Last update 26/08/2019

|

6. Operating segments |

|||||||||||||||||

|

|

Blog note: Operating segment disclosures are consistent with the information reviewed by the chief operating decision maker (CODM) and will vary from one entity to another and may not be in accordance with IFRS. To help users of the financial statements understand the segment information presented, an entity discloses information about the measurement basis adopted – e.g. the nature and effects of any differences between the measurements used in reporting segment information and those used in the entity’s financial statements, the nature and effect of any asymmetrical allocations to reportable segments and reconciliations of segment information to the corresponding IFRS amounts in the financial statements. The Group’s internal measures used in reporting segment information are consistent with IFRS. Therefore, the reconciling items are limited to items that are not allocated to reportable segments, as opposed to a difference in the basis of preparation of the information. |

||||||||||||||||

|

IFRS 8 IN13 |

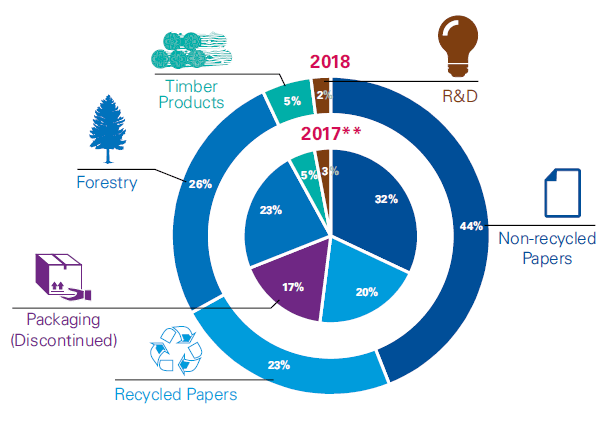

A. Basis for segmentation The Group has the following six strategic divisions, which are its reportable segments. These divisions offer different products and services, and are managed separately because they require different technology and marketing strategies. The following summary describes the operations of each reportable segment. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure |

||||||||||||||||

|

|||||||||||||||||

|

The Group’s chief executive officer reviews the internal management reports of each division at least quarterly. Other operations include the cultivation and sale of farm animals (sheep and cattle), the construction of storage units and warehouses, the rental of investment property and the manufacture of furniture and related parts (see Notes 8 and 16). None of these segments met the quantitative thresholds for reportable segments in 2018 or 2017. There are varying levels of integration between the Forestry and Timber Products segments, and the Non-recycled Papers and Recycled Papers segments. This integration includes transfers of raw materials and shared distribution services, respectively. Inter-segment pricing is determined on an arm’s length basis. |

|||||||||||||||||

|

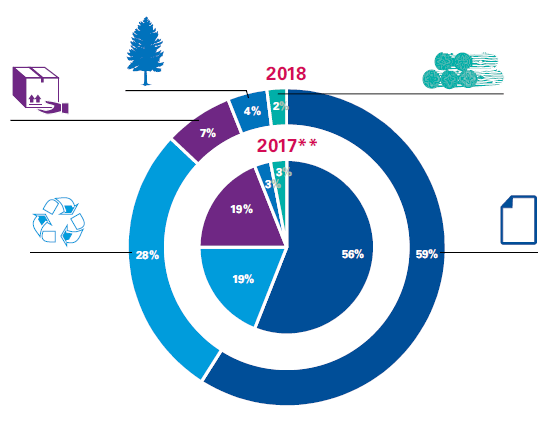

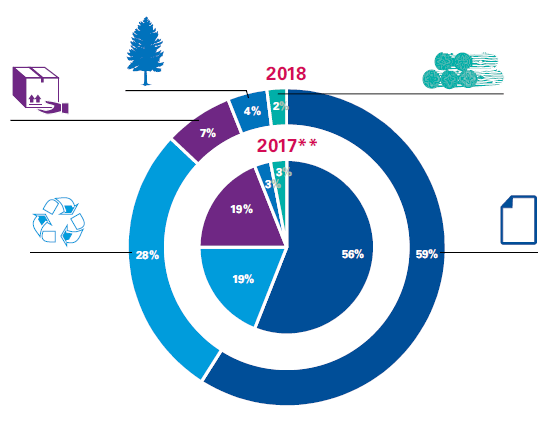

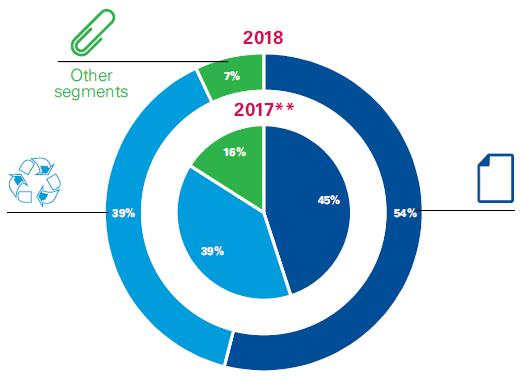

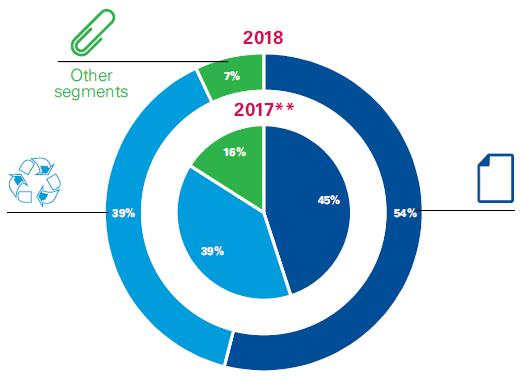

B. Information about reportable segments i. Segmented revenue* Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure

|

|||||||||||||||||

|

ii. Segmented EBITDA* Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure

|

|||||||||||||||||

|

iii. Segmented assets* Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure

|

|||||||||||||||||

|

* As a percentage of the total for all reportable segments. Excludes other segments. ** The Group has changed its internal organisation and the composition of its reportable segments. EBITDA – Earnings Before (Income from continuing operations, excluding) Interest, Tax, Depreciation and Amortisation |

