Last update 28/10/2019

IAS 2 Example Contractual volume rebates provides an example calculation with regard to the costs of inventory in combination with contractual volume rebates.

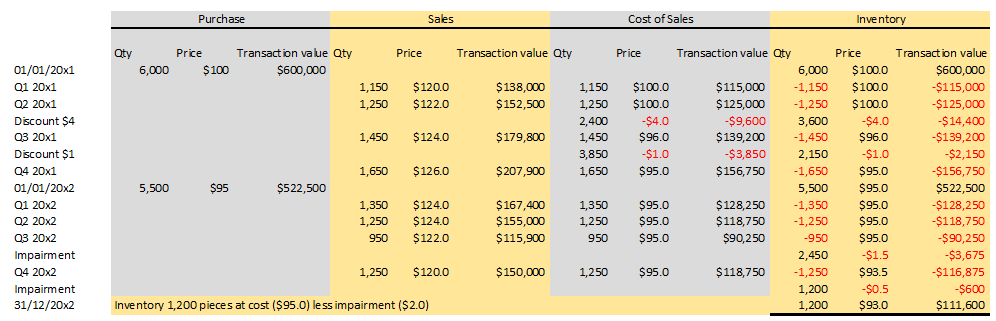

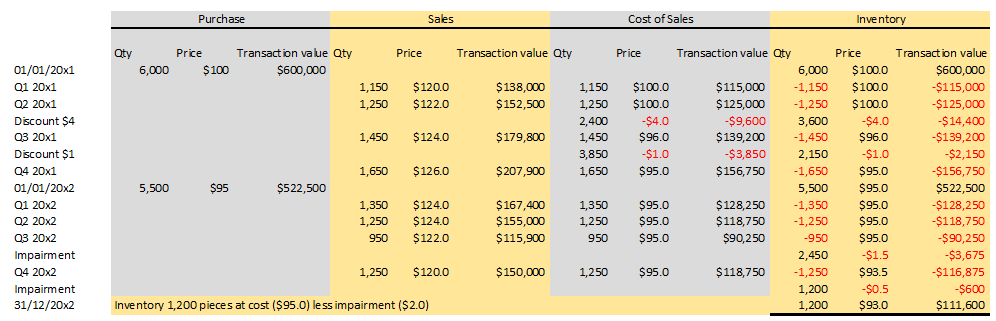

The Case

On 1 January 20X1 Entity A, a retailer, enters into a 2-year contract with a supplier of product X. Under the agreement, Entity A purchases product X for $100 per item. The agreement provides that Entity A will receive a $5 rebate for each purchased item (applied retrospectively to all purchases) if it purchases at least 10,000 products over the 2-year contract term. On 1 January 20X1, Entity A purchased 6,000 products. Sales to customers were 5,500 (Q1 1,150, Q2 1,250, Q3 1,450, Q4 1,650), the sales price was increased every quarter with $2/product, starting at $120/product for Q1. At 31 December 20X1 Entity A assess that it is probable that it will earn the rebate as the sale of product X accelerated during the second half of the 20X1. The total estimated sales quantity for the two year period is 11,250. The rebate is contractual, therefore Entity A accrues it in its financial statements for the year 20X1.

1 January 20X1 IAS 2 Example Contractual volume rebates

|

Purchase of 6,000 products |

DT |

CT |

|

BS – Inventory |

$600,000 |

|

|

BS – Trade accounts payable |

$600,000 |

Q 1 20X1

|

Sales of 1,150 items of product X at $120/product Revenue recognition at a point in time |

DT |

CT |

|

BS – Trade accounts receivable |

$138,000 |

|

|

PL – Revenue |

$138,000 |

|

|

PL – Cost of sales 1,150 * $100 |

$115,000 |

|

|

BS – Inventory |

$115,000 |

Based on the realised sales and forecasts for the rest of the year it is not considered probable that the discount volume of 10,000 pieces for the two years will be reached. IAS 2 Example Contractual volume rebates

Q 2 20X1

|

Sales of 1,250 items of product X at $122/product |

DT |

CT |

|

BS – Trade accounts receivable |

$152,500 |

|

|

PL – Revenue |

$152,500 |

|

|

PL – Cost of sales 1,250 * $100 |

$125,000 |

|

|

BS – Inventory |

$125,000 |

Based on the realised sales (Q1 plus Q2 one-on-one extrapolated is 9,600 pieces for the two years, with Q2 almost 9% higher then Q1) and forecasts for the rest of the year it is estimated 80% probable that the discount volume of 10,000 pieces for the two years will be reached.

