Lease payments – Lessee perspective

or what does a lessee include in its lease liability?

At the commencement date, a lessee measures the lease liability as the present value of lease payments that have not been paid at that date. In a simple lease that includes only fixed lease payments, this can be a simple calculation (IFRS 16.26).

| Worked example – Fixed lease payments are included in lease liabilities | |||||||||||||||||||||

|

Lessee B enters into a five year lease of a photocopier. The lease payments are 10,000 per annum, paid at the end of each year.

Because the annual lease payments are fixed amounts, B includes the present value of the five annual payments in the initial measurement of the lease liability. Using a discount rate (determined as B’s incremental borrowing rate) of 5%, the lease liability at the commencement date is calculated as follows:

|

|||||||||||||||||||||

Categories of lease payment

The payments included in the measurement of the lease liability comprise (IFRS 16.27 ):

- amounts expected to be payable under a residual value guarantee (see Residual value guarantees below);

- the exercise price of an option to purchase the underlying asset that the lessee is reasonably certain to exercise (see Renewal, termination and purchase options below);

- payments for terminating the lease unless it is reasonably certain that early termination will not occur (see Renewal, termination and purchase options below);

- variable lease payments that depend on an index or rate (see Payments that depend on an index or rate below); and

- fixed payments (including in-substance fixed payments (IFRS 16.27), less any lease incentives receivable.

In contrast, the following payments are excluded from the lease liability:

- variable lease payments that depend on sale or usage of the underlying asset (see Payments that depend on sale or usage); and

- payments for non-lease components, unless the lessee elects to combine lease and non-lease components (see Lease and non-lease components) (IFRS 16.15, BC135, BC168–BC169).

Residual value guarantees

A residual value guarantee is a guarantee made to the lessor that the value (or part of the value) of an underlying asset will be at least a specified amount at the end of the lease. This guarantee is made by a party unrelated to the lessor (IFRS 16.A Definitions).

If a lessee provides a residual value guarantee, then it includes in the lease payments the amount that it expects to pay under the guarantee. If the amount expected to be payable under a residual value guarantee changes, then the lessee remeasures the lease liability using an unchanged discount rate ((IFRS 16.27(c), IFRS 16 42–43).

| Worked example – Residual value guarantees |

|

Lessee Z has entered into a lease contract with Lessor L to lease a car. The lease term is five years. In addition, Z and L agree on a residual value guarantee – if the fair value of the car at the end of the lease term is below 400, then Z will pay to L an amount equal to the difference between 400 and the fair value of the car. At commencement of the lease, Z expects the fair value of the car at the end of the lease term to be 400. Z therefore includes an amount of zero in the lease payments when calculating its lease liability. Subsequently, Z monitors the expected fair value of the car at the end of the lease term. If the expected fair value of the car falls below 400, then Z will remeasure the lease liability to include the amount expected to be payable under the residual value guarantee, using an unchanged discount rate. |

| Has the accounting for residual guarantees changed? | ||||||||

Yes – there are two important differences compared with IAS 17.

Taken together, these differences mean that amounts relating to residual value guarantees included in lease payments under the new standard are often lower than under IAS 17 – but the presence of a residual value guarantee creates new volatility in the gross assets and liabilities reported by the lessee. Using the fact pattern in ‘Worked example – Residual value guarantees‘ above, under IAS 17 Lessee Z would disregard how much it expects to pay under the residual value guarantee, and include the full exposure of 400 in its minimum lease payments. Lessees will need to carefully consider what additional processes are required to determine and document the estimate of the amount expected to be paid. They need to consider this at the commencement date and when performing subsequent remeasurements (when expectations change). |

||||||||

| Is it always clear that a lease contains a residual value guarantee? |

||||||||

|

No – in some cases, a lessee will need to use judgement to identify whether a lease contains a residual value guarantee. This is because some features of a lease may function economically as residual value guarantees but be expressed in a different manner. Consider the two clauses in the following example. Lessee Z leases new cars, typically for lease terms of five years. Z agrees to indemnify the lessors for excess wear and tear on the vehicles.

|

Renewal, termination and purchase options

At the commencement date, a lessee determines whether it is reasonably certain to exercise an option to extend the lease or to purchase the underlying asset, or not to exercise an option to terminate the lease early. Lessees make this determination by considering all relevant facts and circumstances that create an economic incentive to exercise an option, or not to do so (IFRS 16.18–20, IFRS 16 B37–B40).

