Last Updated on 15/10/2025 by 75385885

IFRS 13 Significant Judgments and Estimates – Fair value is one of the most discussed measurements in modern financial reporting. IFRS 13 establishes a single framework for fair-value measurement across all IFRS standards and defines both the principle and the disclosure of the judgments and estimates that make it work. In theory, fair value is an objective market price. In practice, it is a carefully constructed number, anchored in assumptions about markets, participants, timing, and data quality. Understanding the standard therefore means understanding where judgment enters the model.

Where it bites

IFRS 13 bites wherever observable market data fade and professional estimation begins. This occurs in valuation of unlisted equity, derivatives with complex optionality, structured debt, investment property, biological assets, and financial instruments during stressed markets. Even within Level 2 hierarchies, management must decide which prices are orderly, which inputs remain observable, and whether adjustments are required for liquidity or credit risk. The further the model moves from traded prices, the higher the need for transparent disclosure of the reasoning behind it. IFRS 13 does not remove judgment; it standardises it.

Why it matters

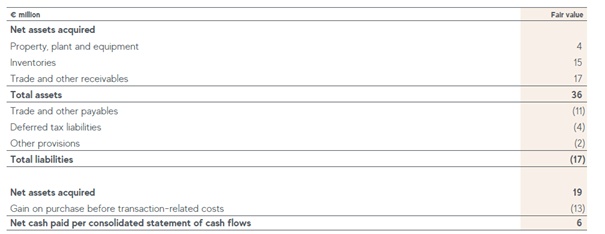

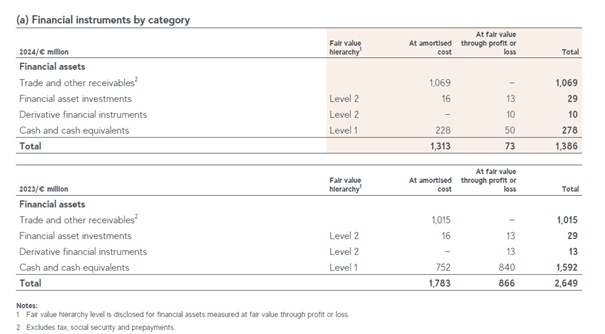

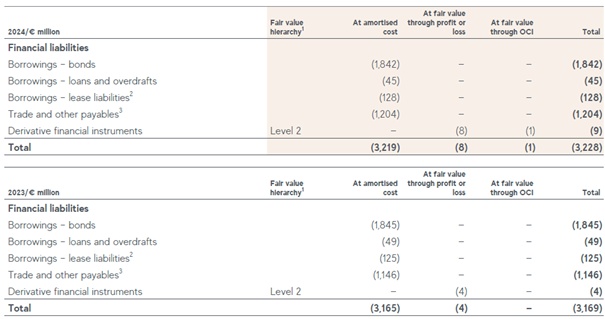

Fair-value decisions shape profit, equity, and key ratios. A small change in discount rate can move impairment charges by millions. Because fair value is used across multiple standards—IFRS 9 for financial instruments, IFRS 16 for leases, IFRS 3 for business combinations, IAS 40 for investment property—the integrity of IFRS 13 judgments underpins consistency throughout financial reporting. Investors and regulators rely on the note disclosures in IFRS 13.93–99 to assess whether reported values are reliable or merely convenient. The standard’s discipline forces preparers to show how they reached their conclusions and how sensitive those conclusions are to change.

Read the standard IFRS 13 Fair value measurement at ifrs.org

Judgment areas under IFRS 13 Significant Judgments and Estimates

- Unit of account: Whether the asset or liability is measured individually or as part of a group affects valuation technique and market assumption (IFRS 13.14–16).

- Principal or most advantageous market: The market with the highest volume and activity normally defines fair value, but entities must prove access to that market (13.19–20).

- Valuation technique: Market, income, or cost approach (13.61–66) depending on data availability and nature of the asset.

- Input hierarchy: Observable (Level 1–2) versus unobservable (Level 3) inputs (13.72–90).

- Non-performance risk: Credit standing of both counterparty and the entity itself (13.42).

- Orderly transaction assessment: Especially under volatile conditions (13.B37–B43).

- Highest and best use: For non-financial assets, whether current use is the highest and best use from a market-participant perspective (13.27–33).

Each area contains embedded judgments about markets, assumptions, and models that require explanation under IAS 1 §122–125 or IFRS 18 §115–119.

