Last update 27/12/2019

This is an example set of Financial statements 2018. It is intended to help entities to prepare and present financial statements in accordance with IFRS by illustrating a possible format for financial statements for a fictitious multinational corporation (the Group) involved in general business activities. This hypothetical reporting entity has been applying IFRS for some time – i.e. it is not a first-time adopter of IFRS. Here are the main statements presented in different formats and with reference to the IFRS standards/paragraphs applicable to these main statements (Consolidated Statement of Profit or Loss and Other Comprehensive Income, Consolidated statement of financial position, Consolidated statement of cash flows, Consolidated Statement of Changes in Equity). Then it is continued to example notes to the Financial Statements, from the start (Basis of presentation) to the end (Commitments, Contingencies and Subsequent events).

Continued IFRS Reporting 1

Group Reporting Entity Legal Entity

Consolidated Financial Statements

General financial statement presentation requirements

| Link | Description IFRS Example Financial Statements 2018 |

| IAS 1:10 | Composition of a complete set of financial statements. IFRS Example Financial Statements 2018 |

| IAS 1:10A | Single or two statement approach for profit or loss and other comprehensive income. |

| IAS 1:49 | Clear identification of financial statements from other information. |

| IAS 1:51 | Clear identification of each component of the financial statements, and various details of the reporting entity. |

Entity specific disclosures

| Link | Description IFRS Example Financial Statements 2018 |

| IAS 1:51(a) | Name of entity. |

| IAS 1:138 | Various details of the reporting entity. |

Group Reporting Entity Legal Entity 2

In practice, the (Consolidated) Financial Statements are part of a larger booklet, for example, called Annual Report. The Annual Report’s high level content is for example:

- Management commentary IFRS Example Financial Statements 2018

- Consolidated Financial Statements IFRS Example Financial Statements 2018

- Other information IFRS Example Financial Statements 2018

Management commentary is a more or less free form narrative report that provides a context within which to interpret the financial position, financial performance and cash flows of the group of entities. It also provides management with the opportunity to explain objectives and the strategies for achieving those objectives. The financial information contained in management commentary has to be derived from the same source as the information contained in the financial statements, it supplements, and compliments the amounts included in the financial statements.

The Consolidated Financial Statements also may contain the (Ultimate) Parent Company Financial Statements, many times based on legal requirements of the jurisdiction of the parent company. These Parent Company Financial Statements may be any kind if condensed, again mostly based on legal requirements or common (historical) practice in the jurisdiction of the parent company.

Other information comprises multiple types of forms, for example: IFRS Example Financial Statements 2018

- shareholders meeting invitation and/or meeting agenda,

- the parent company financial statements (rather than as part of the Consolidated Financial Statements),

- statutory requirements (profit appropriation requirements, profit appropriation proposal, subsequent events).

