IFRS 2 applies not only to transactions involving an entity’s own shares but also to transactions involving the shares of another group entity (i.e. group share-based payments).

Overview

In a group share-based payment:

- the ‘receiving entity’ is the entity that receives goods or services in a share-based payment transaction;

- the ‘settling entity’ is the entity that has the obligation to settle the share-based payment transaction; and

- the ‘reference entity’ is the entity whose equity instruments are granted or on whose equity instruments a cash payment is based.

A share-based payment in which the receiving entity, the settling entity and the reference entity are in the same group from the perspective of the ultimate parent is a group share-based payment in the scope of IFRS 2 from the perspective of both the receiving and the settling entities.

A share-based payment that is settled by an external shareholder is also in the scope of IFRS 2 from the perspective of the receiving entity, as long as the reference entity is in the same group as the receiving entity.

A receiving entity without any obligation to settle the transaction classifies a share-based payment transaction as equity-settled.

A settling entity classifies a share-based payment transaction as equity-settled if it is obliged to settle in its own equity instruments, and otherwise as cash-settled.

The normal recognition and measurement requirements for equity-settled and cash-settled share-based payment transactions apply.

Recharge arrangements do not affect the classification of the share-based payment.

In our view, if the recharge is clearly linked to the share-based payment, then it should be accounted for separately from the share-based payment, but as an adjustment to the capital contribution recognised in respect of the share-based payment.

If the recharge is not clearly linked to the share-based payment, then it is also accounted for separately from the share-based payment, and the entity considers whether it is in the scope of another standard.

Introduction

A share-based payment transaction in a group context may involve more than one entity in delivering the benefit to the group employees providing services. For example, a parent may grant its own equity instruments to employees of its subsidiary. From the perspective of the parent’s consolidated financial statements, this transaction is a share-based payment in the scope of IFRS 2.

The transaction is also a share-based payment in the scope of IFRS 2 from the perspective of the parent’s separate financial statements, even though it is the subsidiary that receives the services from the employees. It is also a share-based payment in the scope of IFRS 2 from the perspective of the subsidiary’s financial statements, even though it is the parent that has the obligation to settle the transaction and it is not the subsidiary’s own shares that are granted to the employees.

The requirements for group share-based payments apply to the separate, individual and consolidated financial statements of a group entity. This section focuses on the requirements in the separate financial statements of the parent and in the financial statements of the subsidiary for arrangements meeting the definition of a group share-based payment.

In this section, when reference is made to the financial statements of an entity, it includes any separate financial statements, individual financial statements of the entity and consolidated financial statements that it might prepare of the subgroup of which it is the parent, unless otherwise noted. An entity that has no subsidiaries, but which has an investment in an associate and/or an interest in a joint arrangement, may prepare individual financial statements.

Definition and scope

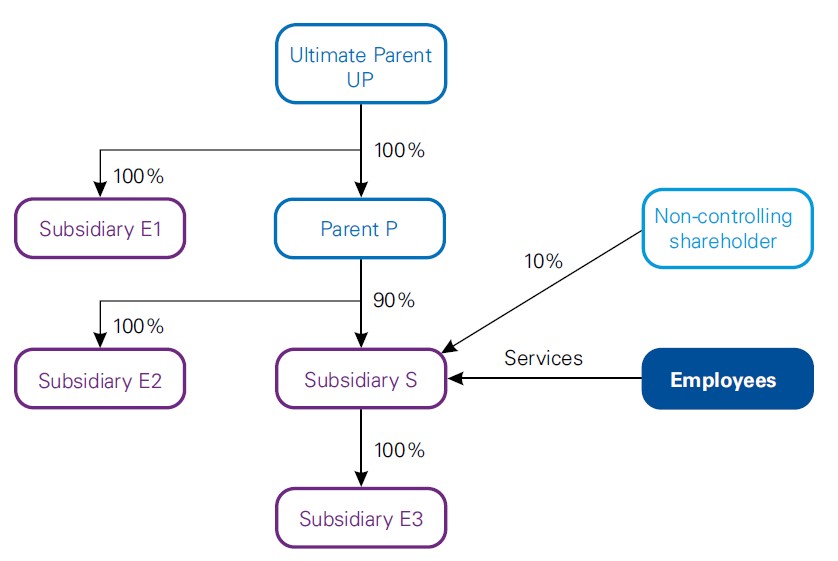

Using this diagram, examples of a share-based payment arrangement that involves two entities include:

- Parent P grants its own equity instruments or a cash payment based on its own equity instruments to the employees of Subsidiary S; and

- S grants equity instruments of P or a cash payment based on the equity instruments of P to its own employees.