|||||||||||||||||

|

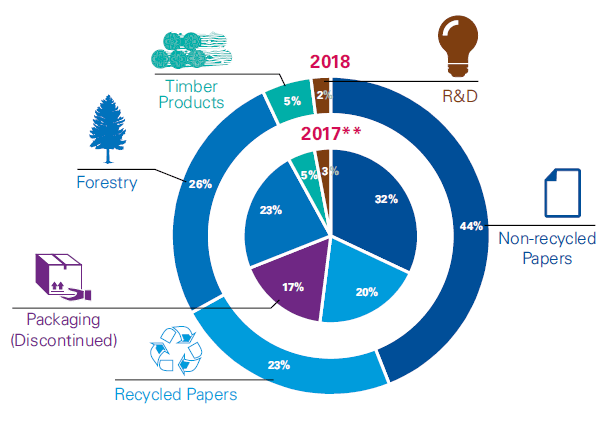

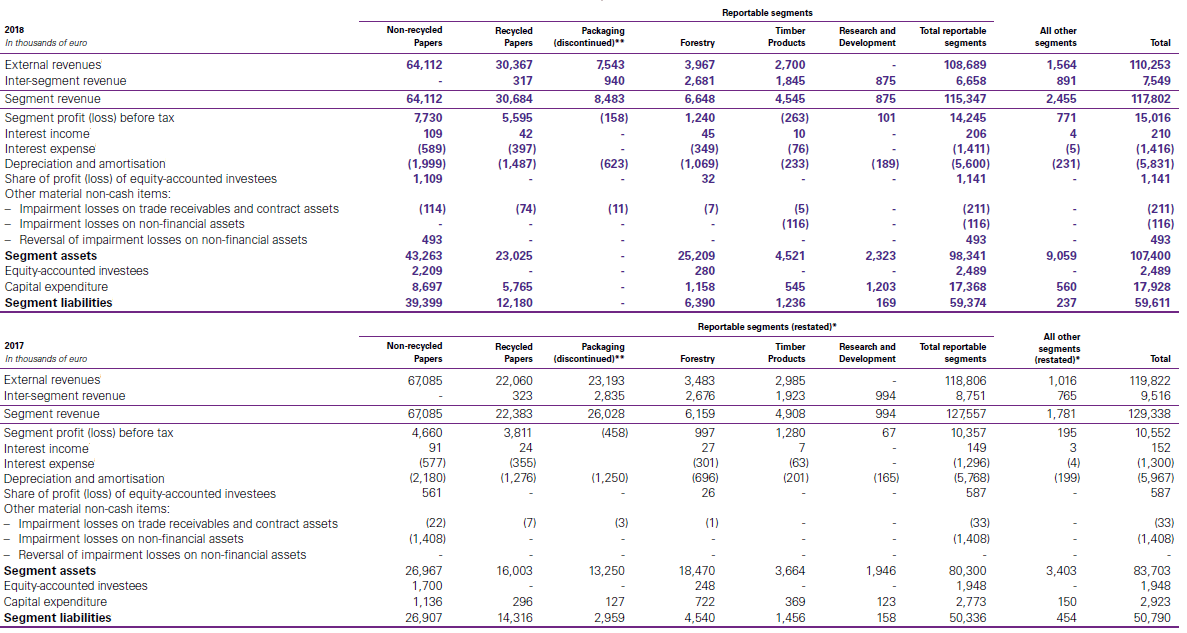

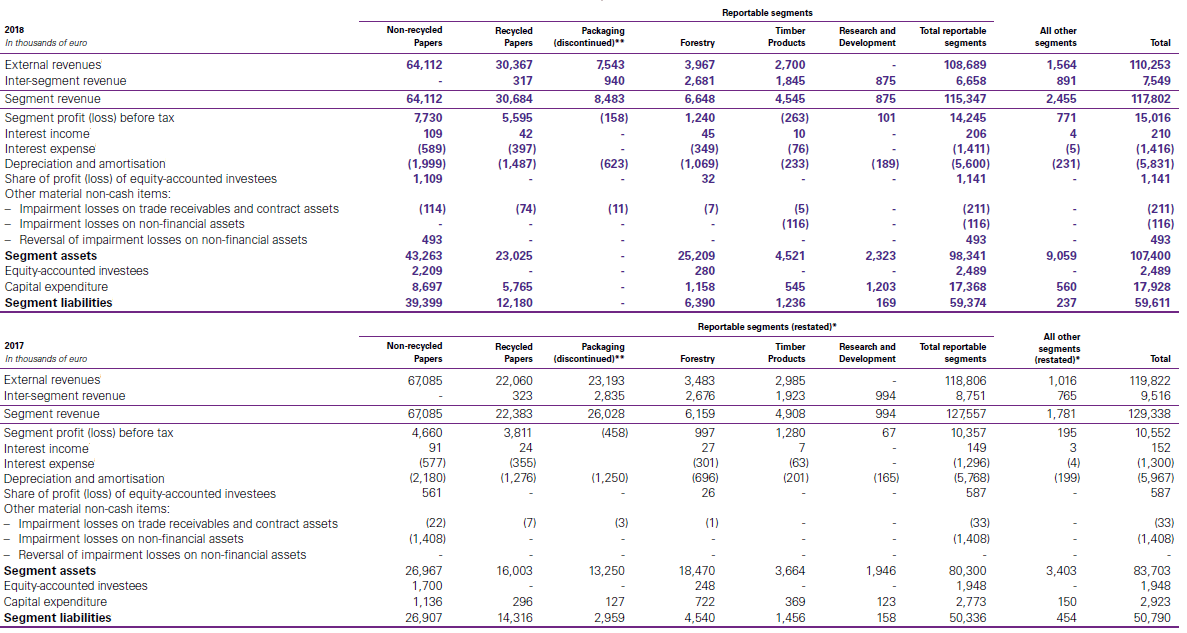

Information related to each reportable segment is set out below. Segment profit (loss) before tax is used to measure performance because management believes that this information is the most relevant in evaluating the results of the respective segments relative to other entities that operate in the same industries. |

|||||||||||||||||

|

* As a result of the acquisition of Papyrus Pty Limited (‘Papyrus’) during the year ended 31 December 2018 (see Note 22), the Group has changed its internal organisation and the composition of its operating segments, which resulted in a change in reportable segments. Accordingly, the Group has restated the previously reported segment information for the year ended 31 December 2017. ** See Note 7. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure |

|||||||||||||||||

|

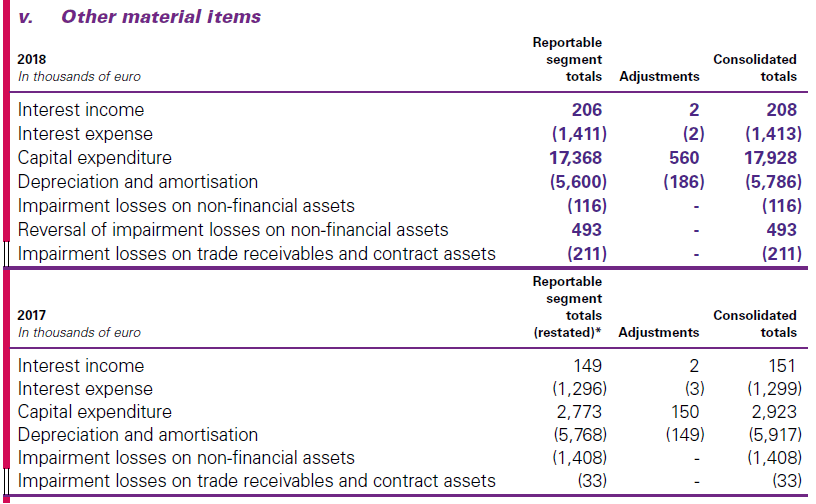

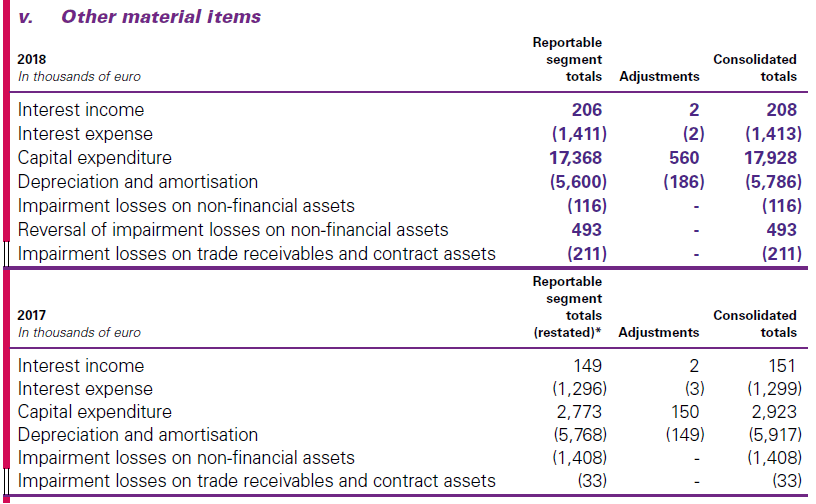

The Group has disclosed these amounts for each reportable segment because they are regularly reviewed by the CODM. IFRS 8 Operating Segments does not specify the disclosure requirements for a discontinued operation; nevertheless, if the CODM regularly reviews the financial results of the discontinued operation (e.g. until the discontinuance is completed), and the definition of an operating segment is otherwise met, then an entity may need to disclose such information to meet the core principle of IFRS 8. |