Group Reporting Entity Legal Entity

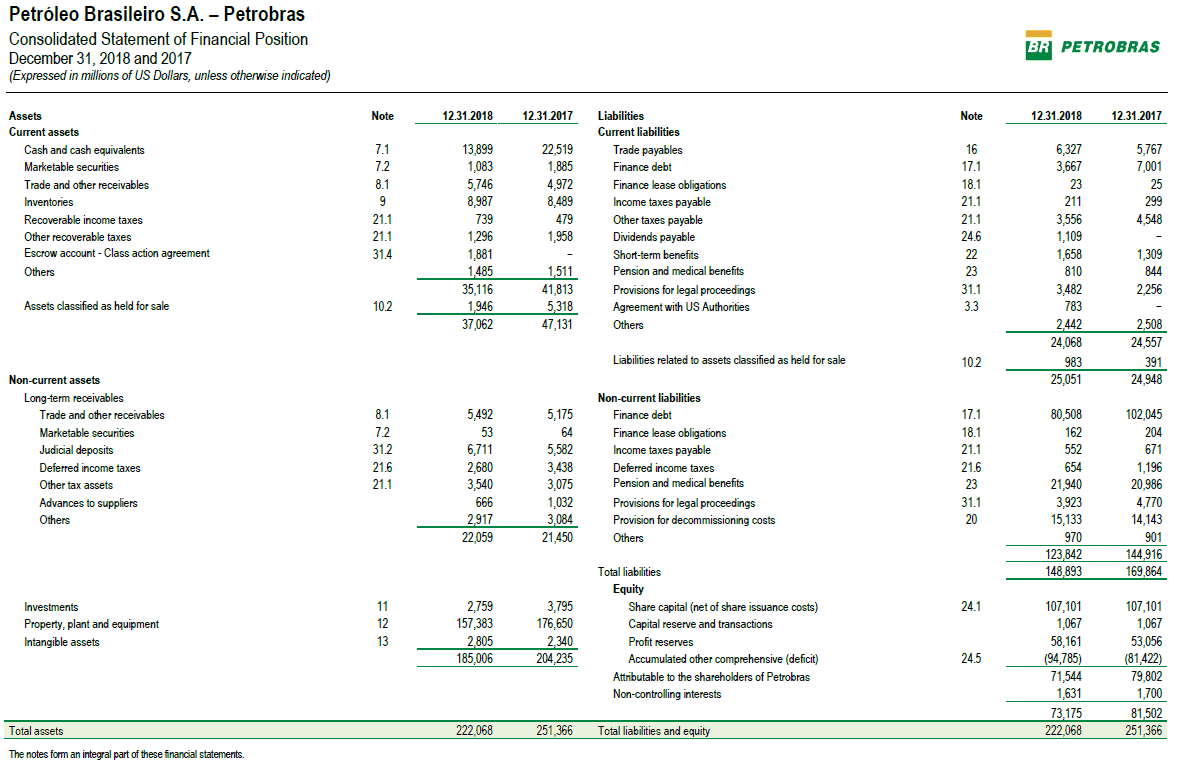

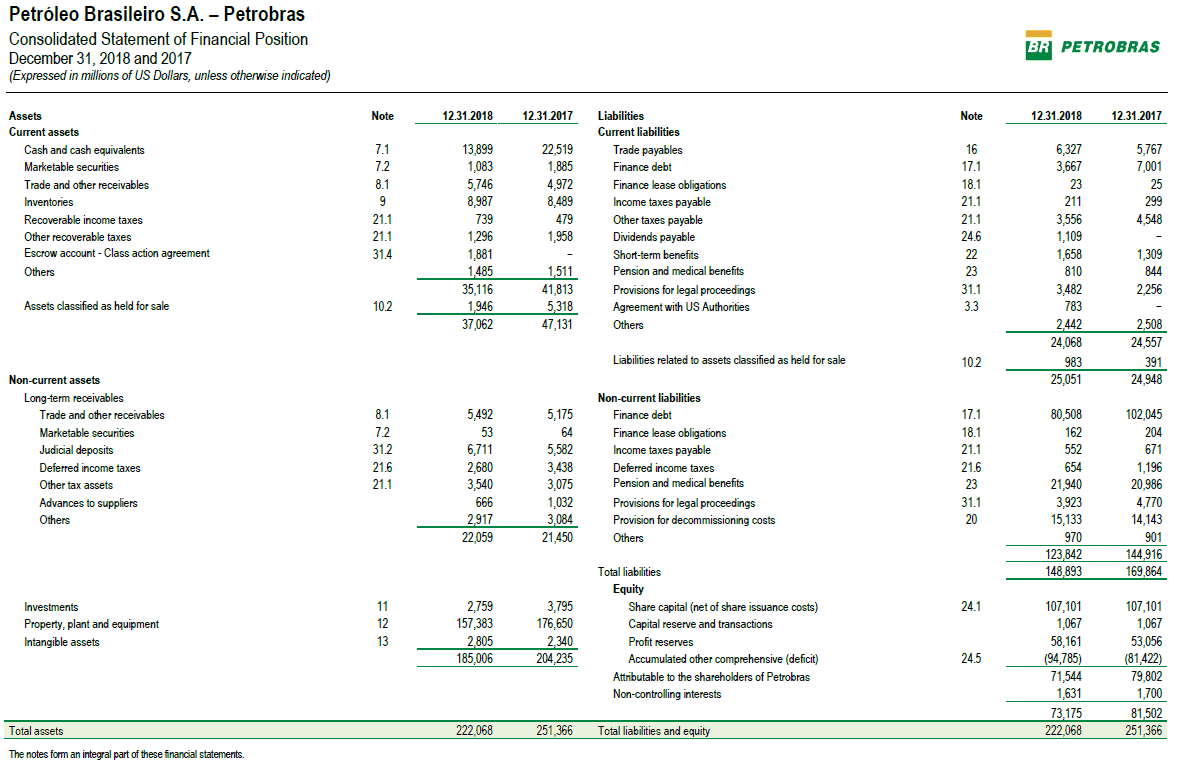

Consolidated statement of financial position3

ASSETS, LIABILITIES AND EQUITY IFRS Example Financial Statements 2018

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:55 | Present additional line items, headings and sub-totals as required. |

| IAS 1:77-78 | Present further sub-classifications as required (or in the notes). |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

| IAS 1:10(f), 40A-B | Instances when the presentation of a third balance sheet is required. |

Specific line item requirements

| Link | Description |

| IAS 1:54 | Specific line items required in the statement of financial position. |

| IAS 1:56 | Deferred tax assets must not be presented as current. |

| IAS 1:57 | A list of items that warrant separate disclosure. IAS 1 does not prescribe the order or format of presentation of line items. |

| IAS 1:60 | Presentation of line items on a: – Current and non-current basis – Liquidity basis (subject to criteria and additional requirements). |

| IAS 1:61 | Disclosure of items expected to be recovered or settled within and after 12 months of reporting date. |

| IFRS 16:48 | Presentation of right-of-use assets subject to lessor operating leases by their nature (i.e. Investment property). |

| IFRS 5.35 | Specific line items required for assets held for sale. |

| IFRS 5.38, IFRS 5.40 | Specific line items required for assets held for sale and assets in disposal groups held for sale. |

| IAS 10:17 | Details of authorisation of the financial statements |

Petrobas Financial Position 31 December 2018

Petrobas Financial Position 31 December 2018Group Reporting Entity Legal Entity

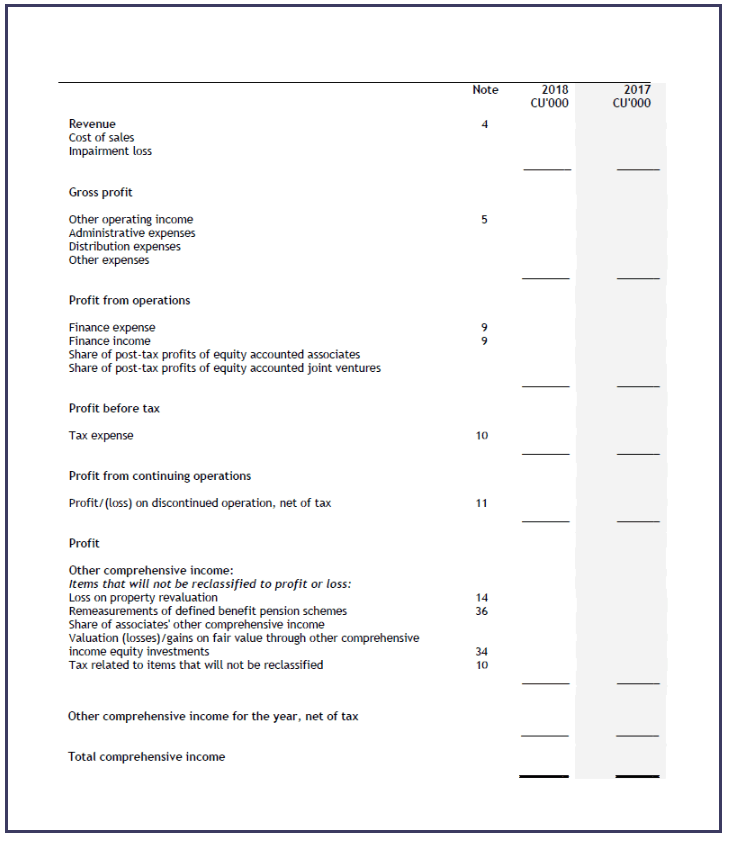

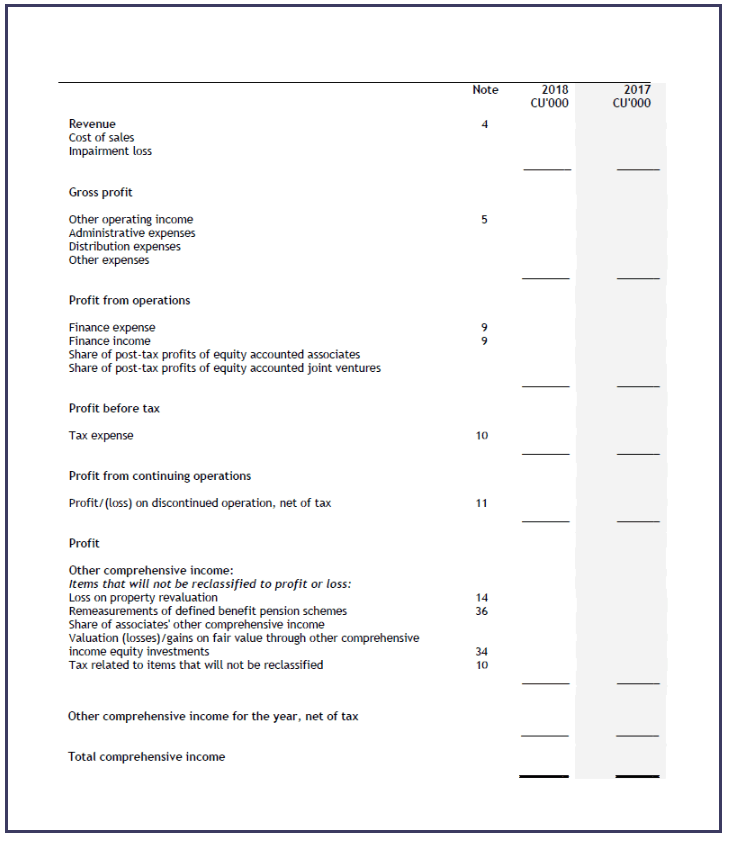

Consolidated Statement of Profit or Loss and Other Comprehensive Income

(Single statement approach and by function of expense)

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:85 | Present additional line items, headings and sub-totals as required. |

| IAS 1:99-100 | Presentation of the analysis of expenses (nature or their function). |

| IAS1:103 | Example presentation of analysis of expenses by function. |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

