Last update 16/12/2019

IFRS 3 Definition: Measurement period – the period after the acquisition date during which the acquirer may adjust the provisional amounts recognized for a business combination, providing the acquirer with a reasonable time to obtain the information necessary to apply the requirements of IFRS 3. The measurement period shall not exceed one year from the acquisition date.

Use of provisional amounts at the reporting date

Accounting for a business combination requires substantial effort and resources. The initial accounting often is incomplete at the end of the reporting period in which the business combination happens. This is because the acquirer has been unable to obtain all pertinent information necessary to evaluate the conditions that existed as of the acquisition date. As a result, the acquirer may have to record provisional amounts for certain assets or liabilities — for instance, independent valuations for intangible assets may not yet be finalized.

The measurement period is intended to allow an acquirer sufficient time to obtain the information necessary to evaluate the conditions that existed as of the acquisition date. When the acquirer receives the necessary information, adjustments may be necessary either:

- To revise the amounts recorded for assets and liabilities recognized at the time of the acquisition

- To recognize new assets and liabilities that would have been recognized at the time of the acquisition if all facts and circumstances had been known at that time. [IFRS 3 45 – 50]

An acquirer must not record a measurement period adjustment for either of the following:

- The correction of an error. An acquirer must account for the correction of an error according to IAS 8 Accounting policies, Changes in accounting estimates and Errors. For example, an acquirer might record the wrong amount in its general ledger for an asset acquired due to a typo. The adjustment made to record the proper amount is accounted for as the correction of an error under IAS 8.

- Events that happened after the acquisition date. These events must be accounted for in the periods in which they occur following relevant guidance in other IFRSs.

Amounts that may be reported provisionally and then (potentially) revised include (IFRS 3 46):

- fair values of identified assets and liabilities

- fair values of previously-held interests, consideration transferred and non-controlling interests

- acquired tax benefits that meet certain criteria (IAS 12.68)

- resulting goodwill or gain on a bargain purchase

When provisional amounts are used, the acquirer discloses:

- the particular accounts where provisional amounts are used and

- the reasons why the accounting for the business combination is incomplete (see IFRS 3 B67).

