EPS measures are intended to represent the income earned (or loss incurred) by each ordinary share during a reporting period and therefore provide an indicator of reported performance for the period.

The EPS measure is also widely used by users of financial statements as part of the price-earnings ratio, which is calculated by dividing the price of an ordinary share by its EPS amount. This ratio is therefore an indicator of how many times (years) the earnings would have to be repeated to be equal to the share price of the entity.

Users of financial statements also use the EPS measure as part of the dividend cover calculation. This measure is calculated by dividing the EPS amount for a period by the dividend per share for that period. It therefore provides an indication of how many times the earnings cover the distribution being made to the ordinary shareholders.

Basic EPS and diluted EPS are presented by entities whose ordinary shares or potential ordinary shares (POSs) are traded in a public market or that file, or are in the process of filing, their financial statements for the purpose of issuing any class of ordinary shares in a public market. (IAS 33.2)

Basic EPS and diluted EPS for both continuing and total operations are presented in the statement of profit or loss and OCI, with equal prominence, for each class of ordinary shares that has a differing right to share in the profit or loss for the period. (IAS 33.66-67A)

Separate EPS information is disclosed for discontinued operations, either in the statement of profit or loss and OCI or in the notes to the financial statements. (IAS 33.66-68A)

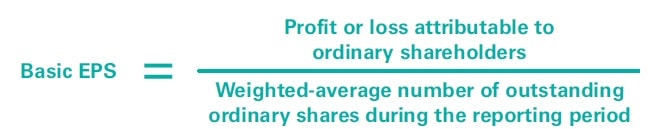

Basic EPS is calculated by dividing the profit or loss attributable to ordinary shareholders by the weighted-average number of ordinary shares outstanding during the period. (IAS 33.10)

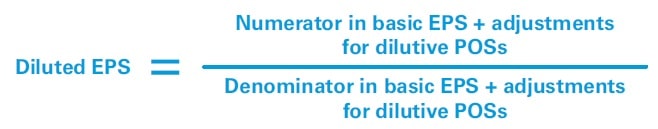

To calculate diluted EPS, profit or loss attributable to ordinary shareholders and the weighted-average number of shares outstanding during the period are adjusted for the effects of all dilutive POSs. (IAS 33.31)

POSs are considered dilutive only when they decrease EPS or increase loss per share from continuing operations. In determining if POSs are dilutive, each issue or series of POSs is considered separately, rather than in aggregate. (IAS 33.41, IAS 33.44)

For diluted EPS, diluted POSs are determined independently for each period presented. (IAS 33.37)

Contingently issuable ordinary shares are included in basic EPS from the date on which all necessary conditions are satisfied and, when they are not yet satisfied, in diluted EPS based on the number of shares that would be issuable if the reporting date were the end of the contingency period. (IAS 33.24, IAS 33.52)

If a contract may be settled in either cash or shares at the entity’s option, then the presumption is that it will be settled in ordinary shares and the resulting POSs are used to calculate diluted EPS. If a contract may be settled in either cash or shares at the holder’s option, then the more dilutive of cash-settlement and share-settlement is used to calculate diluted EPS. (IAS 33.58, IAS 33.60)

If the number of ordinary shares outstanding changes, without a corresponding change in resources, then the weighted-average number of ordinary shares outstanding during all periods presented is adjusted retrospectively for both basic and diluted EPS. (IAS 33.64)

Additional basic and diluted EPS based on alternative earnings measures may be disclosed and explained in the notes to the financial statements. (IAS 33.73)

Basic EPS aims to provide a measure of the interest of each ordinary share in the performance of the entity over a reporting period. (IAS 33.11)

A consistently determined EPS facilitates comparison between entities and across reporting periods. Accordingly, IAS 33 prescribes certain principles for the determination and presentation of EPS. However, this is not without limitations – e.g. different entities may use different accounting policies to determine earnings.

Simply put, basic EPS is an entity’s profit or loss that is attributable to ordinary shareholders for a reporting period (the numerator) divided by the weighted-average number of outstanding ordinary shares during the reporting period (the denominator). (IAS 33.10)

Although IAS 33 focuses on the denominator, it also contains certain requirements in respect of the numerator. (IAS 33.1)

|

How simple it can be…. |

|

Case

Basic EPS calculation

Basic EPS for Year 1 is therefore 1.53 (4,600,000 / 3,000,000). |

In practice, the basic EPS calculation may be more complex than this case and adjustments may be required to the numerator and denominator.

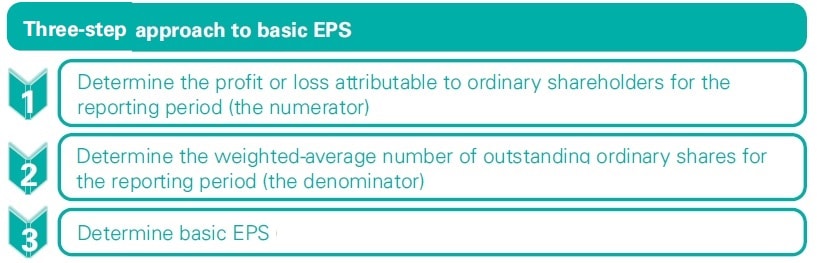

The basic EPS calculation is made following a three-step approach.

Step 1: Determine the numerator

Which earnings to use?

The numerator for basic EPS is the profit or loss that is attributable to ordinary shareholders of an entity. As such, the net profit or loss of an entity is generally adjusted for returns to other classes of equity instruments, such as preference shares and other participating instruments, that have not already been deducted in arriving at net profit or loss. The returns to (and other profit or loss effects of) liability-classified preference shares are not adjusted, because these amounts are already deducted from the net profit or loss. (IAS 33.12–13)

|

Step 1: Determine the numerator |

Net profit or loss, adjusted for: |

|

Returns on equity-classified preference shares |

|

|

Returns on participating equity instruments and other classes of ordinary shares |

|

|

Obligation to cover NCI losses |

If an entity reports discontinued operations, then it presents separate EPS amounts for continuing, discontinued and total operations. In this case, to determine the basic EPS from continuing operations, net profit or loss is also adjusted for net profit or loss from discontinued operations.