Practical examples

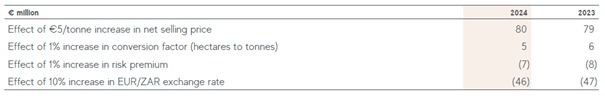

Technology and Level 3 inputs. When Apple or Siemens values equity stakes in private suppliers, there are no market quotes. Valuation uses income approaches—discounted cash-flow or option models—calibrated to observable transactions. The selection of discount rate, growth rate, and volatility is judgment-heavy. IFRS 13.93(h)–(i) require disclosure of quantitative information about significant unobservable inputs and sensitivity to reasonably possible changes.

Industrial projects and bespoke equipment. Airbus, Rolls-Royce, or Philips often deal with assets so specific that only internal cash-flow forecasts exist. They must justify that the valuation reflects market-participant assumptions, not entity-specific expectations (13.22). Sensitivity analysis becomes the language of credibility.

Financial institutions. Banks continuously assess whether market spreads reflect orderly transactions. During crises, trading may occur at distressed prices. IFRS 13 allows management to disregard those quotes if evidence shows they are not orderly, but such a judgment must be documented and disclosed (13.B43).

What’s the judgment or estimate

Judgment enters first in model selection. A preparer decides whether to apply a market approach (comparable prices), an income approach (present value of future cash flows), or a cost approach (replacement cost). This decision shapes every subsequent input.

Next come estimates: the numerical assumptions—growth rates, discount rates, credit spreads, yield curves, volatilities. Each must reflect market-participant assumptions at the measurement date. IFRS 13 distinguishes between the choice of model (a judgment) and the measurement within the model (an estimate). IAS 1 §122–125 require disclosure of both when they have a significant effect on the statements.

Another recurring judgment is identifying the principal market. For global groups quoted on several exchanges, determining which market has the greatest volume and activity can shift values and FX effects. Entities must justify that choice with data, not convenience.

When prices are stale or missing, management estimates the orderliness of transactions. IFRS 13 B37–B43 require consideration of volume, spreads, and information about forced sales. The line between active and inactive markets is never bright; the judgment must be transparent.

Read a presentation made for the World Bank Group – Fair Value measurement IFRS 13.

IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates

Disclosure requirements

IFRS 13.91–99 set out a robust disclosure regime intended to make judgments visible. Key requirements include:

- Valuation techniques and inputs used (13.93 d–e);

- Level in the hierarchy for each class of asset or liability (13.93 b);

- Transfers between levels and the reasons (13.93 c);

- Quantitative information about significant unobservable inputs for Level 3 (13.93 h);

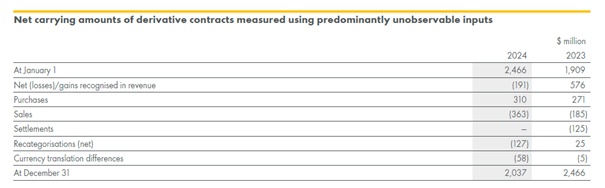

- Reconciliation of opening and closing Level 3 balances (13.93 f);

- Sensitivity analysis for reasonably possible changes in unobservable inputs (13.93 i).

IAS 1 and IFRS 18 build on this by requiring explanation of significant judgments and estimation uncertainty that could materially affect future periods. The two standards operate together: IFRS 13 provides the numbers; IAS 1 / IFRS 18 provide the narrative.

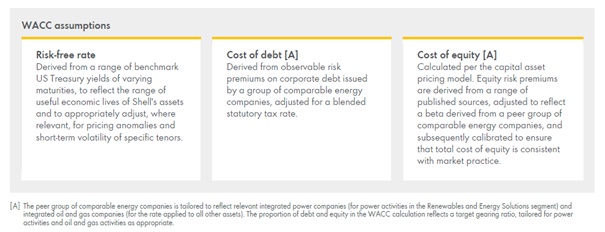

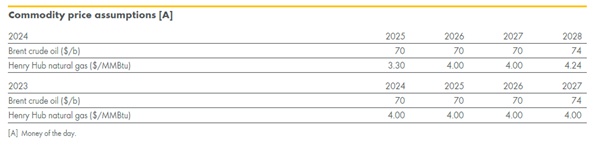

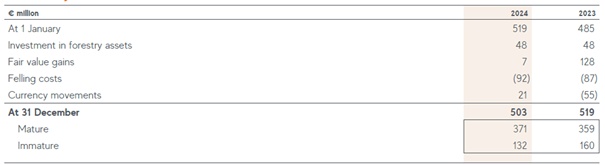

Example 1: Shell plc (Oil & Gas / Energy) — 2024

Governance and internal control

Behind every fair-value number stands a governance process. IFRS 13 implicitly assumes robust internal control over financial reporting. Entities typically maintain valuation policies approved by the board or audit committee. Common control activities include:

IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates

- Model validation by independent risk or finance teams;

- Periodic back-testing against market outcomes;

- Documented approval of key assumptions;

- Segregation between trading desks and valuation units;

- Independent price verification for Level 2 instruments.