Specific line item requirements

| Link | Description |

| IAS 1:81A | Specific sub-totals required for profit or loss, total other comprehensive income and comprehensive income for the period. |

| IAS 1:82 | Specific line items required within profit or loss. |

| IAS 1:82A | Specific categorisation required for items within other comprehensive income. |

| IAS 1:82 | In addition to items required by other IFRSs, the profit or loss section or the statement of profit or loss shall include line items that present the following amounts for the period: (ba) impairment losses (including reversals of impairment losses or impairment gains) determined in accordance with Section 5.5 of IFRS 9 |

| IAS 1:87 | Specifically prohibits extraordinary items. |

| IAS 1:90, 91 | Specific presentation for items of other comprehensive income (either pretax or post-tax) required. |

| IAS 12:77 | Specific presentation required for tax expense. |

| IFRS 5:33, 33A,34 | Specific presentation required for discontinued operations. |

| IAS 21:52(b) | Specific presentation required for net exchange differences recognised in other comprehensive income. |

| IFRS 7:20(a)(ii) | Specific disclosures for available-for-sale investments |

| IFRS 7:23F | Specific disclosures for cash flow hedges. |

Group Reporting Entity Legal Entity

Consolidated Statement of Profit or Loss and Other Comprehensive Income4

For the year ended 31 December 2018

Group Reporting Entity Legal Entity

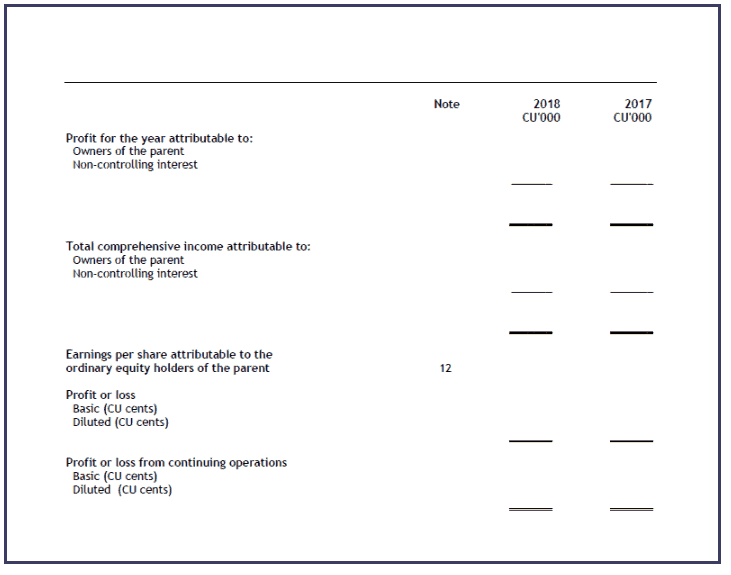

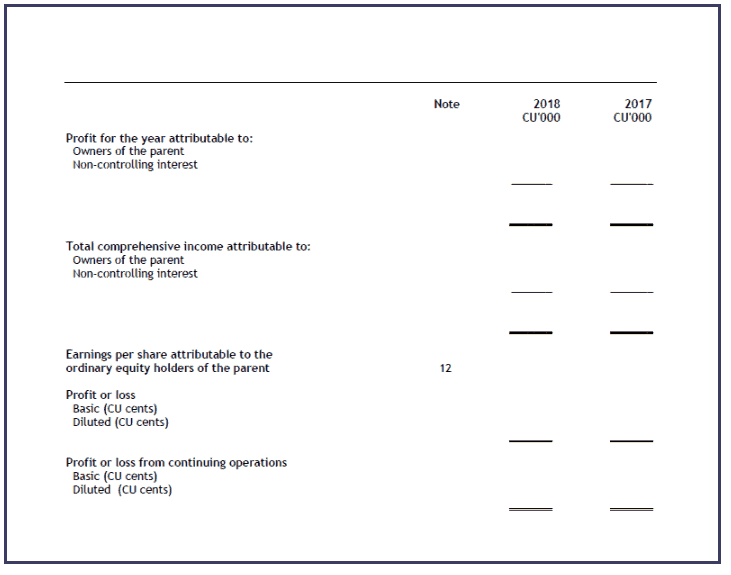

Consolidated Statement of Profit or Loss and Other Comprehensive Income

(Single statement approach and by function of expense)

(continued)

Potential additional presentation items

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:85 | Present additional line items, headings and sub-totals as required. |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

Potential additional line items

Specific line item requirements

| Link | Description |

| IAS 1:81B | Specific presentation required for the split of profit or loss and total comprehensive income between non-controlling interests and owners of the parent. |

| IAS 33.4 – IAS33.66 | Specific disclosures presentation required for basic and diluted earnings per share. |

Group Reporting Entity Legal Entity

Consolidated Statement of Profit or Loss and Other Comprehensive Income5

For the year ended 31 December 2018

Group Reporting Entity Legal Entity

Consolidated Statement of Profit or Loss

(Dual statement approach and by nature of expense)

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:85 | Present additional line items, headings and sub-totals as required. |

| IAS 1:99-100 | Presentation of the analysis of expenses (nature or their function). |

| IAS1:102 | Example presentation of analysis of expenses by nature. |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

Specific line item requirements

| Link | Description |

| IAS 1:81A | Specific sub-totals required for profit or loss, total other comprehensive income and comprehensive income for the period. |

| IAS 1:82 | Specific line items required within profit or loss. |

| IAS 1:87 | Specifically prohibits extraordinary items. |

| IAS 12:77 | Specific presentation required for tax expense. |

| IFRS 5:33, 33A,34 | Specific presentation required for discontinued operations. |

| IAS 1:81B | Separate presentation required for the split of profit or loss to noncontrolling interest and owners of the parent |

| IAS 33.4 – IAS33.66 | Specific presentation required for basic and diluted earnings per share. |

Consolidated Statement of Profit or Loss IFRS Example Financial Statements 2018

Group Reporting Entity Legal Entity

Consolidated Statement of Other Comprehensive Income

(Dual statement approach and by nature of expense) IFRS Example Financial Statements 2018

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:85 | Present additional line items, headings and sub-totals as required. |

| IAS 1:85 | Notes to be presented in a systematic manner and cross referenced. |

Specific line item requirements

| Link | Description |

| IAS 1:10A | Under the two statement approach, the statement of comprehensive income must begin with profit or loss. |

| IAS 1:82A | Specific categorisation required for items within other comprehensive income. |

| IAS 1:90, 91 | Specific presentation for items of other comprehensive income (either pretax or post-tax) required. |

| IAS 1:90, 91 | Specific presentation for the net exchange differences recognised in other comprehensive income. |

| IFRS 7:20(a)(ii) | Specific disclosures for available-for-sale investments. |

Specific disclosures

| Link | Description |

| IAS 1:81B | Separate presentation required for the split of total comprehensive income between non-controlling interests and owners of the parent |