|||||||||||||||||

|

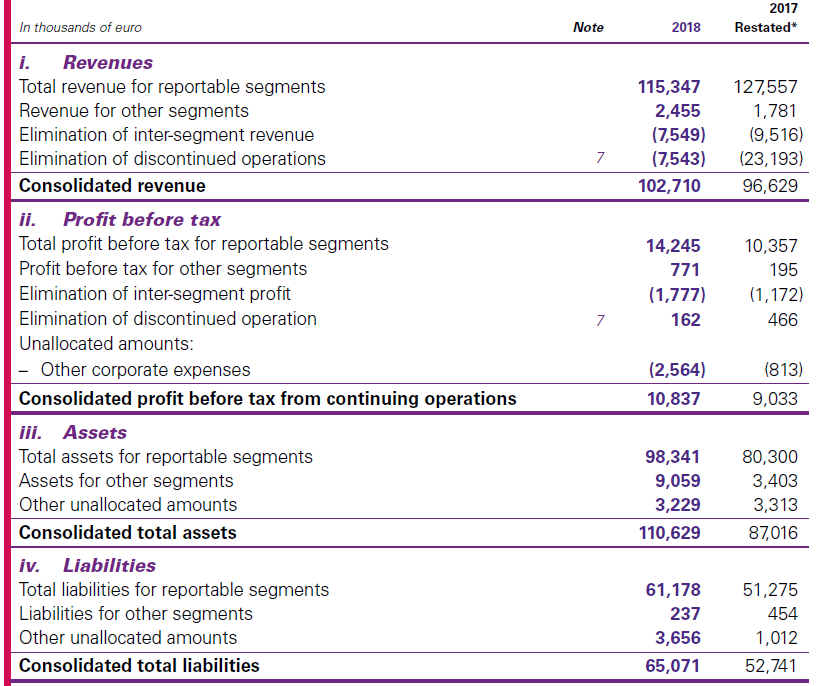

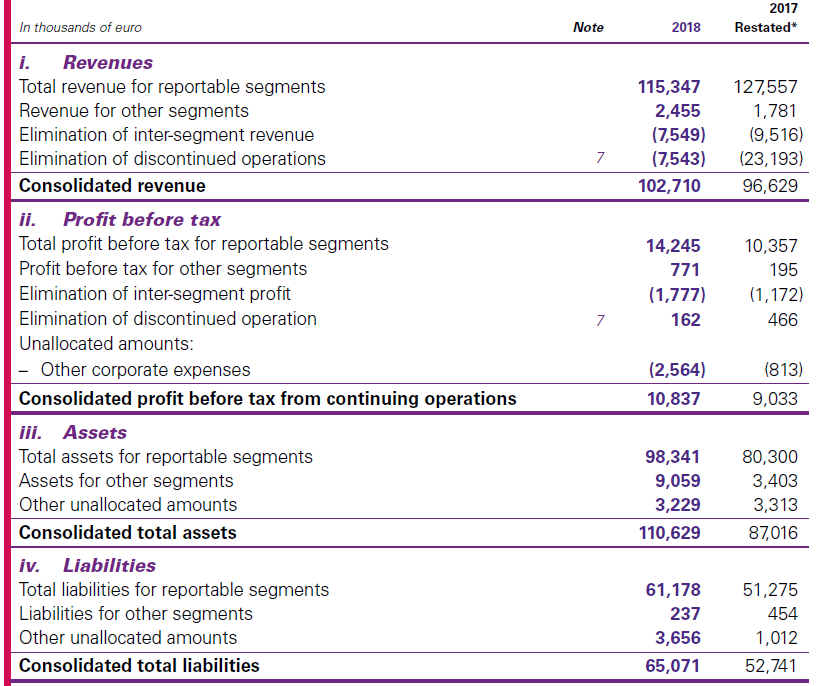

C. Reconciliations of information on reportable segments to IFRS measures

* See Notes 5, 6(B) and 44. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure |

|||||||||||||||||

|

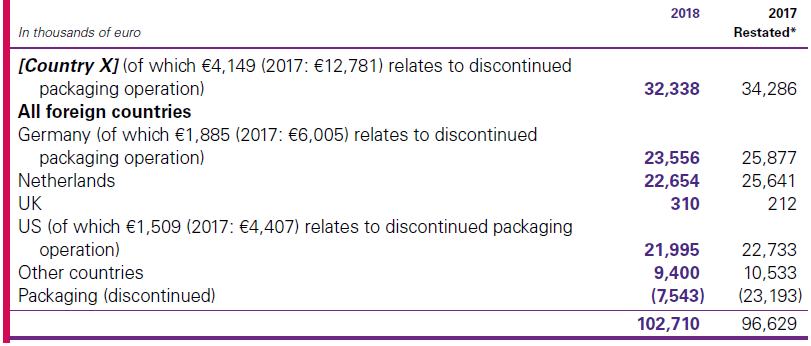

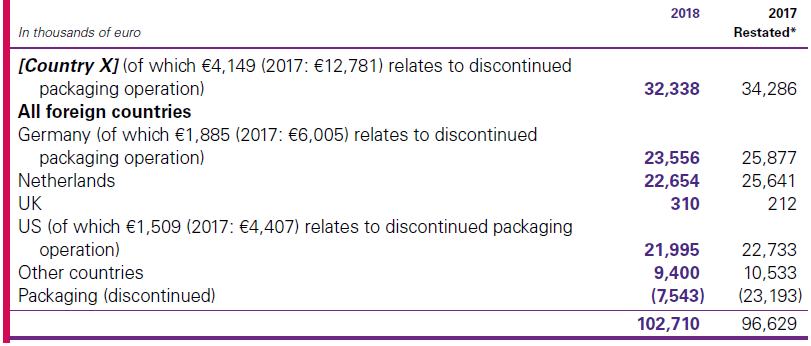

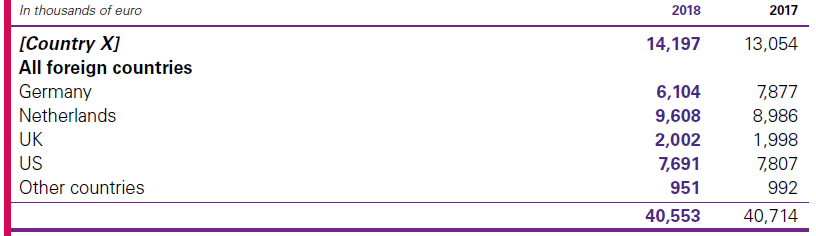

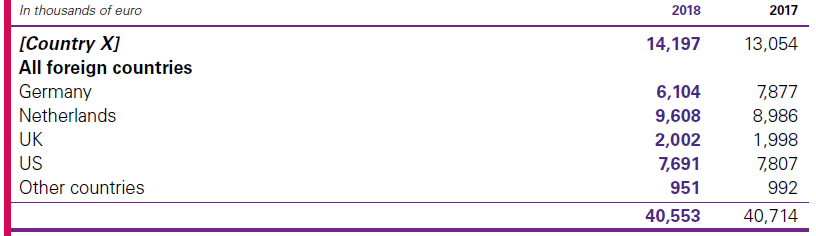

* See Notes 5 and 6(B). Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure D. Geographic information2 The Non-recycled Papers, Recycled Papers and Forestry segments are managed on a worldwide basis, but operate manufacturing facilities and sales offices primarily in [Country X], the Netherlands, Germany, the UK and the US. The geographic information analyses the Group’s revenue and non-current assets by the Company’s country of domicile and other countries. In presenting the geographic information, segment revenue has been based on the geographic location of customers and segment assets were based on the geographic location of the assets. |

