hide

Modifications of employee share-based payment transactions

- The accounting for a modification depends on whether the modification changes the classification of the arrangement and whether the changes are beneficial to the employee.

- As a minimum, the original grant-date fair value of the equity instruments granted is recognised under modification accounting.

- Modifications that increase the fair value of the grant result in recognition of the incremental fair value measured at the date of modification.

- Modifications that increase the number of equity instruments granted result in recognition of the fair value of the additional equity instruments, measured at the date of modification.

- Other beneficial modifications – e.g. changes to service conditions or non-market performance conditions – are taken into account in applying the modified grant-date method.

- Modifications that are not beneficial for the employee do not affect the total share-based payment cost.

- Cancellations by the employee or by the entity result in accelerated vesting.

- Compensation payments made for cancellations by the employer are recognised as a repurchase of equity interests. To the extent that a compensation payment exceeds the fair value of the equity instruments granted at the repurchase date, it is recognised as an expense.

- Replacement awards need to be identified as such by the employer at the date when the new award is granted.

- Replacement awards are accounted for by applying the principles of modification accounting, rather than as a separate new award and cancellation of the unvested old award.

This narrative contains guidance on modifications of share-based payment transactions with employees. There are no specific requirements for cash-settled share-based payments that are modified or cancelled because cash-settled share-based payments are remeasured to the ultimate cash payment

The modification requirements also apply to share-based payment transactions with parties other than employees that are measured indirectly – i.e. with reference to the fair value of the equity instruments granted. In this case, any reference to grant date is read as a reference to the applicable measurement date under those transactions – i.e. the date when the goods or services are received.

As a basic principle, IFRS 2 requires an entity to recognise, as a minimum, the original grant-date fair value of the equity instruments granted unless those equity instruments do not vest because of failure to meet any service and non-market performance conditions under the original terms and conditions. (IFRS 2.27)

In addition to the original grant-date fair value, an entity recognises the effects of modifications that increase the fair value of the equity instruments granted or are otherwise beneficial to the employee. (IFRS 2.27)

In other words, the entity cannot reduce the share-based payment cost that would be recognised under the original terms and conditions by modifying or cancelling a share-based payment. However, the timing of recognition of the cost of a share-based payment may change as a result of modifications. (IFRS 2.BC237)

Modifications

The accounting for a modification depends on whether the modification changes the classification of the arrangement and whether the changes are beneficial to the counterparty.

Modifications that do not change classification of arrangement

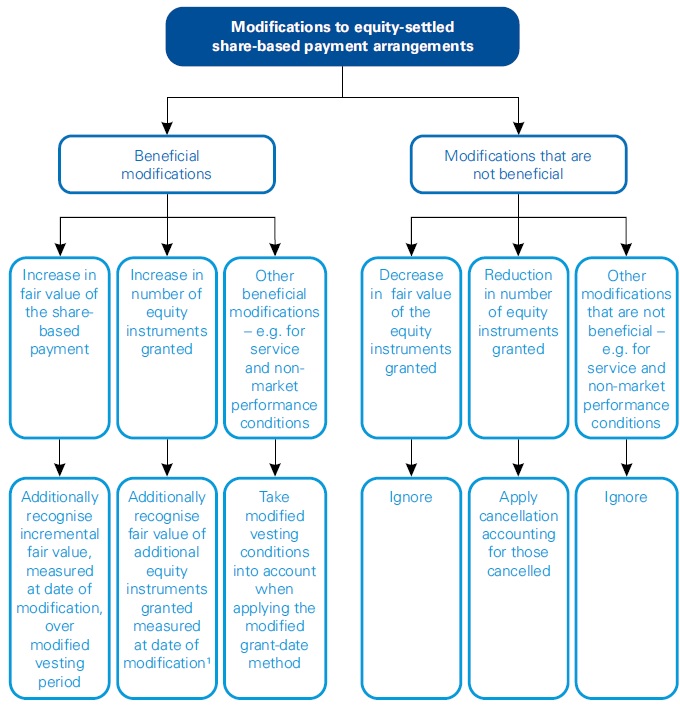

IFRS 2 distinguishes between different types of beneficial and non-beneficial modifications. The following flowchart provides an overview of the categories discussed and the respective accounting consequences, assuming that the modification does not affect the classification of the share-based payment. (IFRS 2.B42-B44)

Note

Note

1. Over the period from date of modification to the end of the vesting period of the additional equity instruments.

Increases in fair value of equity instruments granted

Sometimes a modification increases the fair value of the equity instruments granted – e.g. by reducing the exercise price of a share option granted. In these cases, the incremental fair value is recognised over the remaining modified vesting period, whereas the balance of the original grant-date fair value is recognised over the remaining original vesting period. (IFRS 2.B43(a), IFRS 2.IG.Ex 7)

The ‘incremental fair value’ is the difference between the fair value of the modified share-based payment and that of the original share-based payment, both measured at the date of the modification – i.e. the fair values as measured immediately before and after the modification. (IFRS 2.B43)

