In short – For employee cash-settled share-based payments, an entity recognises a cost and a corresponding liability. The liability is remeasured, until settlement date, for subsequent changes in fair value.

Overview

- Employee services received in a cash-settled share-based payment are measured indirectly at the fair value of the liability at grant date.

- Market and non-vesting conditions are taken into account in determining the fair value of the liability.

- Service and non-market performance conditions are taken into account in estimating the number of awards that are expected to vest, with a true-up to the number ultimately satisfied.

- The grant-date fair value of the liability is recognised over the vesting period.

- The grant-date fair value of the liability is capitalised if the services received qualify for asset recognition.

- The liability is remeasured at each reporting date and at settlement date so that the ultimate liability equals the cash payment on settlement date.

- Remeasurements during the vesting period are recognised immediately to the extent that they relate to past services, and recognised over the remaining vesting period to the extent that they relate to future services. Remeasurements after the vesting period are recognised immediately.

- Remeasurements of the liability are recognised in profit or loss.

Initial measurement

Cash-settled share-based payments result in the recognition of a liability, which is an obligation to make a payment in cash or other assets, based on the price of the underlying equity instrument (e.g. share price). (IFRS 2.30)

Employee services received in a cash-settled share-based payment are measured indirectly at the fair value of the liability at grant date. The initial measurement of the liability is based on the fair value of the underlying instruments. Measurement of the liability takes into account the extent to which services have been rendered to date. (IFRS 2.32-33)

An entity measures the fair value of a cash-settled liability taking into account only market and non-vesting conditions, meaning that service and non-market performance conditions affect the measurement of the liability by adjusting the number of rights to receive cash based on the best estimate of the service and non-market performance conditions that are expected to be satisfied – i.e. the accounting for the effects of vesting conditions on cash-settled share-based payment transactions follows the approach used for equity-settled share-based payments; see Basic principles here.

The grant-date fair value of the liability is recognised over the vesting period. If no services are required, then the amount is recognised immediately.

The grant-date fair value of the liability is capitalised if the services received qualify for asset recognition (see remeasurements hereafter).

Remeasurements

At each reporting date, and ultimately at the settlement date, the fair value of the recognised liability is remeasured. Remeasurement applies to the recognised portion of the liability through to vesting date. The full amount is remeasured from vesting date to settlement date. The cumulative net cost (asset recognition (see below) and amounts recognised in profit or loss) that will ultimately be recognised in respect of the transaction will be equal to the amount paid to settle the liability. This is different from equity-settled transactions for which there is no true-up of the share-based payment cost for failure to satisfy a market or non-vesting condition (see Basic principles here.).

Remeasurements during the vesting period are recognised immediately to the extent that they relate to past services and recognition is spread over the remaining vesting period to the extent that they relate to future services. That is, in the period of the remeasurement there is a catch-up adjustment for prior periods in order for the recognised liability at each reporting date to equal a defined proportion of the total fair value of the liability. The recognised proportion is generally calculated by dividing the period for which services have been provided as at the reporting date by the total vesting period. Remeasurements are recognised in profit or loss.

Remeasurements after the vesting period are recognised immediately in profit or loss. (IFRS 2.32)

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

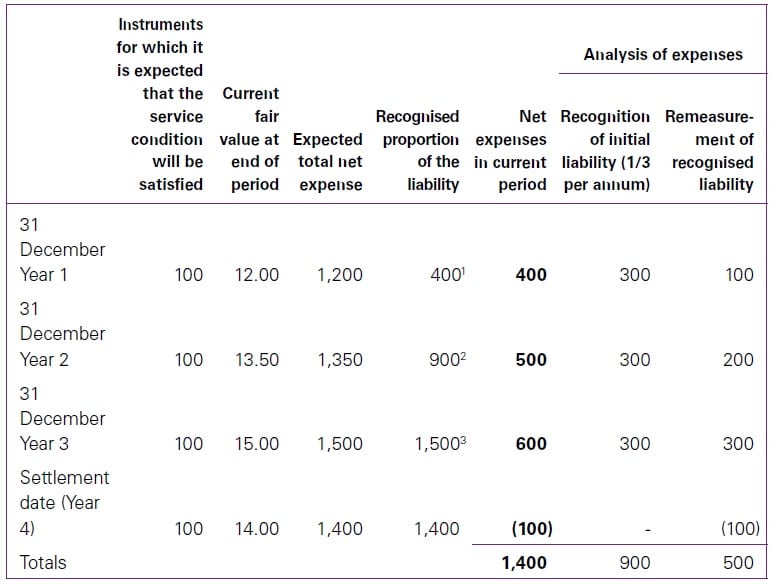

On 1 January Year 1, Company B grants one SAR to each of its 100 employees, subject to a three-year service condition. If the service condition is met, then the SAR will be settled in cash on 29 January Year 4. The employees will receive the intrinsic value of the SAR at settlement date – i.e. any increase in the share price between grant date and 29 January Year 4. At grant date and throughout the vesting period, B expects all employees to remain in service with B and they eventually do. The fair value of the SARs develops as follows.