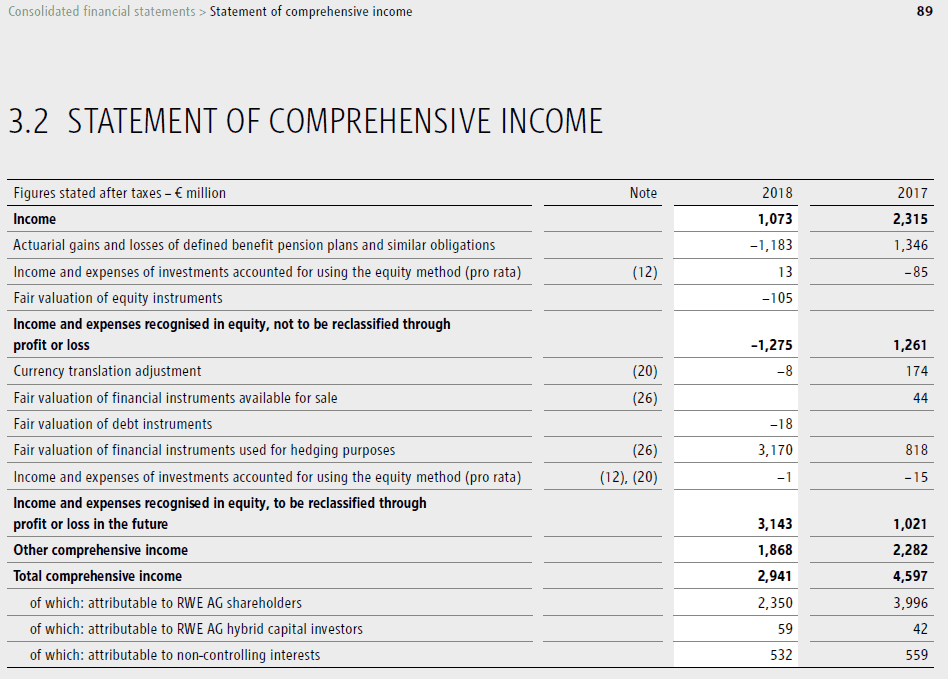

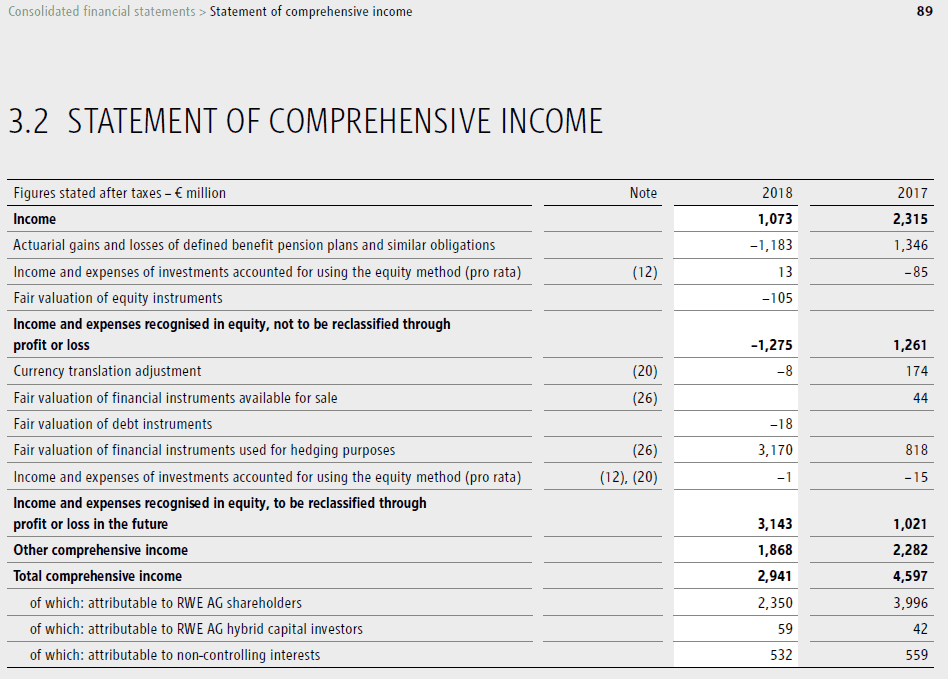

Consolidated Statement of Other Comprehensive Income

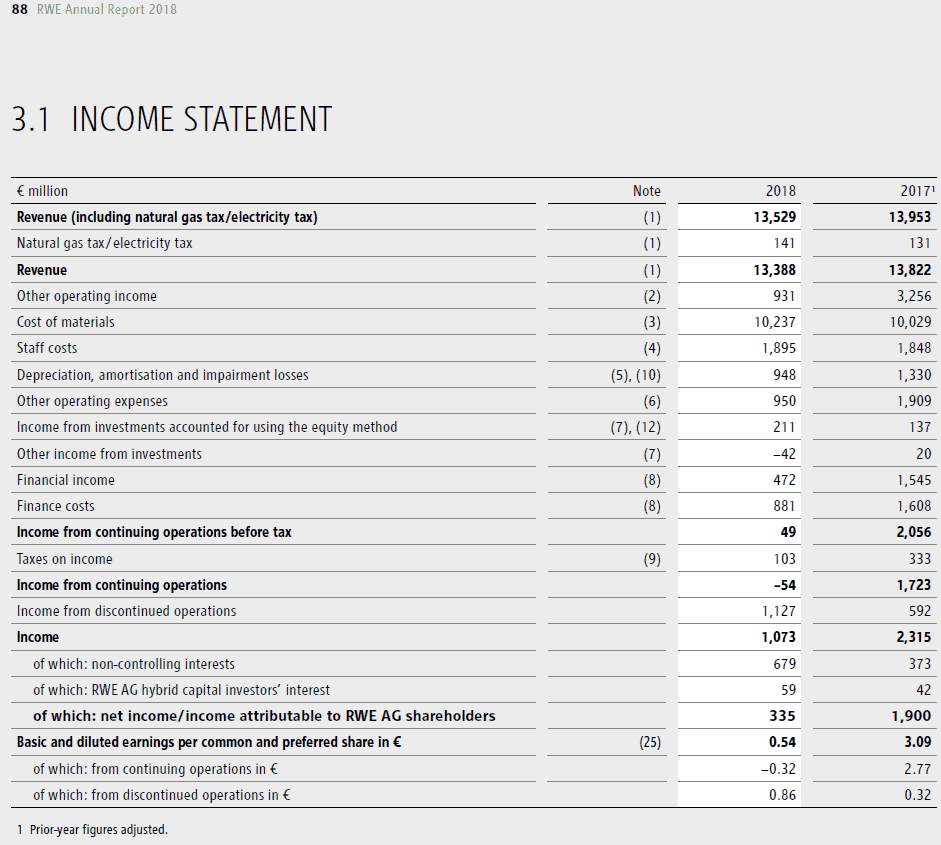

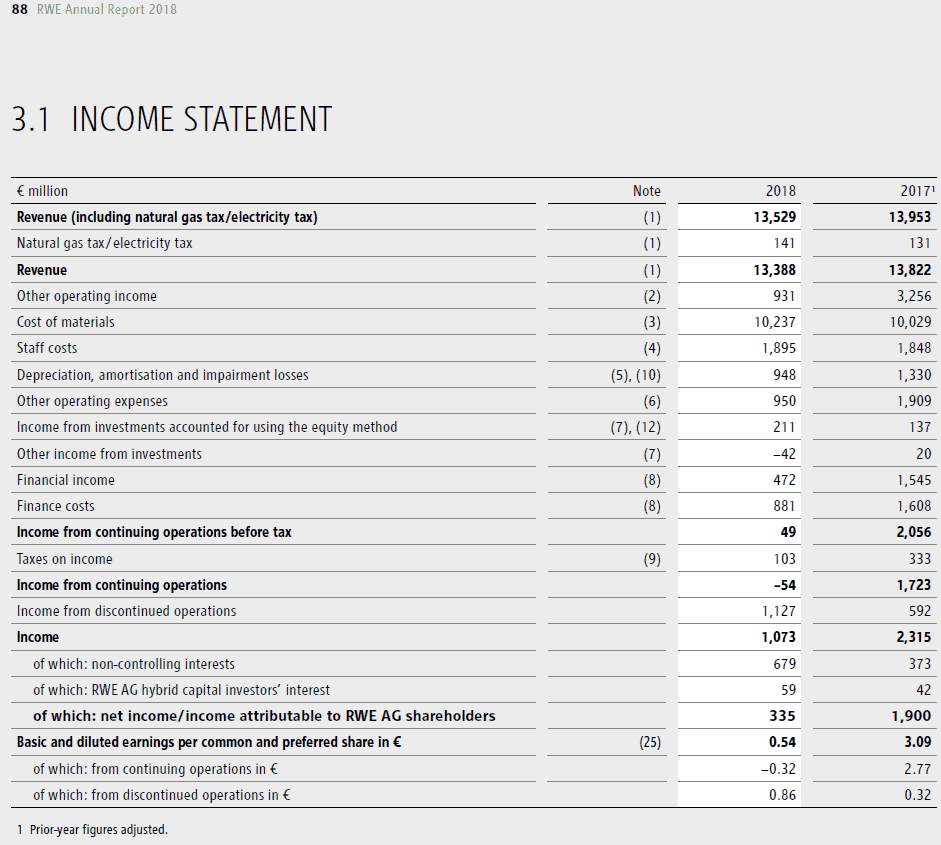

RWE Statement of comprehensive income 2018

RWE Statement of comprehensive income 2018Group Reporting Entity Legal Entity

Consolidated Statement of Changes in Equity IFRS Example Financial Statements 2018