Case – Reduction of exercise price during the vesting period |

|

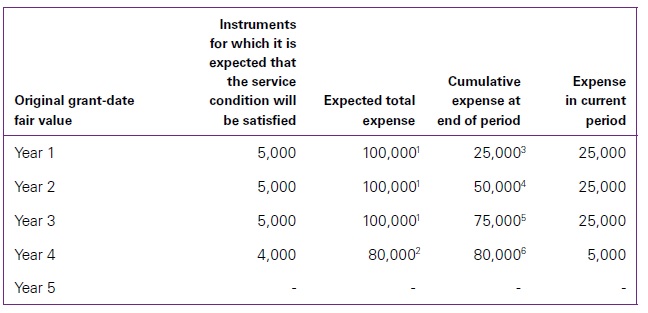

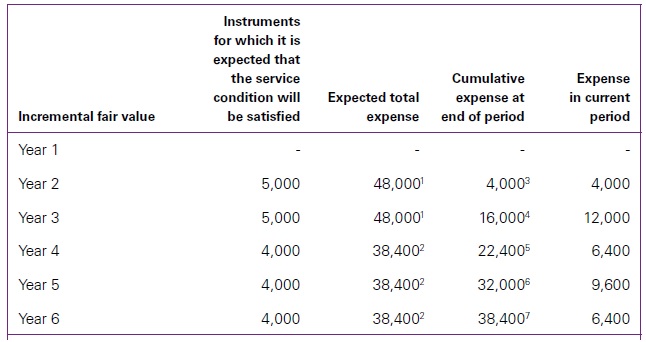

On 1 January Year 1, Company C grants 1,000 share options to each of its five board members, subject to a four-year service condition. The share options can be exercised at any date in Year 5. The current share price at grant date is 100 and the exercise price is also 100. The grant-date fair value of an option is determined to be 20. In Year 2, C’s share price declines significantly to 40 and the option is deeply out-of-the-money. To re-establish the motivational effect of the share options on the employees, C re-prices the share options by modifying the exercise price to 40 on 1 September Year 2. Simultaneously, the service condition is prolonged to four years from the date of modification. The fair value of a share option immediately before the modification is 0.1 and immediately after the modification is 9.7; the incremental fair value is therefore 9.6 per option. At the date of modification, C estimates that all five board members will remain in service over both the original vesting period and the modified vesting period. However, one board member leaves in Year 4. C recognises share-based payment expenses and corresponding increases in equity in accordance with the following table.

Notes

Although the modified fair value of a share option is 9.7, which is less than the grant-date fair value of 20, there is an incremental fair value to account for because the incremental fair value is the difference between the fair value immediately before and after the modification. In total, C recognises share-based payment expenses of 118,400 (4 x 1,000 x (20 + 9.6)) or (80,000 + 38,400). |

In the the case – Reduction of exercise price during the vesting period above, the attribution of the incremental fair value to the remaining modified vesting period has been illustrated based on a monthly approximation rather than on a calculation based on days. In our experience, such approximations are used in practice and may be appropriate if their use does not lead to significantly different outcomes.

In my view, when determining fair value at the date of modification, the same requirements as for determining the grant-date fair value apply – i.e. service conditions and non-market performance conditions are not taken into account in determining the fair value (see Basic principles in Employee equity-settled share-based payment).

If, for example, a share-based payment arrangement with a non-market performance condition is modified such that only the non-market performance target is modified, and all other terms and conditions remain the same, then the incremental fair value is zero.

This is because the fair value measured on an IFRS 2 basis – i.e. without adjustments for service and non-market performance conditions – is the same before and after the modification. For a discussion of the accounting for such modifications, see Modifications that do not change classification or arrangement.

If, in contrast, a market condition or a non-vesting condition is reduced or eliminated, then this beneficial modification may result in an incremental fair value. This is because under the modified grant-date method, market and non-vesting conditions are reflected in the fair value of an equity-settled share-based payment (see Basic principles in Employee equity-settled share-based payment). (IFRS 2.B43(a))

If an award that contains a market condition is modified by an entity to make the market condition easier to meet, or if a market condition is eliminated, then this is a modification of a vesting condition that is beneficial to employees. The original market condition is taken into account in estimating the fair value of the original grant at the date of modification.

If it is unlikely that the original market condition will be met at the date of modification, then the fair value of the original award at the date of modification may be significantly lower than the fair value of the original award as determined at grant date.

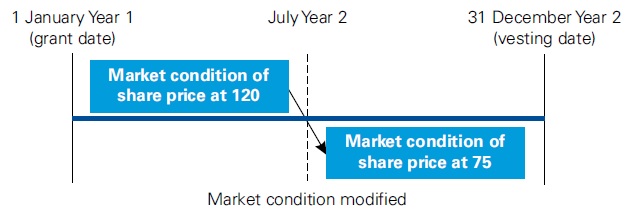

Case – Beneficial modification of market condition |

|

On 1 January Year 1, Company D grants 1,000 shares for no consideration to its CEO, subject to a two-year service condition and the share price achieving a target of 120. At grant date, the share price is 100 and the grant-date fair value of the equity instrument granted, including consideration of the possibility of not meeting the share price target, is 80. In July Year 2, the share price decreases to 70 and D now estimates that it is highly unlikely that the share price target will be met. To motivate the CEO, the market condition is reduced to a share price target of 75. The fair value of equity instrument granted considering the market condition immediately before the modification is 1 and immediately after the modification is 56; the incremental fair value is therefore 55 per share.

D recognises the grant-date fair value of the equity instruments granted of 80,000 (1,000 x 80) over Year 1 and Year 2 in respect of the original grant. Additionally, D recognises the incremental fair value of 55,000 (1,000 x 55) in Year 2, assuming that the CEO fulfils the service requirement. The total compensation cost that will be recognised of 135,000 is greater than the fair value of the modified award of 56,000. |

Increases in number of equity instruments granted

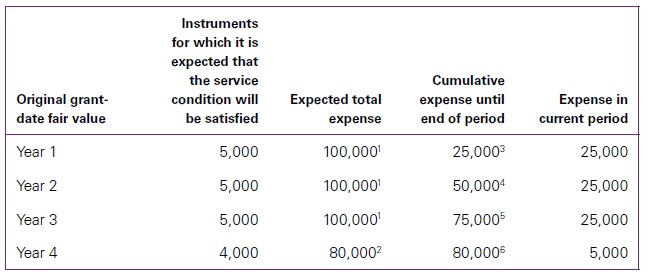

If a modification increases the number of equity instruments granted, then the entity recognises the fair value of the additional equity instruments measured at the date of modification. The additional share-based payment cost is attributed over the period from the date of modification to the end of the vesting period of the additional equity instruments. (IFRS 2.B43(b))

A common example of increases in the number of equity instruments granted is when an entity issues additional shares due to a decline in the share price to maintain the economic position of the share-based payment holder.