P is not part of the reporting entity when S prepares its financial statements. Share-based payment arrangements that involve entities outside the reporting entity are referred to as ‘group share-based payment arrangements’, if the other entity is, from the perspective of Ultimate Parent UP, in the same group as the reporting entity.

If, for example, a shareholder grants equity instruments of the reporting entity, or a cash payment based on those equity instruments, to parties that have supplied goods or services to the reporting entity, then such a transaction is a share-based payment transaction in the scope of IFRS 2 from the perspective of the reporting entity.

Similarly, if the shareholder grants equity instruments, or a cash payment based on those equity instruments, of the reporting entity’s parent or another entity in the same group as the reporting entity to parties that have supplied goods or services to the reporting entity, then that grant is a group share-based payment transaction.

If a reporting entity, rather than, for example, the shareholder, grants equity instruments of its parent or equity instruments of another entity in the same group as the reporting entity (or a cash payment based on those equity instruments) to parties that have supplied goods or services to the reporting entity, then such a transaction is a share-based payment transaction in the scope of IFRS 2 from the perspective of the reporting entity. (IFRS 2.B52(b))

When considering the application of IFRS 2 to group share-based payments, the definition of a share-based payment arrangement may appear to be narrow. If in the definition the term ‘entity’ is read as the reporting entity, then a payment in cash or other assets of another group entity or a shareholder would not be covered because the definition reads (emphasis added): “… to receive (a) cash or other assets of the entity for amounts that are based on the price (or value) of equity instruments (including shares or share options) of the entity or another group entity, or (b) equity instruments …”.

In our view, the term ‘entity’ as emphasised in the definition should be read as including other group entities and shareholders. We believe that this broader reading is appropriate based on the Board’s stated objective for the group cash-settled share-based payment transactions amendment to IFRS 2.

This narrative distinguishes between the following types of share-based payment transactions:

- share-based payment transactions that involve only the supplier of goods or services and the reporting entity – i.e. the reporting entity receives the goods or services and settles the transaction in its own equity instruments or in a cash payment based on the price (or value) of its own equity instruments; and

- share-based payment transactions that involve the supplier, the reporting entity and at least one other group entity or a shareholder of any group entity (group share-based payment transactions).

In some cases, group share-based payment transactions involve the supplier of the goods and services and more than one group entity. The relevant entities in a group share-based payment transaction can be described as follows:

- a ‘receiving entity’ is the entity that receives goods or services in a share-based payment transaction; and

- a ‘settling entity’ is the entity that has the obligation to settle the share-based payment transaction.

In some group share-based payments, intermediate entities are involved – e.g. when an entity’s parent grants a share-based payment to a subsidiary of that entity.

Additionally, group share-based payments may involve equity instruments of another entity within the group or a cash payment based on the value of that other group entity’s instruments. To help describe the scope and classification of group share-based payments, in this handbook the term ‘reference entity’ is used to describe the entity whose equity instruments are granted or on whose equity instruments the transfer of cash or other assets is based.

Using these terms, we believe that most group share-based payment transactions discussed in this section can be described as follows.

‘A group share-based payment transaction is one in which the receiving entity and the reference entity are in the same group from the perspective of the ultimate parent and which is settled either by an entity in that group or by an external shareholder of any entity in that group.’

In the definition above, the receiving entity, settling entity and reference entity can be three different entities. Alternatively, two entities may be the same as long as the third entity is a different entity in order to meet the definition of a group share-based payment. If all three entities are the same, then the share-based payment is in the scope of IFRS 2.

Settlements by a shareholder are included in the scope of group share-based payments because they can be seen in substance as two transactions: (1) the entity has reacquired equity instruments for no consideration; and (2) the entity has received services as consideration for equity instruments issued to the employees. The second transaction is a share-based payment transaction. (IFRS 2.BC19-BC21)

Because the consequences are different for the settling entity (see Group share-based payment transactions settled by group entity and Group share-based payment transactions settled by external shareholder), a distinction is made between:

- group share-based payment transactions that are settled by a group entity; and

- group share-based payment transactions that are settled by an external shareholder.

