M and A or Mergers and Acquisitions

in IFRS language Business Combinations.

1 Identifying a business combination

IFRS 3 refers to a ‘business combination’ rather than more commonly used phrases such as takeover, acquisition or merger because the objective is to encompass all the transactions in which an acquirer obtains control over an acquiree no matter how the transaction is structured. A business combination is defined as a transaction or other event in which an acquirer (an investor entity) obtains control of one or more businesses.

An entity’s purchase of a controlling interest in another unrelated operating entity will usually be a business combination (see Simple case – Straightforward business combination below). However, a business combination (M and A) may be structured, and an entity may obtain control of that structure, in a variety of ways.

|

Examples of business combinations structurings |

Examples of ways an entity may obtain control |

|

A business becomes the subsidiary of an acquirer |

The entity transfers cash, cash equivalents or other assets(including net assets that constitute a business) |

|

Net assets of one or more businesses are legally merged with an acquirer |

The entity incurs liabilities |

|

One combining entity transfers its net assets, or its owners transfer their equity interests, to another combining entity or its owners |

The entity issues shares |

|

The entity transfers more than one type of consideration, or |

|

|

Two or more entities transfer their net assets, or the owners of those entities transfer their equity interests to a newly created entity, which in exchange issues shares, or |

The entity does not transfer consideration and obtains control for example by contract alone Some examples of this:

|

|

A group of former owners of one of the combining entities obtains control of the combined entity, i.e. former owners, as a group, retain control of the entity they previously owned. |

Therefore, identifying a business combination transaction requires the determination of whether:

- what is acquired constitutes a ‘business’ as defined in IFRS3, and

- control has been obtained.

A Basic Guide to Cash Flow Forecasting

Nobody wants their business to fail. Although it’s impossible to predict the future with 100% accuracy, a cash flow forecast is a tool that will help you prepare for different possible scenarios in the future.

In a nutshell, cash flow forecasting involves estimating how much cash will be coming in and out of your business within a certain period and gives you a clearer picture of your business’ financial health

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating how much cash you’ll have and ensuring you have a sufficient amount to meet your obligations. By focusing on the revenue you expect to generate and the expenses you need to pay, cash flow forecasting can help you better manage your working capital and plan for various positive or difficult scenarios.

A cash flow forecast is composed of three key elements: beginning cash balance, cash inflows (e.g., cash sales, receivables collections), and cash outflows (e.g., expenses for utilities, rent, loan payments, payroll).

Building Out Cash Flow Scenario Models

It’s always good to create best case, worst-case and moderate financial scenarios. Through cash flow forecasting, you’ll

be able to see the impact of these three scenarios and implement the suitable course of action. You can use the models to predict what needs to happen especially during difficult and uncertain times.

be able to see the impact of these three scenarios and implement the suitable course of action. You can use the models to predict what needs to happen especially during difficult and uncertain times.

In situations where variables shift quickly such as during a recession, it is highly recommended to review and update your cash flow forecasts regularly on a monthly or even weekly basis. By monitoring your cash flow forecast closely, you’ll be able to identify warning signs such as declining revenue or increasing expenses.

What is initial public offering

An Initial Public Offering (IPO) comprises of a privately owned business that wants access the public capital market through the sale of securities (shares in the before IPO privately owned business). Thereby, the business can raise monies more readily than by the retention of profits in order to also grow through acquiring other businesses. Other possible motivations for an IPO include the prestige of ownership of a public company or the desire of major shareholders to exit the company.

Back-door listings

Another way that entities may list is through a reverse restructure with an existing non-operating listed entity that has few assets or liabilities (i.e. a shell company) or a Special Purpose Acquisition Company (SPAC).

Special Purpose Acquisition Companies (SPACs) are publicly traded companies formed for the sole purpose of raising capital through an IPO and using the IPO proceeds to acquire one or more unspecified businesses in the future.

The management team that forms the SPAC (the “sponsor”) forms the entity and funds the offering expenses in exchange for founder shares. There are various tax considerations and complexities that can have significant implications both during the SPAC formation process and down the road.

Under these circumstances where a private entity is ‘acquired’ by the listed entity, this is commonly referred to as a

back-door listing. Since the listed non-operating entity is not a business, the transaction is not a business combination. Normally such transactions are accounted for similar to reverse acquisitions.

back-door listing. Since the listed non-operating entity is not a business, the transaction is not a business combination. Normally such transactions are accounted for similar to reverse acquisitions.