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

Specific line item requirements

| Link | Description |

| IAS 1:106 | Specific line items and information required for the components of equity in the statement of changes in equity. |

| IAS 1:106A | Analysis of other comprehensive income by component of equity (or in the notes). |

| IAS 1:107 | Dividends recognised as distributions to owners and the related amount per share (or in the notes). |

Group Reporting Entity Legal Entity

Consolidated Statement of Changes in Equity IFRS Example Financial Statements 2018

Several Consolidated Statements of Changes in Equity 2018

Group Reporting Entity Legal Entity

Notes to the consolidated financial statements IFRS Example Financial Statements 2018

General requirement for the Notes to the consolidated financial statements

| Link | Description |

| IAS 1:112 | The Notes to the consolidated financial statements include the following information:

|

| IAS 1:113 | Notes are required to be presented in a systematic manner and cross-referenced. |

Group Reporting Entity Legal Entity

Consolidated statement of cash flows

OPERATING ACTIVITIES

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

| IAS 7:10 | Cash flows are to be classified as either operating, investing, or financing activities. |

| IAS 7:18 | Report operating cash flows either using: – Direct method – Indirect method. |

| IAS 7:21, IAS 7:22 |

Criteria when cash flows are to be presented gross or net. |

Specific line item requirements

| Link | Description |

| IAS 7:14 | Examples of operating activity cash flows. |

| IAS 7:31 | Present cash flows from interest and dividends as either operating, investing or financing activities (must be consistent year-on-year). |

| IAS 7:35 | Present cash flows from taxes on income as operating activities (unless they can be separately identified with financing and investing activities). |

Group Reporting Entity Legal Entity

Consolidated Statement of Cash Flows – Operating Activities IFRS Example Financial Statements 2018