|||||||||||||||||

|

i. Revenue Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure

|

|||||||||||||||||

|

* See Note 5. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure ii. Non-current assets Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure

|

|||||||||||||||||

|

Non-current assets exclude financial investments (other than equity-accounted investees), deferred tax assets and employee benefit assets3. |

|||||||||||||||||

|

E. Major customer Revenues from one customer of the Group’s Non-recycled Papers and Recycled Papers segments represented approximately €20,000 thousand (2017: €17,500 thousand) of the Group’s total revenues |

|||||||||||||||||

|

7. Discontinued operation See accounting policy in Note 45(C). In February 2018, the Group sold its entire Packaging segment (see Note 6). Management committed to a plan to sell this segment early in 2018, following a strategic decision to place greater focus on the Group’s key competencies – i.e. the manufacture of paper used in the printing industry, forestry and the manufacture of timber products. The Packaging segment was not previously classified as held-for-sale or as a discontinued operation. The comparative consolidated statement of profit or loss and OCI has been represented to show the discontinued operation separately from continuing operations. Subsequent to the disposal, the Group has continued to purchase packaging from the discontinued operation. Although intra-group transactions have been fully eliminated in the consolidated financial results, management has elected to attribute the elimination of transactions between the continuing operations and the discontinued operation before the disposal in a way that reflects the continuance of these transactions subsequent to the disposal, because management believes this is useful to the users of the financial statements. To achieve this presentation, management has eliminated from the results of the discontinued operation the inter-segment sales (and costs thereof, less unrealised profits) made before its disposal. Because purchases from the discontinued operation will continue after the disposal, inter-segment purchases made by the continuing operations before the disposal are retained in continuing operations. |

|||||||||||||||||

|

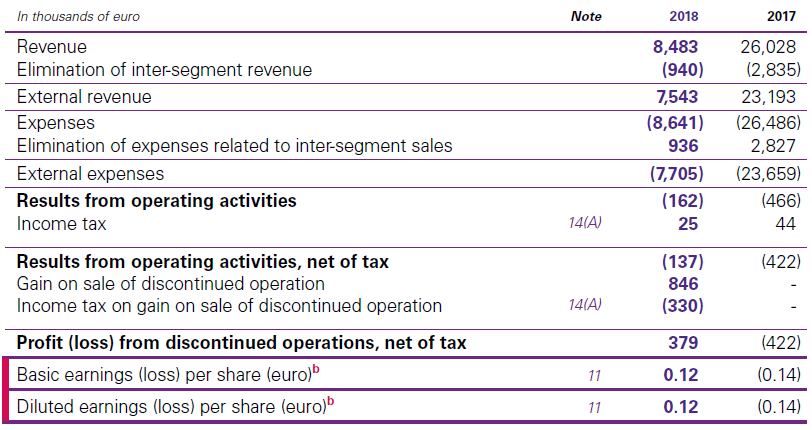

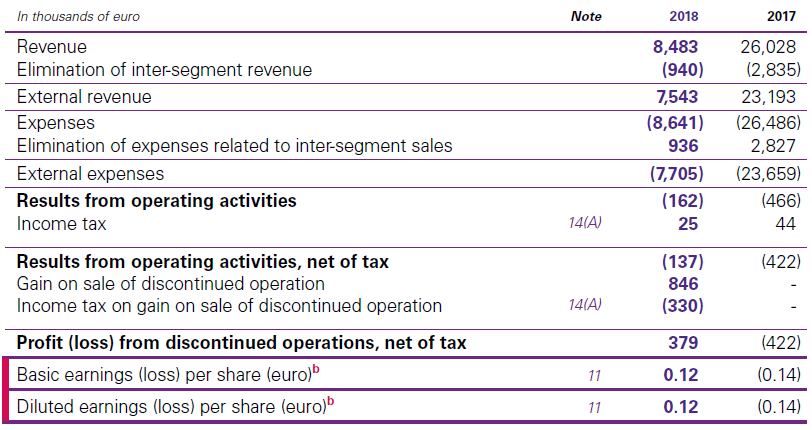

A. Results of discontinued operation

The profit from the discontinued operation of €379 thousand (2017: loss of €422 thousand) is attributable entirely to the owners of the Company. Of the profit from continuing operations of €7,498 thousand (2017: €6,516 thousand), an amount of €6,978 thousand is attributable to the owners of the Company (2017: €6,149 thousand). |

|||||||||||||||||

|

Blog note: IFRS 5 does not specify how the elimination should be attributed to continuing and discontinued operations (see Note 6(B)–(C)), an entity may present transactions between the continuing and discontinued operations in a way that reflects the continuance of those transactions, when that is useful to the users of the financial statements. It may be appropriate to present additional disclosure either on the face of the statement of profit or loss and OCI or in the notes. In our experience, if the additional disclosure is provided in the statement of profit or loss and OCI, then judgement may be required over whether the disaggregated information should be presented as part of the statement itself or as an additional disclosure alongside the totals in that statement. Clear disclosure of the approach taken to the elimination of intra-group transactions will be relevant, including an explanation of any additional analysis of discontinued operations in the notes to the statement of profit or loss and OCI. |

|||||||||||||||||

|

Blog note: The Group has elected to present basic and diluted EPS for the discontinued operation in the notes. Alternatively, basic and diluted EPS for the discontinued operation may be presented in the statement of profit or loss and OCI. |

|||||||||||||||||

|

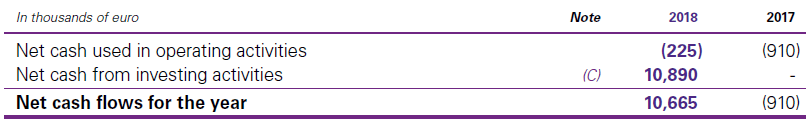

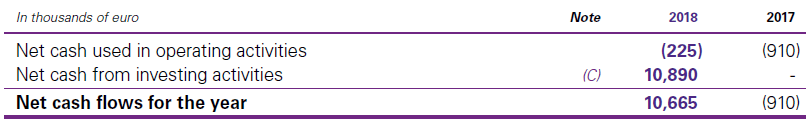

B. Cash flows from (used in) discontinued operation

|

|||||||||||||||||

|

Blog note: There are many ways in which the requirements of IFRS 5 and IAS 7 on cash flow presentation may be met. The Group has elected to present:

Alternatively, cash flows attributable to operating, investing and financing activities of discontinued operations can be presented separately in the statement of cash flows. |