Case – Increase in number of equity instruments granted |

|

On 1 January Year 1, Company E grants 1,000 shares for no consideration to its CEO, subject to a three-year service condition. At grant date, the fair value of the shares is 15. In Year 1, the share price decreases significantly. Although E has no obligation to do so under the current share-based payment arrangement and there are no other indications (e.g. past practice) that such an obligation exists, on 1 January Year 2, when the share price is 5, E modifies the share-based payment to restore the economic position of the CEO. E grants an additional 2,000 shares for no consideration, worth 10,000, compensating the CEO for the price fall of 10 per share on the original grant of 1,000 shares. E recognises a share-based payment expense of 15,000 (1,000 x 15) evenly over the original three-year vesting period, and an additional share-based payment expense of 10,000 (2,000 x 5) evenly over Year 2 and Year 3. Although the intention of the modification is to restore the economic position of the employee, E recognises a total share-based payment expense of 25,000 (15,000 + 10,000), which is significantly higher than the modification-date value of the two grants. |

Beneficial modifications of service and non-market performance conditions

If the modification changes a service or non-market performance condition in a manner that is beneficial to the employee – e.g. by reducing the vesting period or by modifying or eliminating a non-market performance condition – then the remaining grant-date fair value is recognised using the revised expectations with true-up to actual outcomes (see Basic principles in Employee equity-settled share-based payment).

Modification of service condition

If a service period is reduced, then the entity uses the modified vesting period when applying the requirements of the modified grant-date method. In the period of change, the entity calculates the cumulative amount to be recognised at the reporting date based on the new vesting conditions. (IFRS 2.B43(c))

Case – Reduction of service period |

|

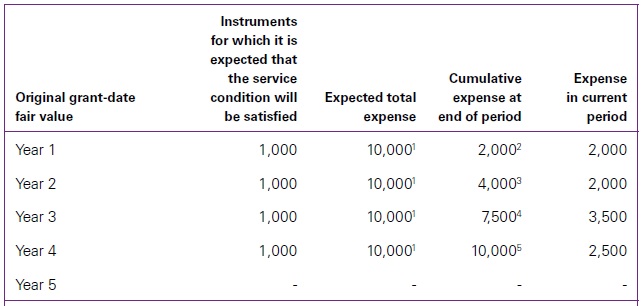

On 1 January Year 1, Company F grants 1,000 share options to one of its employees, subject to a five-year service condition. The grant-date fair value of a share option is 10 and the employee is expected to remain in service. In the middle of Year 3, the service period is reduced to four years; the employee remains employed. In this case, ignoring interim financial reporting requirements, F calculates the cumulative amount to be recognised at the end of Year 3 based on the new vesting period, which results in an additional share-based payment expense in Year 3, and to a lesser extent also in Year 4, so that the cumulative amounts recognised at the end of Year 3 and Year 4 mirror the pattern of services as they are rendered under the new vesting period.

Notes |

Acceleration of vesting in response to termination of employment by the employee

If an employee leaves before vesting date, then an entity may respond by amending the terms of the share-based payment or granting a new award such that the award vests despite the employee not having completed the service period originally required.

This fact pattern could be seen as a forfeiture of the original award and a grant of a new award. Forfeiture resulting from voluntary termination of employment by the employee would result in a true-up to zero of the original award. A grant of a new award would result in recognition of the new grant-date fair value immediately because no further services are provided. (IFRS 2.27, IFRS 2B42, IFRS 2B43(c))

In my view, if on termination of employment by either the employee or the employer, the employer accelerates the vesting period such that the employee receives the award despite not having completed the requisite service period, then this is a modification of the award and not a forfeiture of the original award (forfeiture would result in true-up to zero) and a grant of a new unrelated award, (which would result in recognising the new grant-date fair value immediately because no further services are provided).

This is because IFRS 2 illustrates an acceleration of the vesting period as an example of a modification that is beneficial to an employee. The accounting would be the same if the acceleration of vesting were treated as the forfeiture of the original grant and a grant of a replacement award. This is because the grant of a replacement award is also treated as a modification.

Under modification accounting, there is an incremental fair value to account for only if the fair value has changed because of the modification, which is not the case when only a service condition is modified (e.g. waived on employee resignation). Therefore, under modification accounting, the grant-date fair value of the original award is recognised immediately because at a minimum the original grant-date fair value is recognised over the revised vesting period of the share-based payment. (IFRS 2.27-28)

Case – Acceleration of service condition on termination of employment |

|

Company G awards a share-based payment similar to that in Example 9.2.4, but the employee leaves at the end of Year 2. Although under the terms and conditions of the arrangement the employee forfeits their right to receive the share-based payment, G voluntarily accelerates the vesting date to the end of Year 2, so that the employee has met the modified service condition. In this case, G recognises the remaining share-based payment expenses of 8,000 (10,000 – 2,000) in Year 2. |

Acceleration of vesting in response to termination of employment by entity

An entity may terminate the employment of an employee so that the employee cannot provide the required services. Although the share-based payment does not contain a good leaver clause (see below), the entity nevertheless does not want the employee to lose entitlement to the share-based payment. In this case, the entity may amend the terms of the share-based payment or grant a new award to accelerate vesting.