Returns on equity-classified preference shares

Returns on equity-classified preference shares are not deducted in arriving at the net profit or loss for a period. Accordingly, the numerator for basic EPS needs to be adjusted for these returns so that it reflects only the profit or loss attributable to ordinary shareholders. (IAS 33.12)

|

Returns on equity-classified preference shares Post-tax dividends on non-cumulative preference shares declared in respect of the period (IAS 33.14(a)) + Post-tax dividends on cumulative preference shares required for the period, declared or not (IAS 33.14(b)) +/- Any original issue discount (premium) on increasing-rate preference shares (IAS 33.15) +/- Any differences on settlement (IAS 33.16-18) |

Preference dividends – Cumulative vs non-cumulative

Dividends on equity-classified preference shares may be cumulative or non-cumulative. Preference dividends are cumulative if any dividend entitlements that are not paid or declared in respect of a particular period accumulate and are carried forward. Preference dividends are non-cumulative if dividend entitlement lapses if the dividends are not declared or paid when scheduled; they are not added to future dividend payments or other returns.

If the dividends are cumulative, then these preference dividends for the period are deducted from net profit or added to the net loss, irrespective of whether they are declared. (IAS 33.14(b))

In contrast, dividends on non-cumulative preference shares are not deducted in arriving at the numerator unless they have been declared by the reporting date. (IAS 33.14(a), IAS 10.12–13) In general, the numerator should not be adjusted for non-cumulative dividends declared after the reporting date, even if these dividends relate to the reporting period. This is consistent with the requirement that dividends declared after the reporting date are non-adjusting events in accordance with IAS 10 Events after the Reporting Period, because no obligation exists at the reporting date.

The following examples contrast the treatment of cumulative and non-cumulative preference dividends in the numerator for basic EPS.

|

Case – Cumulative preference dividends |

||||||||||||||||||||

|

Case

Determining the numerator Irrespective of whether the preference dividends are declared or paid during Year 1, the numerator for basic EPS is determined as follows.

|

||||||||||||||||||||

|

Case – Non-cumulative preference dividends |

||||||||||||||||||||

|

Case Assume the same facts as in Case – Cumulative preference dividends (see above), except that the preference dividends are non-cumulative. The following facts regarding preference dividends are also relevant.

Determining the numerator The numerators for basic EPS under each of the above scenarios are as follows.

|

Although non-cumulative preference dividends are generally ignored in the numerator for basic EPS unless they are declared, separate considerations apply to the allocation of earnings if the corresponding preference shares participate in dividends with ordinary shares as participating instruments (see Returns on participating equity instruments and other classes of ordinary shares).

Some preference shares provide a low initial dividend to compensate an entity for issuing the shares at a discount, or an above-market dividend in later periods to compensate investors for purchasing these shares at a premium. These shares are often referred to as ‘increasing-rate’ preference shares. (IAS 33.15)

The amortisation of any original issue discount or premium on increasing-rate preference shares is effectively an adjustment to the returns to preference shareholders. Accordingly, the amortisation of the discount or premium is treated as a preference dividend in the numerator for EPS purposes. This impact is illustrated in the case Original issue discount on increasing-rate preference shares below, which is based on Illustrative Example 1 of IAS 33.

Although the amortisation of the discount to retained earnings is reflected in the calculation of EPS, this reclassification in equity is not a requirement under IFRS.

|

Case – Original issue discount on increasing-rate preference shares |

|||||||||||||||||||||||||||||||

|

Case On 1 January Year 1, Company X issues 10,000 non-redeemable cumulative preference shares with a par value of 100 each. Each of these shares is entitled to a cumulative discretionary dividend of 7 each year, starting from Year 4, paid in arrears. At the time of issue, the market yield on instruments with similar terms is 7% per annum. To compensate for the below-market dividend yield in the first three years, X issues each preference share at 81.63 – a discount of 18.37 per share. X classifies the preference shares as equity instruments and amortises the original issue discount to retained earnings using the effective interest method. X’s net profit for Year 1 is 400,000. Determining the numerator The annual amortisation of the original issue discount on X’s increasing-rate preference shares in the first three years is treated as a preference dividend when determining the numerator.

The numerator for basic EPS in Year 1 is determined as follows.

|

Differences on settlement

Equity-classified preference shares may be repurchased under an entity’s tender offer to the holders. Any differences on settlement – e.g. an excess of the fair value of the consideration paid over the carrying amount of the preference shares – represent a return to the holders of the preference shares that is not recognised in profit or loss. Accordingly, the numerator is adjusted for any differences on the settlement of equity-classified preference shares. The numerator is also adjusted for ‘other similar effects’ of equity-classified preference shares (see below). (IAS 33.12, IAS 33.16-18)

|

Case – Differences on settlement |

||||||

|

Case On 1 January Year 1, Company B issues 50,000 equity-classified cumulative preference shares with a par value of 100 each. Total proceeds amount to 5,000,000. Each share is entitled to a cumulative discretionary dividend of 7 each year. This is equal to the market yield on instruments with similar terms at the time of issue. In light of the availability of surplus funds and declining market yields, B agrees with the preference shareholders to redeem the preference shares issued, with a carrying amount of 5,000,000. On 1 January Year 2, B completes the redemption for a total consideration of 6,000,000. B’s net profit for Year 2 is 5,000,000. Because the preference shares are settled at the beginning of the year, there is no requirement to pay preference dividends for Year 2. Determining the numerator The numerator for basic EPS in Year 2 is determined as follows.

|

An example of the ‘other similar effects’ referred to above is an inducement for early conversion of equity-classified convertible preference shares, either by favourably amending the original conversion terms or by paying additional consideration to the preference shareholders. Similar to differences on settlement, such an inducement is not recognised in profit or loss but nevertheless represents a return to preference shareholders for which the numerator is adjusted. (IAS 33.17)

If the fair value of the ordinary shares or other consideration paid exceeds the fair value of the ordinary shares issuable under the original conversion terms, then this excess is a return to preference shareholders and is deducted from net profit or loss in arriving at the numerator for basic EPS, as illustrated in the following case.

|

Case – Inducement for early conversion |

||||||

|

Case On 1 January Year 1, Company C issues convertible preference shares with a par value of 1,000,000. The preference shares bear a discretionary dividend of 10 each year and are convertible at the holders’ option into 500,000 ordinary shares of C. C classifies the preference shares as equity instruments. During Year 2, in light of changes in market yields, C wishes to induce early conversion of the preference shares. To achieve this, C agrees with the preference shareholders to modify the conversion terms such that the preference shares are convertible into 600,000 ordinary shares – i.e. 100,000 additional ordinary shares will be issued on a full conversion. All of the preference shares are converted into ordinary shares on 30 June Year 2, when the market price per ordinary share of C is 2.50. C’s net profit for Year 2 is 1,000,000. No dividends are declared for Year 2. Determining the numerator The numerator for basic EPS in Year 2 is determined as follows.

|

The capital structure of some entities may include: (IAS 33.A13–A14)

- equity instruments that participate in dividends with ordinary shares according to a predetermined formula with, at times, an upper limit on the extent of participation (participating equity instruments); and/or

- a class of ordinary shares with a dividend rate different from that of another class of ordinary shares but without prior or senior rights.