In this handbook, the term ‘external shareholder’ is used to denote any shareholder that is outside the group but is a shareholder of any entity in the group.

If the share-based payment is consideration for services, then in some cases it might be difficult to determine whether it is the entity or the entity’s shareholders that receive the service. For example, an entity’s shareholder grants a share-based payment to members of the entity’s management. The non-market performance condition is completion of a pending sale of the entity.

In our view, management’s services are received by the entity rather than received only by the shareholders, because it is one of management’s normal duties to act in the best interest of the entity’s shareholders. The entity might also benefit from the sale in other ways – e.g. additional sources of financing, enhanced liquidity, access to new markets etc. Therefore, this share-based payment should be reflected in the financial statements of the entity.

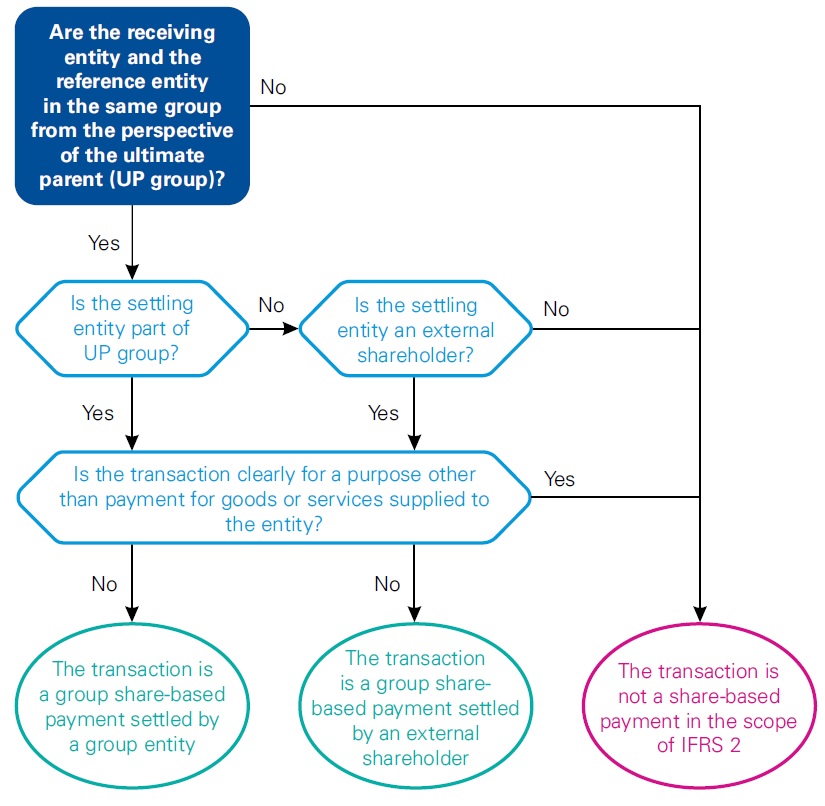

The following decision tree summarises the requirements for determining whether a share-based payment that involves different entities is a group share-based payment.

In all scenarios in which the receiving entity, the reference entity and the settling entity are in the same group from the perspective of the ultimate parent, the share-based payment transaction is in the scope of IFRS 2 in the financial statements of the receiving and the settling entity. A group entity that is only a reference entity does not account for the transaction, because it is not a party to the arrangement. (IFRS 2.43A-43C)

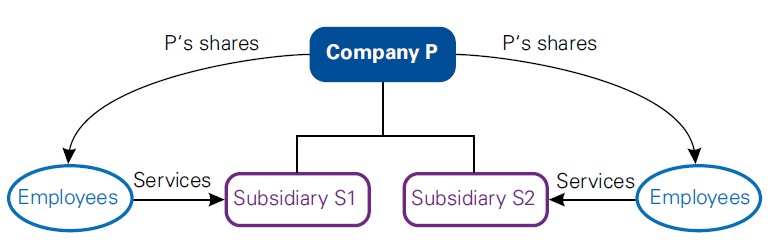

A common example of a group share-based payment transaction is one in which the parent grants its own shares to employees of its subsidiaries, as illustrated in the following case.

|

|

|

Parent P grants its own shares to the employees of Subsidiaries S1 and S2. The grant is subject to the condition that the employees stay in service within P’s group for a specified period.

