Metrics in use for ESG Reporting

Here is a list of Metrics in use for ESG Reporting that companies can use to start communicating on the ESG issues. The metrics have been divided into four categories:

Each category contains recommended disclosure metrics (both qualitative and quantitative) that have been marked either as minimum disclosures (relevant to all companies) or additional disclosures (that might not be relevant to all companies).

The selection of recommended disclosure metrics has been informed by relevant regulatory initiatives i.e. the CSRD and the ESRS as well as the Warsaw Stock Exchange corporate governance code. Moreover, to address increasing investors’ data needs, they have been also aligned with the mandatory PAI indicators for corporate investments required by the SFDR (see mapping in the Appendix – Relevance of the Guidelines to investors). References have been added below each section to other frameworks and resources that companies may also consider (Appendix – Alignment with EU regulations and other frameworks).

It should be emphasized that the Guidelines do not provide an exhaustive list of indicators and topics. Rather they aim to offer less advanced companies a minimum set of carefully selected disclosure metrics that will help them to prepare for the upcoming requirements stemming from the CSRD and the ESRS and better respond to investors’ ESG data needs. Companies in scope of the CSRD should use the ESRS to prepare their disclosures on material sustainability topics.

Metrics in use for ESG Reporting – General information

General information metrics provide essential context to understand the company business activities and value creation model, it’s material ESG impacts, risks and opportunities, and how it is managing them.

|

General information |

What should be disclosed: |

||

|

I |

M 1 |

Companies may consider including the following characteristics when describing their business model: economic activities; products and services offered; markets of operation, company size (in terms of workforce, business locations, revenue, etc.) |

|

|

I |

M 2 |

Sustainability integration |

|

|

I |

M 3 |

Sustainability governance |

|

|

I |

M 4 |

Material impacts, Risk and Opportunities |

|

|

I |

M 5 |

Stakeholder engagement |

|

Metrics in use for ESG Reporting- Environmental disclosures

Environmental metrics cover issues that arise from or impact the natural environment.

– Climate Change

Climate change has emerged as the biggest environmental challenge of our times, posing significant risks and opportunities for businesses and investors alike. As the momentum around necessary climate action continues to build with new regulatory measures entering into force, the demand for climate-related information and metrics is expected to follow suit.

Relevance to investors / issuers

Investors want to understand whether companies:

- might be negatively impacted by tightening carbon regulations (i.e. carbon pricing) for example through regulatory fines or the stranded assets risks

- consider physical risks of climate change as part of business continuity/resilience planning

- are transition-ready and have aligned their strategies and investment plans with the requirements of the Paris Agreement and the low-carbon economy

- pursue climate-related opportunities such as investments in innovative technologies or new products or services

|

Climate change |

What should be disclosed: |

||

|

E |

M 1 |

Climate change management |

Companies are advised to use recommendations of the TCFD, ESRS E1 – Climate change and/or IFRS S2 Climate-related Disclosures to inform their disclosures with regard to climate governance, strategy, risk management, and targets and metrics. |

|

E |

M 2 |

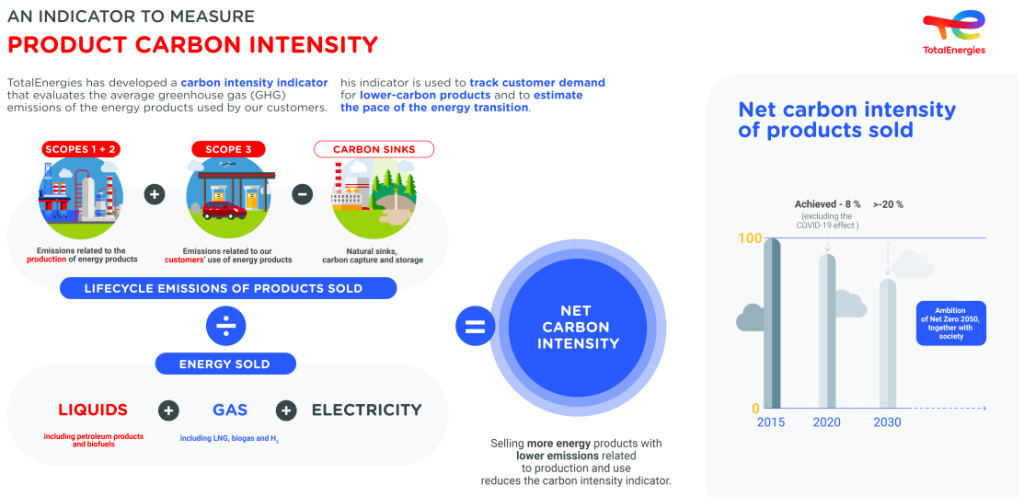

GHG Emissions Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

|

Definition GHG emissions are understood as total direct and indirect emissions. They should be further categorised into Scope 1 emissions, Scope 2 emissions and Scope 3 emissions. Disclosures:

