incorrectly be included within changes in accounts payable for operating items. Consequently, unless payments for property, plant and equipment are separated from other payments related to operating activities, they may be allocated incorrectly to operating activities.

- Cash inflows and outflows related to deposits held by financial institutions, or the purchase of short term investments, included within operating activities. Surplus funds are sometimes used to purchase investments with short-to-medium term maturities that do not meet the definition of cash and cash equivalents (e.g. a deposit with a fixed term maturity that is greater than 3 months (IAS 7.7)). Entities sometimes argue that, because these funds are included in their working capital balances (because the funds will be used in the short-to-medium term for operating activities), the cash flows related to these investments should be classified within operating activities. This is incorrect. The entity is acquiring debt instruments of another entity that neither meet the definition of cash and cash equivalents, nor are held for dealing and trading purposes. Consequently, these cash outflows and inflows should be classified as investing (IAS 7.16(c)). Upon maturity of the investment the subsequent use of the funds for operating activities will result in cash flows being included in that category. In contrast, if an entity holds financial assets that are classified as held for dealing or trading activities (such as cash held by most financial institutions), then cash flows associated with those assets are classified within operating activities. This is because financial assets classified as held for dealing or trading purposes are typically held by an entity in the short-term (a matter of days) for the purposes of short term profits or losses. Consequently, they fall within the entity’s operating activities.

- Failure to classify cash flows arising from an entity’s principal operating activities as operating. An entity in the financial services sector typically derives operating income from advancing loans to customers in return for future payments of principal and interest. Although IAS 7.31 permits an entity to classify interest cash flows as operating, investing or financing, the requirements of IAS 7.6 (which includes the definition of operating activities) override this option. Consequently, cash flows relating to loans advanced to customers by a financial institution are required to be classified as operating activities.

- Including cash flows in investing activities when they do not result in the recognition of an asset. Some cash outflows relate to items which do not qualify to be recorded as assets (for example, research costs and certain development costs do not qualify to be capitalised as intangible assets in accordance with IAS 38 Intangible Assets). Some argue that such cash outflows should be included within investing activities, because they relate to items which are intended to generate future income and cash flows. IAS 7.16 states that for a cash flow to be classified as an investing cash outflow, the expenditure must result in an asset being recognised in the statement of financial position (IAS 7.BC7). This is particularly relevant for entities operating in the extractive industry which apply IFRS 6 Exploration for and Evaluation of Mineral Resources, as these entities have a (temporary) exemption from applying the requirements of paragraphs 11 and 12 of IAS 8 Accounting policies, Changes in Estimates and Errors when developing an accounting policy in respect of the recognition of exploration and evaluation assets. If the accounting policy adopted by the entity in accordance with IFRS 6 does not result in the recognition of an asset, then those cash flows do not qualify to be included within investing activities.

- Cash receipts relating to the leased assets of lessors. When an entity is the lessor of assets, cash receipts relating to rental income as well as any subsequent sale of the leased assets are classified within operating activities. This may seem to contradict the requirement of IAS 7.16(b) which lists cash receipts from sale of assets as investing activities. However IAS 7.15 makes it clear that for lessors, cash flows received from lessees in respect of leased assets are classified in operating activities.

Classification of interest and dividends

IAS 7.31 requires cash flows from interest and dividends received and paid to be disclosed separately, and permits each of them to be classified within either operating, financing, or investing activities. The classification chosen must be applied consistently from period to period.