From the perspective of P’s consolidated financial statements, only the employees and one entity are involved; P, as the reporting entity, receives the services and settles the transaction in its own equity instruments. Accordingly, from this perspective, the transaction is a share-based payment transaction without considering the additional group share-based payment features and therefore is in the scope of IFRS 2. From the perspective of the separate financial statements of P, and from the perspective of the financial statements of S1 and S2, the definitions including the features for group share-based payment transactions should be considered because, from their perspectives, multiple entities are involved.

The analyses and conclusions are the same irrespective of whether P grants shares of S1 or S2. |

The analysis in the above listed case is the same if the transaction is settled in cash or in equity, as long as the cash payment is based on the price (or value) of an equity instrument of a group entity.

|

|

|

Modifying the above listed case, the share-based payment is settled in cash rather than in equity. The scope conclusions are the same, because the receiving entities, the reference entity and the settling entity are in the same group – i.e. it does not matter whether the transaction is settled in equity instruments or in cash based on equity instruments. The transaction is a share-based payment in the scope of IFRS 2 from the perspective of:

The analyses and conclusions are the same irrespective of whether the cash payment is based on S1’s or S2’s shares. |

In determining whether the receiving entity, the reference entity and the settling entity are in the same group, an evaluation is made from the perspective of the ultimate parent.

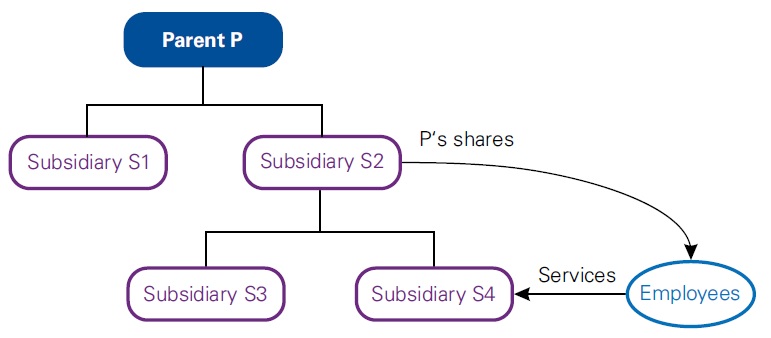

|

|

|

Subsidiary S2 grants shares of its Parent P to the employees of its Subsidiary S4. The grant is subject to the condition that the employees stay in service within S2’s group for a specified period.

From the perspective of P’s consolidated financial statements, the transaction is in the scope of IFRS 2, because the reporting entity (P group) receives services and settles the transaction in its own equity instruments. From the perspective of S2’s consolidated financial statements, the transaction is also in the scope of IFRS 2, because the receiving entity (S2’s group), the reference entity (P) and the settling entity (S2’s group) are in the same group from the perspective of the ultimate parent (P). In other words, the evaluation of whether the entities involved are in the same group is not made from the perspective of the reporting entity for which the financial statements are being considered – i.e. the S2 group. From the perspective of S2’s separate financial statements, it is also a transaction in the scope of IFRS 2, because the receiving entity (S4), the reference entity (P) and the settling entity (S2) are in the same group from the perspective of the ultimate parent (P). The same analysis and conclusion apply to the financial statements of S4. |

The requirement to treat transactions involving instruments of another entity as a share-based payment applies only to transactions involving the equity instruments of a group entity. The determination of whether another entity is a group entity is based on the definition of a group – i.e. a parent and all of its subsidiaries – from the perspective of the ultimate parent.

Therefore, a transaction in which the entity receives services from its employees and the employees receive equity instruments of a non-group shareholder is outside the scope of IFRS 2 from the perspective of the reporting entity (see the case below).

