Because share-based payments are common and they impact EPS, it is important to understand how IFRS 2 interacts with IAS 33. Accordingly, this narrative starts with an alternative IFRS 2 perspective and discusses the EPS implications of each type of arrangement under IFRS 2.

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

For details on the specific EPS implications of particular types of instrument, this chapter may need to be read in conjunction with the chapter on those specific instruments. For example, for a number of the instruments described in other chapters, the treasury share method is used in calculating diluted EPS. The general principles underlying the treasury share method are explained in detail in 5.9.40, and the additional implications of applying the treasury share method to share-based payment instruments are further explained in 5.17.80.

Simply put, share-based payments are generally transactions in which an entity acquires goods or services (including employee services) in exchange for its (or another group entity’s) equity instruments or a liability that is based on the price or value of its (or another group entity’s) equity instruments. There are three main factors to be considered in assessing how a share-based payment will affect EPS.

|

IFRS 2 Conditions |

Analysis |

|

Settlement alternatives that drive the classification as equity- or cash-settled share-based payments under IFRS 2 See 1 |

They determine whether and how EPS is affected – e.g. if a share-based payment is a POS. |

|

They impact how a share-based payment is dealt with in EPS – e.g. as an option or as a contingently issuable share. |

|

|

It determines which other considerations might be necessary to understand the EPS implications – e.g. dividend entitlements for non-vested shares or exercise prices for options. |

1. IFRS 2 Settlement alternatives

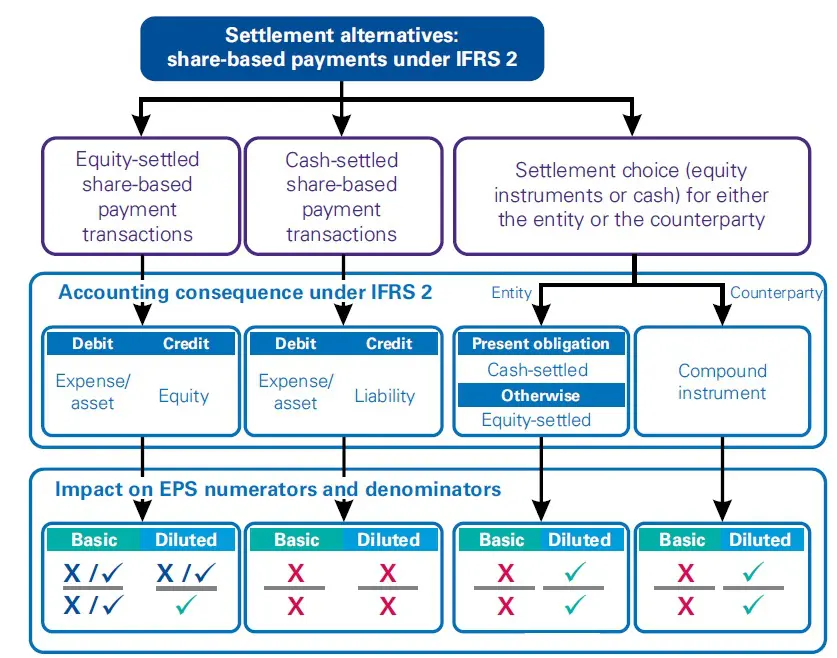

IFRS 2 distinguishes between share-based payment transactions by their manner of settlement. For each of these settlement alternatives, the accounting outcome under IFRS 2 and the IAS 33 consequences can be summarised as follows.

| 1.1 Equity-settled share-based payments | 1.3 Share-based payment arrangements with the option to settle in ordinary shares or cash |