These instruments may reduce the entitlement of an ordinary shareholder to the net profit or loss of an entity and therefore the numerator for basic EPS is adjusted for the effects of these instruments.

To determine the profit or loss that is attributable to ordinary shareholders, the net profit or loss for the period is allocated to the different classes of ordinary shares and participating equity instruments. This allocation is made in accordance with the rights of the various classes of instruments to participate in distributions or other rights to participate in undistributed earnings. In this regard, IAS 33 specifies the following methodology to determine basic EPS for each class of instruments for which the amount is presented. (IAS 33.A14)

|

Step A |

Adjust net profit or loss by the amount of dividends declared in the period for each class of shares, and by the contractual amount of dividends or interest not recognised in profit or loss for the period that has yet to be paid – e.g. unpaid cumulative dividends. |

|

↓ |

|

|

Step B |

Notionally allocate the remaining profit or loss to the different classes of instruments as if all of the profit or loss for the period had been distributed (participation feature). |

|

↓ |

|

|

Step C |

Determine the profit or loss attributable to each class of instruments by adding together the amount allocated for dividends (see Step A) and the amount notionally allocated for the participation feature (see Step B). |

|

↓ |

|

|

Step D |

Divide the amount determined in Step C by the weighted-average number of outstanding instruments for the period. |

|

Case – Participating equity instruments |

||||||||||||||||||||||||||||||||||

|

Case

Basic EPS calculation In this example, D concludes that the class Y shares are the only ordinary shares for which EPS disclosure is required. Class X shares are not ordinary shares, because the fixed entitlement creates a preference over the class Y shares, and the holders of class Y are subordinate to the holders of class X. Class X shares are nevertheless participating equity instruments whose profit entitlement has to be adjusted in arriving at the numerator for basic EPS for class Y shares.

|

||||||||||||||||||||||||||||||||||

|

Case – Two classes of ordinary shares |

||||||||

|

Case

Basic EPS calculation

|

Obligation to cover NCI losses

When determining basic EPS for consolidated financial statements, the numerator is the profit or loss that is attributable to ordinary shareholders of the parent entity. (IAS 33.A1)

This ‘profit or loss’ refers to the profit or loss of the consolidated entity after adjusting for the share of profit or loss attributable to NCI and for the items that are discussed above.

A parent and the non-controlling shareholders of a subsidiary may enter into an arrangement to share profits (losses) in a manner other than in proportion to their ownership interests (i.e. a profit-sharing arrangement) or to place the parent under an obligation to absorb losses attributable to NCI. In our view, in its consolidated financial statements the parent should choose an accounting policy, to be applied consistently, for accounting for such a profit-sharing arrangement or guarantee. (IFRS 10.BCZ162)

It can:

- take the profit-sharing arrangement/guarantee into account when doing the original attribution in the statement of profit or loss and OCI; or

- use the following two-step approach:

- attribute to the NCI their portion of the profits (losses) in the statement of profit or loss and OCI in proportion to their present ownership interests in the subsidiary – i.e. unaffected by the existence of the profit-sharing arrangement/guarantee; and

- account for the profit-sharing arrangement/guarantee separately in the statement of changes in equity by attributing any additional profits (losses) to the controlling interest or NCI based on the terms of the agreement.

For the purposes of basic EPS in the consolidated financial statements, in our view a parent should adjust the numerator to take into account any obligations to cover losses that are attributable to NCI, irrespective of its accounting policy on accounting for these obligations.

|

Case – Obligation to cover NCI losses |

||||||||||||

|

Case

Determining the numerator If P is not obliged to cover the losses attributable to NCI, then P’s basic EPS in its consolidated financial statements is as follows.

However, if P is obliged to cover the losses attributable to NCI, then P’s basic EPS in its consolidated financial statements is as follows.

|

Step 2: Determine the denominator

The denominator of basic EPS is the weighted-average number of outstanding ordinary shares during the reporting period. (IAS 33.19)

|

Step 2: Determine the denominator |

Weighted-average number of shares outstanding during the period |

|

When shares become outstanding – general principles |

|

|

Should these shares be included?

|

|

|

Changes in the number of outstanding ordinary shares without corresponding changes in resources |

To determine the weighted average during a reporting period, the number of outstanding ordinary shares at the beginning of the period is generally adjusted by the number of ordinary shares bought back or issued during the period multiplied by a time-weighting factor. However, in certain situations – e.g. if there was a share split during the period – retrospective adjustment is also made to the denominator (see Changes in the number of outstanding ordinary shares without corresponding changes in resources).

The weighted average is used so that the effect of any increase or decrease in the number of ordinary shares on the EPS is related only to the portion of the period during which the related resources are available for use in the entity’s operations.

For determining the denominator, IAS 33 states that the time-weighting factor is the number of days that the ordinary shares are outstanding as a proportion of the total number of days in the period. Although this is a more precise way of calculating the weighted average, IAS 33 acknowledges that a reasonable approximation is adequate in many circumstances. This might involve using weeks or parts of months, rather than the precise number of days. (IAS 33.20)

The following example illustrates the basic idea behind the calculation of the weighted average.

|

How simple it can be…. |

||||||||||||||||||||||||||||||||

|

Case

Determining the denominator

Therefore, the denominator for basic EPS for Year 1 is 1,416,667. |

||||||||||||||||||||||||||||||||

Ordinary shares are usually considered ‘outstanding’ from the date on which the corresponding consideration is receivable. In all cases, the precise timing of the inclusion of ordinary shares as being outstanding is determined by the terms and conditions attached to their issue, after taking due consideration of the substance of any contract associated with their issue. (IAS 33.21–23)

The following table sets out the general principles in this regard.