As a reminder, if vesting is not accelerated as set out above, then I believe that termination of employment by the entity may be accounted for as forfeiture or as a cancellation.

If vesting is accelerated, then the accounting treatment as a beneficial modification should be the same as the case in which the employee cancels the share-based payment (i.e. immediate recognition of the unrecognised amount). This is regardless of which accounting treatment is applied for failure to provide required service due to termination when vesting is not accelerated. (IFRS 2.27)

Acceleration of vesting as part of the arrangement

In contrast to the case – Acceleration of service condition on termination of employment above, if the share-based payment arrangement contains a good leaver clause under which the employee would qualify for accelerated vesting if G terminates their employment, then the entity would not need to modify the arrangement for the share-based payment to vest. Under the original terms of the share-based payment, the acceleration would result in recognition of the balance of the share-based payment cost.

Modification of non-market performance condition

Like modifications of a service condition (see above), a modification of a non-market performance condition does not affect the modification-date fair value of the share-based payment. The entity determines whether the modification is beneficial to the employee and, if it is, then the modified vesting conditions are taken into account in determining when to recognise the share-based payment cost. (IFRS 2.B43(c))

Case – Modification of non-market performance condition |

|

On 1 January Year 1, Company H grants 1,000 share options to an employee, subject to a four-year service condition and the company achieving a cumulative profit target of 100 million at the end of the service period. The grant-date fair value of a share option is 10. At grant date, the employee is expected to stay employed and the profit target is also expected to be met. However, in Year 2 the profit target is no longer expected to be met. Therefore, in Year 3 H reduces the profit target to 80 million (a beneficial modification), which at the time of the modification is expected to be met. At the end of Year 4, the revised profit target is not met. H accounts for the transaction as follows.

Notes |

Judgement may be necessary to decide whether a change in the non-market performance conditions of a share-based payment arrangement should be considered a modification. A change in the method of computation may not be a modification, but rather could be a predetermined adjustment that is not accounted for as a modification. As discussed in Discretion clauses in Determination of grant date, I believe that a predetermined adjustment to a share-based payment would not result in modification accounting as described above.

Case – Predetermined adjustment of non-market performance condition |

|

Company P grants employees a share-based payment, the vesting of which depends on the company’s relative position within a comparator group of companies. P’s relative position within this comparator group is based on market share determined with respect to revenue (i.e. a non-market performance condition). The agreement specifies that, should one of the comparator group companies need to be deleted from the list for reasons outside P’s control – e.g. de-listing of a competitor such that financial information is no longer available – then it will be replaced by the next company in a predetermined list. The agreement specifies that the objective of the clause is to ensure that the top five competitors by market share are included in the comparator group. I believe that any substitution in the comparator group in accordance with the original terms is not a modification because the composition of the group and the objective of the clause were clearly stated and defined in advance as part of the terms and condition of the original grant – i.e. the change was predetermined (see Discretion clauses in Determination of grant date). |

Case – No predetermined adjustment of non-market performance condition |

|

Assume the same facts as in the case – Predetermined adjustment of non-market performance condition above, except that the agreement does not specify the objective of the clause or how a company in the comparator group will be replaced and the revision to the comparator group is a free choice or the change is made at the discretion of the entity. In this case, I believe that this should be accounted for as a modification because of the subjectivity involved (see Discretion clauses in Determination of grant date). |

Non-beneficial modifications

Modifications to equity-settled share-based payment transactions that decrease the fair value of the grant are generally ignored. The fair value of the share-based payment decreases when the fair value immediately after the modification is lower than the fair value immediately before the modification.

In determining the fair value, I believe that the same principles apply as when determining the grant-date fair value (see Basic principles in Employee equity-settled share-based payment). (IFRS 2.27, B44(a))

If the modification reduces the number of equity instruments granted, then that reduction is accounted for as a cancellation. (IFRS 2.27, B44(b))

If the entity modifies the vesting conditions in a manner that is not beneficial to the employee – e.g. by increasing the vesting period or by increasing or adding a non-market performance condition – then this modification is also ignored (i.e. the grant-date fair value of the equity instruments granted is recognised over the original vesting period) if the original service and non-market performance conditions are met.

That is, if an employee leaves before the end of the original vesting period, then this forfeiture results in a true-up of the original compensation expense. If, in contrast, the employee leaves after the original vesting date, but before the later modified vesting date, then this is not treated as a forfeiture. (IFRS 2.27, B44(c))

Give-and-take modifications

A package of modifications might include several changes to the terms of a grant, some of which are favourable to the employee whereas other changes are not. For example, a share option grant can be modified by reducing the exercise price (give) and simultaneously reducing the number of granted options (take).

In my view, it is appropriate to net the effects of both modifications, provided that they are agreed as part of a package. This is because the employee realises the net change rather than being able to earn the enhanced benefit of the reduction of the exercise price without suffering the loss in the total number of options.

If the net effect is beneficial, then I believe that this net effect should be accounted for by applying the requirements for beneficial modifications to the net change.

Case – Give-and-take modifications |

|

On 1 January Year 1, Company M grants 1,000 share options to its CEO, subject to a three-year service condition. The grant-date fair value of a share option is 10 and the total grant-date fair value is 10,000. At the beginning of Year 3, the following modifications are carried out in a single arrangement:

The net effect of the package of modifications is beneficial to the employee, because the total fair value of 1,000 units before modification of 7,000 (1,000 x 7) is lower than the total fair value of 800 units after modification of 8,800 (800 x 11). I believe that M should account for the package of modifications as one net beneficial modification that increases the fair value of the equity instruments granted as follows.