The lessee determines the lease payments in a manner consistent with this assessment, as follows.

- Renewal options: If the lessee is reasonably certain to exercise a renewal option, then it includes in the lease liability the relevant lease payments payable in the period covered by the renewal option.

- Termination option: Unless the lessee is reasonably certain not to terminate the lease early, it reflects the early termination in the lease term and includes the termination penalty in the measurement of the lease liability.

- Purchase option: If the lessee is reasonably certain to exercise an option to purchase the underlying asset, then it includes the exercise price of the purchase option in the lease payments (IFRS 16.18, IFRS 16 27(d)–(e)).

A lessee remeasures the lease liability, using a revised discount rate, if it changes its assessment of whether it is reasonably certain to exercise a renewal or purchase option, or not to exercise an option to terminate the lease early (IFRS 16.36(c), IFRS 16 40). (See Reassessment of renewal, termination and purchase options for further discussion of this reassessment.)

| Worked example – Lessee purchase option: Assessing if reasonably certain to be exercised at commencement date |

|

Lessee E enters into a non-cancellable five-year lease with Lessor R to use a piece of equipment in an evolving area of the technology sector. There is no renewal option, but E has the option to purchase the equipment at the end of the lease for 500. Because this piece of equipment is used in an evolving area of the technology sector, which is subject to rapid change, the fair value of the equipment at the end of the lease is subject to significant volatility – estimates range from 400 to 900. The duration of the non-cancellable period of five years is significant in this context. This reflects, for example, that newer and/or better alternative assets may be introduced during the five-year lease term. E makes an overall assessment of whether it has an economic incentive to exercise the purchase option at the end of the lease and concludes that it is not reasonably certain to do so. This includes E’s assessment of the significant volatility in the future fair value of the equipment at the end of the lease and the probability that better alternative assets may be introduced during that period. Assessing whether E is reasonably certain to exercise the option can involve significant judgement. A shorter term (e.g. one or two years) or a different environment (e.g. lease of real estate in a historically highly predictable real estate market) could lead to a different conclusion. |

|

Worked example – Lessee termination option: Assessing if reasonably certain not to be exercised |

|

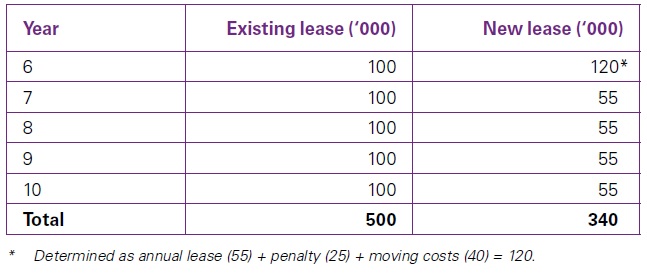

Lessee B enters into a 10-year lease of a floor of an office building. There is no renewal option, but B has the option to terminate the lease early after Year 5 with a penalty equal to three months’ rent. The annual lease payments are fixed at 100,000 per annum. At the commencement date, the building is brand new and is technologically advanced for office buildings in the surrounding business parks, and the lease payments are consistent with the market rental rate. Initial assessment at commencement At the commencement date, B concludes that it is reasonably certain not to exercise the option to terminate the lease early, and therefore excludes the termination penalty from its lease liability and determines the lease term as 10 years. Subsequent reassessment of certainty that option will be exercised During Year 4, B sells a significant component of its business and reduces its headcount by 50%. At the end of Year 4, similar office buildings in the area that meet B’s needs for a smaller workforce are available for lease from Year 6 for annual payments of 55,000. B estimates that the cost to move its workforce would be 40,000. B concludes that the change in circumstance is significant, is within its control and affects whether it is still reasonably certain not to exercise the termination option (IFRS 16.20–21). To evaluate whether it is still reasonably certain that it will not terminate the lease early, B compares the future cash outflows as follows.