|||||||||||||||||

|

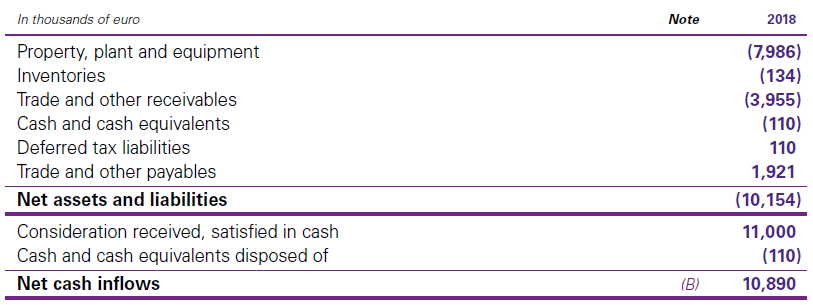

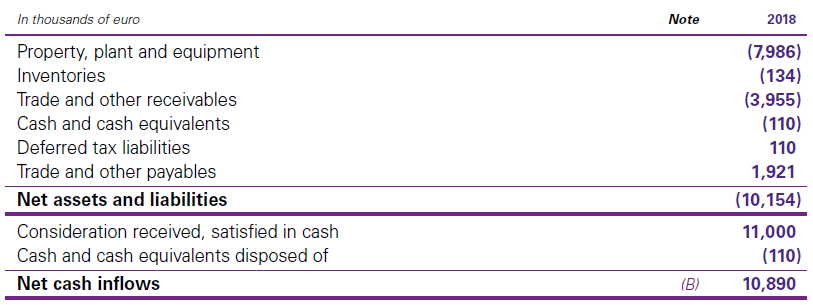

C. Effect of disposal on the financial position of the Group

|

|||||||||||||||||

|

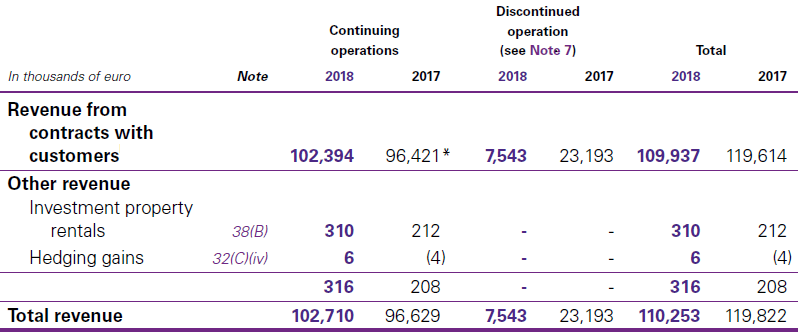

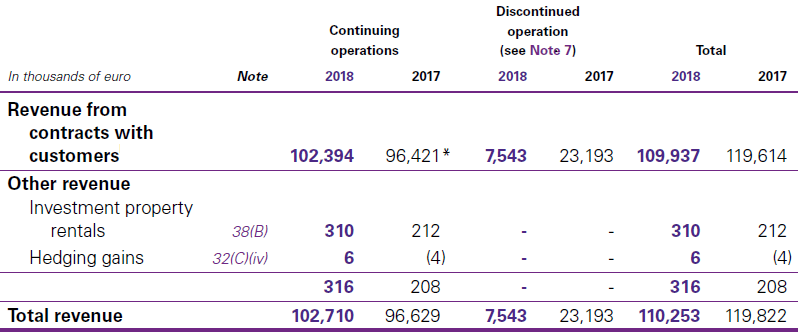

8. Revenue The effect of initially applying IFRS 15 on the Group’s revenue from contracts with customers is described in Note 5. Due to the transition method chosen in applying IFRS 15, comparative information has not been restated to reflect the new requirements. |

|||||||||||||||||

|

Blog note: IFRS 15 requires an entity to provide disclosure about costs to obtain or fulfil a contract with a customer. The Group does not incur such costs, and therefore the related disclosures are not illustrated in this guide. Similarly, the Group has determined that its contracts with customers do not contain a significant financing component, and therefore the related disclosures are not illustrated. |

|||||||||||||||||

|

A. Revenue streams The Group generates revenue primarily from the sale of paper and timber products and provision of forestry services to its customers (see Note 6(A)). Other sources of revenue include rental income from investment properties. |

|||||||||||||||||

|

|

|||||||||||||||||

|

* Of which €641 thousand relates to revenue from construction contracts. |

|||||||||||||||||

|

Blog note: In providing a separate disclosure of revenue from contracts with customers – either in the notes or in the statement of profit or loss – we believe that an entity should not include amounts that do not fall in the scope of IFRS 15. |

|||||||||||||||||

|

Blog note When an entity hedges a sale, whether in a forecast transaction or a firm commitment, the costs of hedging related to that sale are reclassified to profit or loss as part of the cost related to that sale in the same period as the revenue from the hedged sale is recognised. It appears that when these costs of hedging are reclassified to profit or loss, an entity may choose an accounting policy, to be applied consistently, to present them:

The Group has chosen to present the costs of hedging related to sales transactions as revenue. |

|||||||||||||||||

|

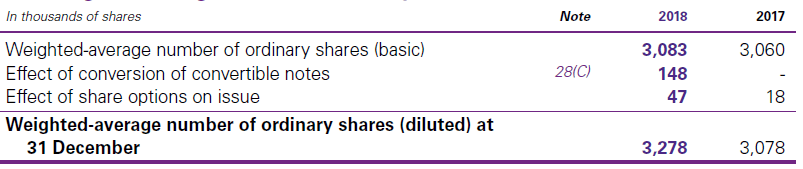

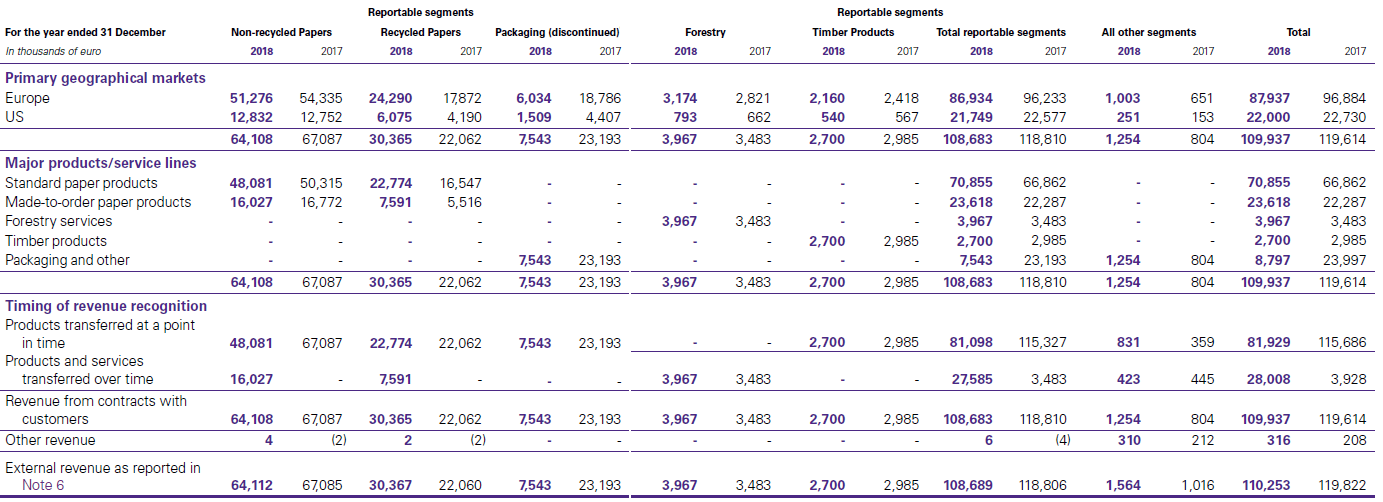

B. Disaggregation of revenue from contracts with customers In the following table, revenue from contracts with customers (including revenue related to a discontinued operation) is disaggregated by primary geographical market, major products and service lines and timing of revenue recognition. The table also includes a reconciliation of the disaggregated revenue with the Group’s reportable segments (see Note 6). |

|||||||||||||||||

|

|||||||||||||||||

|

Blog note: The extent to which an entity’s revenue is disaggregated for the purposes of this disclosure depends on the facts and circumstances of the entity’s contracts with customers. In determining the appropriate categories, an entity considers how revenue is disaggregated in:

Examples of categories that might be appropriate in disclosing disaggregated revenue include, but are not limited to, the following: |

|||||||||||||||||

|

|||||||||||||||||

|

IFRS 15 BC340 |

Some entities may not be able to meet the objective in IFRS 15 114 for disaggregating revenue by providing segment revenue information and may need to use more than one type of category. Other entities may meet the objective by using only one type of category. Even if an entity uses consistent categories in the segment note and in the revenue disaggregation note, further disaggregation of revenue may be required because the objective of providing segment information under IFRS 8 is different from the objective of the disaggregation disclosure under IFRS 15 and, unlike IFRS 8, there are no aggregation criteria in IFRS 15. Nonetheless, an entity does not need to provide disaggregated revenue disclosures if the information about revenue provided under IFRS 8 meets the requirements of IFRS 15 114 and those revenue disclosures are based on the recognition and measurement requirements in IFRS 15. |

||||||||||||||||

|

An entity is required to disclose sufficient information to enable users of financial statements to understand the relationship between the disclosure of disaggregated revenue and revenue information that is disclosed for each reportable segment, if the entity applies IFRS 8. |

|||||||||||||||||

|

Although it is not explicitly required, the Group has disclosed comparative information related to disaggregation of revenue because it is relevant to understanding the current period’s financial statements. |

|||||||||||||||||

|

Although it is not explicitly required to include discontinued operations as part of disaggregation of revenue from contracts with customers, the Group has provided that information |

|

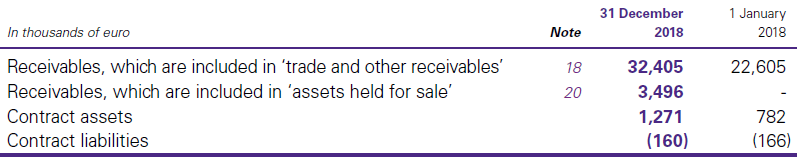

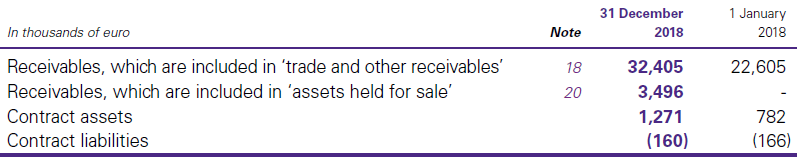

8. Revenue (continued) C. Contract balances The following table provides information about receivables, contract assets and contract liabilities from contracts with customers.

The contract assets primarily relate to the Group’s rights to consideration for work completed but not billed at the reporting date on made-to-order paper products. The amount of contract assets during the period ended 31 December 2018 was impacted by an impairment charge of €4 thousand. There was no impact on contract assets as a result of an acquisition of the subsidiary (see Note 34). The contract assets are transferred to receivables when the rights become unconditional. This usually occurs when the Group issues an invoice to the customer. |

|||||||||||||||||||||||||

|

The contract liabilities primarily relate to the advance consideration received from customers for construction of storage units and warehouses, for which revenue is recognised over time, and to the unredeemed customer loyalty points. As at 31 December 2018, the amount of unredeemed customer loyalty points is €50 thousand. This will be recognised as revenue when the points are redeemed by customers, which is expected to occur over the next two years. |

|||||||||||||||||||||||||

|

The amount of €166 thousand recognised in contract liabilities at the beginning of the period has been recognised as revenue for the period ended 31 December 2018. |

|||||||||||||||||||||||||

|

The amount of revenue recognised in the period ended 31 December 2018 from performance obligations satisfied (or partially satisfied) in previous periods is €8 thousand. This is mainly due to changes in the estimate of the stage of completion of construction of storage units and warehouses. |

|||||||||||||||||||||||||

|

No information is provided about remaining performance obligations at 31 December 2018 that have an original expected duration of one year or less, as allowed by IFRS 15. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea |

|||||||||||||||||||||||||

|

D. Performance obligations and revenue recognition policies Revenue is measured based on the consideration specified in a contract with a customer. The Group recognises revenue when it transfers control over a good or service to a customer. The following table provides information about the nature and timing of the satisfaction of performance obligations in contracts with customers, including significant payment terms, and the related revenue recognition policies. For the accounting policy for onerous contracts, see Note 45(S). |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

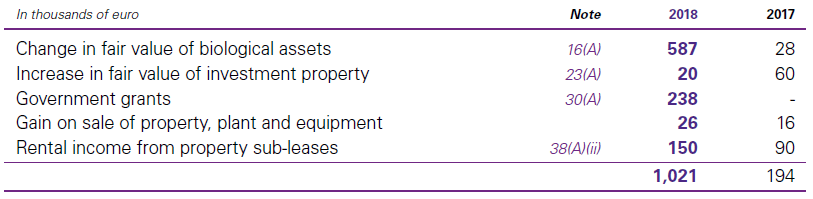

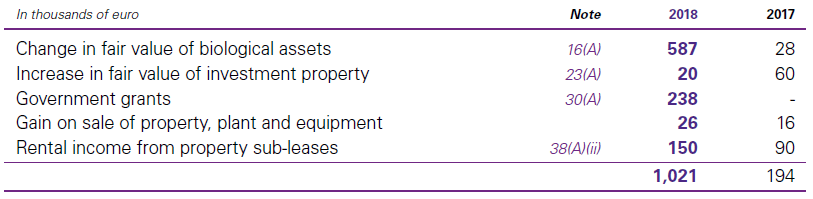

9. Income and expenses A. Other income

|

|||||||||||||||||||||||||

|

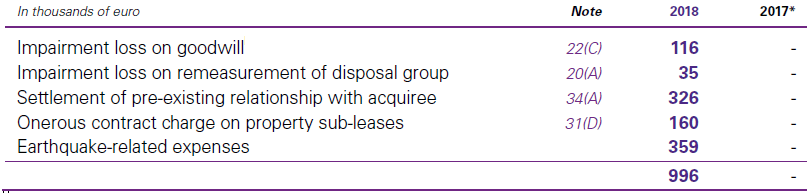

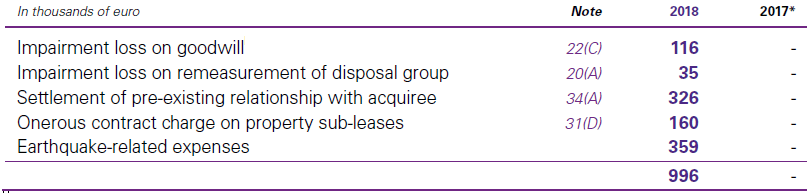

B. Other expenses

* An impairment loss on trade receivables of €30 thousand in the year ended 2017 was reclassified from other expenses to a separate line item (see Note 5(B)). |

|||||||||||||||||||||||||

|

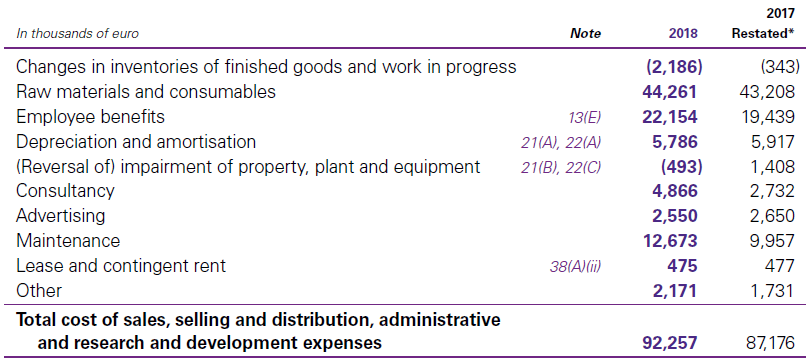

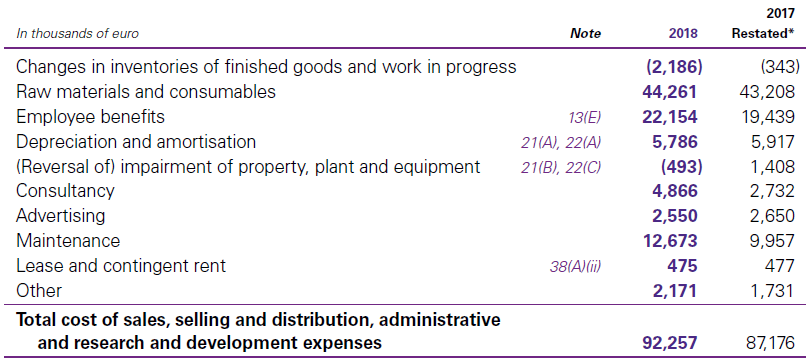

C. Expenses by nature

* See Notes 5 and 44. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea |

|||||||||||||||||||||||||

|

Blog note: There is no guidance in IFRS on how specific expenses are allocated to functions. An entity establishes its own definitions of functions. In our view, cost of sales includes only expenses directly or indirectly attributable to the production process. Only expenses that cannot be allocated to a specific function are classified as ‘other expenses’. |

