Last update 11/12/2019

IFRS 3 Business combinations Content – In April 2001 the International Accounting Standards Board (Board) adopted IAS 22 Business Combinations, which had originally been issued by the International Accounting Standards Committee in October 1998. IAS 22 was itself a revised version of IAS 22 Business Combinations that was issued in November 1983.

In March 2004 the Board replaced IAS 22 and three related Interpretations (SIC-9 Business Combinations—Classification either as Acquisitions or Unitings of Interests, SIC-22 Business

Combinations—Subsequent Adjustment of Fair Values and Goodwill Initially Reported and SIC-28 Business Combinations—‘Date of Exchange’ and Fair Value of Equity Instruments) when it issued IFRS 3 Business Combinations. IFRS 3 Business combinations Content

Combinations—Subsequent Adjustment of Fair Values and Goodwill Initially Reported and SIC-28 Business Combinations—‘Date of Exchange’ and Fair Value of Equity Instruments) when it issued IFRS 3 Business Combinations. IFRS 3 Business combinations Content

Minor amendments were made to IFRS 3 in March 2004 by IFRS 5 Non-current Assets Held for Sale and Discontinued Operations and IAS 1 Presentation of Financial Statements (as revised in September 2007), which amended the terminology used throughout the Standards, including IFRS 3.

In January 2008 the Board issued a revised IFRS 3. IFRS 3 Business combinations Content

Background

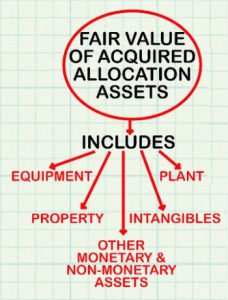

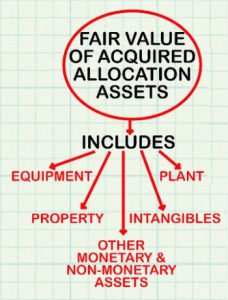

IFRS 3 (2008) seeks to enhance the relevance, reliability and comparability of information provided about business combinations (e.g. acquisitions and mergers) and their effects. It sets out the principles on the recognition and measurement of acquired assets and liabilities, the determination of goodwill and the necessary disclosures. IFRS 3 Business combinations Content

Key definitions

| [IFRS 3, Appendix A] | |

| Business combination | A transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ are also business combinations as that term is used in IFRS 3. |

| Business1 | An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.

IFRS 3 Business combinations Content IFRS 3 Business combinations Content IFRS 3 Business combinations Content |

| Acquisition date | The date on which the acquirer obtains control of the acquiree

IFRS 3 Business combinations Content IFRS 3 Business combinations Content IFRS 3 Business combinations Content

|

| Acquirer | The entity that obtains control of the acquiree |

| Acquiree | The business or businesses that the acquirer obtains control of in a business combination |

Scope

IFRS 3 must be applied when accounting for business combinations, but does not apply to:

- The formation of a joint venture2 [IFRS 3.2(a)]

- The acquisition of an asset or group of assets that is not a business, although general guidance is provided on how such transactions should be accounted for [IFRS 3.2(b)]

- Combinations of entities or businesses under common control (the IASB has a separate agenda project on common control transactions) [IFRS 3.2(c)]

- Acquisitions by an investment entity of a subsidiary that is required to be measured at fair value through profit or loss under IFRS 10 Consolidated Financial Statements. [IFRS 3.2A]

CONTENTS IFRS 3 Business combinations blogs – Work in progress!

See also: The IFRS Foundation