B makes an overall assessment of whether it now has an economic incentive to terminate the lease early, including consideration of the cost saving of moving to a smaller office space. Because the cost saving of moving to a smaller office space far exceeds the penalty for early termination, at the end of Year 4 B concludes that it is no longer reasonably certain not to exercise the option to terminate early at the end of Year 5. Note that in practice B would consider the time value of money when making this assessment. B includes the termination penalty (25,000) in its lease payments and also determines that the remaining lease term has been reduced to one year. B remeasures its lease liability using a revised discount rate. Any net remeasurement of the lease liability is adjusted against the right-of-use asset. |

| How have the accounting consequences of the ‘reasonably certain’ threshold changed? |

|

IFRS 16 retained the ‘reasonably certain’ threshold when assessing renewal, termination and purchase options. This threshold is familiar from IAS 17, though there is additional guidance on how to apply it. More importantly, the accounting consequences of concluding that a lessee is reasonably certain to exercise such an option are different. Under IAS 17, this conclusion typically impacts the assessment of lease classification:

Under the new standard, this conclusion generally impacts the measurement of the lease liability, because the lease payments are determined in a manner consistent with the conclusion on whether the lessee is reasonably certain to exercise the option. Another key difference is that under IAS 17 a lessee does not reassess the likelihood that it would exercise an option unless there is a change in the terms and conditions in the lease. Under the new standard, a lessee reassesses whether it is reasonably certain to exercise an option after the occurrence of a significant event or a significant change in circumstance that would impact the assessment and is within the lessee’s control. The new requirement to remeasure the lease liability introduces new financial statement volatility in gross assets and liabilities. Lessees will need to develop new processes to keep these options under review and to document their assessment at each reporting date. |

Lease payments – Lessor perspective

or what does a lessor include in its lease liability?

Unlike lessees, who now apply a single lease accounting model under the new standard, lessors continue to classify their leases using the dual model that exists under IAS 17 – as either a financing or an operating lease. The lease classification test for lessors is essentially unchanged.

On commencement of a finance lease, a lessor derecognises the underlying asset and recognises a finance lease receivable. The finance lease receivable

is measured at the present value of the future lease payments plus any unguaranteed residual value accruing to the lessor.

However, lease payments are defined differently for lessees and lessors.

|

The key differences in how lessees and lessors identify lease payments are as follows.

IFRS 16 15, IFRS 16 20–21, IFRS 16 27(c)–(e), IFRS 16 40, IFRS 16 70(c)–(e)

The IASB has noted that most constituents did not consider symmetry between lessee and lessor accounting to be a high priority. The inconsistencies noted above were acknowledged by the IASB as it finalised the standard. The risk is that these inconsistencies may give rise to structuring opportunities in more complex arrangements |

Payments that depend on an index or rate

Initial measurement of the lease liability

Variable lease payments that depend on an index or rate are initially included in the lease liability using the index or rate as at the commencement date of the lease (IFRS 16.27(b)).

This approach applies to, for example, payments linked to a consumer price index (CPI), payments linked to a benchmark interest rate (e.g. LIBOR) or payments that are adjusted to reflect changes in market rental rates (IFRS 16.28).

Reassessment of the lease liability

After the commencement date, lessees are required to remeasure the lease liability to reflect changes to the lease payments arising from changes in the index or rate. Any remeasurement is generally adjusted against the right-of-use asset (IFRS 16.36(c), IFRS 16.39).

Lessees reassess the lease liability by discounting the revised lease payments in the following scenarios (IFRS 16.42(b), IFRS 16.43, IFRS 16.B42).

|

Lessee remeasures lease liability using revised lease payments and… |

|

|

an unchanged discount rate when:

|

a revised discount rate when:

|

IFRS 16’s approach to accounting for payments that depend on an index or a rate is a change in practice for most companies. Under IAS 17, the usual practice is to treat these payments as contingent rents, recognised in the period in which they are incurred.

The new approach is simple to apply, insofar as lease payments are always based on current information. For example, a lessee is never required to forecast the future amount of an index or a rate. However, remeasuring the lease liability for changes in the value of an index or rate introduces new balance sheet volatility in gross assets and liabilities, and system challenges.

Payments that depend on an index

On lease commencement, variable lease payments that depend on an index are measured using the index as at the commencement date of the lease (IFRS 16.27(b)).