It is recommended to use internationally recognised standards for the corporate accounting and reporting of GHG emissions such as the GHG Protocol or the ISO 14064-1:2018 standard. |

|

E |

M 2 |

GHG emissions intensity |

Definition Emission intensity is the ratio of GHG emissions per unit of economic activity. Disclosures:

|

|

E |

M 3 |

Energy consumption and mix |

Definition: Energy consumption is the total amount of energy consumed within an organisation. It comprises purchased and self-generated energy sources. Disclosures:

|

– Other Environmental Issues

Other environmental disclosures may relate to topics such as, use of natural resources, impacts on the biodiversity as well as waste and pollution. As exposure to environmental issues may differ between companies some disclosure recommendations outlined below may not be applicable to all issuers.

|

Other environmental issues |

What should be disclosed: |

||

|

E |

M 6 |

Environmental Policy |

Definition: Environmental policy is a formal document outlining the company commitments and approach in relation to managing environmental aspects of its operations. Disclosures:

It is recommended that the policy covers the following areas:

|

|

General information |

|

E |

A 1 |

Water Consumption |

Definition: Water consumption is the total volume (in m3) of water consumed by the organisation. Disclosures:

|

|

E |

A 2 |

Water Management |

Definition: Water management is a process by which a company optimises its water consumption to reduce its impact on natural environment. It includes activities to reduce water use within operations, increase water circularity (through water reuse and recycling) and preserve water resources (through water stewardship efforts). Disclosures:

|

|

E |

A 3 |

Biodiversity Impacts |

Definition: Biodiversity has been defined by the UN Convention on Biological Diversity as “the term given to the variety of life on Earth and the natural patterns it forms.” It includes species diversity as well as genetic and ecosystem diversity. Biodiversity loss is considered a serious environmental challenge. It arises due to destruction and fragmentation of habitats mainly by human activities, such as overexploitation of resources, land use changes (e.g. deforestation, urbanisation, intensive mono-culture), pollution and climate change. Disclosures:

|

|

E |

A 4 |

Waste Management |

Definition: Waste management is a set of activities to monitor, manage and reduce (including reuse and recycle) waste produced by an organisation. Disclosures:

|

Metrics in use for ESG Reporting – Social disclosures

Social metrics relate to the rights, well-being and interests of people and communities.

– Working Conditions

Relevance to investors / issuers

Investors are interested in companies that:

- recognise the value of its workforce and provide reasonable terms of employment;

- align with labour and certification standards;

- have a stable structure and operations;

- do not interfere or discourage workers from forming or joining workers’ organisations.

|

Working conditions |

What should be disclosed: |

||

|

Minimum disclosures (applicable to all sectors) |

|||

|

S |

M 1 |

Diversity Policy |

Definition: Diversity policy is a formal document outlining the company commitment to prevent discrimination at the workplace and ensure equal opportunities. Disclosures:

It is recommended that the policy covers the following areas:

|

|

S |

M 2 |

Employment Policy |

Definition: Employment policy is a formal document outlining the company commitment to ensure stable employment for its employees. Disclosures:

It is recommended that the policy covers the following areas:

|

|

S |

M 3 |

Work-life balance Policy |

Definition: Work-life balance policy is a formal document outlining the company commitment to ensure employment allowing better balance between work and private life of its employees. Disclosures:

It is recommended that the policy covers the following areas:

|

|

S |

M 4 |

Reintegration Policy |

Definition: Reintegration policy is a formal document outlining the company commitment to ensure undisturbed return of an employee to work after parental leave. Disclosures:

It is recommended that the policy covers the following areas:

|

|

S |

M 5 |

Gender Pay Gap Ratio Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting |

Definition: Gender pay gap ratio is a difference between the average (gross) remuneration (including bonuses and other economic incentives) of men and women within an organisation. Disclosures:

To calculate gender pay gap ratio:

The result of the formula tells how much more (or less) men earn than women on average in your organisation, and thus by how much women’s average salary would need to be raised (lowered) to equal that of men. |

|

S |

M 6 |

Employee Turnover Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting |

Definition The employee turnover measures the proportion of employees (Employee is an individual who is in an employment relationship with the undertaking according to national law or practice) that have left an organisation during the fiscal year. High employee turnover may signal dissatisfaction with the work environment, compensation or workplace health or safety. The employee turnover rate could be:

Disclosures:

The turnover rate is calculated by dividing the number of employees that left the company during the fiscal year (voluntary or unvoluntary) by the average number of employees within that year. |

|

S |

M 7 |

Freedom of Association and Collective Bargaining |

Definition Collective bargaining and freedom of association is the right for workers to join workers’ organisations of their own choosing and to negotiate their terms of employment. Disclosures:

|

|

Sector-specific disclosures |

|

S |

A 1 |

Employee Health and Safety |

Definition Employee health and safety is a set of activities and procedures to prevent accidents and injuries in the workplace. Company performance on this issue is often measured by the following indicators:

Disclosures:

|

– Human Rights

Businesses have a responsibility to respect international human rights standards. Beyond ethical concerns, companies that do not evaluate and manage their human rights impacts may face reputational and regulatory risks and/or lose its social licence to operate.

Relevance to investors / issuers

Investors are interested in companies that:

- understand its responsibility to respect human rights;

- embed human rights considerations into its operations and risk management process;

- actively manage human rights impacts both within own operations and supply chain.

|

Human rights |

What should be disclosed: |

||

|

Minimum disclosures (applicable to all sectors) |

|||

|

S |

M 8 |

Human Rights Policy |

Definition: Human rights policy is a formal document outlining the company’s position on human rights. It can have a stand-alone format or be integrated into a wider set of company standards such as a code of ethics or an employee/supplier code of conduct. Disclosures:

It is recommended that the policy:

|

|

S |

M 9 |

Human Rights Due Diligence |

Definition: Human rights due diligence is a set of activities to identify, mitigate and act on actual and potential risks of human rights violations. Disclosures:

It is recommended that the company discloses whether its human rights due diligence includes:

|

Metrics in use for ESG Reporting – Governance disclosures

Governance metrics cover issues relating to corporate governance and business ethics standards.

– Corporate Governance

Corporate governance is a system of controls and procedures by which an organisation is operated. A company with strong corporate governance structures is defined by professional management, a well-structured board, and organised systems and processes.

These in turn reduce and mitigate risks, and ensure decisions are aligned with the company’s and the shareholders’ interests. Weak governance performance can impact the risk exposures and the bottom line significantly, and thereby also the credit ratings, and the access to capital over time.

Relevance to investors / issuers

Investors favour companies that demonstrate good corporate governance, including:

- well-structured framework of policies and procedures

- protection and equitable treatment of all shareholders, including minority shareholders

- good understanding and management of stakeholders’ interests vis-à-vis the company

- defined transparency and disclosure practices

- clear responsibilities of the board addressing the role of the board, compliance matters, treatment of shareholders, the code of conduct, and the company’s objectives

- board structure that considers balance of skills and gender, and

- transparent corporate governance and accounting practices

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Appendix – Relevance of the Guidelines to investors

Background and investor objectives

The ESG Reporting Guidelines were published to support companies listed on the Warsaw Stock Exchange in reporting high quality ESG information and data to investors and other stakeholders. They provide clarity on various ESG topics, specific metrics to be reported, as well as a step-by-step guide for the ESG reporting process.

While the companies can benefit by better identifying, understanding and managing their ESG impacts, risks and opportunities investors can also derive value by better understanding the companies and their value potential.

Investors seek to have as complete and good understanding of companies, their performance, risk exposures, and future outlook. In addition to using financial analysis, ESG reporting can complement and improve the understanding of a company and its long-term potential value, either where there is a direct bearing on value at risk, or where it may be a broader reflection of general operational or managerial excellence.

Focus on limited number of carefully selected disclosure metrics

The number of ESG topics can be overwhelming. To provide guidance, structure and priority to the ESG reporting, a limited number of recommended ESG disclosure metrics have been defined in the Guidelines (See above in main taxt). These metrics have been informed by the relevant UE regulations (CSRD and ESRS, EU Taxonomy and SFDR), WSE corporate governance code (DPNS2021), as well as international sustainability reporting standards and frameworks.

Furthermore to facilitate the reporting process for companies and the ESG analysis for investors, the recommended ESG disclosure metrics have been categorised by topic and divided into minimum disclosure requirements (relevant to all companies regardless of their sector of operation) and additional sector-specific disclosure

requirements.