However, because the accounting acquiree is not a business the transaction is considered a share-based payment. That is, the private entity is deemed to have issued shares to obtain control of the listed entity and to the extent their fair value exceeds the fair value of the listed entity’s identifiable net assets an expense will arise.

Disclosure of key judgements

Determining the appropriate accounting treatment of a reverse restructure with an existing non-operating listed entity that has few assets or liabilities (i.e. a shell company) or a SPAC often involves judgements. Therefore entities need to ensure that they comply with the disclosure requirements of IAS 1 Presentation of Financial Statements (‘IAS 1’), specifically paragraph 122.

Sale and leaseback accounting

A sale and lease back transaction is a popular way for entities to secure long-term financing from substantial property, plant and equipment assets such as land and buildings. IFRS 16 made significant changes to sale and lease back accounting in comparison with IAS 17. A sale and leaseback transaction is one where an entity (the -lessee) transfers an asset to another entity (the -lessor) for consideration and leases that asset back from the -lessor.… Read more

Lessee accounting under IFRS 16

The key objective of IFRS 16 is to ensure that lessees recognise assets and liabilities for their major leases.

1. Lessee accounting model

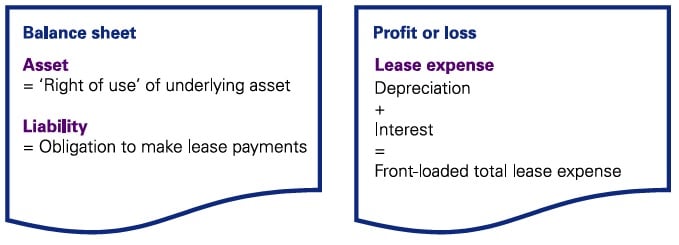

A lessee applies a single lease accounting model under which it recognises all leases on-balance sheet, unless it elects to apply the recognition exemptions (see recognition exemptions for lessees in the link). A lessee recognises a right-of-use asset representing its right to use the underlying asset and a lease liability representing its obligation to make payments. [IFRS 16.22]

IFRS 16 Lessor accounting

Lessors continue to classify leases as finance or operating leases.

1. Lessor accounting model

The lessor follows a dual accounting approach for lease accounting. The accounting is based on whether significant risks and rewards incidental to ownership of an underlying asset are transferred to the lessee, in which case the lease is classified as a finance lease. This is similar to the previous lease accounting requirements that applied to lessors. The lessor accounting models are also essentially unchanged from IAS 17 Leases. [IFRS 16.B53, IFRS 16.BC289]

|

Are the lessee and lessor accounting models consistent? |

|

No. A key consequence of the decision to retain the IAS 17 dual accounting model for lessors is a lack of consistency with the new lessee accounting model. This can be seen in the case Lease classification below:

There are also more detailed differences. For example, lessees and lessors use the same guidance for determining the lease term and assessing whether renewal and purchase options are reasonably certain to be exercised, and termination options not reasonably certain to be exercised. However, unlike lessees, lessors do not reassess their initial assessments of lease term and whether renewal and purchase options are reasonably certain to be exercised, and termination options not reasonably certain to be exercised (see changes in the lease term in the link). Other differences are more subtle. For example, although the definition of lease payments is similar for lessors and lessees (see lease payments in the link), the difference is the amount of residual value guarantee included in the lease payments.

|

Sub-leases under IFRS 16

The classification guidance in IFRS 16 means that many sub-leases are finance leases, impacting the financial position and financial performance of intermediate lessors.

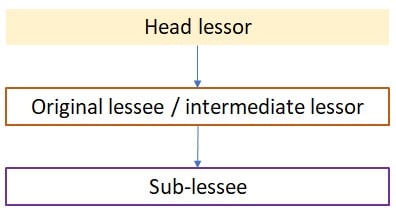

A sub-lease is a transaction in which a lessee (or ‘intermediate lessor’) grants a right to use the underlying asset to a third party, and the lease (or ‘head lease’) between the original lessor and lessee remains in effect.