When the change in future lease payments is a result of a change in an index (or rate), the lessee remeasures the liability using an unchanged discount rate (IFRS 16.42(b), IFRS 16.43).

|

Worked example – Payments that depend on an index

IFRS 16.27–28, IFRS 16 39, IFRS 16.42(b), IFRS 16.43, IFRS 16 IE6 |

|

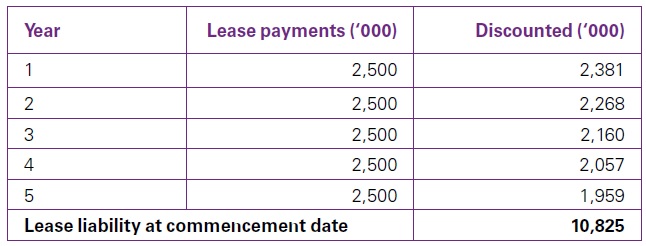

Company Y rents an office building. The lease term is five years and the initial annual rental payment is 2.5 million. Payments are made at the end of each year. The rent will be reviewed every year and increased by the change in the CPI. The discount rate is 5%. Initial measurement of the lease liability To measure the lease liability on commencement, Y assumes an annual rental of 2.5 million.

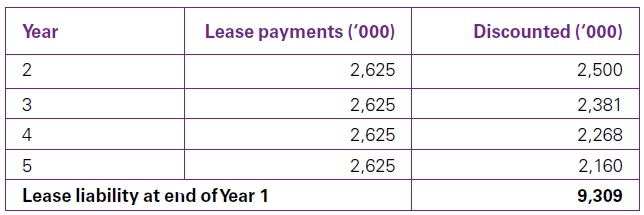

Subsequent reassessment of lease liability During Year 1, the CPI increases from 100 to 105 (i.e. the rate of inflation over the preceding 12 months is 5%). Because there is a change in the future lease payments resulting from a change in the CPI, which is used to determine those lease payments, Y needs to remeasure the lease liability. At the end of Year 1, Y calculates the lease payment for Year 2 as 2.6 million (2.5 million x (105 / 100)). Accordingly, Y remeasures the lease liability as follows. The subsequent remeasurement of the lease liability is adjusted against the right-of-use asset.

|

|

Worked example – Amortisation of lease liability and change in payment linked to an index |

| Lessee Y enters into a lease for a five-year term with Lessor L for a retail building, commencing on 1 January. Y pays 155 per year, at the end of each year.

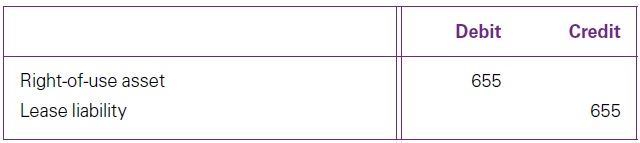

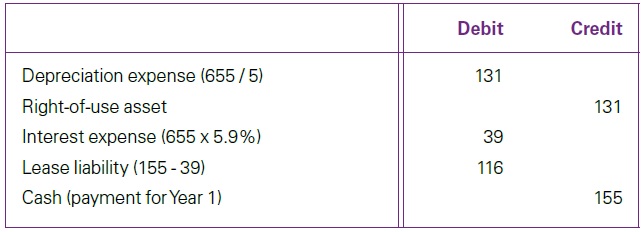

Y’s incremental borrowing rate is 5.9%. Additionally, the lease contract states that the lease payments for each year will increase on the basis of the increase in the CPI for the preceding year. At the commencement date, the CPI for the previous year is 120 and the lease liability is 655, based on annual payments of 155 discounted at 5.9%. Assume that initial direct costs are zero and there are no lease incentives, prepayments or restoration costs. Y records the following entries for Year 1.

To recognise lease at commencement date

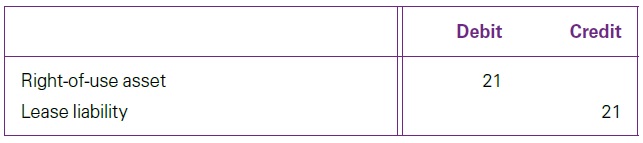

To recognise payment and expense for Year 1 Subsequent reassessment of lease liability at end of Year 1 At the end of Year 1, the CPI increases to 125. Y calculates the revised payments for Year 2 and beyond, adjusted for the change in CPI as 161 (155 x 125 / 120). Because the lease payments are variable payments that depend on an index, Y adjusts the lease liability to reflect the change based on an unchanged discount rate. The adjustment is calculated as the difference between the original lease payments (155) and the reassessed payment (161) over the remaining four-year lease term, discounted at the original discount rate of 5.9%.