|

|

|

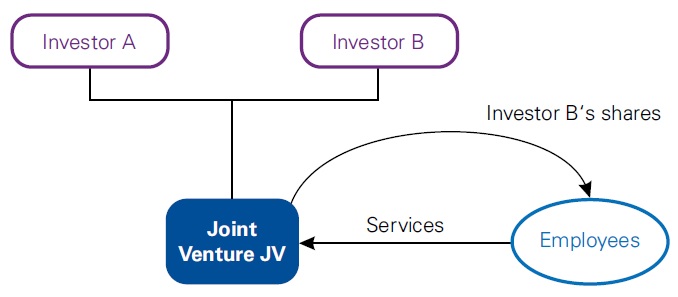

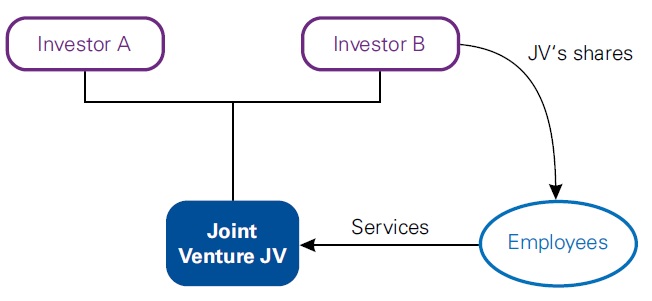

Joint Venture JV, a joint venture of Investor A and Investor B, grants shares of B to its employees. The grant is subject to the condition that the employees stay in service with JV for a specified period.

In this example, the grant is not a share-based payment in the scope of IFRS 2 from the perspective of the reporting entity (JV), because the receiving entity (JV) and the reference entity (B) are not in the same group. |

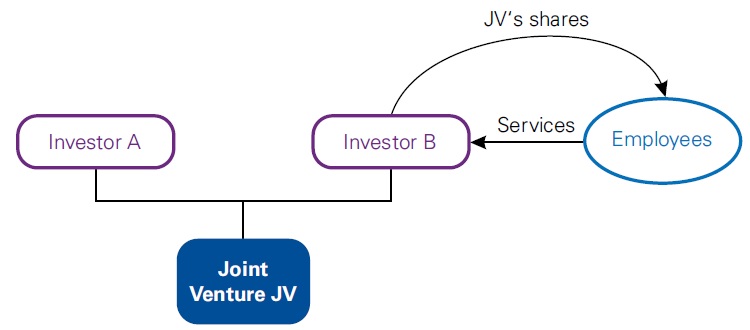

Also, a transaction in which the reporting entity receives services from its employees and the employees receive equity instruments of a joint venture or associate is outside the scope of IFRS 2 from the perspective of the reporting entity (see the case below).

|

|

|

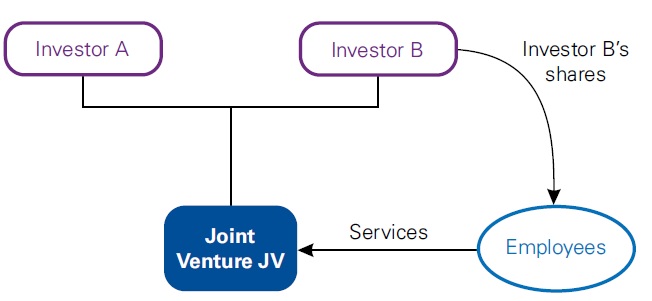

Investor B, a shareholder of Joint Venture JV, grants shares of JV to B’s employees. The grant is subject to the condition that the employees stay in service with B for a specified period.

In this example, the grant of shares is not a share-based payment in the scope of IFRS 2 from the perspective of the reporting entity (B) because the receiving entity (B) and the reference entity (JV) are not in the same group. |

However, when a grant of equity instruments of a joint venture or of an associate is provided by the reporting entity directly to its employees, then in our view the transaction is an employee benefit in the scope of IAS 19 Employee Benefits to be accounted for by the reporting entity.

IFRS 2.3A A group share-based payment transaction also includes transactions settled by a party that is an external shareholder, as long as the receiving entity and the reference entity are under common control by the same ultimate parent and are therefore in the same group.

An ‘external shareholder’ is any shareholder that is outside that group but is a shareholder of any entity in the group. Examples of external shareholders include parties holding non-controlling interests in subsidiaries of the group or any shareholder of the ultimate parent.

Group share-based payment transactions that are settled by an external shareholder are in the scope of IFRS 2 from the perspective of the receiving entity if the reference entity is in the same group as the receiving entity.

IFRS 2 does not clearly address the perspective of the settling shareholder. Transactions settled by an external shareholder, depending on specific circumstances, can be in the scope of IFRS 2 in either the receiving entity or the settling entity, but not in both at the same time.

Which entity accounts for the transaction in the scope of IFRS 2 depends on whether the reference entity belongs to the group of the receiving entity or to the group of the settling external shareholder. Therefore, as discussed in the next few paragraphs, identification of the reference entity is a key factor in determining whether a transaction is in the scope from the perspective of the settling entity.