In total, M recognises share-based payment expenses of 11,800 (10,000 grant-date fair value of the equity instruments granted of 10,000 + an incremental value of 1,800). Notes |

Modifications that change classification of arrangement

When change in classification should be treated as modification

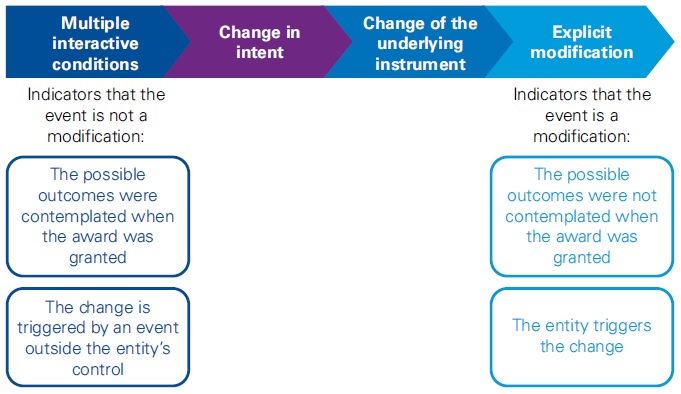

Not all changes to the classification of a share-based payment arrangement are modifications. In some cases, changes to the classification of an arrangement that contains multiple interactive vesting conditions may result from a change in the most likely outcome. In this case, in my view a switching approach should be followed for the change in classification.

There are also cases in which judgement is needed to determine whether modification accounting should be applied to the change in classification. In my view, the factors to consider in determining whether the change is a modification include the following:

- whether the different possible outcomes were contemplated when the award was granted; and

- whether the change is triggered by the entity or by an event that is outside the entity’s control.

The diagram below illustrates how I believe that these factors should be taken into account.

Case – Change is triggered by an event outside entity’s control (switching approach) |

|

Company N is an income trust under the relevant tax legislation in its jurisdiction. On 1 January Year 1, N grants an award to its employees that is redeemable at the option of the holder. N classifies the award as a cash-settled award because the units issued to its employees will ultimately result in a cash payment by N to its employees. On 1 January Year 2, new tax legislation is enacted that requires all income trusts to be converted into traditional corporate structures. As a result, N’s unit- I believe that this change in classification should not be treated as a modification, because the change is triggered by an event outside the entity’s control. In this case, I believe that a switching approach should be followed for the change in classification. |

Case – Change in classification treated as modification |

|

Company O has granted an award that gives it the choice of cash or equity settlement. O’s original intent was equity settlement, and this has been its practice, but it changes its policy and begins to settle in cash; therefore, O reclassifies its outstanding share-based payments from equity-settled to cash-settled. I believe that this change in classification should be treated as a modification because O triggered the change. |

Modifications altering manner of settlement

A share-based payment may sometimes be modified to alter its manner of settlement; as a result, a share-based payment that was classified as equity-settled at grant-date may be modified to become cash-settled, or vice versa.

IFRS 2 contains guidance on accounting for modifications that result in a change from cash-settled to equity-settled but no explicit guidance on the accounting for modifications that result in a change from equity-settled to cash-settled.

The modification-date fair value of the original share-based payment may increase, decrease or remain equal compared with its grant-date fair value. In addition, the terms of the modified share-based payment may grant incremental fair value to its recipient.