To recognise remeasurement at end of Year 1 |

| What common types of indices do lease payments depend on? | ||||||

|

In practice, it is common for lease agreements to include periodic rent review clauses that depend on a published index. These clauses adjust contracted lease payments to reflect changes in inflation measures and other factors. Common indices used include the following.

|

||||||

|

When does the guidance apply? |

||||||

|

The guidance described above applies only when the lease payments depend on the future – i.e. uncertain – level of an index. It does not apply to fixed uplifts designed to reflect expected changes in an index. Consider two different rent adjustment clauses, as follows.

|

What if a rent review mechanism contains an embedded derivative?

Under IFRS, derivatives embedded in a lease that are considered not closely related to the lease host have to be separated and accounted for under IFRS 9 Financial Instruments. This is because although IFRS 16 includes requirements for features of a lease that may meet the definition of a derivative (e.g. options), the new standard was not developed with accounting for derivatives in mind (IFRS 16.BC81).

As an example, a lease agreement with variable lease payments adjusted for two times the change in CPI needs to be separated and accounted for under IFRS 9 because the feature is considered leveraged.

Conversely, an inflation-indexed embedded derivative in a lease contract may be considered closely related to the lease if:

- the index relates to inflation in the country in which the leased asset is operated; and

- the feature is not leveraged.

In this case, the feature is not separated and, instead, the whole payment is accounted for under IFRS 16.

Payments that depend on a rate

Consistent with payments that depend on an index, variable lease payments that depend on a rate are initially measured using the rate as at the commencement date of the lease (IFRS 16.27(b), IFRS 16.39, IFRS 16.42(b)).

The lease liability is subsequently remeasured if the variable lease payments change as a result of a change in the relevant rate (e.g. LIBOR).

The lessee remeasures the liability using an unchanged discount rate when the change in future lease payments results from a change in a rate, with the exception of floating interest rates (IFRS 16.42(b), IFRS 16.43).

In the case of a floating interest rate, the lessee revises the discount rate for the change in the interest rate.

| Worked example – Payments that depend on a rate: Initial measurement and subsequent remeasurement |

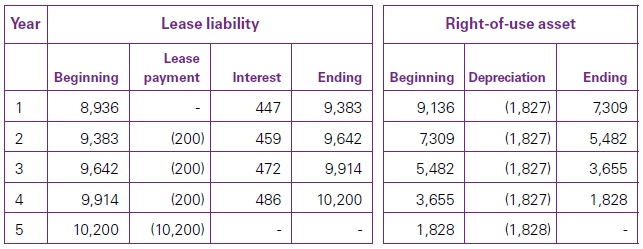

Lessee C enters into a five-year lease of a car. The lease payments are paid at the beginning of each year and are determined as follows.

Initial measurement of the lease liability On commencement, C determines the lease liability as follows.

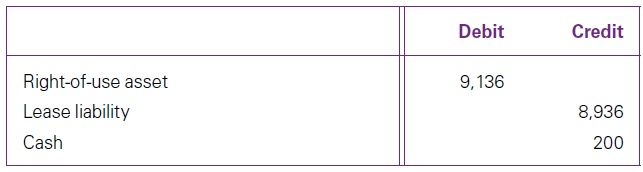

At commencement, C makes the payment for Year 1 and then measures the lease liability and right-of-use asset as follows.

At commencement, C records the following entry.

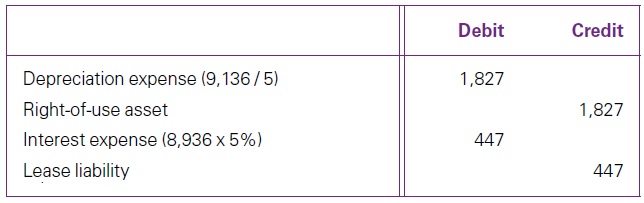

To recognise lease at commencement date At the end of Year 1, C records the following entries.

