EPS Impact of share-based payments

Because share-based payments are common and they impact EPS, it is important to understand how IFRS 2 interacts with IAS 33. Accordingly, this narrative starts with an alternative IFRS 2 perspective and discusses the EPS implications of each type of arrangement under IFRS 2.

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

For details on the specific EPS implications of particular types of instrument, this chapter may need to be read in conjunction with the chapter on those specific instruments. For example, for a number of the instruments described in other chapters, the treasury share method is used in calculating diluted EPS. The general principles underlying the treasury share method are explained in detail in here, and the additional implications of applying the treasury share method to share-based payment instruments are further explained in 1.3 below.

Simply put, share-based payments are generally transactions in which an entity acquires goods or services (including employee services) in exchange for its (or another group entity’s) equity instruments or a liability that is based on the price or value of its (or another group entity’s) equity instruments. There are three main factors to be considered in assessing how a share-based payment will affect EPS.

|

IFRS 2 Conditions |

Analysis |

|

Settlement alternatives that drive the classification as equity– or cash-settled share-based payments under IFRS 2 |

They determine whether and how EPS is affected – e.g. if a share-based payment is a POS. |

|

They impact how a share-based payment is dealt with in EPS – e.g. as an option or as a contingently issuable share. |

|

|

It determines which other considerations might be necessary to understand the EPS implications – e.g. dividend entitlements for non-vested shares or exercise prices for options. |

1. IFRS 2 Settlement alternatives

Contingently issuable POSs

Contingently issuable POSs are not specifically defined in IAS 33, but they are closely related to contingently issuable ordinary shares (see Other contingencies in EPS and Contingently issued ordinary shares). These are POSs that are issuable for little or no cash or other consideration on the satisfaction of specified conditions. An example is a contingently issuable convertible instrument. [IAS 33.57]

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

EPS implications

Generally, by their nature contingently issuable POSs do not impact basic EPS. However, these instruments generally do impact diluted EPS and, similar to contingently issuable ordinary shares, their impact depends on the extent to which the specified conditions are met at the reporting date.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator is not affected, the denominator might or might not be affected. |

The numerator might or might not be affected, the denominator is affected. |

|

By their nature, contingently issuable POSs are generally ignored in basic EPS. This is because, on satisfying the specified conditions, POSs – as opposed to ordinary shares – will be issued, and these would not generally result in outstanding ordinary shares until they are exercised or otherwise converted. However, if any options that are contingently issuable can be exercised immediately for little or no further consideration, then the resulting options are included in the denominator from the vesting date (see EPS Implications). |

IAS 33 prescribes a two-step approach for determining whether a contingently issuable POS is included in diluted EPS. [IAS 33.57] Step i. Should the contingently issuable POS be assumed to be issuable? This is the same assessment as that for contingently issuable ordinary shares (see EPS Implications and How to apply the test for different conditions in a contingent share agreement) – i.e. if the reporting date were the end of the contingency period, then would the POS be issuable? If the instrument passes the test in Step (i), then Step (ii) is applied. Step ii. What is the impact on diluted EPS? This is different from the requirements for contingently issuable ordinary shares. As opposed to including in the denominator the number of ordinary shares that would be issuable, the impact is determined based on the relevant guidance in IAS 33 for the type of POS in question – that is:

|

Dilutive or anti-dilutive?

Ordinary shares issued and EPS

Ordinary shares issued and EPS summarises the effects of three events involving share issued on EPS calculations including comprehensive examples:

- Ordinary shares issued to settle liabilities,

- Ordinary shares issued to acquire assets, and

- Ordinary shares issued to acquire a business.

Ordinary shares issued to settle liabilities

This chapter deals with ordinary shares issued to fully or partially extinguish a financial or non-financial liability, as a result of a renegotiation of the terms of the liabilities.

This chapter does not deal with:

- the issuance of ordinary shares to settle financial liabilities that have an option of conversion to shares. For further discussion of this scenario, see the following chapters:

- options, warrants and their equivalents: check it here;

- written put options and forwards: check it here; and

- convertible instruments: check it here; and

- the issuance of ordinary shares subject to conditions other than the passage of time: see Unvested ordinary shares and Contingently issuable ordinary shares.