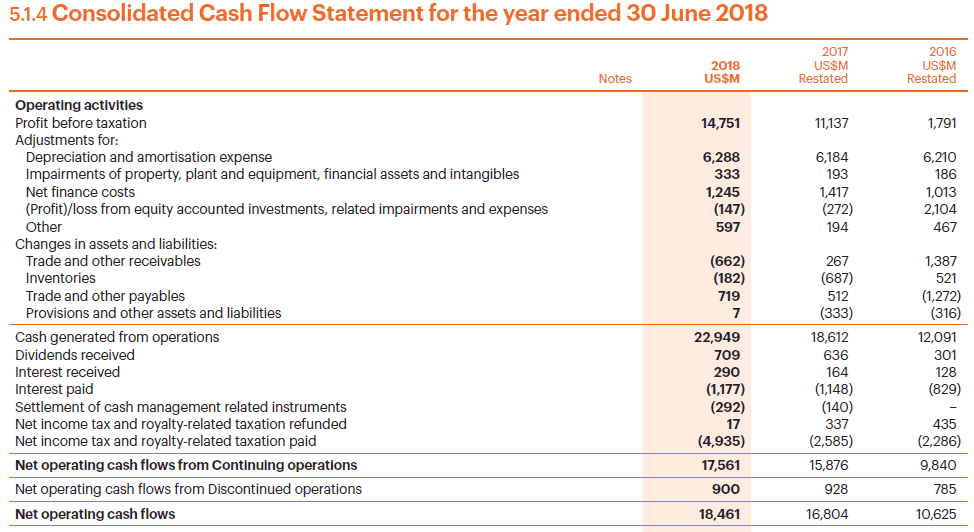

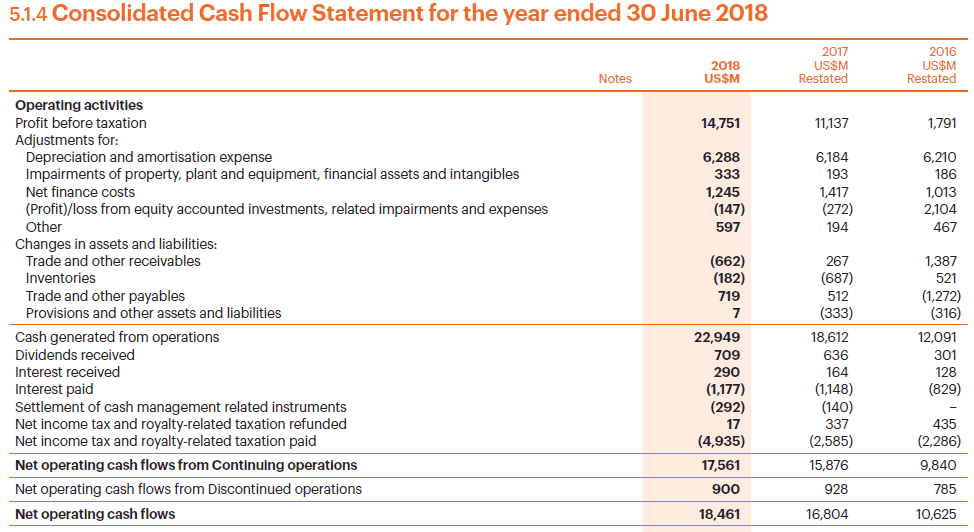

BHP Billiton consolidated operating cash flows 2018

BHP Billiton consolidated operating cash flows 2018

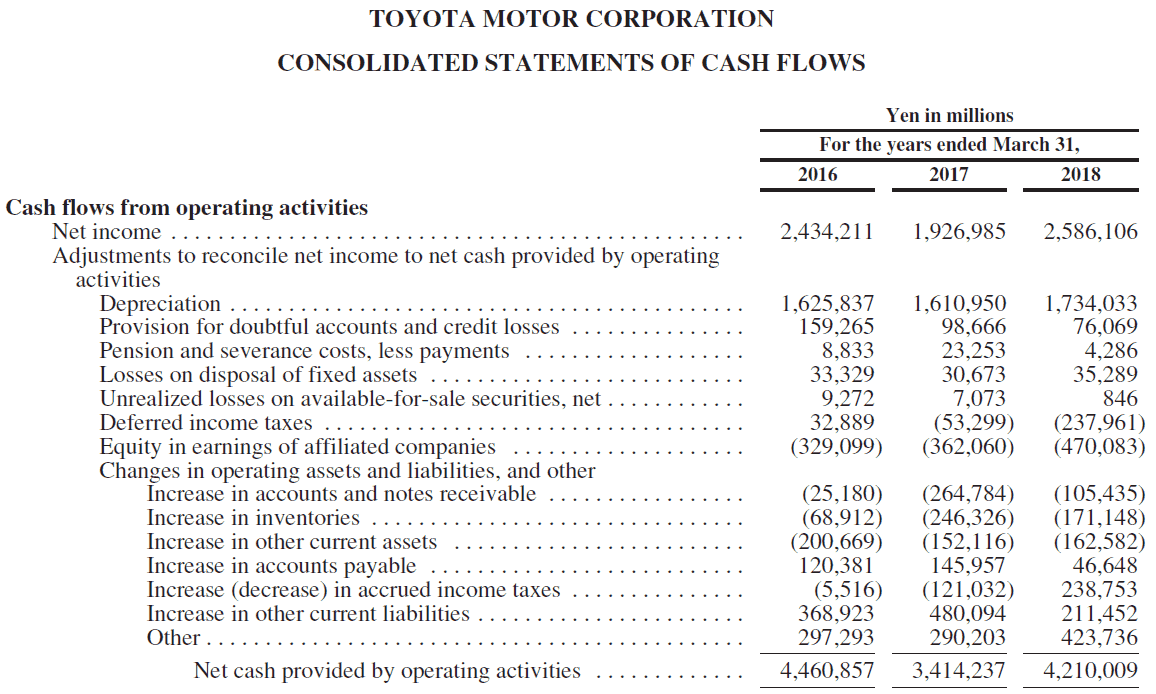

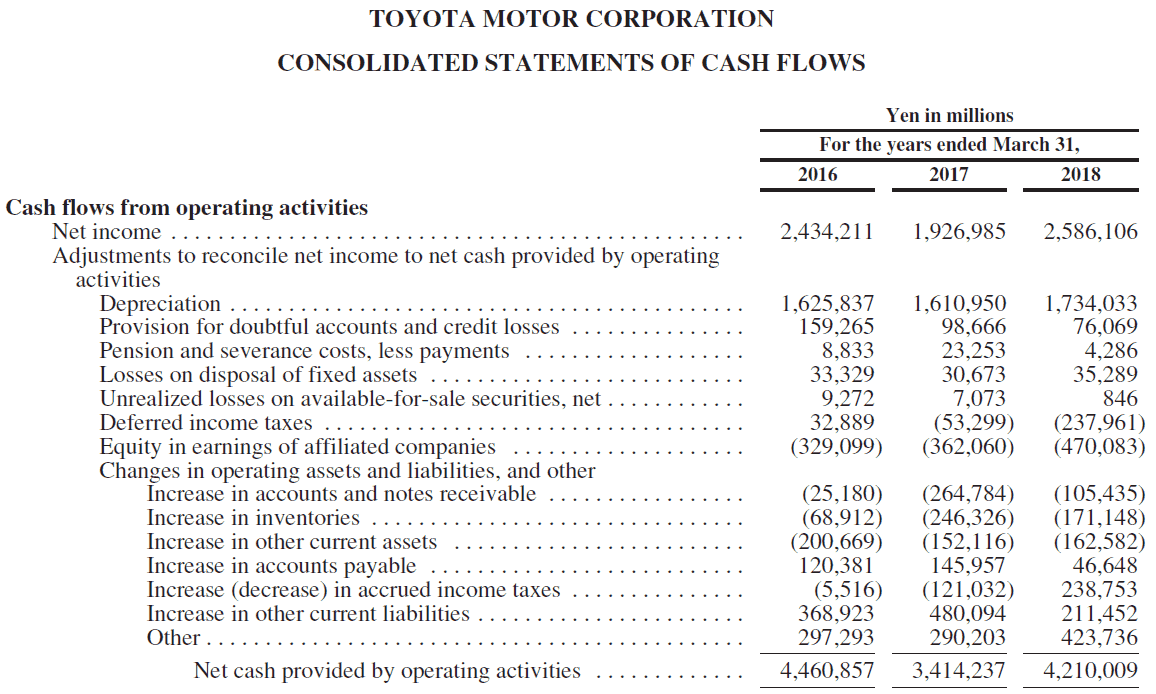

Toyota Consolidated Cash flows from Operating activities 2018

Toyota Consolidated Cash flows from Operating activities 2018

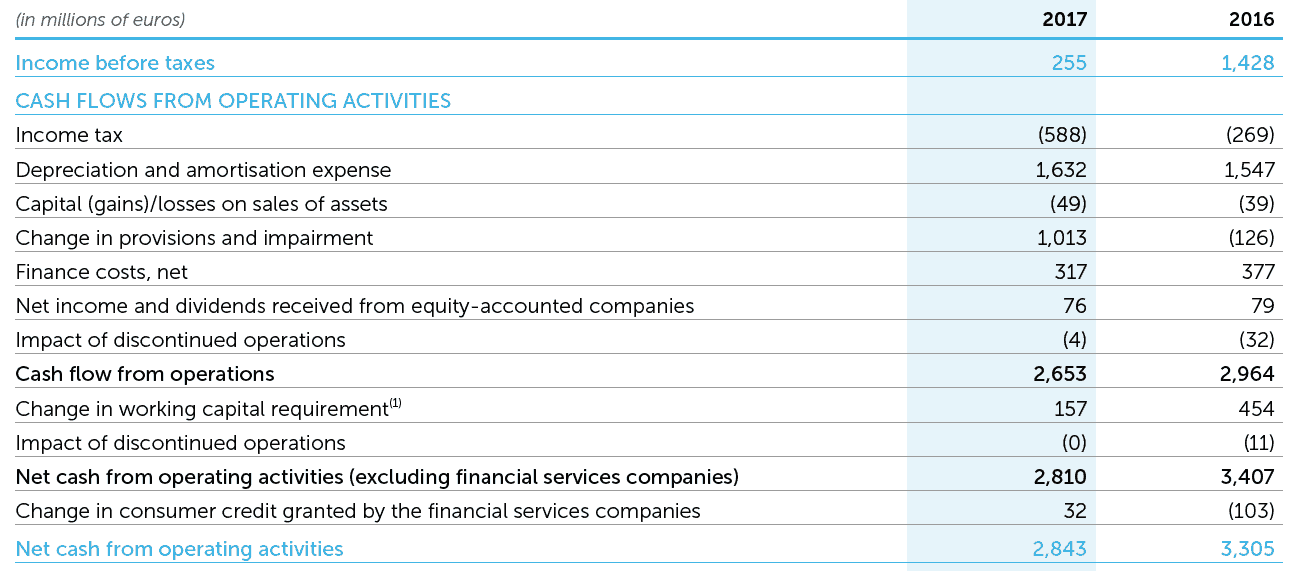

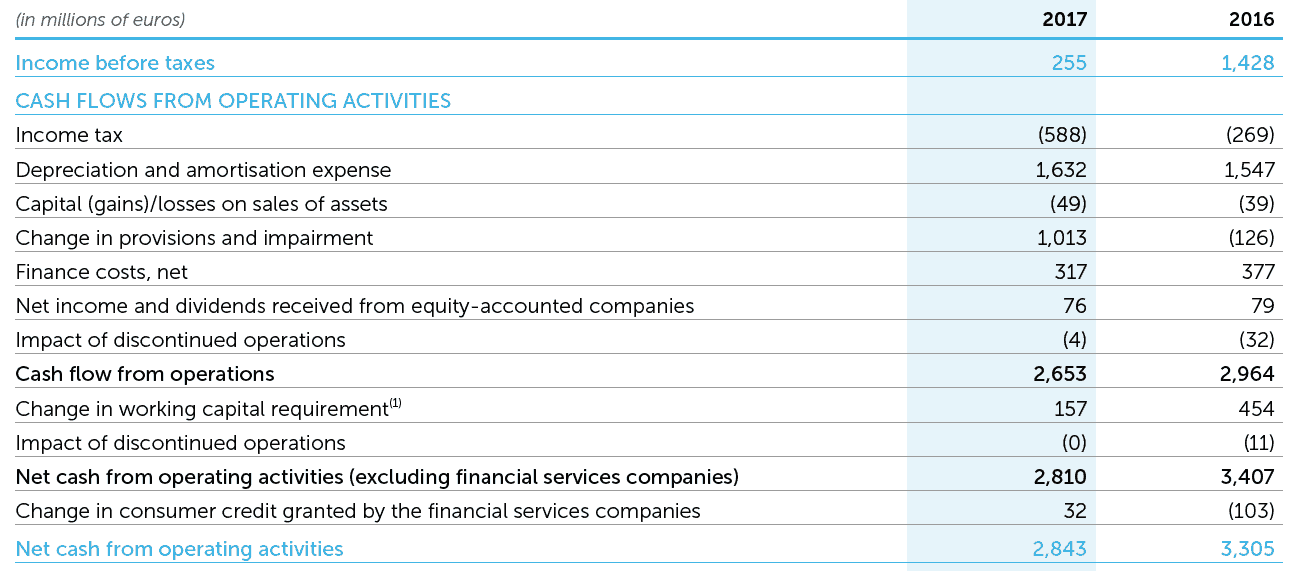

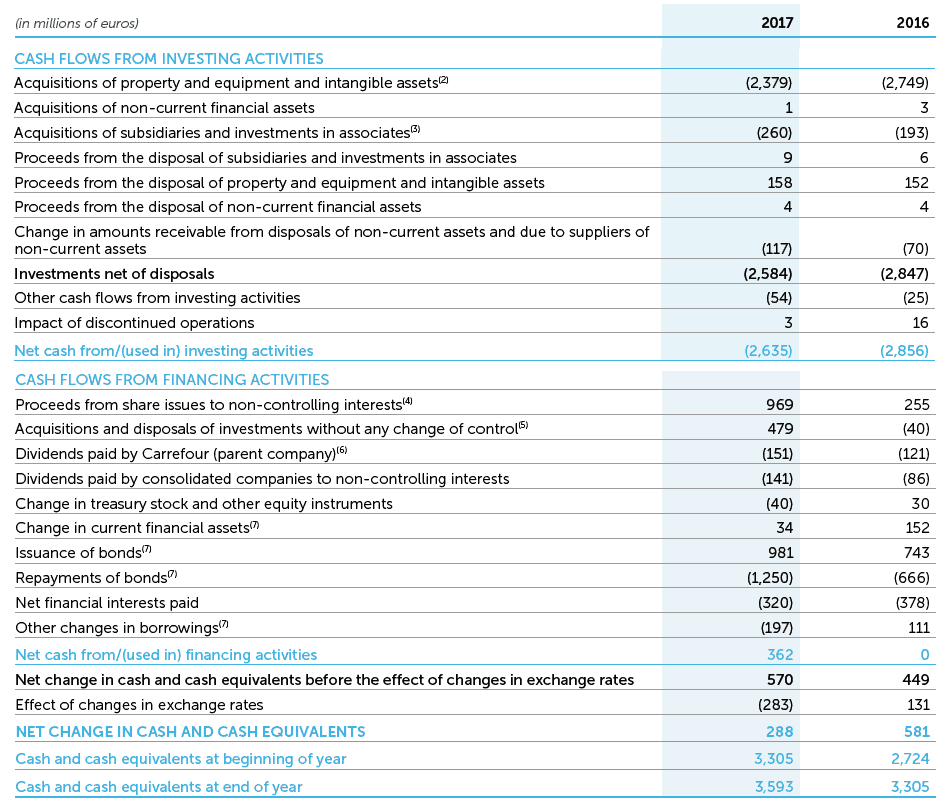

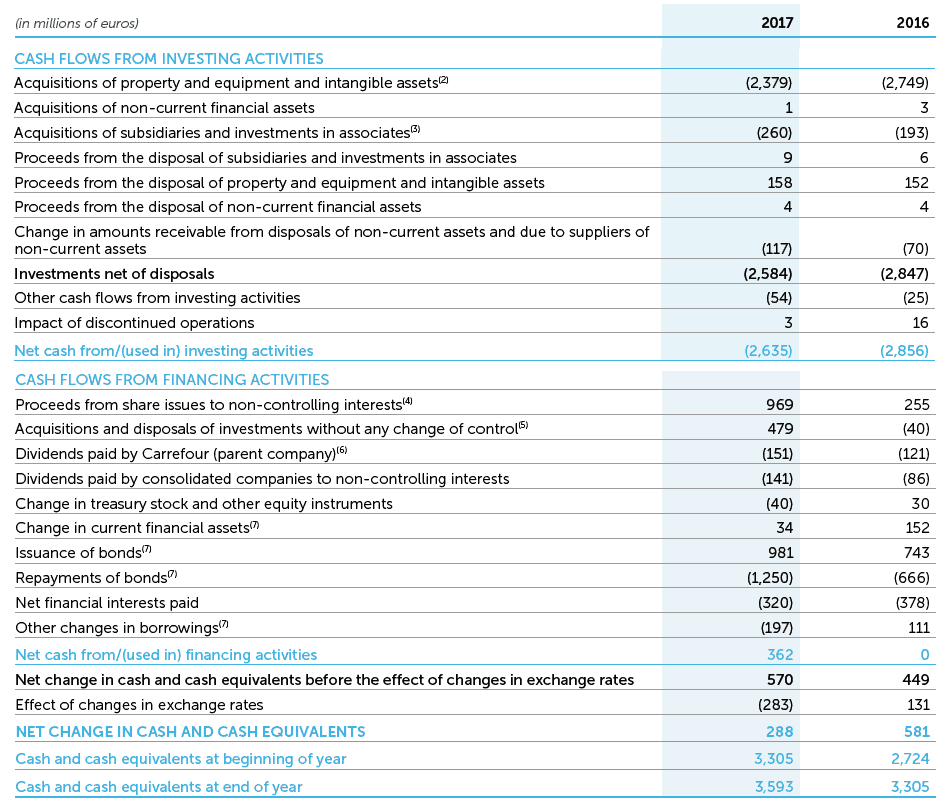

Carrefour Consolidated operating cash flows 2017

Carrefour Consolidated operating cash flows 2017

Group Reporting Entity Legal Entity

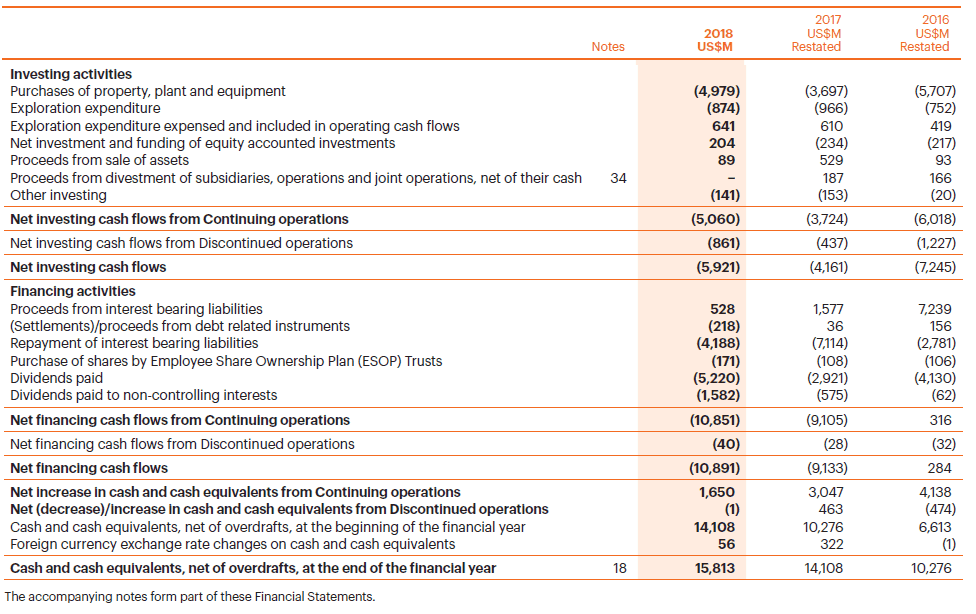

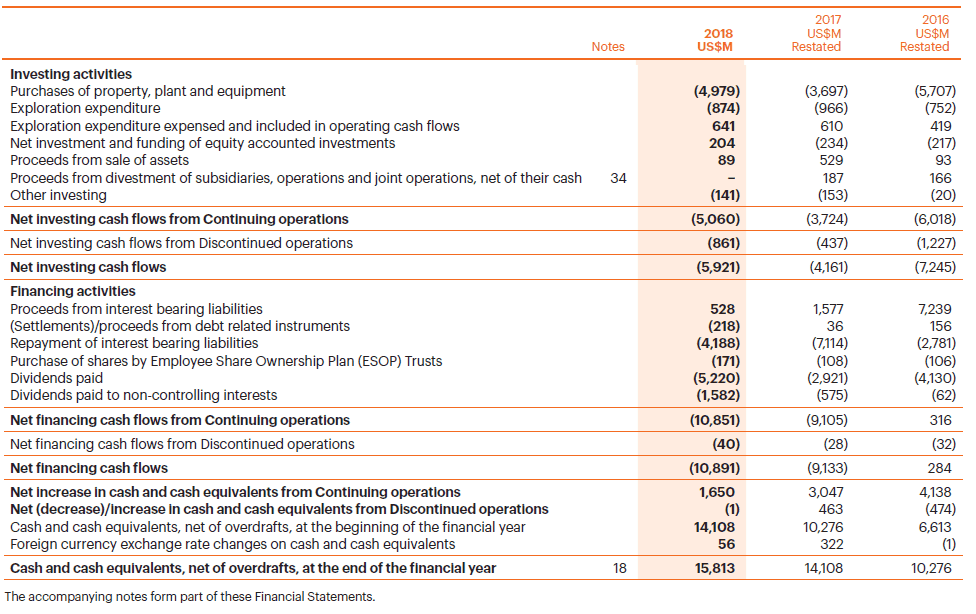

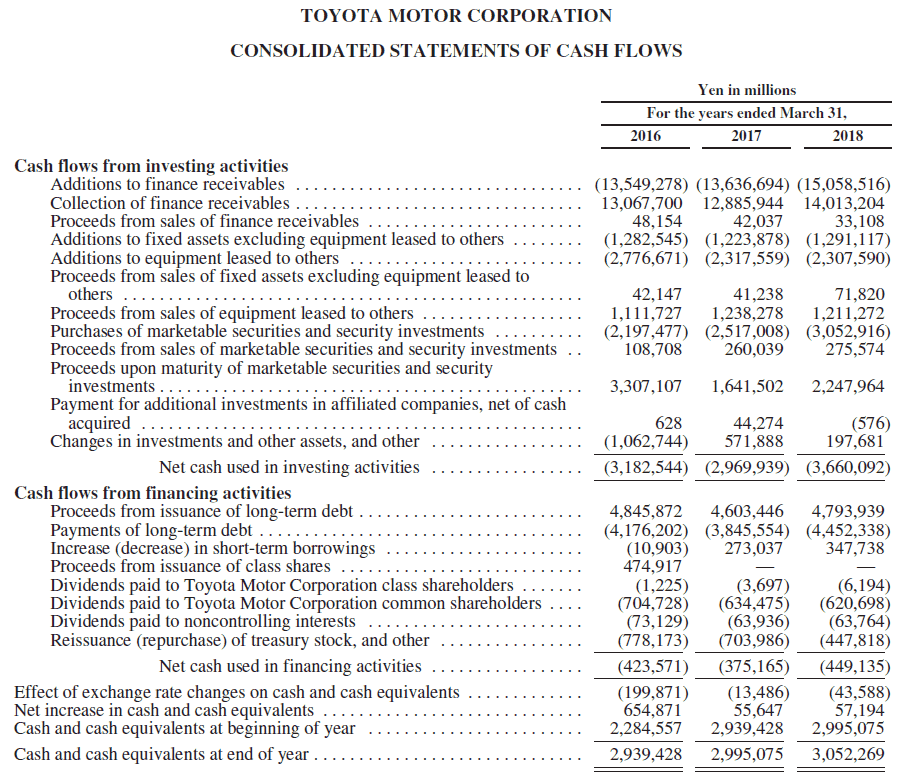

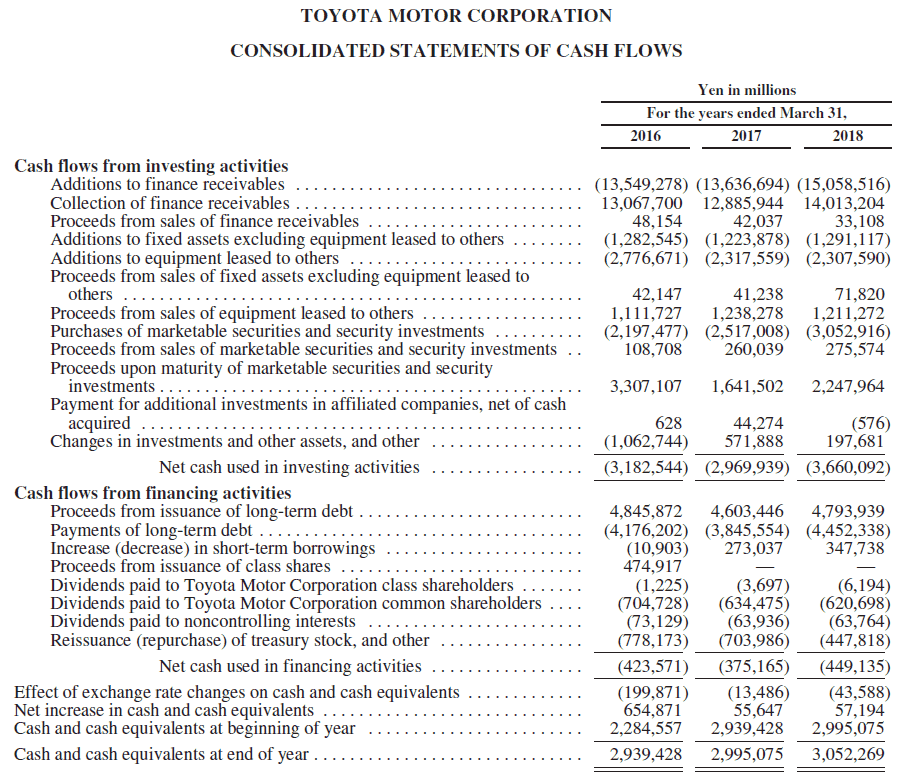

FINANCING AND INVESTING ACTIVITIES

Consolidated Statement of Cash Flows IFRS Example Financial Statements 2018

General financial statement presentation requirements

