Last update 05/12/2019

Fair value disclosures – The below illustrative disclosures are limited to financial assets and liabilities measured in accordance with IFRS 9. In many cases, insurers may have other balances that require fair value measurement disclosures in accordance with IFRS 13.

Fair value hierarchy Fair value disclosures

|

IFRS Link |

Explanation Fair value disclosures |

| IFRS 13 73 |

The insurer categorises a financial asset or a financial liability measured at fair value at the same level of fair value hierarchy as the lowest-level input that is significant to the entire measurement. The insurer ranks fair value measurements based on the type of inputs, as follows: |

| IFRS 13 76, |

Level 1: The fair value of financial instruments traded in active markets (such as publicly traded equities, bonds and derivatives) is based on quoted market prices at the end of the reporting period. The quoted market price used for financial assets held by the insurer is the current bid price. These instruments are included in Level 1. |

| IFRS 13 81 |

Level 2: The fair value of financial instruments that are not traded in an active market is determined using valuation techniques that maximise the use of observable market data and rely as little as possible on entity-specific estimates. If all significant inputs required to fair value an instrument are observable, the instrument is included in Level 2. |

| IFRS 13 86 |

Level 3: If one or more of the significant inputs is not based on observable market data, the instrument is included in Level 3. The insurer has no Level 3 investments during the two reporting periods presented. Fair value disclosures |

| IFRS 13 93(c) |

There were no transfers between Levels 1 and 2 for recurring fair value measurements during both years. |

| IFRS 13 95 |

The insurer’s policy is to recognise transfers into and transfers out of fair value hierarchy levels as at the end of the reporting period. |

Valuation techniques used to determine fair values Fair value disclosures

|

IFRS Link |

Explanation Fair value disclosures |

|

Specific valuation techniques used to value financial instruments include: Fair value disclosures

|

|

|

All of the resulting fair value estimates are included in Level 2. Fair value disclosures |

|

|

Food for thought The presented disclosures on fair value measurement are kept concise. The objective of IFRS 13 is to disclose information that helps users of financial statements assess both of the following:

In order to meet these objectives, an entity shall consider all of the following:

|

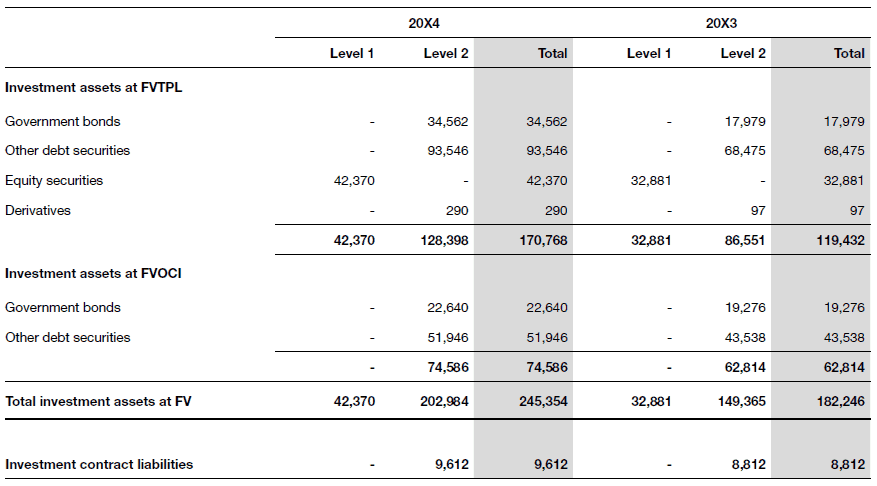

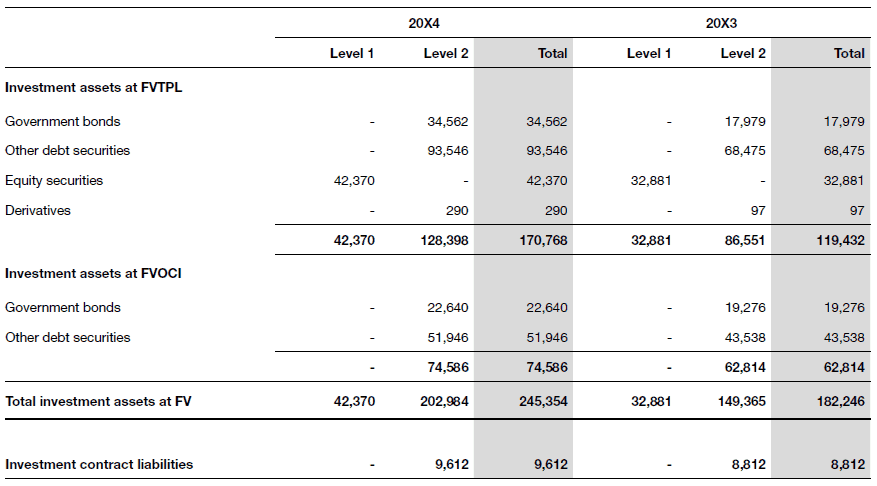

Table of financial instruments at fair value

This note sets out the split of financial instruments by fair value hierarchy level [IFRS 7 6, IFRS 7 25-26, IFRS 13 93 (b) and IFRS 13 94]:

The entity has no Level 3 financial instruments at fair value.

The entity has no Level 3 financial instruments at fair value.

|

Classification of investment contract liabilities Fair value disclosures The Group issues investment contracts without DPF that are designated at FVTPL. For the purpose of the Illustration, it is assumed that these investment contracts are not quoted in an active market and do not have readily available published prices and that their fair values are determined using valuation techniques. It is assumed that all significant inputs used in the valuation are observable and these investment contract liabilities are classified in Level 2. Other classifications are possible depending on the nature of investment products and valuation methods and inputs involved. |

Financial instruments not measured at fair value Fair value disclosures

|

IFRS Link |

Explanation Fair value disclosures |

|

The carrying amounts of cash and cash equivalents, floating rate subordinated debt, other financial assets and other financial liabilities approximate their fair value. |

See also: The IFRS Foundation