|

Ordinary shares issued … |

Time from which shares are ‘outstanding’ |

|

… for cash |

When cash is receivable |

|

… for another asset |

When the asset is recognised |

|

… to settle a liability |

Settlement date |

|

… on conversion of a debt instrument |

Date on which interest ceases to accrue |

|

… in lieu of interest or principal on other financial instruments |

Date on which interest ceases to accrue |

|

… on voluntary reinvestment of dividends |

Date on which dividends are reinvested |

|

… as compensation for services received |

When the services are rendered |

|

… as consideration in a business combination |

Date of acquisition |

|

… on mandatory conversion of a convertible instrument |

Date on which contract is entered into |

Partly paid ordinary shares

Notwithstanding the general principles, partly paid shares are included as a fraction of an ordinary share to the extent that they are entitled to participate in dividends during the period relative to a fully paid ordinary share (see Partly paid ordinary shares). (IAS 33.A15)

Treasury shares

Treasury shares are an entity’s own ordinary shares reacquired and held by the entity. In the consolidated financial statements, treasury shares also include the parent’s shares that are held by its subsidiaries. (IAS 33.IE2)

Treasury shares are not regarded as outstanding and are excluded from the denominator for the period during which they are held by the entity (see Applying the three-step approach). This reflects the rationale underlying the use of the weighted-average number of ordinary shares, because the consideration spent in reacquiring own shares is no longer available for use in the entity’s operations.

Own shares held by employee benefit plans

Although the wording is not entirely clear, it appears that IFRS 10 Consolidated Financial Statements excludes from its scope post-employment benefit plans or other long-term employment plans to which IAS 19 Employee Benefits applies.

Therefore, if an entity’s ordinary shares are qualifying plan assets held by its employee benefit plan and are netted against the employee benefit obligation in accordance with IAS 19, then these shares are not the entity’s treasury shares.

Accordingly, in general these shares should be considered outstanding when calculating EPS. However, if an entity’s own shares held by its employee benefit plan do not meet the definition of plan assets, then they are presented as treasury shares, even though the plan is not consolidated by the employer; in this case, in our view these shares should not be considered outstanding when calculating EPS.

Because the net presentation requirement for employee benefit plans under IAS 19 does not apply to equity-settled share-based payment plans to which IFRS 2 Share-based Payment applies, the consolidation requirements apply to a vehicle established in connection with equity-settled share-based payment plans. When a reporting entity consolidates such a vehicle, its ordinary shares held by that vehicle would be treasury shares in its consolidated financial statements; they are therefore not regarded as outstanding shares for basic EPS purposes. (IAS 19.2, IAS 33.33–34)

Changes in the number of outstanding ordinary shares without corresponding changes in resources

The events that have been discussed so far in this chapter relate to a change in an entity’s number of outstanding ordinary shares that has a corresponding change in the resources available for use in its operations. For example, in the simplest case in which ordinary shares are issued for cash, the weighted-average number of shares outstanding used in the denominator of the basic EPS calculation is adjusted from the date on which the change in resources (cash) is recognised – i.e. when the cash proceeds from the issuance of shares become receivable.

However, the number of outstanding ordinary shares may increase or decrease without a corresponding change in resources. For example, the number of shares may increase as a result of a capitalisation, bonus issue or share split, or decrease as a result of a share consolidation (i.e. reverse share split).

In such cases, ordinary shares are effectively issued or cancelled for no consideration and therefore these events do not contribute to the earning capacity of an entity. As such, to follow the approach mentioned above by taking into account the change in the number of ordinary shares only from the date of these capital events would give an erroneous impression of a change in an entity’s profitability when there is merely a redenomination of shares.

As a result, when there is a capitalisation or bonus issue or a (reverse) share split that has the effect of changing the number of shares outstanding without a corresponding change in resources, the weighted-average number of shares outstanding for the entire period is retrospectively adjusted as if the change had occurred at the beginning of the first period of EPS information presented. (IAS 33.26, IAS 33.29)

Furthermore, such retrospective adjustment is required when these changes occur after the reporting date but before the financial statements for that reporting period are authorised for issue. (IAS 33.64)

Applying the three-step approach

|

Case – Basic EPS – A simple example |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following example illustrates the application of the three-step approach to basic EPS. Company P has both ordinary shares and equity-classified preference shares in issue. The reconciliation of the number of shares during Year 1 is set out below.

The following additional information is relevant for Year 1.

Step 1 Determine the numeratorThe first step in the basic EPS calculation is to determine the profit or loss that is attributable to ordinary shareholders of P for the period. In this example, there is no discontinued operation; therefore, there is no need to determine a separate basic EPS for the total, continuing and discontinued operations. Non-cumulative dividends paid on equity-classified preference shares are not deducted in arriving at net profit or loss for the period, but they are not returns to ordinary shareholders. Accordingly, these dividends are deducted from net profit or loss for the period in arriving at the numerator.

Accordingly, the numerator is 4,180,000. Step 2 Determine the denominatorThe second step in the basic EPS calculation is to determine the weighted-average number of ordinary shares outstanding for the reporting period. In the calculation below, the number of months or parts of months, rather than the number of days, has been used as an approximation (see What number of shares to use).

Note 1. The bonus issue changed the number of shares outstanding without a corresponding change in resources. For this reason, the number of shares is retrospectively adjusted to 1 January. The denominator is therefore 2,608,333. Step 3 Determine basic EPSBasic EPS = 4,180,000 / 2,608,333 = 1.60. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diluted EPS

Entities often enter into financial instruments or other contracts that may entitle their holders to ordinary shares in the future. For example, an entity may issue a bond that is convertible into its ordinary shares. These financial instruments or other contracts are referred to as ‘potential ordinary shares’ (POSs) in IAS 33.

Note the use of the term ‘may’. Accordingly, this includes contracts that result in ordinary shares only if specified conditions are met (see Contingently issuable ordinary shares), and those that are not always settled but that may be settled in ordinary shares (see Contracts that may be settled in shares or cash). (IAS 33.5, IAS 33.7, IAS 33.58–61)

When POSs are exercised or otherwise result in the issuance of ordinary shares, an entity’s basic EPS is affected: the weighted-average number of ordinary shares (the denominator) increases, and the profit or loss attributable to ordinary shareholders (the numerator) may be affected – e.g. when interest on a convertible bond no longer needs to be paid. Depending on the circumstances, the conversion of POSs may result in a decrease (dilution) or an increase (anti-dilution) in basic EPS.

Basic EPS does not consider the impact of a possible dilution to profit or loss attributable to ordinary shareholders as a result of POSs outstanding during a reporting period. ‘Diluted’ EPS aims to fill this gap, by providing an additional historical performance measure that indicates the potential dilution to the entitlement of existing ordinary shareholders that could occur if all of the dilutive POSs outstanding during a reporting period had become outstanding ordinary shares during the period.