Alignment with the SFDR PAI indicators for corporate investment.

The recommended ESG disclosure metrics have been aligned with the mandatory SFDR PAI indicators for corporate investment (see table below). They also should help to conduct the assessment of good governance practices relevant for investments that promote environmental or social characteristics, or that have sustainable investment as their objective. This will allow companies to better respond to growing investors’ ESG data needs, while at the same time facilitating access to such information and data for investors.

|

SFDR Indicators |

WSE Guidelines |

|

|

Environmental indicators |

||

|

1 GHG emissions |

Scope 1 GHG emissions Scope 2 GHG emissions Scope 3 GHG emissions Total GHG emissions |

E-M2 GHG Emissions |

|

2 Carbon footprint |

Carbon footprint |

E-M2 GHG Emissions |

|

3 GHG intensity of investee companies |

GHG intensity of investee companies |

E-M3 Emissions Intensity |

|

4 Exposure to companies active in the fossil fuel sector |

Share of investments in companies active in the fossil fuel sector |

I-M1 – Business Model |

|

5 Share of non-renewable energy consumption and production |

Share of non-renewable energy consumption and non-renewable energy production of investee companies from non-renewable energy sources compared to renewable energy sources, expressed as a percentage |

E-M4 Energy Consumption and Mix |

|

6 Energy consumption intensity per high impact climate sector |

Energy consumption in GWh per million EUR of revenue of investee companies, per high impact climate sector |

I-M1 Business Model + E-M4 Energy Consumption and Mix |

|

7 Activities negatively affecting biodiversity-sensitive areas |

Share of investments in investee companies with sites/operations located in or near to biodiversity-sensitive areas where activities of those investee companies negatively affect those areas |

E-A3 Biodiversity impacts |

|

8 Emissions to water |

Tonnes of emissions to water generated by investee companies per million EUR invested, expressed as a weighted average |

– |

|

9 Hazardous waste and radioactive waste ratio |

Tonnes of hazardous waste and radioactive waste generated by investee companies per million EUR invested, expressed as a weighted average |

E-A4 Waste Management |

|

Social indicators |

||

|

10 Violations of UN Global Compact principles and OECD Guidelines for Multinational Enterprises |

Share of investments in investee companies that have been involved in violations of the UNGC principles or OECD Guidelines for Multinational Enterprises |

Not applicable. Typically verified through third-party data. |

|

11 Lack of processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises |

Share of investments in investee companies without policies to monitor compliance with the UNGC principles or OECD Guidelines for Multinational Enterprises or grievance /complaints handling mechanisms to address violations of the UNGC principles or OECD Guidelines for Multinational Enterprises Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting |

G-M5 Whistle-blower Mechanism + G-M3 Business Ethics Standards G-M4 Anti-corruption Policy S-M8 Human Rights Policy S-M9 Human Rights Due Diligence E-M6 Environmental Policy |

|

12 Unadjusted gender pay gap |

Average unadjusted gender pay gap of investee companies |

S-M5 Gender Pay Gap |

|

13 Board gender diversity |

Average ratio of female to male board members in investee companies, expressed as a percentage of all board member |

G-M2 Board Diversity |

|

14 Exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons) |

Share of investments in investee companies involved in the manufacture or selling of controversial weapons |

I-M1 Business Model |

Interpretation of disclosures

First, investors should develop an understanding of which risks they consider material for a potential investment. If a prospective company leaves out reporting on supposedly core ESG matters, that should raise questions and potentially concerns. If the company on the other hand explains the reason for leaving it out, such concerns may then dissipate.

Second, analysing corporate ESG reporting and performance should be done from a comparative angle – with other companies in the same or similar sectors, and within as well as outside the specific country or market.

Third, the Guidelines are a support for the investment process and decision, but not a replacement for analysis and independent thought. In a similar vein, the primary data provided by the companies in their respective ESG reporting is an important source of information. However, while it complements the investor’s data to be analysed, it neither replaces nor is replaced by external ESG company specific data, ratios and information.