EPS implications

Generally, ordinary shares issued to settle liabilities impact only basic EPS.

Preference shares in EPS Calculations

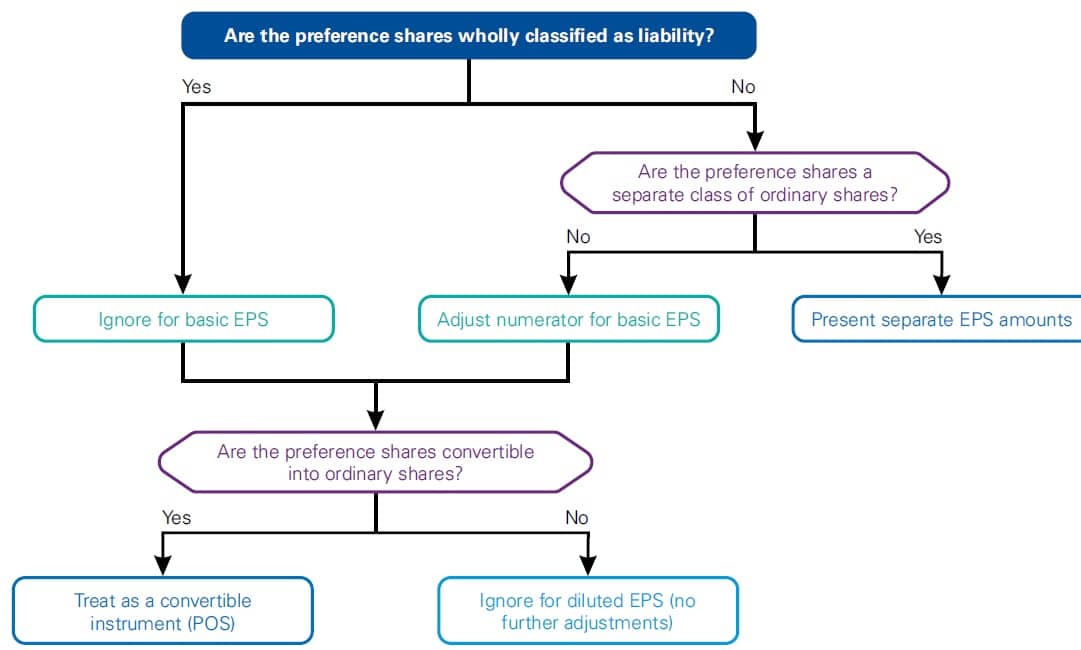

Preference shares may in accordance with IAS 32 Financial Instruments: Presentation be classified as a whole or by their component parts into a financial liability and/or an equity instrument, depending on their terms. They may be convertible into ordinary shares.

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

An entity needs to consider whether equity-classified preference shares are a class of ordinary shares. If the entity has more than one class of ordinary shares, then it is required to present EPS for each class. Ordinary shares of the same ‘class’ are those shares that have the same right to receive dividends or otherwise share in the profit for the period. Additional considerations for classes of ordinary shares are set out below in classes of ordinary shares. [IAS 33.5–6]

EPS implications

Generally, how preference shares are dealt with in EPS depends on their accounting classification as liabilities or equity instruments, and whether they are convertible into ordinary shares.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator might or might not be affected and the denominator is not affected. |

The numerator and the denominator might or might not be affected. |

|

Preference shares that are wholly classified as liabilities under IAS 32 are not ordinary shares. The returns to the holders of these shares – e.g. post-tax amounts of preference dividends – have generally been recognised in profit or loss and therefore no further adjustment to the numerator is necessary. [IAS 33.13] For preference shares that are wholly or partly classified as equity instruments under IAS 32, the numerator is adjusted for any returns to the holders of these shares, which include the post-tax amounts of preference dividends and any differences arising on settlement. For additional considerations and examples of adjustments for equity-classified preference shares in basic EPS. [IAS 33.12] In addition, separate disclosure of EPS amounts is required for equity-classified preference shares that form a separate class of ordinary shares. [IAS 33.66] |

