Last update 10/08/2019

A parent presents non-controlling interests in its consolidated statement of financial position within equity, separately from the equity of the owners of the parent.

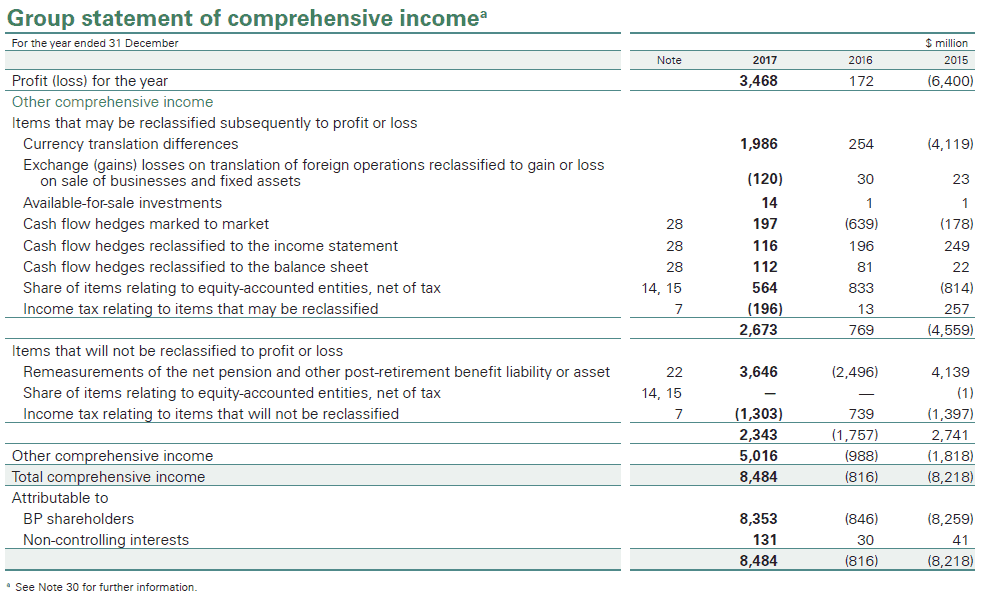

A reporting entity attributes the profit or loss and each component of other comprehensive income to the owners of the parent and to the non-controlling interests. The proportion allocated to the parent and non-controlling interests are determined on the basis of present ownership interests.

The reporting entity also attributes total comprehensive income to the owners of the parent and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance.

Non-controlling interest (NCI), also known as minority interest, is an ownership position whereby a shareholder owns less than 50% of outstanding shares and as a result has no control over decisions. Non-controlling interests are measured at the net asset value of subsidiary entities and do not account for potential voting rights in the parent company.