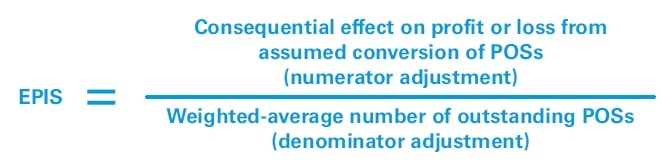

To calculate diluted EPS, an entity adjusts both the numerator and the denominator used in the basic EPS calculation for the effects of all dilutive POSs, as follows.

The objective in determining diluted EPS is to reflect the maximum possible dilutive effect arising from POSs outstanding during the reporting period.

Accordingly, the effects of any anti-dilutive POSs are ignored, and the diluted EPS can never give a more favourable impression of an entity’s performance than the basic EPS from continuing operations.

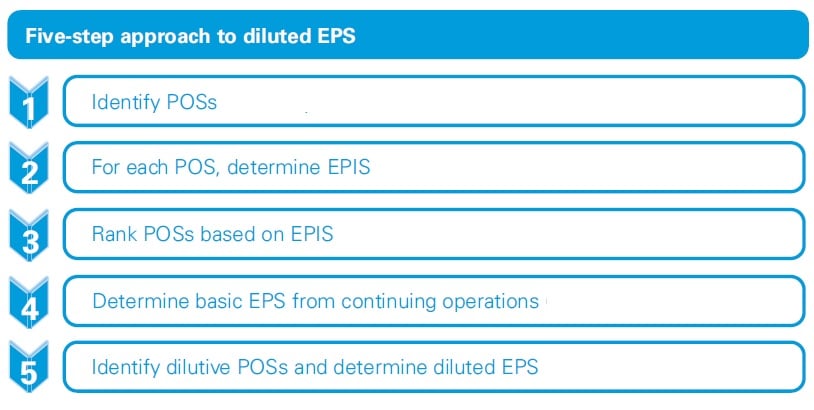

This section provides further guidance on the determination of diluted EPS. It introduces a five-step approach to the calculation of diluted EPS (see below Step 1 to 5), and ends with an illustrative example of the diluted EPS calculation (see Applying the five-step approach).

Diluted EPS calculations are made following a five-step approach.

Step 1: Identify POSs

The first step to calculating diluted EPS is to identify the different classes of POSs that are outstanding during the reporting period, regardless of whether they remain outstanding at the reporting date.

Examples of POSs include the following:

- Unvested shares

- Options, warrants and their equivalents

- Contingently issuable ordinary shares

- Convertible instruments

- Written puts

- Others

Although instruments that are convertible into ordinary shares are generally POSs, those that are mandatorily convertible are not. Mandatorily convertible instruments are regarded as outstanding ordinary shares from the date on which the contracts are entered into; they are therefore included in the denominator for basic EPS from that date (see When shares become outstanding – General principles and convertible instruments). (IAS 33.23)

Because POSs are generally weighted for the period they are outstanding (see denominator adjustment), the identification of POSs is not limited to those that remain outstanding at the reporting date, but also includes those that had been outstanding during the reporting period but were cancelled, allowed to lapse or converted into ordinary shares during the period. (IAS 33.38)

‘Classes’ of POSs

An entity may have multiple POSs outstanding during a reporting period. For example, it may have different types of POSs (e.g. convertible instruments and unvested shares) or POSs of the same type but from series or issues containing different terms (e.g. share options with different exercise prices). Here, these POSs of different types or of different terms are referred to as different ‘classes’ of POSs.

Identifying different classes of POSs is important, because different classes are considered separately rather than in aggregate in determining whether each class of POSs is dilutive or anti-dilutive (see Step 5 Identify dilutive POSs and determine diluted EPS). For example, share options that have different exercise prices or exercise periods need to be considered separately. (IAS 33.44)

For each class of POSs:

- identify:

- adjustments to the numerator; and

- adjustments to the denominator; and

- compute the EPIS.

The second step to calculating diluted EPS is to determine the EPIS for each class of POSs, which is then used to determine whether each of these classes is dilutive and therefore whether it should be included in diluted EPS.

Determining the EPIS for a particular class of POSs is similar to calculating the EPS for that class of POSs. Determining the EPIS for different classes of POSs helps in identifying which of these classes is dilutive and is therefore ultimately included in the denominator for diluted EPS (see Step 5 Identify dilutive POSs and determine diluted EPS). The EPIS for a class of POSs is determined using the following formula.

Numerator adjustment

Diluted EPS assumes that all dilutive POSs have been converted into or otherwise resulted in ordinary shares (see denominator adjustment). Under this assumption, any income and expense relating to these dilutive POSs that have been included in profit or loss would not have been recognised. Accordingly, the numerator is adjusted to reflect any consequential changes in profit or loss that would arise from the assumed conversion of dilutive POSs. (IAS 33.34)

With the exception of equity-settled share-based payment costs (see share-based payment arrangements), the numerator is adjusted for the post-tax effect of: (IAS 33.33)

- any dividends, interest and other items related to the dilutive POSs that are deducted in arriving at the profit or loss attributable to ordinary shareholders; and

- any other changes in income or expense that would result from the assumed conversion of dilutive POSs.

For example, an entity has issued convertible debt that is accounted for wholly as a financial liability under IAS 32 Financial Instruments: Presentation, because the conversion feature is a derivative that does not meet the definition of equity (e.g. because the conversion price is not fixed). If the convertible debt is dilutive, then the adjustments under the first bullet point above include:

- the post-tax effect of interest expense (which includes any amortisation of initial transaction costs and discounts accounted for using the effective interest method under IFRS 9 Financial Instruments), which would have been saved from the assumed conversion of the convertible debt, net of the related tax effects (see convertible instruments for an illustration of this adjustment);

- the post-tax effect of foreign exchange gain or losses in profit or loss, if the instrument is denominated in a foreign currency; and

- the post-tax effect of any fair value remeasurement associated with the derivative component.