Preference shares that are convertible into ordinary shares, other than those that are mandatorily convertible, are POSs (see Convertible instruments). For equity-classified convertible preference shares, the potential adjustment:

Conversion is assumed to have occurred at the beginning of the period (or, if later, the date of issuance of the convertible preference shares). For liability-classified convertible preference shares, the potential adjustment:

Conversion is assumed to have occurred at the beginning of the period (or, if later, the date of issuance of the convertible preference shares). For an example of adjustments for convertible instruments containing a liability component, see contracts settled in shares or cash. |

Dilutive or anti-dilutive?

Generally, a convertible preference share is anti-dilutive whenever the amount of the dividend on such shares declared in or accumulated for the current period and any other required adjustment to the numerator per ordinary share obtainable on conversion exceeds basic EPS from continuing operations. [IAS 33.50]

Classes of ordinary shares

If an entity has more classes of ordinary shares, then EPS is disclosed for each class of ordinary shares that has a different right to share in the profit for the period. Therefore, for an entity that applies IAS 33, it is important to identify which of the instruments in issue are ordinary shares and to determine if there is more than one class of ordinary shares. (IAS 33.66)

IAS 33 defines an ‘ordinary share’ as ‘an equity instrument that is subordinate to all other classes of equity instruments’. It also explains that ordinary shares participate in profit for the period only after other types of shares such as preference shares have participated, and that ordinary shares of the same class are those shares that have the same right to receive dividends or otherwise share in the profit for the period. (IAS 33.5–6)

If an entity has shares with different rights, then it considers whether all of the shares are in fact ordinary shares. Consider the following contrasting examples.

|

Case – Two classes of ordinary shares |

|

Company X has two classes of shares, A and B. The holders of class B shares are entitled to dividends equal to 50% of any dividends declared on the class A shares, but the shares are otherwise identical to class A shares. Both classes are subordinate to all other classes of equity instruments with respect to participation in profit. In this case, X concludes that both class A and class B shares are ordinary shares despite the difference in entitlement to dividends. Disclosure of separate EPS amounts is therefore required for both class A and class B ordinary shares. |

In general, an entity is not required to present separate EPS information for participating preference shares that are not considered to be a separate class of ordinary shares.

|

Case – Participating preference shares that are not ordinary shares |

|

Company C has two classes of shares, X and Y. Shareholders of class X are entitled to a fixed dividend per share and have the right to participate in any additional dividends declared. The class Y shareholders participate equally with class X shareholders with respect to the additional dividends only. In this example, C concludes that class X shares are not considered to be ordinary, because the fixed entitlement creates a preference over the class Y shares, and the class Y shareholders are subordinate to the class X shareholders. This is even if both classes participate equally in the residual assets of C on dissolution. The class Y shares are the only class of ordinary shares, and therefore the only class of shares for which disclosure of EPS information is required. However, the participating rights of each class of these shares should be considered in determining earnings attributable to ordinary shareholders. |

In general, puttable instruments that qualify for equity classification instead of financial liability classification under IAS 32 Financial Instruments: Presentation are not ordinary shares for the purposes of IAS 33. We believe that it is not appropriate to apply by analogy the limited scope exemption under IAS 32 for EPS calculation purposes. (IAS 32.16A–16F)

The EPS presentation is not required for, or as a result of the existence of, such instruments. However, when determining the earnings that are attributable to the ordinary shareholders, the terms of these instruments should be evaluated to determine if they are participating instruments.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations

Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations Preference shares in EPS Calculations

Preference shares in EPS Calculations

Contingently issuable ordinary shares

For EPS purposes, contingently issuable ordinary shares are ordinary shares issuable for little or no cash or other consideration on the satisfaction of specified conditions in a contingent share agreement. [IAS 33 Definition]

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

These conditions do not include service conditions under IFRS 2 Share-based Payment and the passage of time. Therefore, shares that are issuable subject only to the passage of time, and unvested shares and options that require only service for vesting, are not considered contingently issuable. A different set of requirements applies to shares that are subject only to a service condition for vesting (see Unvested ordinary shares and EPS). [IAS 33.21(g), IAS 33.24, IAS 33.48]

Contingently issuable ordinary shares, as discussed in this chapter, are commonly seen in the context of share-based payment arrangements with performance conditions (including market and non-market performance conditions), or contingent consideration in business combinations. Additional considerations in the context of share-based payment arrangements are set out in EPS Impact and Share-based payments.