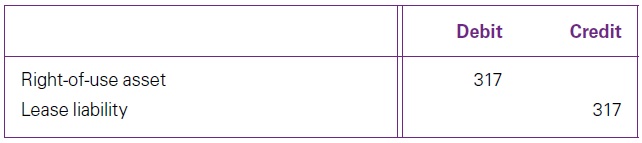

To recognise depreciation and interest expense for Year 1 At the beginning of Year 2, LIBOR increases to 2.5%. Using a revised discount rate of 4.5%, B remeasures the lease liability and right-of-use asset, and then makes payment for Year 2.

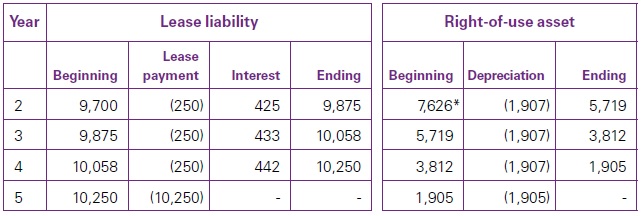

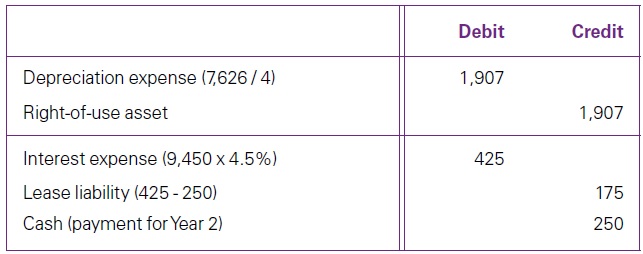

* The right-of-use asset is measured as the balance on commencement (9,136) less depreciation in Year 1 (1,827) plus the adjustment for remeasurement of the lease liability (317). Subsequent reassessment of the lease liability – Year 2 Because the lease payments are determined using LIBOR at the date of payment, the lease payment for Year 2 is 250 (10,000 x 2.5%). C records the following entries during Year 2.

To recognise remeasurement of lease liability at beginning of year 2

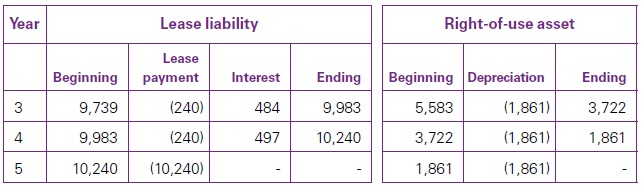

To recognise payment and depreciation for Year 2 Subsequent reassessment of the lease liability – Year 3 At the start of Year 3, LIBOR decreases to 2.4% and C’s discount rate is revised to 5.1%. C remeasures its lease liability and right-of-use asset, and then makes payment for Year 3.

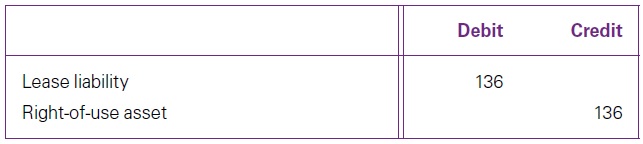

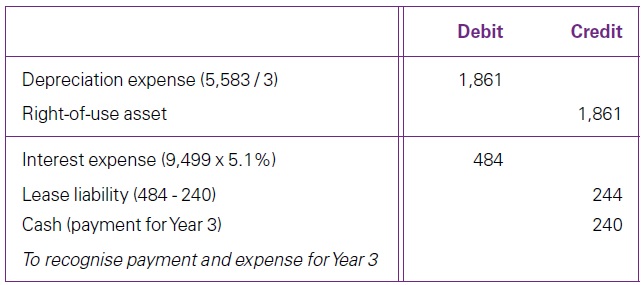

During Year 3, C records the following entries.

To recognise remeasurement of lease liability at beginning of year 3

To recognise payment and expense for Year 3 |

Lessor considerations

There are no differences in the identification of lease payments for lessees and lessors regarding lease payments that depend on an index or a rate, though the accounting consequences may be different due to the different accounting models for lessees and lessors.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments Lease payments