In addition, IAS 33 goes a step further to require adjustments for ‘any other changes in income or expense that would result from the assumed conversion of dilutive POSs’, noting that the conversion of POSs may lead to consequential changes in profit or loss. Continuing the example, examples of other consequential effects on profit or loss may be:

- a decrease in depreciation expense if part of the interest on the debt is capitalised under IAS 23 Borrowing Costs; and

- an increase in the expense related to a non-discretionary employee profit-sharing plan. (IAS 33.35)

Keep in mind, for an item to be treated as having a consequential effect on profit or loss as a result of an assumed conversion of dilutive POSs, there should be a direct or automatic adjustment to profit or loss.

|

Case – Numerator adjustment – Consequential effect on employee profit-sharing plan expense |

||||||||||||||||||||||||

|

Case

Numerator adjustment To determine the EPIS for the convertible bond, G assumes that the bond is converted into ordinary shares from the beginning of Year 1. With the assumed conversion, the interest on the bond would not have been recognised in Year 1. This would have resulted in an increase in profit for Year 1 and, consequently, would have led automatically to an increase in the employee profit-sharing plan expense. Therefore, G determines the numerator adjustment for the EPIS as follows.

|

||||||||||||||||||||||||

|

Case – Numerator adjustment – Consequential effect on capitalised borrowing costs |

||||||||||||||||||||||||

|

Case

Numerator adjustment To determine the EPIS for the convertible bond, H assumes that the bond is converted into ordinary shares from the beginning of Year 1. With the assumed conversion, the interest on the bond would not have been recognised in Year 1. In addition to the reduction in the interest expensed, this would have resulted in a reduction in the interest capitalised and, consequently, would have resulted in a reduction in depreciation expense recognised during Year 1 in respect of such capitalised interest.

|

||||||||||||||||||||||||

|

Case – Numerator adjustment – No consequential effect on profit or loss |

||||||||||||||||||||||||

|

Case Company J issues share options to its employees. To fulfil its obligations in this regard, J writes a call option to Bank B to purchase its own shares at market price. Numerator adjustment In this example, J concludes that this call option is not a derivative, because the value of the option does not depend on an underlying variable – it always has a fair value of zero. Therefore, as far as the call option between J and B is concerned, the assumed conversion of the employee share options would not have any consequential change to profit or loss. Accordingly, no numerator adjustment should be made to the EPIS in this regard. |

||||||||||||||||||||||||

|

Case – Numerator adjustment – No consequential effect on profit or loss |

||||||||||||||||||||||||

|

Case Continuing from the last example, to reduce its exposure to an increase in the market price of its shares when the options become exercisable, Company J enters into a share swap with Bank C.

Numerator adjustment Although J may intend to adjust the notional amount under the swap arrangement to hedge the share-based payment liability, the adjustment is not automatic and J has the discretion to adjust its exposure. Therefore, we believe that there is insufficient linkage between the swap arrangement with C and the exercise of options to consider changes in the swap arrangement with C to be a consequential change to profit or loss. Accordingly, no numerator adjustment should be made to the EPIS in this regard. |

||||||||||||||||||||||||

In general, the numerator should not be adjusted for equity-settled share-based payment costs when calculating diluted EPS. However, if there is a remeasurement expense from a liability of a cash-settled share-based payment that may also be settled in shares, then the numerator is adjusted for such an amount when calculating diluted earnings. (IAS 33.58–59)

Denominator adjustment

The denominator for diluted EPS is the weighted-average number of ordinary shares used in calculating basic EPS (see Step 2 Determine the denominator) plus the weighted-average number of ordinary shares that would be issued on conversion of all of the dilutive POSs into ordinary shares. (IAS 33.36)

When determining the EPIS for different classes of POSs, the POSs are weighted for the period they are outstanding. Accordingly, they are included in the denominator for diluted EPS from the beginning of the reporting period, or the date on which they are issued if this is later. POSs that were cancelled, allowed to lapse or converted to ordinary shares during the reporting period are included for the period they are outstanding – i.e. to the date on which they were cancelled, lapsed or converted. (IAS 33.38)

Similar to the denominator for basic EPS, when determining the denominator, strictly speaking the time-weighting factor is the number of days that the POSs are outstanding as a proportion of the total number of days in the period. However, a reasonable approximation is adequate in many circumstances. This might involve using weeks or parts of months, rather than the precise number of days. (IAS 33.20)

The following case illustrates the idea behind the calculation of the weighted average.

|

Case – Denominator adjustment – A simple example |

||||||||||||||||||||||||||||||||

|

Case Company B has the following transactions involving its non-cumulative preference shares during Year 1. All of these preference shares are convertible into ordinary shares on the same conversion terms.

Determining the denominator adjustment for EPIS B calculates the denominator for EPIS for Year 1 as follows.

Therefore, the denominator adjustment for the EPIS of preference shares is 2,125. |

||||||||||||||||||||||||||||||||

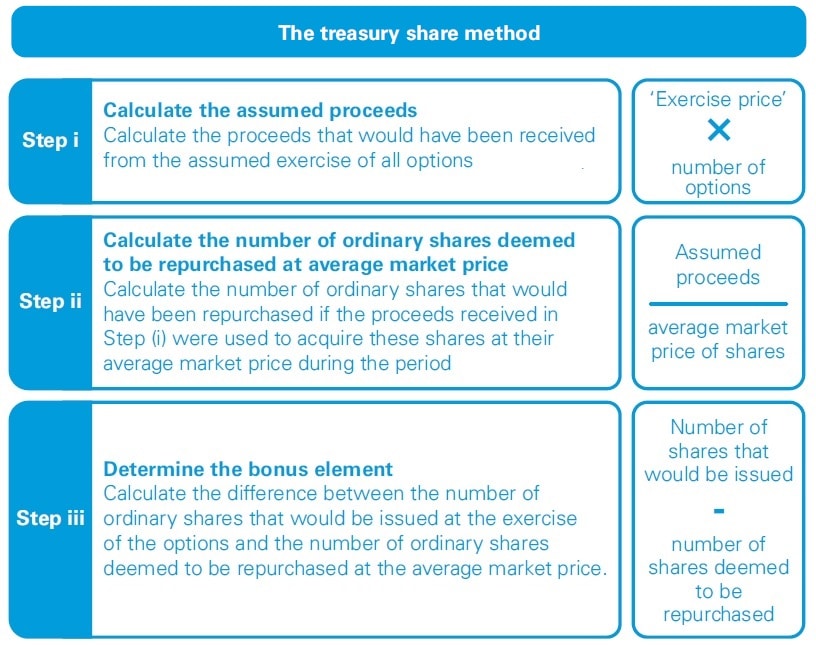

Notwithstanding the general principles above, additional specific requirements apply to the determination of the denominator adjustment for different types of POSs. For example, for options, warrants or their equivalents, rather than simply adding to the denominator the weighted-average number of ordinary shares to be issued from the assumed conversion of the options, IAS 33 prescribes another method, commonly referred to as the ‘treasury share method’, under which only the bonus element of the issue is reflected in the denominator. (IAS 33.45-46)

The following diagram summarises the treasury share method.