Although it is not specifically defined in IAS 33, a related class of instruments is contingently issuable POSs (see Contingently issuable ordinary shares).

EPS implications

EPS Calculation

Here is full example of an EPS Calculation. This narrative builds on the basic principles introduced in the narrative EPS, and sets out the specific basic and diluted EPS calculation rules as per IAS 33 Earnings per share.

Case

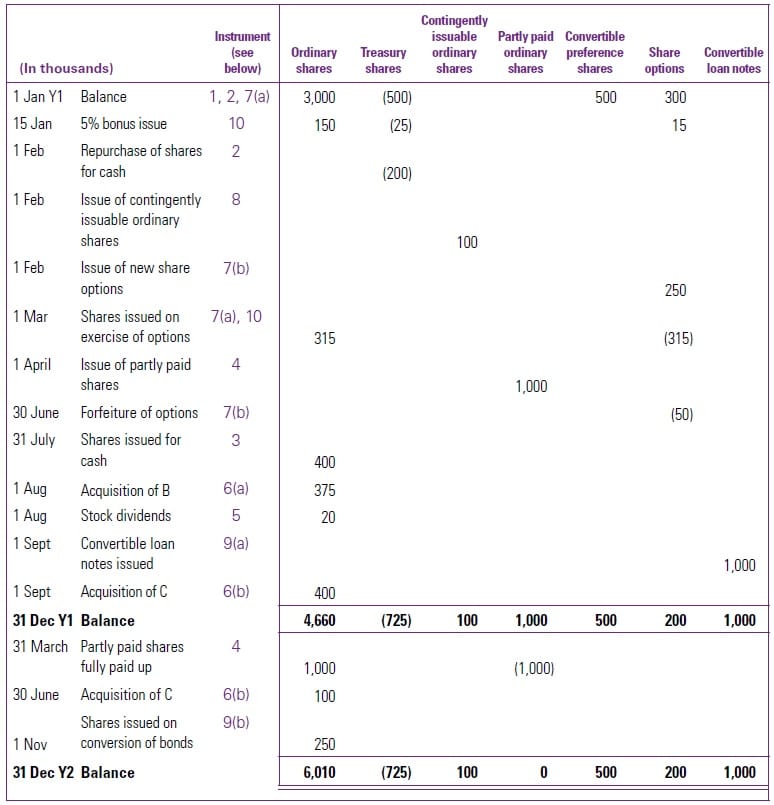

Company P earns a consolidated net profit of 4,600,000 during the year ended 31 December Year 1 and 5,600,000 during the year ended 31 December Year 2. The total number of ordinary shares outstanding on 1 January Year 1 is 3,000,000.

Various POSs are issued before 1 January Year 1 and during the years ended 31 December Year 1 and Year 2. During this period, the outstanding number of ordinary shares also changes.

The statement of changes in equity below summarises only the actual movements in the outstanding number of ordinary shares, followed by detailed information about such movements and POSs outstanding during the periods.

Details of the instruments and ordinary share transactions during Year 1 and Year 2

1. Convertible preference shares

At 1 January Year 1, P has 500,000 outstanding convertible preference shares. Dividends on these shares are discretionary and non-cumulative. Each preference share is convertible into two ordinary shares at the holder’s option.

The preference shares are classified as equity in P’s financial statements.

On 15 October Year 1, a dividend of 1.20 per preference share is declared. The dividend is paid in cash on 15 December Year 1. Preference dividends are not tax-deductible.