Estimated discount calculation/recording

Sold 1,150 (Q1) plus 1,250 (Q2) = 2,400, total purchase 6,000 => 3,600 in stock. Discount $5 * 80% = $4: IAS 2 Example Contractual volume rebates IAS 2 Example Contractual volume rebates IAS 2 Example Contractual volume rebates

|

Discount entry |

DT |

CT |

|

Discount receivable 6,000 * $4 |

$24,000 |

|

|

Inventory 3,600 * $4 |

$14,400 |

|

|

Cost of sales 2,400 * $4 |

$9,600 |

Q 3 20X1

|

Sales of 1,450 items of product X at $124/product |

DT |

CT |

|

BS – Trade accounts receivable |

$179,800 |

|

|

PL – Revenue |

$179,800 |

|

|

PL – Cost of sales 1,450 * ($100 -/- $4) |

$139,200 |

|

|

BS – Inventory |

$139,200 |

Based on the realised sales (Q1 – Q3 one-on-one extrapolated is 10,267 pieces for the two years, with Q3 16% higher than Q2) and forecasts for the rest of the year it is estimated 100% probable that the discount volume of 10,000 pieces for the two years will be reached.

Estimated discount calculation/recording

Sold 1,150 (Q1), 1,250 (Q2) plus 1,450 (Q3) = 3,850, total purchase 6,000 => 2,150 in stock. Discount $5 already recorded is a discount of $4, adjustment $1: IAS 2 Example Contractual volume rebates IAS 2 Example Contractual volume rebates

|

Discount entry |

DT |

CT |

|

Discount receivable 6,000 * $1 |

$6,000 |

|

|

Inventory 2,150 * $1 |

$2,150 |

|

|

Cost of sales 3,850 * $1 |

$3,850 |

Q 4 20X1

|

Sales of 1,650 items of product X at $126/product |

DT |

CT |

|

BS – Trade accounts receivable |

$207,900 |

|

|

PL – Revenue |

$207,900 |

|

|

PL – Cost of sales 1,650 * ($100 -/- $5) |

$156,750 |

|

|

BS – Inventory |

$156,750 |

1 January 20X2

|

Purchase of 5,500 products |

DT |

CT |

|

BS – Inventory 5,500 * $95 (full discounted) |

$522,500 |

|

|

BS – Trade accounts payable |

$522,500 |

Q 1 20X2

|

Sales of 1,350 items of product X at $124/product |

DT |

CT |

|

BS – Trade accounts receivable |

$167,400 |

|

|

PL – Revenue |

$167,400 |

|

|

PL – Cost of sales 1,350 * $95 |

$128,250 |

|

|

BS – Inventory |

$128,250 |

Q 2 20X2

|

Sales of 1,250 items of product X at $124/product |

DT |

CT |

|

BS – Trade accounts receivable |

$155,000 |

|

|

PL – Revenue |

$155,000 |

|

|

PL – Cost of sales 1,250 * $95 |

$118,750 |

|

|

BS – Inventory |

$118,750 |

No changes in cost ($95/product), some concerns regarding impairments because of lower sales and lower sales prices!

Q 3 20X2

|

Sales of 950 items of product X at $122/product |

DT |

CT |

|

BS – Trade accounts receivable |

$115,900 |

|

|

PL – Revenue |

$115,900 |

|

|

PL – Cost of sales 950 * $95 |

$90,250 |

|

|

BS – Inventory |

$90,250 |

Based on the sales development (lowering quantities and lower sales) the entity decides to record a $1.5/product impairment (based on a market price of $95 less cost to sell of $1.5), items in stock are 2,450 (see tables below).

Impairment of inventory |

DT |

CT |

|

Cost of sales impairment of inventory to net realisable value 2,450 * $1.5 |

$3,675 |

|

|

Inventory |

$3,675 |

Q 4 20X2 IAS 2 Example Contractual volume rebates

|

Sales of 1,250 items of product X at $120/product |

DT |

CT |

|

BS – Trade accounts receivable |

$150,000 |

|

|

PL – Revenue |

$150,000 |

|

|

PL – Cost of sales 1,250 * $93.5 |

$116,875 |

|

|

BS – Inventory |

$116,875 |

Financial close 31/12/20×2 IAS 2 Example Contractual volume rebates

In December 20×2 the sales department has decided to discontinue the sale of product X. In the financial close of 31/12/20×2 the entity decide to record an additional impairment of $0.5/product (based on a market price of $95 less cost to sell of $2.0), items in stock are 1,200 (see tables below).

|

Impairment of inventory |

DT |

CT |

|

Cost of sales impairment of inventory to net realisable value 1,200 * $0.5 |

$600 |

|

|

Inventory |

$600 |

Closing inventory 1,200 pieces at cost ($95.0) less impairment ($2.0) is $ 111,600. IAS 2 Example Contractual volume rebates

Transaction summary table:

See also: The IFRS Foundation