The treasury share method is also used to calculate the impact on diluted EPS of other instruments – e.g. partly paid ordinary shares and unvested ordinary shares. However, a different method, commonly referred to as the ‘reverse treasury share method’ applies for written put options and forward contracts.

Multiple conversion bases

Some POSs have more than one basis of conversion. For example, the manner of conversion is at the discretion of one of the contracting parties, or the conversion rates or exercise prices vary over time. When determining the impact of these POSs on diluted EPS, the general principle that the diluted EPS should capture the maximum dilutive effect arising from POSs outstanding during the period applies. (IAS 33.39, IAS 33.58, IAS 33.60)

This generally means that:

- for contracts that may be settled in ordinary shares or cash at the entity’s option, the entity presumes that the contract will be settled in ordinary shares;

- for contracts that may be settled in ordinary shares or cash at the holder’s option, the more dilutive of share-settlement and cash-settlement is used; and

- for contracts whose conversion rate or exercise price varies over time, the most advantageous conversion rate or exercise price from the standpoint of the holder of the POS is assumed.

Changes in the number of POSs outstanding without corresponding changes in resources

Similar to the denominator for basic EPS (Changes in the number of outstanding ordinary shares without corresponding changes in resources), the denominator for diluted EPS may be affected if the number of POSs outstanding increases or decreases without a corresponding change in resources – e.g. as a result of a capitalisation, bonus issue, share split or reverse share split. (IAS 33.64)

Many POSs contain anti-dilution provisions that protect their holders from devaluation of their rights. For example, the terms of a share option may specify that its conversion ratio is to be adjusted in the event of a share split. If there is a change in the number of outstanding ordinary shares without a corresponding change in resources, such as a share split, then the terms of POSs in issue at the time of the change should be evaluated to determine whether there is a corresponding change in the number of POSs outstanding and therefore a corresponding adjustment to the denominator for diluted EPS.

Determining EPIS

Once the adjustments to the numerator and the denominator have been determined, EPIS is calculated using the formula set out at in Step 2 For each class of POSs determine EPIS.

|

Case – Determining EPIS |

||||||

|

Case Consider the same fact pattern as presented in the case Denominator adjustment – A simple example. The following facts are also relevant.

Determining the EPIS The adjustment to the numerator is determined as follows.

The adjustment to the denominator is 2,125 (see last case Denominator adjustment – A simple example). EPIS = 700 / 2,125 = 0.33 |

Step 3: Rank POSs based on EPIS

|

More than one class of POSs |

Rank POSs from the lowest to the highest EPIS – POSs with adjustments only to denominator are included first |

An entity may have more than one class of POSs in existence during a reporting period. For example, it may have both convertible debt and share options that entitle the holders to the entity’s ordinary shares. In another example, an entity may have more than one type of share options, each with a different exercise price. (IAS 33.42, IAS 33.44)

When determining diluted EPS, it is necessary to establish whether an entity’s POSs are dilutive – i.e. whether the assumed conversion of the POSs would decrease net profit per share from continuing operations (see Step 5 below). If an entity has more than one class of POSs, then dilution is judged by the cumulative impact of POSs. Because the objective of diluted EPS is to reflect the maximum dilutive effect taking into account all of an entity’s POSs as a whole, the effects of any anti-dilutive POSs are ignored. (IAS 33.44)

To make this determination, each class of POSs identified in Step 1 is considered in sequence. To work out this sequence, it is necessary to calculate the effect that the assumed conversion of each class of POSs would have on both net profit from continuing operations and the weighted-average number of ordinary shares, by determining the EPIS for each class of POSs. Classes of POSs are then ranked in order from the most dilutive (the class with the lowest EPIS) to the least dilutive (the class with the highest EPIS). This is often referred to as the ‘ranking’ of POSs. (IAS 33.44)

Classes of POSs that have denominator adjustment but do not have numerator adjustment are ranked the most dilutive. An example of these instruments is an equity-classified share option (see Options, warrants and their equivalents). (IAS 33.44)

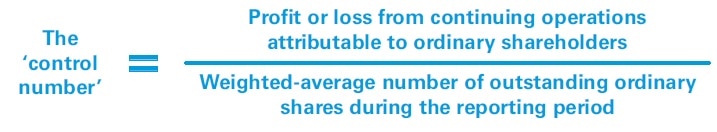

Step 4: Determine basic EPS from continuing operations

As is further explained in Step 5 below, IAS 33 uses ‘profit or loss from continuing operations attributable to an entity’s ordinary shareholders’ as the ‘control number’ in determining whether POSs are dilutive or anti-dilutive. Items relating to discontinued operations under IFRS 5 Non-current Assets Held for Sale and Discontinued Operations are excluded from this control number. (IAS 33.41–42)

Step 5: Identify dilutive POSs and determine diluted EPS

|

More than one class of POSs |

|

|

↓ |

|

|

Diluted EPS |

Dilutive or anti-dilutive?

POSs are included in diluted EPS for a reporting period only if their inclusion would decrease EPS, or increase the loss per share, from continuing operations. In other words, these POSs are ‘dilutive’. If the inclusion of certain POSs in the calculation would increase the EPS, or decrease the loss per share, from continuing operations, then these POSs are anti-dilutive and are ignored in diluted EPS. This is regardless of whether the POSs are dilutive for EPS from total operations. (IAS 33.43)

|

Case – Dilutive or anti-dilutive – The ‘control number’ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Case Company P’s net profit (loss) for Year 1, Year 2 and Year 3 is as follows.

The weighted-average number of P’s outstanding ordinary shares throughout the three years is 200,000 shares. As part of the acquisition of Subsidiary S, before Year 1, P entered into an agreement with the former shareholders of S to issue 20,000 ordinary shares for no further consideration in September Year 4 if the market price of S’s ordinary shares is above 150 at that date. At 31 December Year 1, Year 2 and Year 3, the market price of S’s ordinary shares is above 150. Dilutive or anti-dilutive? The treatment of contingently issuable ordinary shares is discussed in detail in Contingently issuable ordinary shares. Although P would not issue any ordinary shares under its agreement with S’s former shareholders until the specified market price target is met in Year 4, its agreement to issue ordinary shares contingent on the market price target may entitle the former shareholders of S to P’s ordinary shares for no further consideration. Accordingly, the agreement gives rise to POSs that would result in an adjustment to diluted EPS if they are dilutive. Generally, to reflect the potential decrease in the profit entitlement of P’s existing ordinary shares, the denominator for diluted EPS includes the number of ordinary shares that would be issued if the market price at the reporting date were the market price at the end of the contingency period, and the effect would be dilutive. This means that, when P determines diluted EPS for Years 1 to 3, it assumes that the 20,000 contingently issuable ordinary shares were outstanding ordinary shares in each of the three years, to evaluate whether the assumed conversion would decrease EPS from continuing operations in each of these years.