| Link | Description |

| IAS 1:38-38A | Minimum comparative information required (current and previous period). |

| IAS 1:113 | Notes to be presented in a systematic manner and cross referenced. |

| IAS 7:10 | Cash flows are to be classified as either operating, investing, or financing activities. |

| IAS 7:21, IAS 7:22 |

Criteria when cash flows are to be presented gross or net. |

Specific line item requirements

| Link | Description |

| IAS 7:16 | Examples of investing activity cash flows. |

| IAS 7:17 | Examples of financing activity cash flows. |

| IAS 7:31 | Present cash flows from interest and dividends as either operating, investing or financing activities (must be consistent year-on-year). |

| IAS 7:39 | Aggregate cash flows from obtaining or losing control of subsidiaries or other businesses are classified as investing activities. |

| IAS 7:42A | Cash flows from transactions relating to changes in ownership that do not result in a loss of control are classified as financing activities. |

| IAS 7.28 | Present the effect of unrealised foreign exchange gains or losses on cash balances. |

| IAS 7:45 | Reconciliation (or reference to a reconciliation) of the cash balances presented in the statement of cash flows and the statement of financial position. |

Group Reporting Entity Legal Entity

Consolidated Statement of Cash Flows-Financing and Investing activities

BHP Billiton Consolidated cash flows Financing and Investing 2018

BHP Billiton Consolidated cash flows Financing and Investing 2018

Toyotal consolidated financing investing and cash flows 2018

Toyotal consolidated financing investing and cash flows 2018

Carrefour Consolidated financing and investing cash flows 2017

Carrefour Consolidated financing and investing cash flows 2017Group Reporting Entity Legal Entity

Notes to the consolidated financial statements

Contents comparison Notes to Financial Statements 2018

Continue reading: First part Example – Notes to the financial statements – Basis of preparation