Last update 10/08/2019

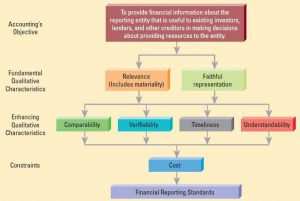

A qualitative characteristic that makes financial information more useful if the information both is relevant and provides a faithful representation.

Comparability, verifiability, timeliness and understand-ability are qualitative characteristics that enhance the usefulness of information that both is relevant and provides a faithful representation of what it purports to represent. The enhancing qualitative characteristics may also help determine which of two ways should be used to depict a phenomenon if both are considered to provide equally relevant information and an equally faithful representation of that phenomenon.

Comparability

An enhancing qualitative characteristic that enables users to identify and understand similarities in, and differences among, items.

The Conceptual Framework provides the following guidance [Conceptual Framework 2.24 – 2.29]:

Users’ decisions involve choosing between alternatives, for example, selling or holding an investment, or investing in one reporting entity or another. Consequently, information about a reporting entity is more useful if it can be compared with similar information about other entities and with similar information about the same entity for another period or another date.

Verifiability

An enhancing qualitative characteristic that enables different knowledgeable and independent observers to reach consensus, although not necessarily complete agreement, that a particular depiction is a faithful representation.

The Conceptual Framework provides the following guidance [Conceptual Framework 2.30 – 2.32]:

Verifiability helps assure users that information faithfully represents the economic phenomena it purports to represent. Verifiability means that different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement, that a particular depiction is a faithful representation. Quantified information need not be a single point estimate to be verifiable. A range of possible amounts and the related probabilities can also be verified.

Timeliness

An enhancing qualitative characteristic possessed by information that is available to decision-makers in time to be capable of influencing their decisions.

The Conceptual Framework provides the following guidance [Conceptual Framework 2.33]:

Timeliness means having information available to decision-makers in time to be capable of influencing their decisions. Generally, the older the information is the less useful it is. However, some information may continue to be timely long after the end of a reporting period because, for example, some users may need to identify and assess trends.

Understand-ability

An enhancing qualitative characteristic possessed by financial information that is classified, characterised and presented clearly and concisely.

The Conceptual Framework provides the following guidance [Conceptual Framework 2.34 – 2.36]:

Classifying, characterising and presenting information clearly and concisely makes it understandable.

Some phenomena are inherently complex and cannot be made easy to understand. Excluding information about those phenomena from financial reports might make the information in those financial reports easier to understand. However, those reports would be incomplete and therefore possibly misleading.

Enhancing qualitative characteristic

Enhancing qualitative characteristic

Enhancing qualitative characteristic Enhancing qualitative characteristic Enhancing qualitative characteristic Enhancing qualitative characteristic Enhancing qualitative characteristic