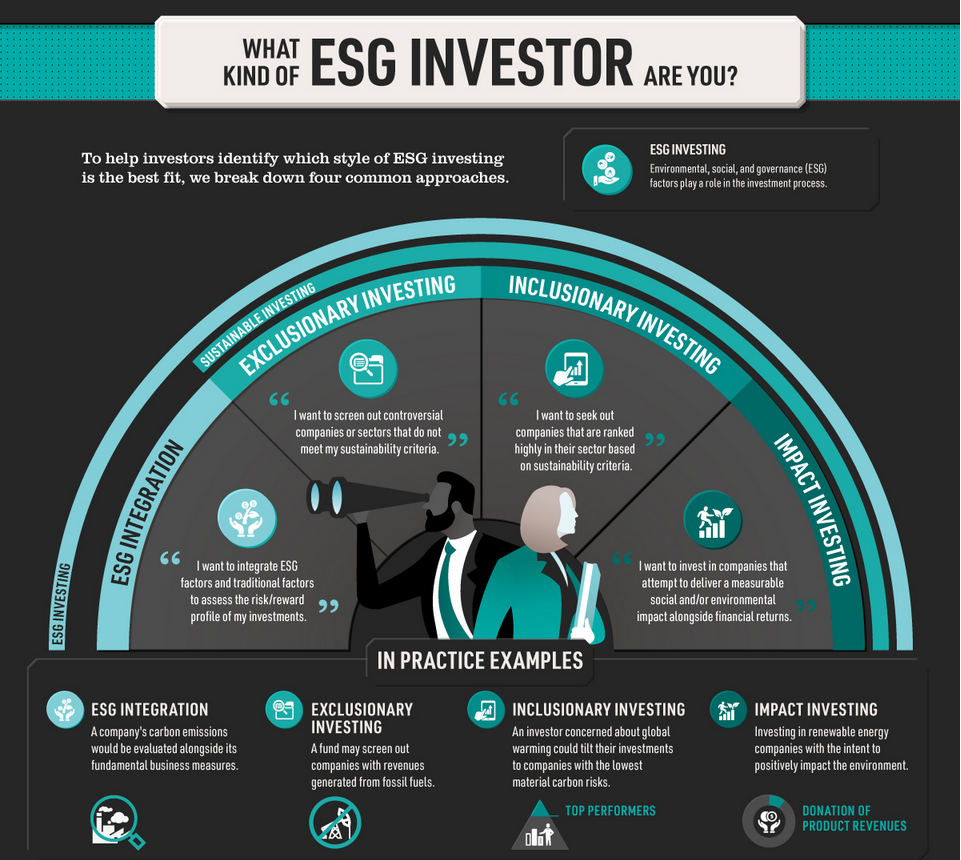

Benefits for investors

Asset owners and managers can have many different reasons for integrating sustainability and ESG data in their investment and portfolio management processes. For investors it is important to understand which reasons are the most relevant for them, and to integrate this data accordingly in their operations.

I. Complying with fiduciary or regulatory requirements.

Regulations are on the increase: the CSRD introduces more detailed and ambitious reporting requirements for affected companies and extends the scope of the NFRD. Meanwhile the EU Taxonomy outlines disclosure obligations for financial market participants under the scope of the SFDR and companies under the scope of the NFRD/CSRD, gaining full legal application by 2023. Hence, investors will need to consider and disclose some ESG data stipulated in these regulations.

II. Meeting client, market and other stakeholder demands.

Many investors view ESG risk management as essential to handle broader reputational risks – to new and existing clients, to local communities surrounding portfolio companies, and to clients of the portfolio companies’ products and services. Being aware of the risk exposures, comfortable with how they are handled by a company, and prepared in case a risk materialises is part of sound investment management.

In addition, communicating such awareness may provide an advantage over other investors in attracting and retaining institutional and individual clients with increasingly higher demands on sustainability integration, such as specific climate targets, alignment with the Paris Agreement, and goals tied to the Sustainable Development Goals and 2030 Agenda.

III. Complementing the financial analysis with ESG analysis.

ESG reporting can complement traditional financial analysis by providing a more comprehensive coverage of risk exposures. Climate resilience, regulatory risks and demands, reputational risks, supply chain operations and practices and other ESG topics do not form part of financial analysis, but they do have a potential to impact a company’s operations, profitability and value.

In addition, the ESG reporting from companies reveals how they perceive their risk exposure – which are the material risks, how are they managed, and how are they performing. Just like other strategic and tactical analyses and decisions, the ESG reporting can complement an investor’s view of how well the company is managed.

IV. Improving investment decisions.

While some ESG factors are difficult to quantify others are not. And regardless of whether they are quantified or not, those ESG factors that are deemed material in terms of their impact on a company need to be considered in investment decisions.

For those factors that are either quantifiable, or whose impacts on a company may have financial repercussions could also impact valuations. This could happen via various channels like adjusted forecast financials (revenues, operating costs, capital expenditure), adjusted valuation models (discount rates, terminal values), and credit risk adjustments.

