Last Updated on 23/02/2020 by 75385885

Effective interest rate

The rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial asset or financial liability to the gross carrying amount of a financial asset or to the amortised cost of a financial liability.

When calculating the effective interest rate, an entity shall estimate the expected cash flows by considering all the contractual terms of the financial instrument (for example, prepayment, extension, call and similar options) but shall not consider the expected credit losses.

The calculation includes all fees and points paid or received between parties to the contract that are an integral part of the effective interest rate (see IFRS 9 paragraphs B 5.4.1–B 5.4.3), transaction costs, and all other premiums or discounts. There is a presumption that the cash flows and the expected life of a group of similar financial instruments can be estimated reliably.

However, in those rare cases when it is not possible to reliably estimate the cash flows or the expected life of a financial instrument (or group of financial instruments), the entity shall use the contractual cash flows over the full contractual term of the financial instrument (or group of financial instruments).

Calculation examples:

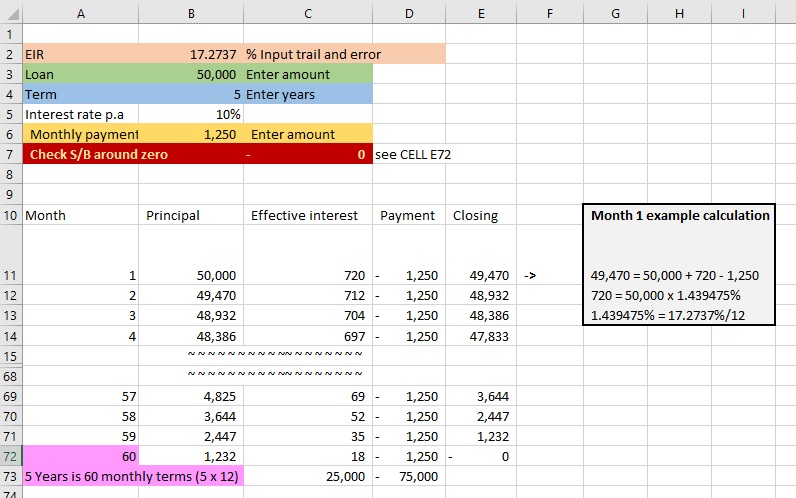

The loan is CU 50,000, monthly payment CU 1,250, loan period 5 years. The add-on interest rate ([total monthly payments / loan amount) – 1] / loan period x 100%) is 10%.

What is the effective interest rate?

The spreadsheet way

Discount 60 monthly terms (5 years of 12 months) of CU 1,250 and an initial loan of 50,000 against an interest rate estimation (CELL B2 below) until the discounted value is equal or very close to CU 0 (CELL C7). The answer is 17.2737% per annum.

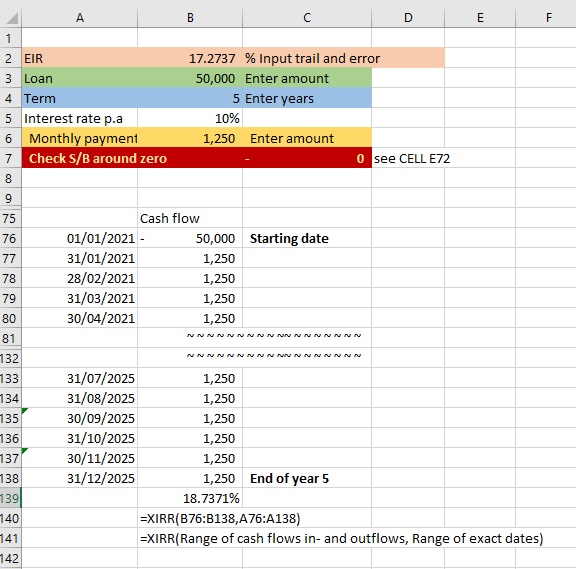

The XIRR Function way

Or use the XIRR function on this table.

=XIRR(values, dates, [guess])

This function returns the internal rate of return for a schedule of cash flows that is not necessarily periodic.

The XIRR function syntax has the following data input:

- Values – requires a range of data source. This is a series of cash flows that corresponds to a schedule of payments in dates. The first payment is optional and corresponds to a cost or payment that occurs at the beginning of the investment. If the first value is a cost or payment, it must be a negative value. The series of values must contain at least one positive and one negative value.

- Dates – requires a range of specific date of cash flows (in- and outflows). This is a schedule of payment dates that corresponds to the cash flow payments. Dates may occur in any order.

- Guess – is an option to enter a reference to a cell where to enter a percentage that is estimated to be close to the result of XIRR.

This looks as follows:

Amortised cost annual movements

This results in the following movement schedule

The website way

Fees that are (not) an integral part of the EIR

IFRS 9 incorporates the guidance on financial service fees (both received and paid) that are an integral part of the EIR of a financial instrument. IFRS 9 also includes examples of fees that are not an integral part of the EIR, which are accounted for under IFRS 15. (IFRS 9.B5.4.1–3)

|

Food for thought – Fees that are an integral part of the EIR |

|

|

Food for thought – Fees that are not an integral part of the EIR |

|

In the spreadsheet this looks like (added 250 transaction costs on 01/01/2021):

And the EIR increases from 18.7371% to 19.0101%.

[content_block id=34203]

Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate Effective interest rate