Link with IAS 1 and IFRS 18

IAS 1 §122–133 (and IFRS 18 §115–119 once effective) form the backbone of disclosure on judgments and estimates. For IFRS 13 measurements this means:

- Explaining how management determined that market data were observable;

- Describing why certain inputs or markets were chosen;

- Quantifying how sensitive the valuation is to those assumptions;

- Identifying which judgments could change materially within the next reporting year.

IFRS 18 encourages integrated disclosure—linking valuation inputs with related performance measures or risk factors instead of isolating them in a technical note. Cross-referencing also prevents duplication. Many entities provide a table of Level 3 sensitivities in the IFRS 13 note and cross-refer to “Key sources of estimation uncertainty” under IAS 1 §125, ensuring consistent language.

IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates IFRS 13 Significant Judgments and Estimates

Where governance meets communication

The audit committee’s oversight role bridges the technical and the communicative sides of IFRS 13. Committees ensure that fair-value assumptions reflect market evidence and that disclosure reflects reality, not optimism. Transparent discussion of valuation sensitivities—especially in private-equity or infrastructure funds—strengthens stakeholder confidence. Inconsistent or opaque language erodes it quickly.

Emerging issues

Fair value is evolving with markets. Three developments are shaping future IFRS 13 practice:

- Data automation and AI. Machine-learning tools now gather and calibrate Level 2 data in real time. While efficiency increases, IFRS 13 still requires human oversight—management remains responsible for ensuring inputs are observable, relevant, and unbiased.

- ESG and carbon pricing. The rise of emissions-trading schemes introduces new fair-value classes. Valuation of carbon credits or environmental liabilities applies IFRS 13 principles but relies on immature markets, increasing judgment intensity. Entities must disclose how they assess market depth and volatility.

- Sustainability-related fair value. Integration with CSRD and ESRS frameworks may extend the fair-value concept to non-financial capitals—natural, social, or human. IFRS 13’s hierarchy and disclosure logic provide a ready template for those emerging valuations.

- Market stress and disorderly trades. Episodes of illiquidity—pandemic, war, rapid rate hikes—test the boundary between fair value and forced sale. The lesson: document, disclose, and avoid mechanical mark-to-market when markets cease to function.

In all these trends, the constant principle remains that management must measure what a knowledgeable, willing market participant would pay or receive. Judgment is inevitable; transparency is optional—but required by IFRS 13.

FAQs – Significant Judgments and Estimates

Q1. What constitutes a “significant unobservable input” under IFRS 13, and when is a valuation considered Level 3?

A significant unobservable input is an input to a valuation technique for which observable market data is not available and must be developed by the entity (e.g. projected cash flow growth rate, discount rates for niche assets). When such inputs have a material effect on the fair value measurement, the valuation is classified as Level 3 per IFRS 13.72–90.

Q2. How should transfers into or out of Level 3 be treated in disclosures?

Transfers between levels must be disclosed (IFRS 13.97). The entity should explain the reasons for transfers (e.g. increased market activity, new data becoming available), and the amounts transferred.

E.g., “During the year, fair value measurements of Investment X were transferred from Level 3 to Level 2 due to emergence of observable market quotes.”

Q3. What sensitivity disclosures are required for Level 3 measurements?

For recurring Level 3 fair values, the entity must provide a narrative sensitivity description and a quantitative sensitivity analysis showing how fair value would change if the unobservable inputs were modified in a reasonably possible way.

Q4. When is it reasonable to use proxy or comparable market data in valuation?

When identical market data is unavailable, entities may use analogous or proxy data (e.g. comparable transactions) and adjust them to reflect the subject asset’s characteristics.

The adjustments must be justifiable, documented, and reflect what market participants would do. The use of proxies is more defensible when supplemented by cross-checks and sensitivity analysis.

Q5. Does IFRS 13 require sensitivity disclosures for Level 1 and Level 2 measurements?

No. The sensitivity disclosure requirement (narrative + quantitative) specifically applies to Level 3 measurements using significant unobservable inputs.

For Level 1/2 measurements, the assumption is that observable inputs dominate, so such sensitivity disclosures are not required under IFRS 13.

Q6. How do we ensure comparability and consistency of fair value judgments over time?

Preparers should:

– Use consistent valuation techniques and input selection across periods unless changes are justified

– Disclose reasons for changes in assumptions or methods

– Benchmark assumptions to observable data or external evidence

– Document governance, reviews, and validation activities

– Provide clear sensitivity disclosures so users can see how changes in assumptions would affect value