Furthermore, taking these factors together across a portfolio may also lead to shifting of strategic and tactical asset allocations – either by taking the risks and related valuation impacts into account, or more proactively by including thematic or ESG objective tilts.

V. Facilitating consistency and comparability across markets.

The increased amount of ESG reporting resulting from these Guidelines will improve data availability to investors. Furthermore, the alignment of the ESG indicators to be used and the setting of core/minimum reporting requirements will make reporting and performance comparisons between companies easier. This applies both to comparing companies in the market and those in other markets since the ESG indicators are aligned with broadly established and recognised international standards.

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Appendix – Alignment with EU regulations and other frameworks

|

Disclosure metric |

Type |

Alignment with the EU regulations |

Alignment with other frameworks |

||

|

ESRS |

SFDR (PAI) |

GRI |

DPNS |

||

|

General information |

|||||

|

I-M1 Business model |

Description |

Ѵ |

Ѵ |

Ѵ |

– |

|

I-M2 Sustainability integration |

Description |

Ѵ |

– |

Ѵ |

Ѵ |

|

I-M3 Sustainability governance |

Description |

Ѵ |

– |

Ѵ |

– |

|

I-M4 Material impacts, risks and opportunities |

Description |

Ѵ |

– |

Ѵ |

– |

|

I-M5 Stakeholder engagement |

Description |

Ѵ |

– |

Ѵ |

– |

|

Environmental disclosures |

|||||

|

Climate change |

|||||

|

E-M1 Climate change management |

Description |

Ѵ |

– |

Ѵ |

Ѵ |

|

E-M2 GHG emissions |

Tons CO2 eq |

Ѵ |

Ѵ |

Ѵ |

|

|

E-M3 GHG emissions intensity |

Tons CO2 eq/rev |

Ѵ |

Ѵ |

Ѵ |

|

|

E-M4 Energy consumption and mix |

MWh |

Ѵ |

Ѵ |

Ѵ |

|

|

Other environmental issues |

|||||

|

E-M5 Environmental policy |

Policy |

Ѵ |

– |

Ѵ |

|

|

E-A1 Water consumption |

m3 |

Ѵ |

– |

Ѵ |

|

|

E-A2 Water management |

Description |

Ѵ |

– |

Ѵ |

|

|

E-A3 Biodiversity impacts |

Description |

Ѵ |

Ѵ |

Ѵ |

|

|

E-A4 Waste management |

Description, # |

Ѵ |

Ѵ |

||

|

Social disclosures |

|||||

|

Working conditions |

|||||

|

S-M1 Diversity policy |

Policy |

Ѵ |

– |

Ѵ |

|

|

S-M2 Employment policy |

Policy |

– |

|||

|

S-M3 Work-life balance policy |

Policy |

– |

|||

|

S-M4 Reintegration policy |

Policy |

– |

|||

|

S-M5 Gender pay gap ratio |

# |

Ѵ |

Ѵ |

Ѵ |

Ѵ |

|

S-M6 Employee turnover |

% |

Ѵ |

– |

Ѵ |

|

|

S-M7 Freedom of association and collective bargaining |

% |

Ѵ |

– |

Ѵ |

|

|

S-A1 Employee health and safety |

Description, # |

Ѵ |

– |

Ѵ |

|

|

Human rights |

|||||

|

S-M8 Human rights policy |

Policy |

Ѵ |

Ѵ |

Ѵ |

|

|

S-M9 Human rights due diligence |

Description |

Ѵ |

Ѵ |

Ѵ |

|

|

Governance disclosures |

|||||

|

Corporate Governance |

|||||

|

G-M1 Board composition |

Description |

Ѵ |

Ѵ |

||

|

G-M2 Board independence |

% |

Ѵ |

Ѵ |

||

|

G-M3 Board diversity |

% |

Ѵ |

Ѵ |

Ѵ |

Ѵ |

|

Business ethics |

|||||

|

G-M4 Code of ethics |

Policy |

Ѵ |

Ѵ |

Ѵ |

|

|

G-M5 Anti-Corruption Policy |

Policy |

Ѵ |

Ѵ |

Ѵ |

|

|

G-M6 Whistle-Blower Procedure |

Description |

Ѵ |

Ѵ |

Ѵ |

|

|

Data security and privacy |

|||||

|

G-A1 Data Security Policy |

Policy |

– |

Ѵ |

||

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting

Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting Metrics in use for ESG Reporting