Change from equity-settled to cash-settled arising from modification

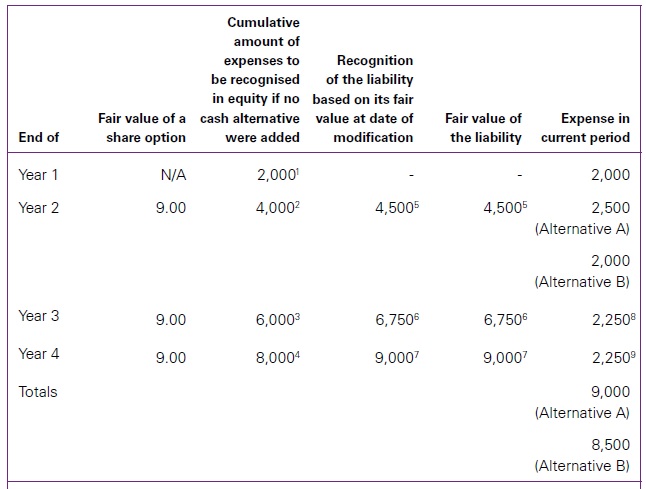

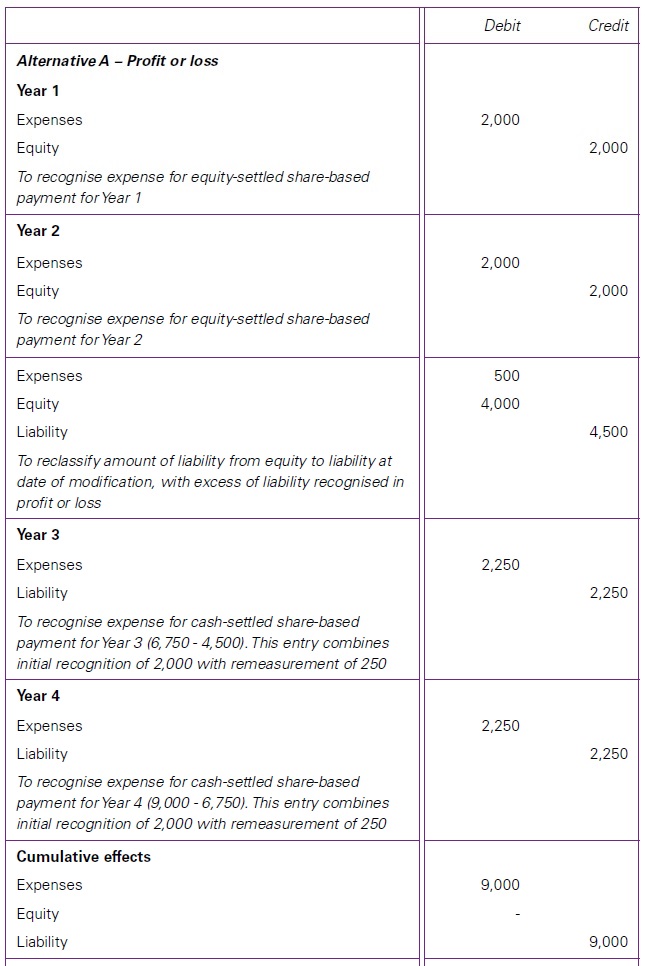

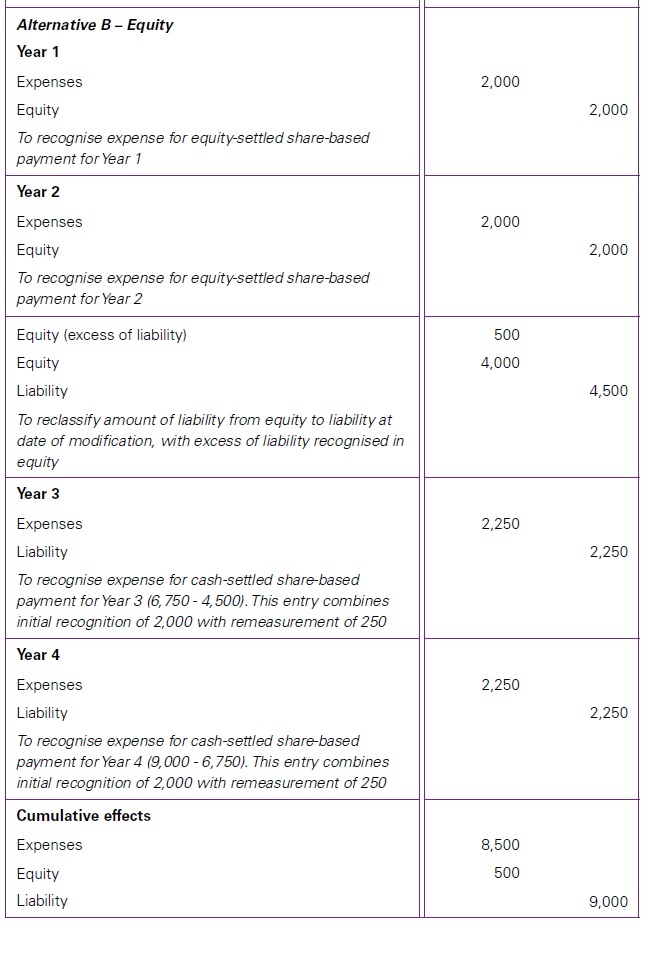

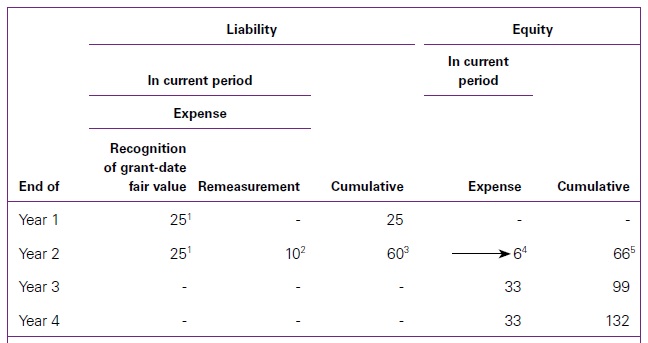

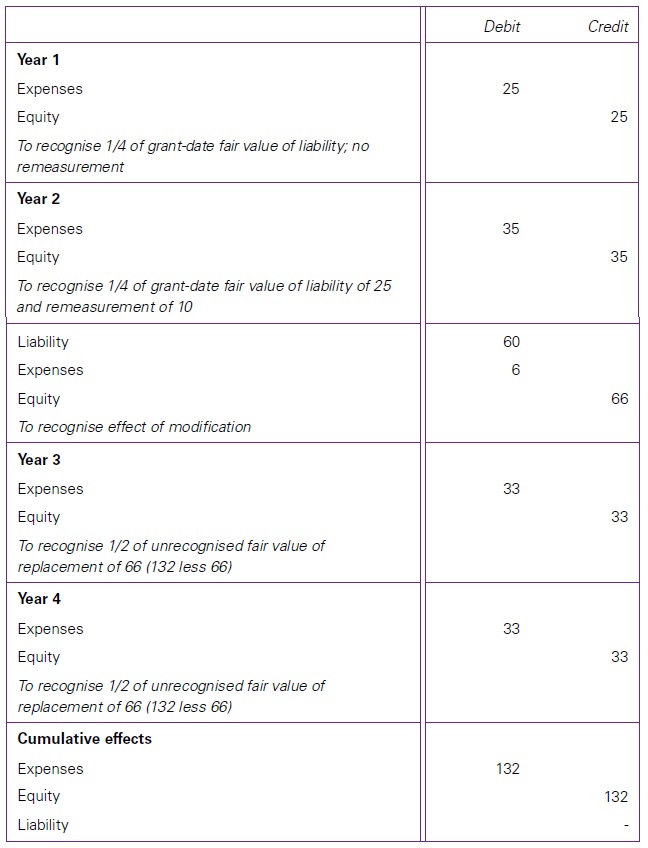

A change from equity-settled to cash-settled arising from a modification would occur if, for example, a cash alternative at the employee’s discretion is subsequently added to an equity-settled share-based payment that results in a reclassification as a financial liability. Such a modification leads to a reclassification, at the date of modification, of an amount equal to the fair value of the liability from equity to liabilities. (IFRS 2.27, IG.Ex9)

If the amount of the liability recognised on the modification date is less than the amount previously recognised as an increase in equity, then no gain is recognised for the difference between the amount recognised to date in equity and the amount reclassified for the fair value of the liability; that difference remains in equity.