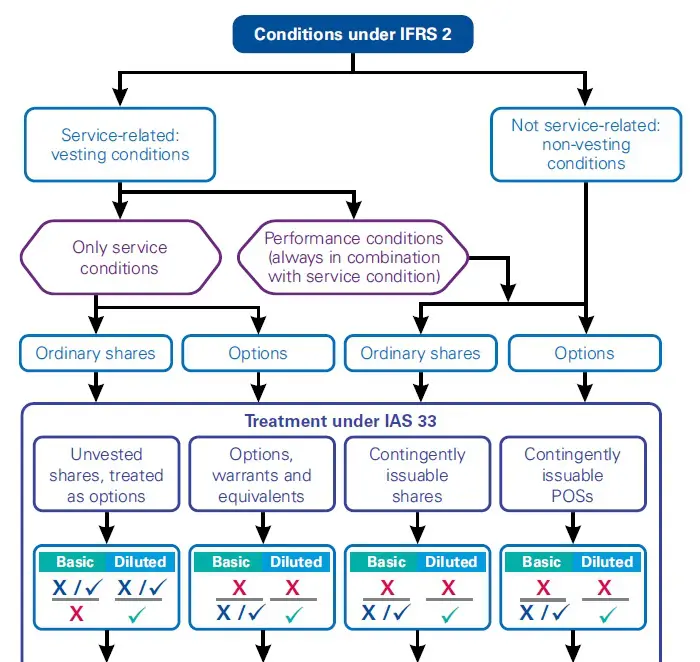

The types of vesting condition and the form of the instrument would impact the determination of EPS for share-based payments that are classified as equity-settled. The following diagram outlines the implications and includes cross-references to the chapters that set out the EPS implications in more detail.

|

Unvested ordinary shares (and ordinary shares subject to recall) |

In addition to the general considerations above, there are two specific aspects relevant to the determination of diluted EPS if there are equity-settled share-based payments. These relate to adjustments to the numerator for diluted EPS and the denominator for diluted EPS with application of the treasury share method.

Numerator for diluted EPS

For share-based payments that are classified as equity-settled under IFRS 2, in our view the numerator should not be adjusted when calculating diluted EPS. (IFRS 2.BC57, IAS 33.47A, IAS 33.IE5A) This covers both: (1) the share-based payment expenses incurred in the current period; and (2) the fair value of future goods or services included as part of assumed proceeds when determining the adjustment to the denominator in a diluted EPS calculation (see below). This is because:

- the share-based payment expenses incurred in the current period would not have been saved by the assumed conversion and are therefore not a ‘consequential change in profit or loss’; and

- the unearned share-based payment treated as assumed proceeds will be recognised in the numerator in basic EPS only over the remaining vesting period, as future services are provided.

However, this is different if the share-based payments were classified as cash-settled under IFRS 2; see 5.17.80. (IAS 33.59)

Denominator for diluted EPS – Application of the treasury share method General considerations relating to the application of the treasury share method for options are set out in 5.9.40. As indicated in 5.17.10, the treasury share method is equally applicable to unvested shares.

When applying the treasury share method to share options and other share-based payment arrangements to which IFRS 2 applies, the ‘assumed proceeds’ of the POSs comprise two components. (IAS 33.47A, IAS 33.IE5A)

The consequence of this is that, holding other factors constant, a particular POS will generally become increasingly dilutive during the period over which the IFRS 2 cost is recognised. This is because the amount of the fair value of goods or services that will be recognised as a cost in future periods will reduce, and therefore the assumed proceeds will reduce over time.

IAS 33 is unclear regarding the basis to be used for the estimation of the future services component and a number of approaches may be acceptable. (IAS 33.45, IAS 33.47A) Two possible acceptable approaches are explained below.

Future IFRS 2 charges

The initial step in applying the treasury share method in the diluted EPS calculation is to determine the assumed proceeds from the exercise of the share option (see 5.9.40). However, IAS 33 is silent on how these assumed proceeds should be calculated. Two approaches to computing the assumed proceeds are outlined below. In our view, there may be other approaches to computing the assumed proceeds – in particular, the value of the future services component of the calculation – that may be acceptable under IFRS. (IAS 33.45, IAS 33.47A)

Under the first approach, the value of the future services component of the assumed proceeds calculation is computed based on the outstanding options at the reporting date (see Approach 1 in Example 5.17).

Alternatively, under the second approach, the value of the future services component of the assumed proceeds calculation is computed based on the average unearned compensation for the period. In our view, this approach is also acceptable because using the average unearned compensation for the period is consistent with including weighted-average options and warrants outstanding during the period in diluted EPS (if they are dilutive) and with the use of the average market price for the period to calculate the bonus element (see Approach 2 in Example 5.17).