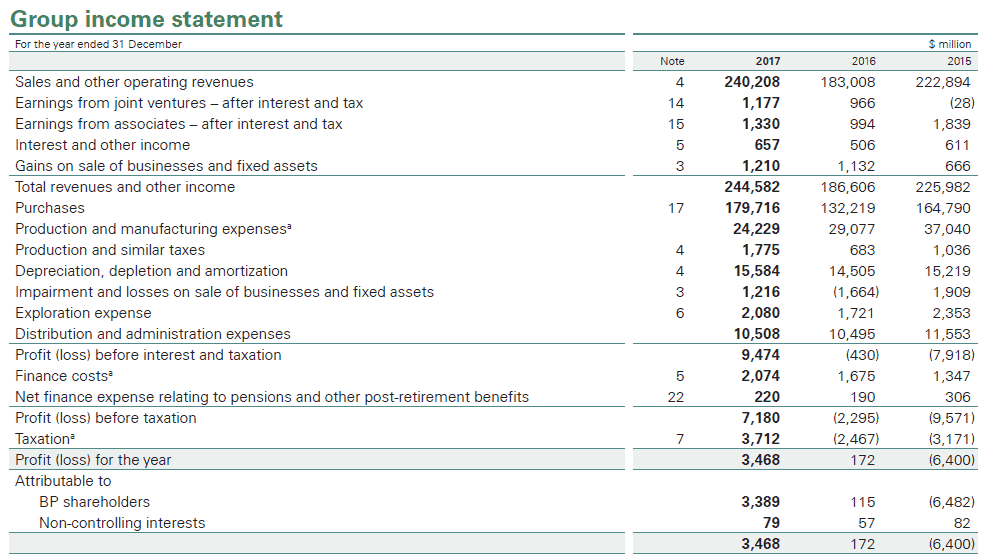

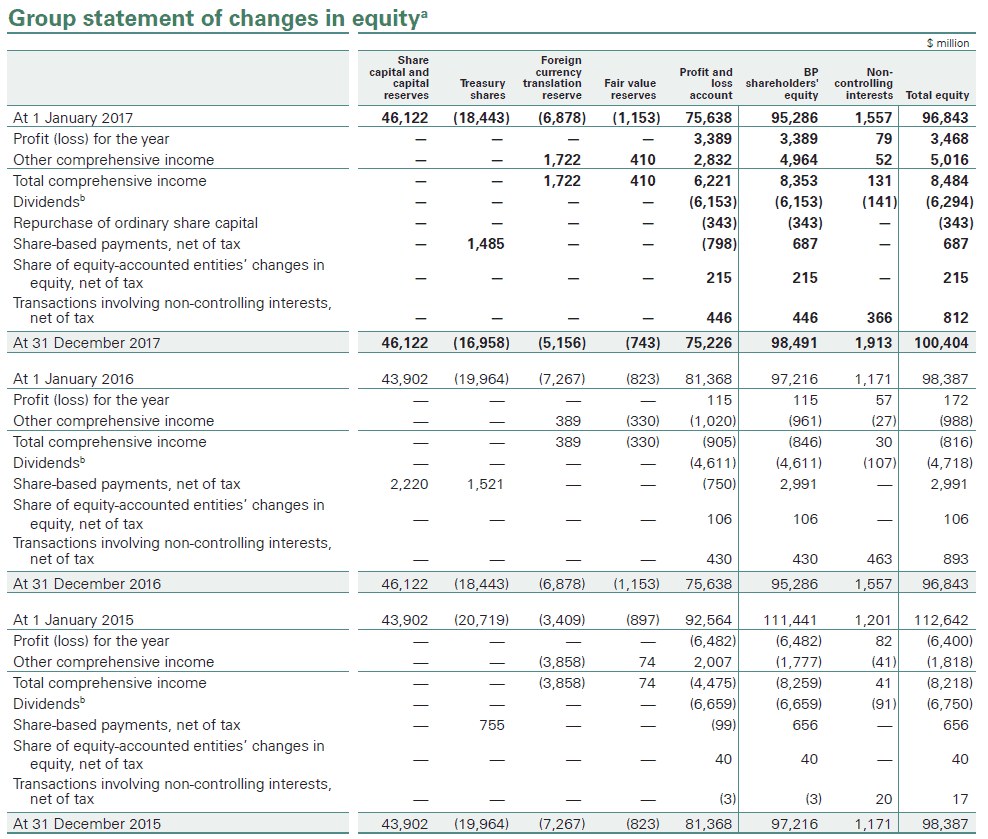

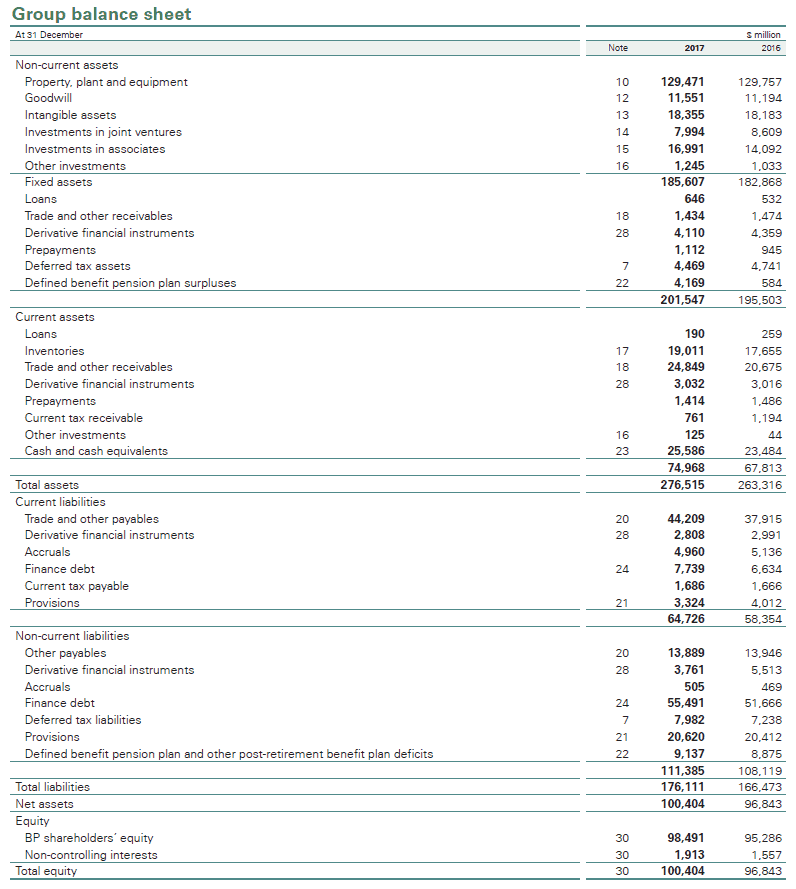

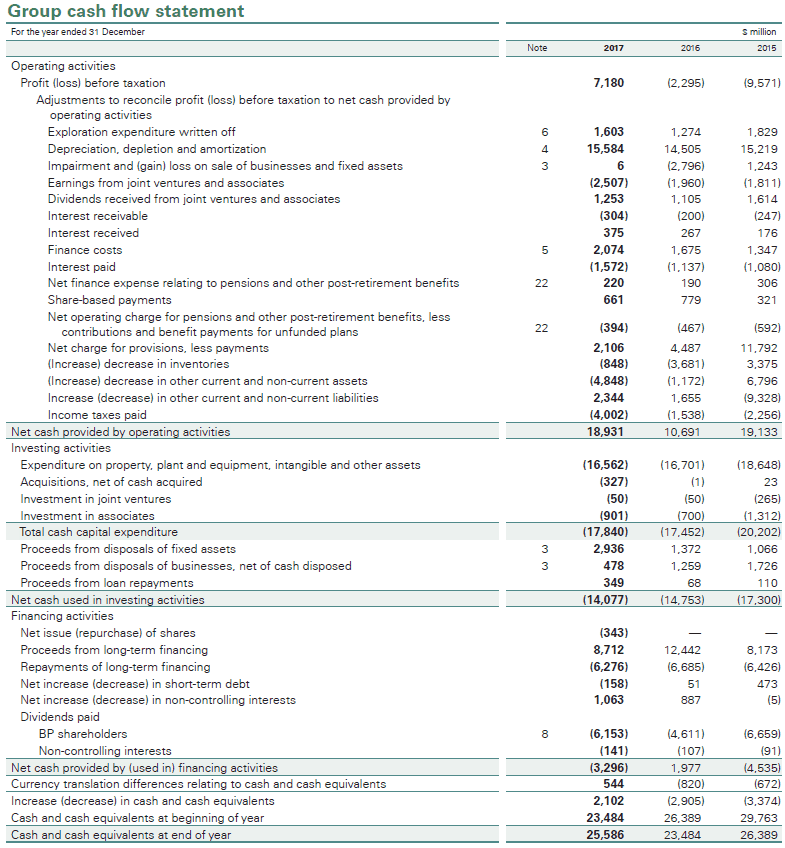

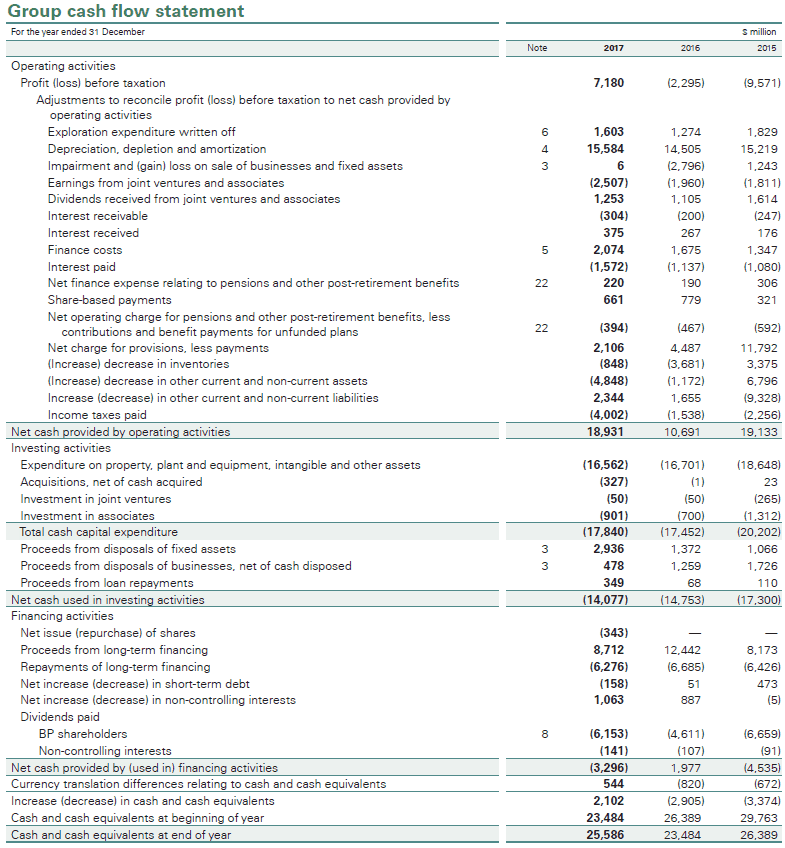

Below are examples of accounting and reporting for non-controlling interest provided for the Group Income Statement, the Group Statement of Comprehensive Income, the Group Statement of changes in Equity, the Group Balance Sheet and the Group Cash Flow Statement, in this case from the Annual Report and Form 20-F 2017 of BP Plc.

Equity attributable to the owners of the parent

Equity attributable to the owners of the parent

Equity attributable to the owners of the parent Equity attributable to the owners of the parent Equity attributable to the owners of the parent Equity attributable to the owners of the parent Equity attributable to the owners of the parent Equity attributable to the owners of the parent

A reporting entity attributes the profit or loss and each component of other comprehensive income to the owners of the parent and to the non-controlling interests. The proportion allocated to the parent and non-controlling interests are determined on the basis of present ownership interests.