Subsequent to the modification, the entity continues to recognise the grant-date fair value of equity instruments granted as the cost of the share-based payment. However, any subsequent remeasurement of the liability (from the date of modification until settlement date) is also recognised in profit or loss. (IFRS 2.IG.Ex9)

The implementation guidance to IFRS 2 illustrates the accounting subsequent to the reclassification in such a case. First, the grant-date fair value of the equity instruments granted continues to be recognised as a share-based payment cost as if no modification had occurred. The amount is credited partially to the liability and partially to equity.

The amount that is credited to the liability is the amount that equals the annual proportion of the fair value of the liability at the date of modification, without taking into account any subsequent changes in the value of the liability. The remainder is credited to equity. Second, the liability is remeasured by applying the usual requirements for remeasurement of a cash-settled share-based payment (see Remeasurement in Employee cash-settled share-based payment).

In effect, this means that the cumulative amount recognised in profit or loss over the life of the award is the grant-date fair value plus or minus any subsequent changes in fair value after the change in classification. Therefore, the cumulative amount may be less than the original grant-date fair value. (IFRS 2.IG15Ex9)

If the amount of the liability recognised on the modification date is greater than the amount previously recognised as an increase in equity, then in my view two approaches are acceptable for recognising the excess liability. I believe that an entity should choose an accounting policy, to be applied consistently, to recognise either:

- the excess as an expense in profit or loss at the date of modification (Alternative A); or

- the entire liability as a reclassification from equity and not recognise any loss in profit or loss (Alternative B).

The approach under Alternative A in 9.2.30 of recognising the excess as an expense in profit or loss in effect transfers an amount recognised in equity in respect of the share-based payment to a liability and then remeasures that amount, through profit or loss, to its current fair value.

The approach under Alternative B in 9.2.30 of recognising the entire amount of the liability as a reduction in equity is consistent with the treatment applied when the liability is less than the amount recognised in equity, in that no gain is recognised for the difference between the amount recognised to date in equity and the initial fair value of the liability.

In my view, it is appropriate for no gain or loss to be recognised when a change in the terms of a compound instrument leads to reclassification as a financial liability provided that the liability at the date of modification is not greater than the fair value of the original equity-settled award at the date of modification.

This is because under IFRS an entity does not recognise a gain or loss when it buys, sells, issues or cancels its own equity instruments – e.g. when treasury shares are repurchased for amounts greater than their issue cost. (IAS 32.33, AG.32)

Case – Change from equity-settled to cash-settled, liability higher than equity, no incremental fair value |

|

On 1 January Year 1, Company K grants 1,000 share options to its CEO, subject to a four-year service condition. The grant-date fair value of a share option is 8 and the total grant-date fair value is 8,000. At the end of Year 2, K adds a cash alternative to the arrangement, under which the employee can choose a cash payment that equals the fair value of the share options. The fair value of a share option at the date of the modification is 9. Accordingly, the total fair value of the liability is 9,000. The proportion of the liability at the end of Year 2 is 4,500 (9,000 x 2/4), which is higher than the cumulative amount recognised in equity of 4,000 (8,000 x 2/4). The fair value of a share option and, accordingly, of the liability for the cash alternative, develops as follows (assuming that the fair value of the share option remains at 9 until the end of Year 4).

Notes K accounts for the transaction as follows.

|

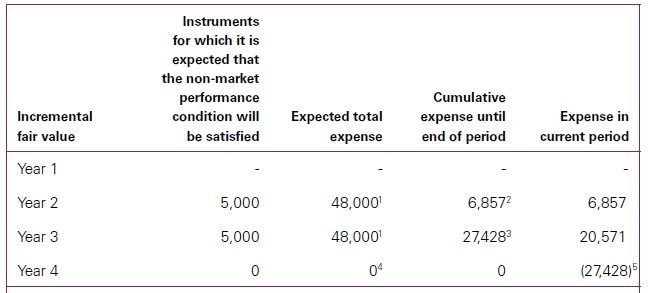

Change from cash-settled to equity-settled arising from modification

A change from cash-settled to equity-settled arising from a modification would occur if, for example, a new equity-settled share-based payment arrangement is identified as a replacement of a cash-settled share-based payment arrangement.

At the modification date an entity: (IFRS 2.B44A-B44C, IG.Ex.12C)

- derecognises the liability for the cash-settled share-based payment;

- measures the equity-settled share-based payment at its fair value as at the modification date and recognises in equity that fair value to the extent that the services have been rendered up to that date; and

- immediately recognises in profit or loss the difference between the carrying amount of the liability and the amount recognised in equity.

Case – Change from cash-settled to equity-settled with incremental fair value |

|

In January Year 1, Company M grants 100 SARs to its CFO, subject to a four-year service condition. The grant-date fair value of a SAR is 1; the total grant-date fair value is 100. The share price at the end of Year 1 is unchanged. At the end of Year 2, the original grant has a fair value of 120. M cancels the grant and in its place grants 100 share options at a fair value of 1.32 each – i.e. the fair value of the new grant is 132 instead of 120, resulting in an incremental fair value of 12. The new equity-settled grant is identified as a replacement for the original cash-settled grant and is therefore accounted for as a modification.