This example illustrates the ‘control number’ notion: once certain POSs are regarded as dilutive for a reporting period because they reduce the EPS from continuing operations, they are included in the denominators for all diluted EPS measures for that period. For example, P includes 20,000 POSs in its diluted EPS from continuing operations in Year 2 because the resulting amount is dilutive (the inclusion reduces the EPS from continuing operations from 5 to 4.55); consequently, P includes the same 20,000 POSs in its diluted loss per share from total operations in Year 2, even though the resulting amount is anti-dilutive to the comparable basic loss per share amount from total operations (the inclusion reduces the loss per share from 10 to 9.09). By contrast, in Year 3 the 20,000 shares are not included in diluted EPS because they are not dilutive for continuing operations, even though they would be for total operations (the inclusion would reduce the EPS from total operations from 10 to 9.09). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Independent determination from period to period

Whether certain POSs are dilutive is determined independently for each period presented. What may be regarded as dilutive in one reporting period may be anti-dilutive in another period. (IAS 33.37)

Further, as a consequence of the above, the number of dilutive POSs included in the annual (or year-to-date) period is not a weighted average of the dilutive POSs included in each interim computation. (IAS 33.37)

Multiple classes of POSs

If an entity has more than one class of POSs outstanding during the reporting period, then its basic EPS from continuing operations is adjusted for the impact of each class of POSs one by one, from the most dilutive to the least dilutive, in sequence and cumulatively.

In each of these ‘sub-steps’, the ‘before’ and ‘after’ EPS amounts are compared – if the adjusted EPS from continuing operations at that sub-step is less than the previous amount (assuming profits), then the class of POSs in question is dilutive. This process is repeated for each class in sequence according to the ranking identified in Step 3 Rank POSs based on EPIS. The process is stopped when a particular class of POSs no longer produces a further dilution; the most dilutive EPS amount is from the ‘before’ amount at this sub-step.

Because the objective of diluted EPS is to determine the maximum dilutive effect of an entity’s POSs on a cumulative basis, it is possible that a class of POSs may be regarded as dilutive on its own but nevertheless be excluded from the diluted EPS calculation, because it is anti-dilutive on a cumulative basis. (IAS 33.44)

Determining diluted EPS

The diluted EPS for continuing operations will have been calculated in the process Dilutive or anti-dilutive?. Net profit or loss from discontinued operations is added or reduced to calculate the diluted EPS for total operations and discontinued operations.

Applying the five-step approach

|

Case – Calculation of Diluted EPS |

||||||||||||||||||||||||||||||||||||

|

This example expands on the case Basic EPS Applying the three-step approach (see above) and illustrates the determination of diluted EPS when an entity has more than one class of POSs. Movements in Company P’s shares and POSs during Year 1 are presented as below.

The following information remains relevant for this example for Year 1:

The following information is also relevant for Year 1.

The basic EPS computations for Year 1 are the same as presented in the case Basic EPS Applying the three-step approach. |

Step 1 Identify POSs

This entity has two classes of outstanding POSs:

- the preference shares, which are convertible in the future into ordinary shares; and

- the contingently issuable shares, which may be issued as ordinary shares at the end of Year 2.

For the contingently issuable shares under (ii), the conditions related to share price would be met if the reporting date were the end of the contingent period. Accordingly, they are considered in the diluted EPS calculation. For further discussion of contingently issuable ordinary shares, see Contingently issuable ordinary shares.

Step 2 For each POS, calculate EPIS

i. Preference shares

Potential adjustments to numerator: The numerator for the EPIS calculation is the impact of dividends attributable to preferred shareholders, segregated during the calculation of basic EPS in Example 3.10 (Chapter 3.4): 420,000.

Potential adjustments to denominator: The shares reflect the adjusted conversion factor from the bonus issue – i.e. 2.1. Therefore, the adjustments to the denominator are 1,050,000 (500,000 x 2.1).

EPIS = 420,000 / 1,050,000 = 0.40

ii. Contingently issuable shares

Potential adjustments to numerator: The shares are classified as equity, and therefore there is no impact on profit or loss for the year.

Potential adjustments to denominator: The number of ordinary shares issuable is 315,000.

EPIS = 0 / 315,000 = 0.00

Step 3 Rank the POSs

The ranking from the most dilutive to the least dilutive is as follows.

- Contingently issuable shares: EPIS = 0.00

- Preference shares: EPIS = 0.40

Step 4 Determine basic EPS from continuing operations

The losses from the discontinued operation are added to the numerator for basic EPS calculated in the case (see Basic EPS Applying the three-step approach.

Therefore, the control number is as follows.

|

Numerator for basic EPS (see Basic EPS Applying the three-step approach): |

4,180,000 |

|

(+) losses from discontinued operations: |

400,000 |

|

= Numerator for basic EPS from continuing operations |

4,580,000 |

|

Denominator for basic EPS (see Basic EPS Applying the three-step approach) |

2,608,333 |

Basic EPS from continuing operations = 4,580,000 / 2,608,333 = 1.76

Step 5 Identify dilutive POSs and determine diluted EPS

|

Earnings |

Weighted-average number of shares |

Per share |

Dilutive? |

|

|

Basic EPS from continuing operations |

4,580,000 |

2,608,333 |

1.76 |

|

|

Contingently issuable shares |

– |

315,000 |

||

|

Subtotal |

4,580,000 |

2,923,333 |

1.57 |

√ |

|

Preference shares |

420,000 |

1,050,000 |

||

|

Diluted EPS from continuing operations |

5,000,000 |

3,973,333 |

1.26 |

√ |

Therefore, the diluted EPS from continuing operations is (5,000,000 / 3,973,333) = 1.26.

The diluted EPS from the discontinued and total operations are further calculated using the same numerator.

|

Earnings |

Weighted-average number of shares |

EPS |

|

|

Diluted EPS from continuing operations |

5,000,000 |

3,973,333 |

1.26 |

|

Diluted EPS from discontinued operations |

400,000 |

-0.10 |

|

|

Diluted EPS from total operations |

4,600,000 |

1.16 |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS EPS