However, it is also necessary to consider other requirements of IAS 7. In particular, if borrowing costs are capitalised to ‘qualifying assets’ in accordance with IAS 23 Borrowing Costs, the related cash flows must be classified as well.

|

Consider this! |

|

In practice, some regulators require consistent classification between interest paid and interest received (i.e. including the two line items within the same classification), particularly when an entity classifies interest received as an operating activity (i.e. financial institutions). Similar regulatory requirements have also been seen in some jurisdictions in respect of the presentation of cash flows relating to dividends paid and received. When classifying cash flows relating to borrowing costs that have been capitalised as part of the carrying value of a qualifying asset as required by IAS 23, inconsistencies exist in the requirements of IAS 7 as to how such interest cash flows should be presented. It could be interpreted that the capitalised borrowing costs should be classified consistently with the cash flows related to the acquisition of the asset (e.g. in investment activities) since IAS 7.16 requires cash flows that relate to the acquisition of items such as property, plant and equipment to be classified as investing activities. Despite this requirements of IAS 7.16, IAS 7.33 states that interest cash flows may be classified as either operating or investing/financing activities as an accounting policy choice. Therefore, in our view, it is acceptable to classify capitalised borrowing costs as either an investing cash flow (i.e. consistent with the cash flows to acquire the qualifying asset) or consistently with other interest cash flows that are not capitalised as borrowing costs (i.e. dependent on the entity’s accounting policy choice for such cash flows). |

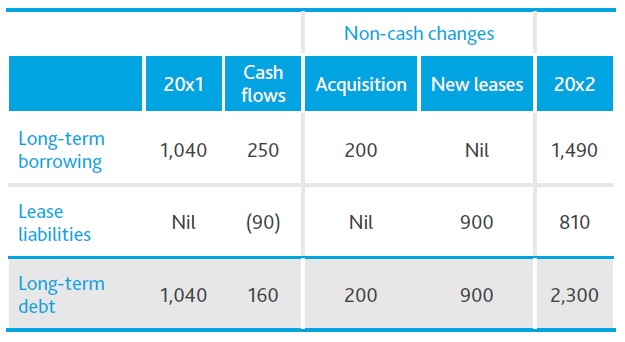

Disclosure of changes in liabilities arising from financing activities

In January 2016 the IASB amended IAS 7 to require additional disclosures surrounding the change in liabilities arising

from financing activities. These additional requirements were added as IAS 7.44A – 44E. This amendment was made in response to feedback from users of financial statements who felt that it was challenging to understand the changes in debt and other bank borrowings based on the existing disclosure requirements of IFRS. Non-cash movements in financing activities resulted in the movement in borrowings being challenging to reconcile.

from financing activities. These additional requirements were added as IAS 7.44A – 44E. This amendment was made in response to feedback from users of financial statements who felt that it was challenging to understand the changes in debt and other bank borrowings based on the existing disclosure requirements of IFRS. Non-cash movements in financing activities resulted in the movement in borrowings being challenging to reconcile.

IAS 7.44C also requires disclosure of changes in financial assets (e.g. assets that hedge liabilities arising from financing activities) if cash flows from those financial assets were, or future cash flows will be, included in cash flows from financing activities.

The requirements added to IAS 7 mean that an entity needs to provide disclosures that enable users to evaluate changes in liabilities arising from financing activities, including changes arising from cash flows and non-cash changes. Examples of these changes may include:

- Changes from financing cash flows;

- Changes arising from obtaining or losing control of subsidiaries or other businesses;

- The effect of changes in foreign exchange rates; and

- Changes in fair values.

Entities that do not have complex movements in borrowings (e.g. the only change being cash payments on term debt) may not require additional disclosure beyond what is presented in the statement of cash flows in order to comply with these requirements.

Entities which have more complex movements in borrowings (e.g. foreign exchange, fair value movements, business combinations, etc.) may require tabular reconciliation with each category of change in borrowing activities being a separate column in the table.

The reconciliation should be presented in such a way that enables users to link items included in the reconciliation to the statement of financial position and the statement of cash flows (i.e. line items in the reconciliation should tie to other applicable line items in the financial statements). Such tabular disclosure may also need to be supplemented by narrative disclosure in some cases.

In ESMA’s 23rd Extract from the EECS’s Database of Enforcement, which was published in July 29, ESMA (European Securities and Markets Authority) noted that entities are encouraged to provide the tabular format for disclosure purposes, in order to meet the requirements of IAS 7.

An illustration of tabular disclosure:

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows Operating cash flows