Settlement by external shareholder when reference entity is in same group as receiving entity. (IFRS 2.3A) If a shareholder that is not a group entity settles by granting equity instruments of the receiving entity (or a cash payment based on those equity instruments), then the transaction is in the scope of IFRS 2 from the perspective of the receiving entity.

However, in our view such a transaction is not a share-based payment in the scope of IFRS 2 from the perspective of the shareholder. This is because the reference entity is not in the same group as the shareholder settling the transaction.

If the reporting entity receives services from its employees and the employees receive equity instruments of a shareholder that is not a group entity, but the number of equity instruments received by the employees is based on the value of the reporting entity’s equity instruments, then the transaction is in the scope of IFRS 2 from the perspective of the reporting entity.

This is because, in such a case, the reporting entity is identified as the reference entity because the employees receive assets – the shareholder’s equity instruments – based on the value of the reporting entity’s equity instruments. The transaction is also in the scope of IFRS 2 from the perspective of the shareholder.

|

|

|

Investor B grants shares of Joint Venture JV to the employees of JV. The grant is subject to the condition that the employees stay in service with JV for a specified period.

From the perspective of B’s financial statements, the grant is not in the scope of IFRS 2 because the reference entity (JV) is not in the same group as the settling entity (B). From the perspective of JV’s financial statements, the grant is a share-based payment in the scope of IFRS 2. This is because the reference entity (JV) is in the same group as the receiving entity (JV) and the transaction is settled by an external shareholder (B) – i.e. a shareholder of the group entity (JV). |

If an external shareholder settles in or based on its own equity instruments, rather than in the receiving entity’s equity instruments, which is addressed above, then the transaction is in the scope of IFRS 2 from the perspective of the shareholder. This is because the shareholder grants its own shares or a cash payment based thereon in return for receiving services.

The fact that the shareholder receives the services only indirectly – i.e. via its investment, rather than directly – does not change this conclusion because the requirement to recognise unidentifiable goods or services applies. (IFRS 2.2(a), IFRS 2.13A)

From the perspective of the receiving entity in which the shareholder invests, the transaction is not generally in the scope of IFRS 2. This is because the receiving entity and the reference entity are not in the same group, because the reference entity is an external shareholder.

IFRS 2 also applies to transactions in which the reporting entity grants equity instruments of the entity’s parent or another entity in the same group as the reporting entity to parties that have supplied goods or services to another party in the group.

|

|

|

Investor B grants its own shares to the employees of Joint Venture JV. The grant is subject to the condition that the employees stay in service with JV for a specified period.

In contrast to Example 10.1.6, from the perspective of B’s financial statements the transaction is a share-based payment in the scope of IFRS 2 (see above). In contrast to Example 10.1.6, from the perspective of JV’s financial statements the grant of shares is not a share-based payment in the scope of IFRS 2. This is because the reference entity (B) is outside the group to which the receiving entity (JV) belongs (see above). |

Indirect relationships

The following example illustrates the consequences of the scope requirements for group share-based payments. It demonstrates that both the settling entity and the reference entity can have indirect relationships with the employee and the entity receiving services in the legal and operating structure, but the transaction would still be in the scope of IFRS 2. That is, the settling entity is not required to be the immediate or ultimate parent or shareholder of the entities that receive services from employees and the reference entity can be an entity other than the settling entity or the receiving entity.

|

|

|

Company SH, a shareholder of Company P1 with a 10% equity interest in P1, grants a cash payment based on Company S1’s shares to the employees of Company S4. The transaction is a share-based payment transaction in the scope of IFRS 2 in the consolidated financial statements of Company P2 because:

The transaction is also a share-based payment transaction in the scope of IFRS 2 in the financial statements of S4 because:

The transaction is not a share-based payment transaction in the scope of IFRS 2 in the financial statements of SH (see Example 10.1.7). The transaction is also not a share-based payment in the scope of IFRS 2 in the financial statements of Companies P1, S1, S2 or S3, because they are neither receiving nor settling entities. |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Group share-based payments Group share-based paymentsGroup share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments

Group share-based payments Group share-based paymentsGroup share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments

Group share-based payments Group share-based paymentsGroup share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments Group share-based payments