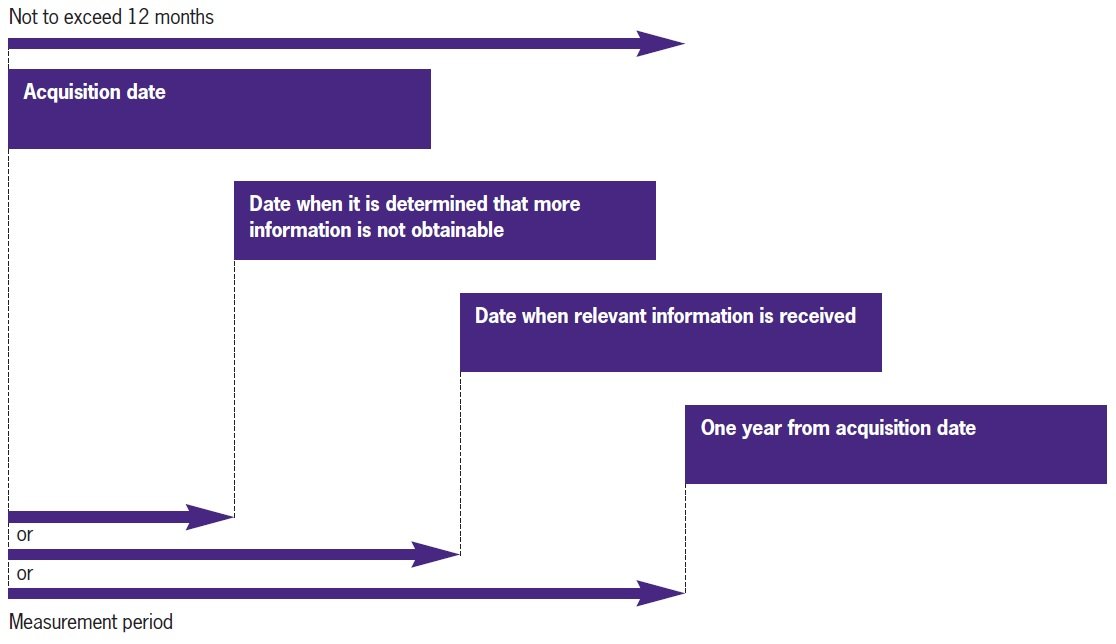

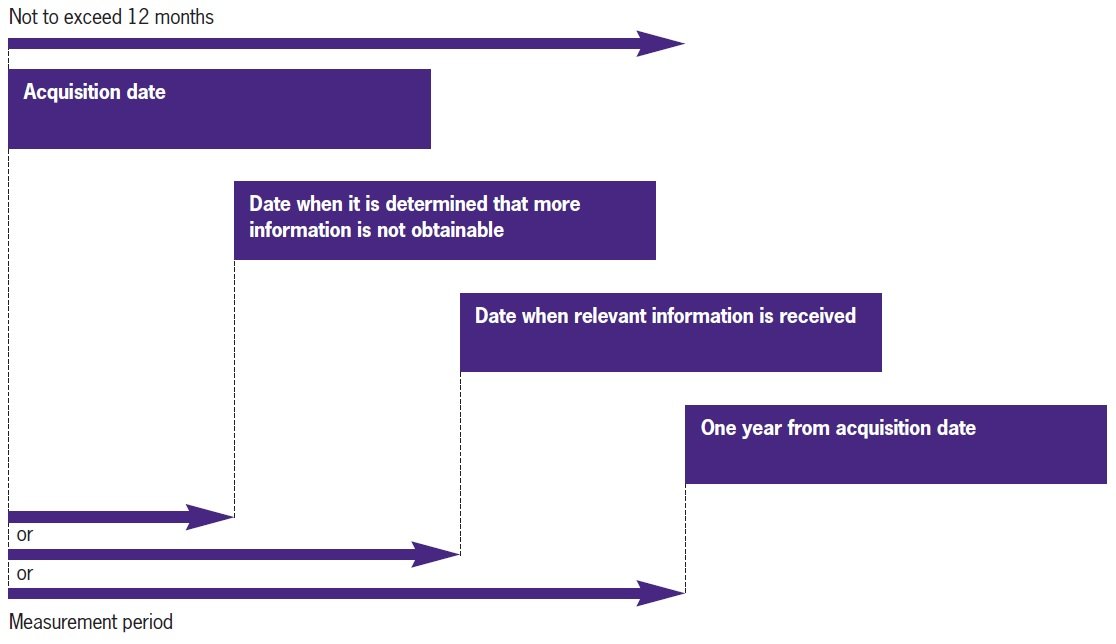

The measurement period ends at the earlier of (IFRS 3 45):

- date on which required information is obtained (or found to be unavailable)

- one year from the acquisition date

The following diagram illustrates the measurement period definition:

Measurement period adjustments must be distinguished from normal accounting adjustments that may arise during the measurement period. The former are limited to those that arise from new information obtained about facts and circumstances that existed at the acquisition date. Developments after this date may also lead to changes in estimates and give rise to new assets and liabilities. However, these are not measurement period adjustments and are reported as they occur in the normal way. In making this distinction the acquirer should consider:

- the timing of the receipt of the new information (information received shortly after the acquisition date is more likely to indicate that the facts and circumstances existed on the acquisition date)

- the reason for the adjustment.

|

Type of adjustment |

IFRS 3 Accounting |

|

Measurement period adjustments |

Retrospectively adjust the provisional amounts and/or recognise additional assets and liabilities to reflect new information (IFRS 3 45) Adjustments are recognised as if the accounting for the business combination had been completed at the acquisition date. Comparative information from prior periods is revised by: increasing or decreasing the amount of goodwill or gain from a bargain purchase. If the adjustment affects more than one asset or liability, the adjustment to goodwill reflects the net effect of those adjustments making any change in depreciation, amortisation or other income effects recognised in the initial accounting for the business combination (IFRS 3 48-49) |

|

Other adjustments within the measurement period |

Prospectively adjust the provisional amounts to reflect new facts and circumstances arising after the acquisition date (ie recognise adjustments in earnings in the period the adjustment is made, without adjusting goodwill) Correcting any error retrospectively in accordance with IAS 8 |

|

Adjustments after the measurement period |

No adjustment to the accounting for the business combination is allowed except for correction of an error in accordance with IAS 8 (IFRS 3 50) |

EXAMPLE – Changes to provisional amounts

On 1 October 20X1, Company Q acquired 100% interest in Company S. When Company Q issued its 31 December 20X1 financial statements, the valuation of an acquired trademark was incomplete. Company Q used CU10 million as the provisional fair value of trademarks and determined a 5-year amortisation life. Company Q appropriately disclosed in its 31 December 20X1 financial statements that the trademark was measured at a provisional amount. On 30 April 20X2, the valuation of the trademark was finalised. The fair value at the acquisition date amounted to CU12 million.

Adjustments in the 31 December 20X2 financial statements:

Company Q will make retrospective adjustments to the accounting for the business combination in the comparative amounts for 20X1 as follows:

- the carrying amount of trademarks as of 31 December 20X1 is increased by CU1.9 million, representing the increase in fair value of CU2 million less additional amortisation from the acquisition date to 31 December 20X1 of CU0.1 million (CU 2 million x 3 months/60 months)

- amortisation expense for 20X1 is increased by CU0.1 million. The amortisation adjustment is intended to reflect that the trademark’s final fair value of CU12 million has been recognised on the acquisition date

- goodwill is decreased by CU2 million.

See also: The IFRS Foundation

Measurement period

Measurement period

Measurement period

Measurement period Measurement period Measurement period