Assuming that the services received do not qualify for asset recognition (for an illustration in which they do, see next case below), the accounting for the share- based payment is as follows. The grant-date fair value of 900 (100 SARs for which the service condition is expected to be satisfied multiplied by the fair value of 9) is recognised over the vesting period – i.e. 300 per annum. Additionally, the pro-rata share of the remeasurement is recognised in each period.

Notes B accounts for the transaction as follows.

|

Capitalisation of the services received

Only the grant-date fair value of the arrangement may qualify for capitalisation under other standards. Accordingly, the remeasurement of the liability is recognised in profit or loss even if the related share-based payment cost has been capitalised (see next case below, case Cash-settled share-based payment with capitalisation). Failure to satisfy a market or non-vesting condition will trigger a remeasurement of the liability to zero through profit or loss and will not impact any amounts capitalised for services received (see case after next case i.e. case- Cash-settled share-based payment with service and market condition).

Common examples in which services received qualify for capitalisation include:

- employees working on a development project that qualifies for recognition as an intangible asset under IAS 38 Intangible Assets; and

- employee services forming part of the cost of inventory under IAS 2 Inventories. (IFRS 2.9)

|

|

||||||||||||

|

The facts and circumstances are the same as in the above case – Cash-settled share-based payment transaction with change in value of equity instrument. However, Company B is a boat manufacturer and the costs of the employee services relate directly to the manufacturing of boats held as inventory. Therefore, the services received qualify for capitalisation as part of the cost of the boats. As a result of capitalising the grant-date fair value of the liability as part of inventory, the cumulative effect of the entries recognised by B is as follows.

This example illustrates that if the services received qualify for asset recognition, then only the initial measurement of the liability – i.e. the grant-date fair value – can be capitalised. Remeasurements are recognised in profit or loss. |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

On 1 January Year 1, Company C grants one SAR to each of its 100 employees, subject to a three-year service condition and the share price achieving a target price of at least 120 at the end of the vesting period (market condition). If the service and market condition are met, then the SARs will be settled in cash on 29 January Year 4 at the intrinsic value of the SARs at that date. C is a boat manufacturer and the costs of the employee services relate directly to the manufacturing of boats held as inventory. Therefore, the services received qualify for capitalisation as part of the cost of the boats. C’s expectation about the number of employees that will satisfy the service condition develops as follows.

At the end of the vesting period, the share price target is not met. The values of the SARs develop as follows. Table SARS The cost can be analysed as follows. Table cost can be analysed Notes:

The accounting for the share-based payment is as follows.

The example illustrates that the amount capitalised (490) is the grant-date fair value (7) multiplied by the number of employees that have satisfied the service condition (70). The failure to meet the market condition is reflected in the remeasurement of the liability, which is recognised as a credit in profit or loss (see above). |

No service period required

If there is no service period required, then the grant-date fair value is recognised immediately. Nevertheless, remeasurement is required until settlement date and remeasurements are recognised in full in profit or loss because there is no vesting period. (IFRS 2.32 )

Fair value vs intrinsic value

Remeasurement of the liability until settlement is based on the fair value of the underlying instruments, even though the cash payment may be based on an intrinsic value, because the fair value represents the present value of the expected intrinsic value at settlement date. (IFRS 2.33, BC246-BC250)

A payment under a SAR is equal to the increase in value of a share between two dates (the employee does not suffer

loss if the share price declines). Consequently, a SAR is equivalent to an option to buy a share with an exercise price equal to the reference price – i.e. grant-date share price. The fair value of the liability for the SAR will be equal to the fair value of the equivalent share option because the fair value of a SAR that settles on a future date is the intrinsic value plus a premium (time value) for the possibility of future increases in the intrinsic value.

loss if the share price declines). Consequently, a SAR is equivalent to an option to buy a share with an exercise price equal to the reference price – i.e. grant-date share price. The fair value of the liability for the SAR will be equal to the fair value of the equivalent share option because the fair value of a SAR that settles on a future date is the intrinsic value plus a premium (time value) for the possibility of future increases in the intrinsic value.

The final remeasurement of the liability is made on settlement date to equal the ultimate cash payment. That is, the measurement switches from a fair value-based measurement to an intrinsic value-based measurement. (IFRS 2.BC249)

If the settlement of a SAR is at a fixed date, then the fair value of the liability on that date will equal the intrinsic value of the SAR.

However, if the settlement is not at a fixed date but instead the SAR can be settled on any date in a period, then the fair value and the intrinsic value of the SAR will be equal only on the last day of that period. Between vesting date and the end of the settlement period of the SAR, the intrinsic value and the fair value will differ, because by exercising their settlement right before the end of the period the employee gives up the time value of the option. That means that an adjustment is required from fair value measurement to intrinsic value measurement for those SARs that are settled before the end of the settlement period.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments Employee cash-settled share-based payments