In addition, the assumed proceeds from the exercise of a share-based payment will be affected by the number of employees who exercise their share options. (IAS 33.45, IAS 33.47A)

Accordingly, to determine assumed proceeds an entity factors actual forfeitures into the calculation because forfeitures will impact both the consideration received and the future services under the share-based payment. In our view, the consideration received on the exercise of the options component of the assumed proceeds should be based on the weighted-average number of options for the period.

|

Case – Calculating the assumed proceeds under the treasury share method for share-based payments |

A ‘pure’ cash-settled share-based payment that can be settled only in cash or other financial assets does not entitle the holders to an entity’s equity instruments. Accordingly, it does not impact EPS.

For a discussion of share-based payments that have settlement options but are classified as cash-settled share-based payments in accordance with IFRS 2, see 5.17.80.

Plus – Contracts that may be settled in shares or in cash LLIIINK

Although both IFRS 2 and IAS 33 deal with instruments that may be settled in ordinary shares or in cash, the settlement assumption as prescribed in IFRS 2 may not necessarily be consistent with that prescribed by IAS 33. For example, a share-based payment that may be settled either in ordinary shares or in cash may be classified as cash-settled under IFRS 2 because an entity has a present obligation to settle it in cash; however, the share-based payment nevertheless gives rise to POSs for EPS purposes because it may entitle its holders to the entity’s ordinary shares. The following paragraphs set out the specific EPS implications for share-based payments with settlement choices.

Numerator for diluted EPS – Remeasurement expense

If an item is classified as cash-settled because of settlement options with both equity and liability components (a compound instrument) under IFRS 2 (IAS 33.45, IAS 33.47A), then a remeasurement expense will be incurred that would not have been recognised if the share-based payment were classified as equity-settled. (IAS 33.59)

The remeasurement expense on the liability recognised has a consequential effect on the numerator if the share-based payment were to be classified as equity-settled (for the purposes of the EPS calculation). Therefore, the post-tax remeasurement expense is reversed from the numerator so that the amount that remains within the numerator is based on what would have existed if the item had been classified as equity-settled under IFRS 2.

Denominator for diluted EPS – Using the treasury share method

An entity recognises a share-based payment cost for unvested cash-settled payments over the remaining period until settlement date, which includes amounts arising from the remeasurement of the liability at each reporting date and ultimately at settlement date. (IFRS 2.30, IFRS 2.IG19, IAS 33.47A)

In our view, the cost resulting from the remeasurement of cash-settled share-based payment arrangements should not be included in assumed proceeds. This view is based on the fact that if the share-based payment is classified as equity-settled, then there is no remeasurement of the share-based payment. Instead, the future services are measured using the grant-date fair value of the cash-settled share-based payment in accordance with IFRS 2.

2 Vesting conditions

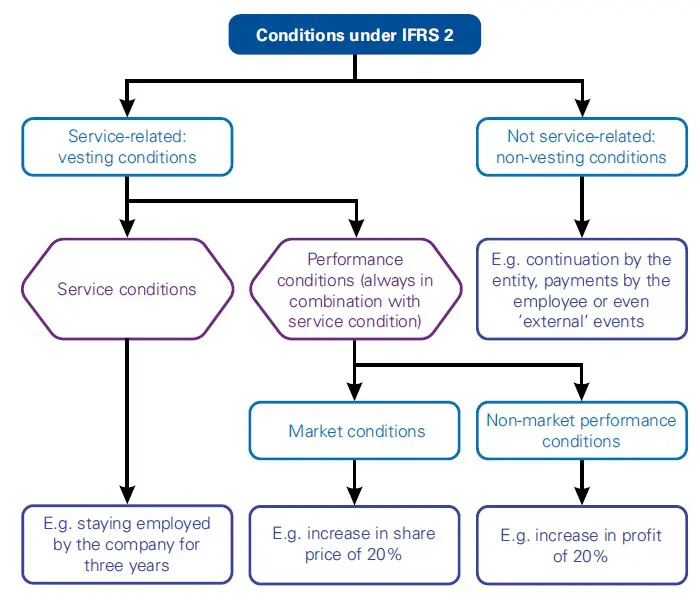

In addition to understanding how the manner of settlement of a share-based payment impacts EPS, it is important to understand as a second factor in 5.17.20 the nature of vesting conditions under IFRS 2.

It becomes clear that any share-based payment transaction under IFRS 2 could involve any combination of manner of settlement and conditions (or combination of conditions). The instruments to be issued might also be different from case to case (shares, options, share appreciation rights or redeemable shares), as might be the consideration that the entity will receive for these instruments.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments EPS Impact of share-based payments