|||||||||||||||||||||||||

|

The Group has classified expenses by function and has therefore allocated the impairment loss to the appropriate function. In our view, in the rare case that an impairment loss cannot be allocated to a function, it should be included in ‘other expenses’ as a separate line item if it is significant (e.g. impairment of goodwill), with additional information given in a note. |

|||||||||||||||||||||||||

|

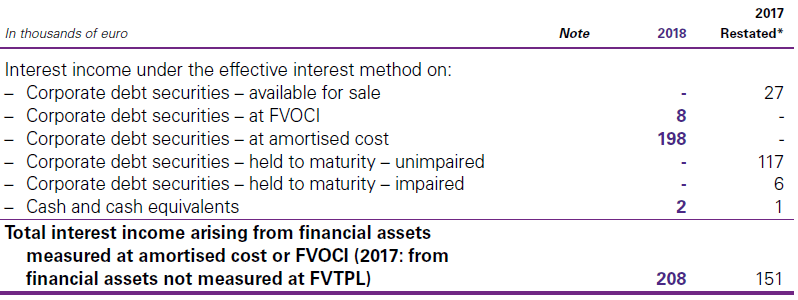

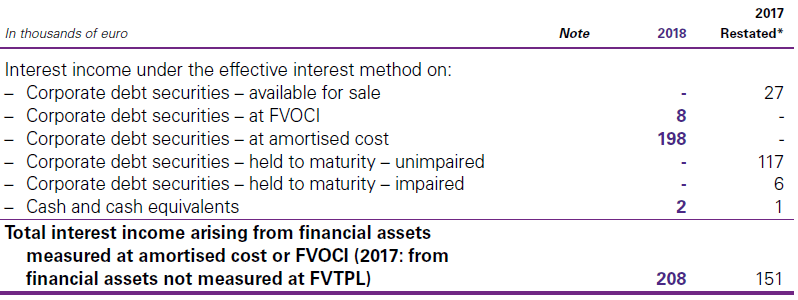

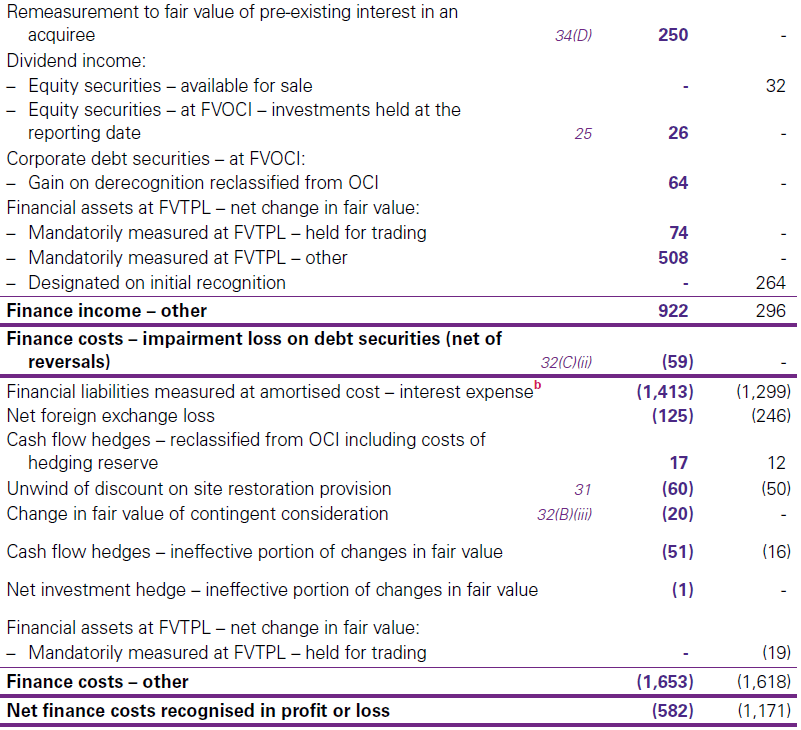

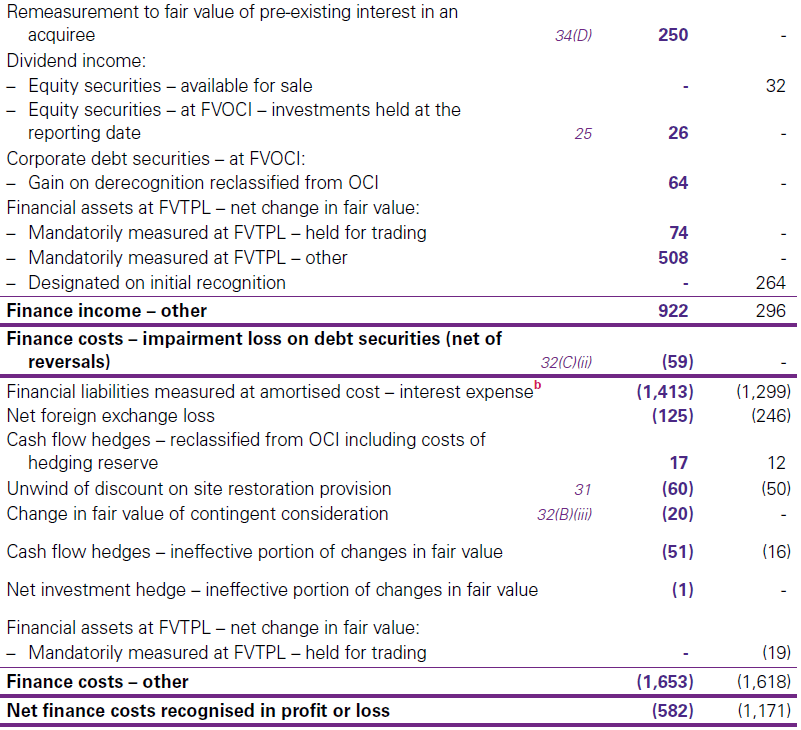

10. Net finance costs See accounting policies in Notes 45(G) and (O). The effect of initially applying IFRS 9 is described in Note 5.