Notes M accounts for the transaction as follows.

|

Modifications that change nature of arrangement

A modification may change the nature of an arrangement from a share-based payment arrangement to an employee benefit in the scope of IAS 19 Employee Benefits.

In my view, the accounting for modifications that change the classification of an equity-settled share-based payment arrangement to a cash-settled share-based payment arrangement should be applied by analogy to account for an IAS 19 employee benefit that is identified as a replacement of an equity-settled share-based payment arrangement.

However, some adjustments should be made to reflect the fact that the new award is not a cash-settled share-based payment but an IAS 19 employee benefit – e.g. it may be necessary to change from a straight-line attribution method to a projected unit credit method.

The employee benefit should be measured and recognised based on the general requirements of IAS 19 applicable to the type of employee benefit issued.

Modified awards that are forfeited

As discussed in 6.9.10, the equity-settled share-based payment cost is estimated and trued up for forfeiture because of an employee failing to provide services or failing to satisfy a non-market performance condition.

There is no specific guidance regarding the amount to be reversed because of an employee failing to meet a non-market performance condition after a share-based payment has been modified. Therefore, a question arises about whether the amount to be reversed includes the amount that was recognised in respect of the original award (the grant-date fair value).

In my view, if the employee meets the original condition but fails to meet a non-market performance condition that was added as part of the modification, then the amount to be reversed because of forfeiture is limited to any compensation cost recognised in respect of the modification.

Therefore, if the original service condition (and non-market performance condition, if there is any) is met, then the entity should still recognise as the cost of the share-based payment the original grant-date fair value of the equity instruments granted.

I believe that this is the appropriate treatment because IFRS 2 states that “the entity shall recognise, as a minimum, the services received measured at the grant-date fair value of the equity instruments granted, unless those equity instruments do not vest because of failure to satisfy a vesting condition (other than a market condition) that was specified at grant date”.

IFRS 2 goes on to state that “this applies irrespective of any modifications to the terms and conditions on which the equity instruments were granted, or a cancellation or settlement of that grant of equity instruments (IFRS 2.27)

Case – Modified awards with a non-market performance condition that are forfeited |

|

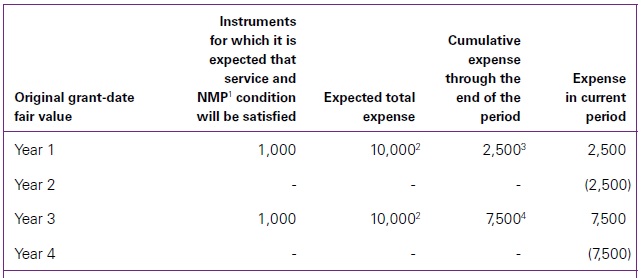

On 1 January Year 1, Company C grants 1,000 share options to each of its five board members, subject to a four-year service condition. The share options can be exercised at any date in Year 5. The current share price at grant date is 100 and the exercise price is also 100. The grant-date fair value of an option is determined to be 20. In Year 2, C’s share price declines significantly to 40 and the option is deeply out-of-the-money. To re-establish the motivational effect of the share options on the employees, C re-prices the share options by modifying the exercise price to 40 on 1 September Year 2. Simultaneously, a non-market performance condition is dded that requires a profit target of 1 million to be met by 31 December Year 4. The fair value of a share option immediately before the modification is 0.1 and immediately after the modification is 9.7; the incremental fair value is therefore 9.6 per option. At the date of modification, C estimates that all five board members will remain in service over both the original vesting period and the modified vesting period. However, one board member leaves in Year 4. The non-market performance condition is not met by 31 December Year 4; therefore, the award is forfeited. C recognises share-based payment expenses and corresponding increases in equity as follows.

Notes

Notes Although the modified fair value of a share option is 9.7, which is less than the grant-date fair value of 20, there is an incremental fair value to account for because the incremental fair value is the difference between the fair values immediately before and after the modification. The grant-date fair value of the original award is recognised for those awards for which the service condition is satisfied, even if the award has since been forfeited because the non-market performance condition added as part of the modification was not satisfied. |

Modifications after vesting date

In contrast to the general principle that no adjustment is made to the accounting for equity-settled share-based payments after the vesting date (see Basic principles in Employee equity-settled share-based payment), an adjustment is recognised for modifications occurring after the vesting date. In this case, any incremental fair value is recognised immediately or over the new service period, if there is one. (IFRS 2.B43)

Case – Reduction of exercise price after the vesting period |

|

On 1 January Year 1, Company D grants 1,000 share options to each of its five board members, subject to a four-year service condition. The share options can be exercised at any date in Year 5. The current share price at grant date is 100 and the exercise price is also 100. The grant-date fair value of an option is 20. Beginning in Year 4, D’s share price declines significantly. In Year 5 – i.e. after the end of the vesting period – D re-prices the share options by modifying the exercise price to 60 on 1 February Year 5, which is the then-current share price. No share options have been exercised by 1 February Year 5. The fair value of a share option immediately before the modification is 2 and immediately after the modification is 9; the incremental fair value is therefore 7 per option. D estimates that all five employees will remain in service until the vesting date, and they ultimately do. D recognises a share-based payment expense of 100,000 (1,000 x 5 x 20) over the vesting period in respect of the original grant. Additionally, D recognises the incremental fair value of 35,000 (Year 1 to Year 4) (1,000 x 5 x 7) immediately on 1 February Year 5, because the modification occurred after the options had vested. |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment

Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment Modifications of employee share-based payment