Stock dividends

Stock dividends are dividends paid to the ordinary shareholders of an entity in the form of additional ordinary shares rather than in cash. They may also be referred to as ‘scrip dividends’, or ‘share dividends’, and they may or may not have a cash alternative. IAS 33 EPS Calculations

This narrative builds on the basic principles introduced in the narrative EPS, and sets out the specific basic and diluted EPS implications of the following types of instrument(s). IAS 33 EPS Calculations

EPS implications

Generally, how stock dividends are dealt with in EPS depends on whether the investor has a cash alternative.

EPS (Earnings per share)

EPS measures are intended to represent the income earned (or loss incurred) by each ordinary share during a reporting period and therefore provide an indicator of reported performance for the period.

The EPS measure is also widely used by users of financial statements as part of the price-earnings ratio, which is calculated by dividing the price of an ordinary share by its EPS amount. This ratio is therefore an indicator of how many times (years) the earnings would have to be repeated to be equal to the share price of the entity.

Users of financial statements also use the EPS measure as part of the dividend cover calculation. This measure is calculated by dividing the EPS amount for a period by the dividend per share for that period. It therefore provides an indication of how many times the earnings cover the distribution being made to the ordinary shareholders.

Basic EPS and diluted EPS are presented by entities whose ordinary shares or potential ordinary shares (POSs) are traded in a public market or that file, or are in the process of filing, their financial statements for the purpose of issuing any class of ordinary shares in a public market. (IAS 33.2)

Basic EPS and diluted EPS for both continuing and total operations are presented in the statement of profit or loss and OCI, with equal prominence, for each class of ordinary shares that has a differing right to share in the profit or loss for the period. (IAS 33.66-67A)

Separate EPS information is disclosed for discontinued operations, either in the statement of profit or loss and OCI or in the notes to the financial statements. (IAS 33.66-68A)

Basic EPS is calculated by dividing the profit or loss attributable to ordinary shareholders by the weighted-average number of ordinary shares outstanding during the period. (IAS 33.10)

Options in EPS Calculations, warrants and their equivalents

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

For EPS purposes, ‘options, warrants and their equivalents’ (collectively, ‘options’ in this chapter) are financial instruments that give holders the right to purchase ordinary shares. Options in this chapter are generally written calls that give holders the right, but not the obligation, to acquire an entity’s ordinary shares with cash and/or by providing goods or services. If an entity receives goods or services in exchange for the options, then the transaction generally falls in the scope of IFRS 2 Share-based Payment; other options are generally in the scope of IAS 32 Financial Instruments: Presentation. [IFRS 2.2, IAS 33.5]

In addition, the options discussed in this chapter are those that may require settlement in ordinary shares. An option that is always settled net in cash does not entitle its holder to ordinary shares; this option is therefore not a POS and is ignored in diluted EPS. [IAS 33.5]

This chapter covers the EPS implications for options in general. Some instruments may require additional consideration, which are set out in the following chapters:

Contracts settled in shares or cash

Contracts that may be settled in shares or in cash deals with contracts that contain settlement alternatives at the issuing entity’s or the holder’s option. An example of such contracts is a share warrant that can be settled either gross in ordinary shares or net in cash.

If the contract falls under IFRS 2 Share-based Payment, then the classification depends on which party holds the settlement choice. If the issuing entity has that choice, then the contract is classified wholly as either equity-settled or cash-settled, depending on whether the entity has a present obligation to settle in cash. If the counterparty has the choice of settlement, then the contract is classified as a compound instrument. [IFRS 2.34–43]

If such a contract falls in the scope of IAS 32 Financial Instruments: Presentation, then it can contain a derivative, a liability and/or an equity component, depending on its terms. For example, a conversion option in a convertible bond that on exercise can be settled in shares or net in cash would generally mean that the whole instrument is a liability. [IAS 32.26–27, IAS 33.IE8]

This narrative covers the EPS implications of contracts that may be settled in shares or in cash in general. Additional considerations in the context of specific instruments are set out in the following chapters:

- instruments under share-based payment arrangements: see Chapter 5.17; and

- convertible instruments: see Chapter 5.11.