A company applies IFRS 16 to all leases of right-of-use assets in a sub-lease. The intermediate lessor accounts for the head lease and the sub-lease as two different contracts, applying both the lessee and lessor accounting requirements. [IFRS 16.3]

An intermediate lessor classifies the sub-lease as a finance lease or as an operating lease with reference to the right-of-use asset arising from the head lease. That is, the intermediate lessor treats the right-of-use asset as the underlying asset in the sub-lease, not the item of property, plant or equipment that it leases from the head lessor. [IFRS 16.B58]

IFRS 15 Customers unexercised rights and breakage

INTRO An entity may receive a non-refundable prepayment from a customer that gives the customer the right to receive goods or services in the future. Common examples include gift cards, vouchers and non-refundable tickets. Typically, some customers do not exercise their right – this is referred to as ‘breakage’.

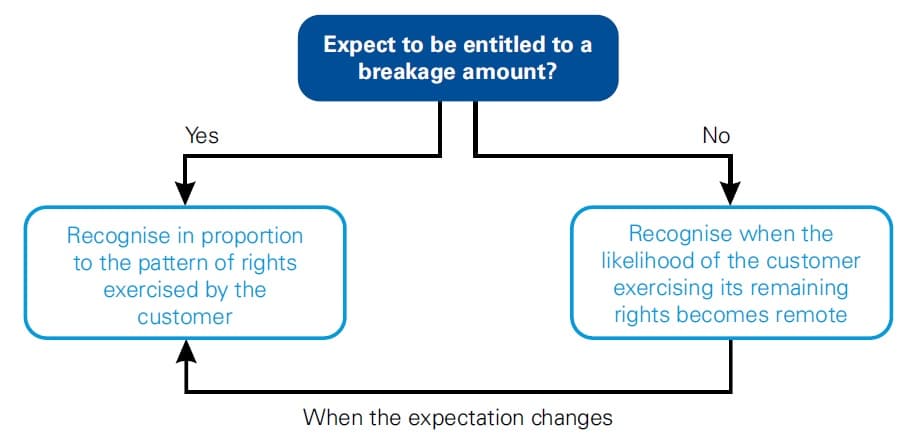

An entity recognises a prepayment received from a customer as a contract liability and recognises revenue when the promised goods or services are transferred in the future. However, a portion of the contract liability recognised may relate to contractual rights that the entity does not expect to be exercised – i.e. a breakage amount. [IFRS 15.B44–B45]

The timing of revenue recognition related to breakage depends on whether the entity expects to be entitled to a breakage amount – i.e. if it is highly probable that recognising breakage will not result in a significant reversal of the cumulative revenue recognised. [IFRS 15.B46]

5 steps in IFRS 15

Under IFRS 15 Revenue from contracts with customers, entities apply the 5 steps in IFRS 15 to determine when to recognize revenue, and at what amount. The model specifies that revenue is recognized when or as an entity transfers control of goods or services to a customer at the amount to which the entity expects to be entitled. Depending on whether certain criteria are met, revenue is recognized:

- over time, in a manner that best reflects the entity’s performance; or

- at a point in time, when control of the goods or services is transferred to the customer.

IFRS 15 provides application guidance on numerous related topics, including warranties and licenses. It also provides guidance on when to capitalize the costs of obtaining a contract and some costs of fulfilling a contract (specifically those that are not addressed in other relevant authoritative guidance – e.g. for inventory).

5 steps in IFRS 15 – What is IFRS 15?

Step 1: Identify the contract with a customer

A contract with a customer is in the scope of IFRS 15 when the contract is legally enforceable and certain criteria are met. If the criteria are not met, then the contract does not exist for purposes of applying the general model of IFRS 15, and any consideration received from the customer is generally recognized as a deposit (liability). Contracts entered into at or near the same time with the same customer (or a related party of the customer) are combined and treated as a single contract when certain criteria are met.

A contract with a customer is in the scope of IFRS 15 when it is legally enforceable and meets all of the following criteria. [IFRS 15.9]

Step 5 Recognise the revenue

when the entity satisfies each performance obligation

– is the end of the process in revenue recognition as introduced by IFRS 15 Revenue from contracts with customers.

IFRS 15 The revenue recognition standard provides a single comprehensive standard that applies to nearly all industries and has changed revenue recognition quite significant. Step 5 Recognise the revenue

IFRS 15 introduced a five step process for recognising revenue, as follows:

- Identify the contract with the customer

- Identify the performance obligations in the contract

- Determine the transaction price for the contract

- Allocate the transaction price to each specific performance obligation

- Recognise the revenue when the entity satisfies each performance obligation

INTRO Step 5: Recognize revenue when or as … Read more