* See Note 5. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea |

|||||||||||||||||||||||||

|

Blog note: IFRS 7 20(b), as amended by IFRS 9, an entity is required to disclose the total interest income (calculated using the effective interest method) for financial assets that are measured at amortised cost or at FVOCI – showing these amounts separately. Although this level of disaggregation is not required under the superseded paragraph 20(b) of IFRS 7S, for 2017 the Group has disaggregated total interest income calculated under the effective interest method for each type of financial asset category. An entity is required to disclose separately any material items of income, expense and gains and losses arising from financial assets and financial liabilities. |

|||||||||||||||||||||||||

|

The Group has grouped dividends classified as an expense with interest on other liabilities. Alternatively, they may be presented as a separate item. If there are differences between interest and dividends with respect to matters such as tax deductibility, then it is desirable to disclose them separately. |

|||||||||||||||||||||||||

|

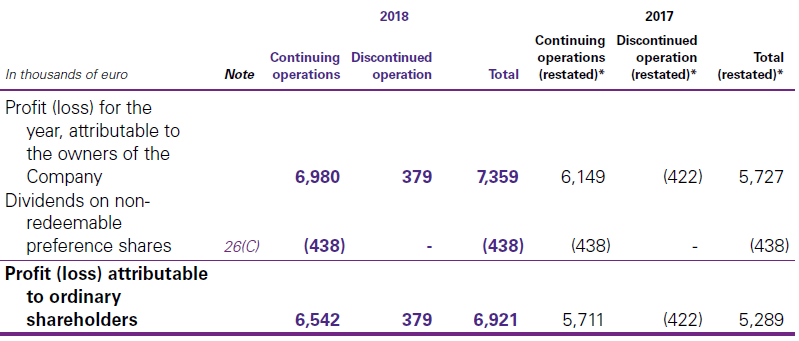

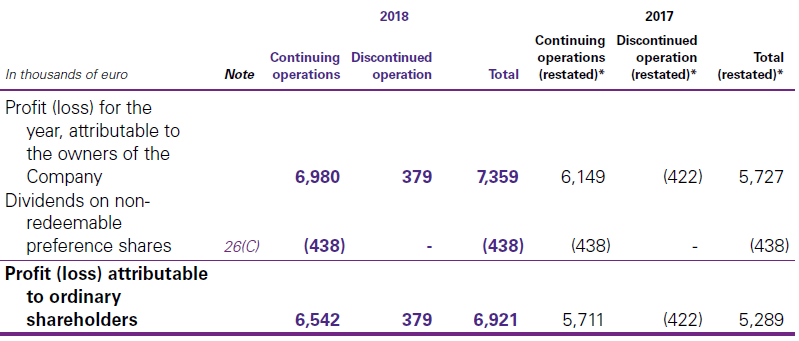

11. Earnings per share A. Basic earnings per share The calculation of basic EPS has been based on the following profit attributable to ordinary shareholders and weighted-average number of ordinary shares outstanding. i. Profit (loss) attributable to ordinary shareholders (basic)

* See Notes 5, 7 and 44. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea |

|||||||||||||||||||||||||

|

ii. Weighted-average number of ordinary shares (basic)

|

|||||||||||||||||||||||||

|

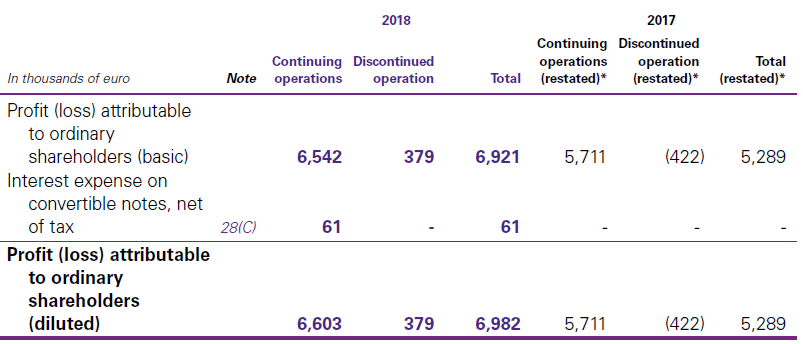

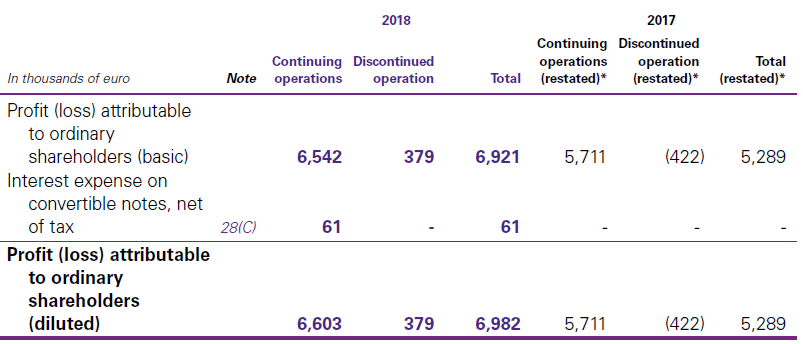

B. Diluted earnings per share The calculation of diluted EPS has been based on the following profit attributable to ordinary shareholders and weighted-average number of ordinary shares outstanding after adjustment for the effects of all dilutive potential ordinary shares. i. Profit (loss) attributable to ordinary shareholders (diluted)

* See Notes 5, 7 and 44. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea |

|||||||||||||||||||||||||

|

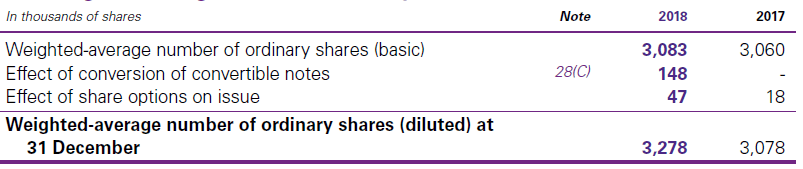

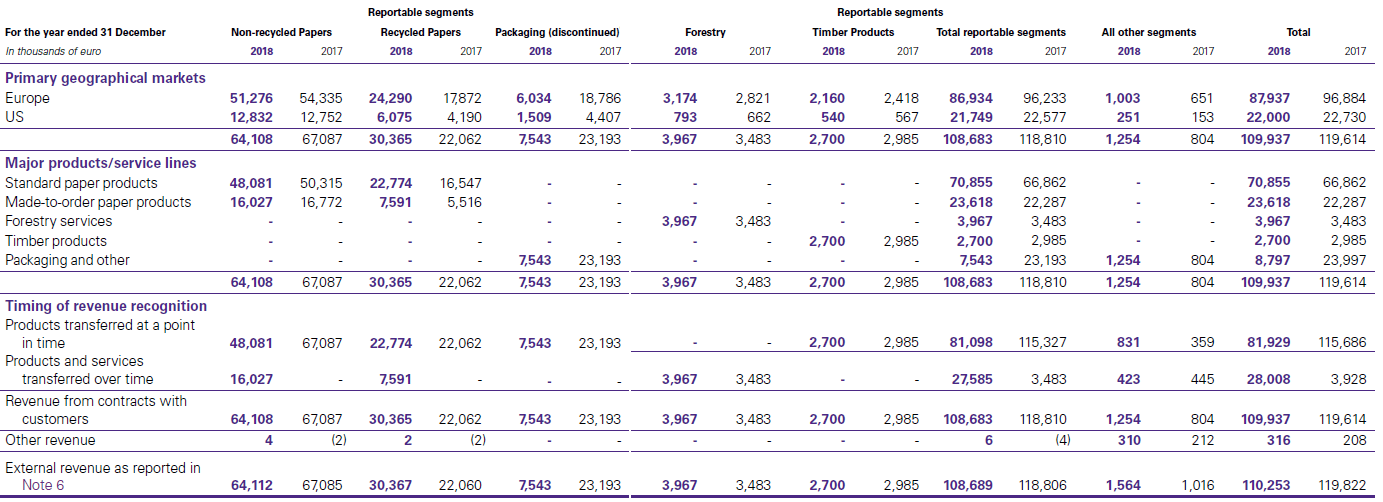

ii. Weighted-average number of ordinary shares (diluted)

|

|||||||||||||||||||||||||

|

At 31 December 2018, 135,000 options (2017: 44,000) were excluded from the diluted weighted average number of ordinary shares calculation because their effect would have been anti-dilutive. Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the yea The average market value of the Company’s shares for the purpose of calculating the dilutive effect of share options was based on quoted market prices for the year during which the options were outstanding. |

|||||||||||||||||||||||||

|

Blog note: The method used to determine the average market price for ordinary shares should be disclosed in the notes |

Next – Notes to the financial statements: Employee benefits

Notes disclosure – Performance for the year

Notes disclosure – Performance for the year

Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the year Notes disclosure – Performance for the year