Last update 20/12/2019

Distinct goods or services is a cornerstone of IFRS 15 Revenue from contracts with customers.

Determining a distinct good or service is part of identifying separate performance obligations. An important item to look at is whether a ‘promise to’ in a contract (established to be a contract for accounting purposes in Step 1) is a distinct good or service, and as a result thereof is a performance obligation. Here is the context:

| Determining when promises are performance obligations

After identifying the promised goods and services in a contract, an entity determines which of those promises will be treated as performance obligations. At contract inception, an entity shall assess the goods or services promised in a contract with a customer and shall identify as a performance obligation each promise to transfer to the customer either (IFRS 15 22):

Therefore promises to transfer goods or services are performance obligations if the goods or services are:

If a promised good or service is not distinct, an entity should combine that good or service with other promised goods or services until it identifies a bundle of goods or services that is distinct. In some cases, this would result in accounting for all the goods or services promised in a contract as a single performance obligation (IFRS 15 30). |

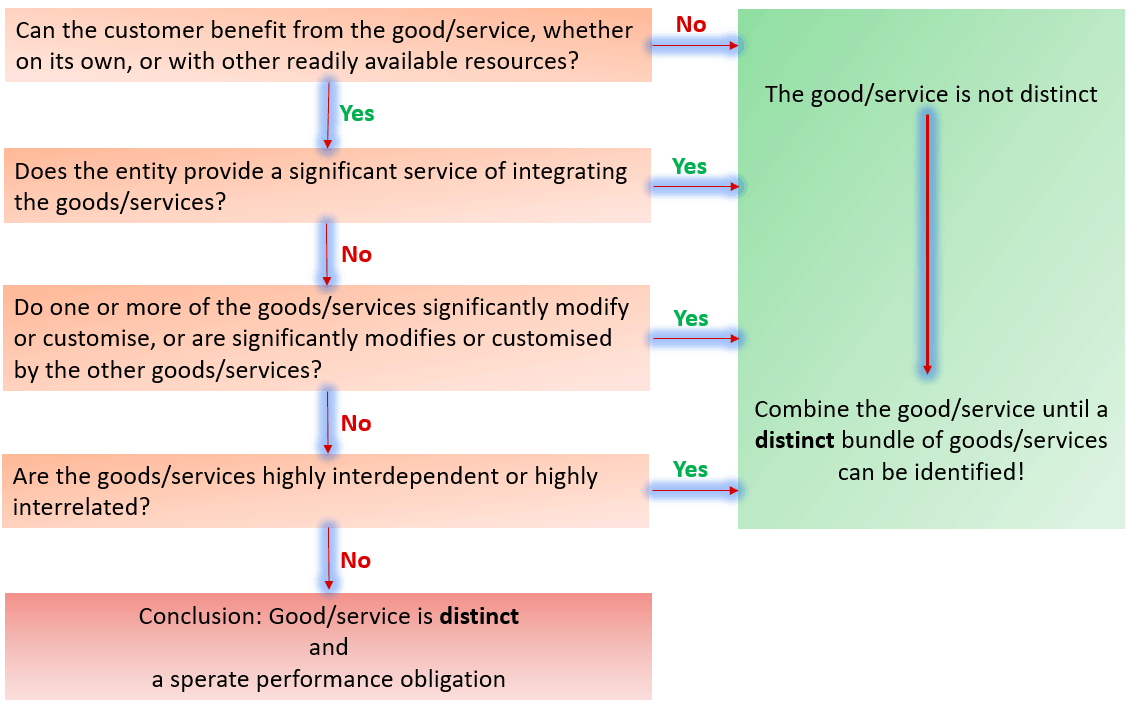

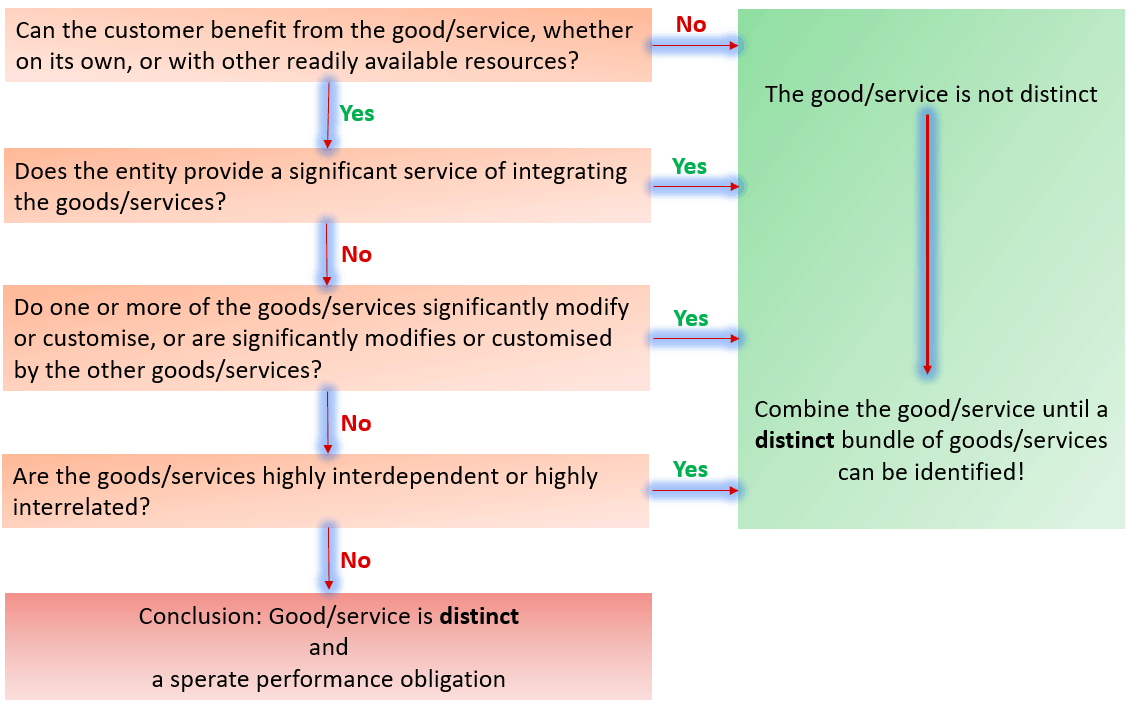

A good or service (or bundle of goods and services) is distinct if the customer can benefit from the good or service on its own or together with other readily available resources (i.e., the good or service is capable of being distinct) and the good or service is separately identifiable from other promises in the contract (i.e., the good or service is distinct within the context of the contract). A promised good or service that an entity determines is not distinct is combined with other goods or services until a distinct performance obligation is formed.

Use the following decision tree to identify distinct goods/services or to combine them to come to a distinct bundle of goods/services:

Example Licensing

A license establishes a customer’s rights to the intellectual property of an entity. Licenses of intellectual property may include, but are not limited to, licenses of any of the following:

- Software (other than specific software subject to a hosting arrangement) and technology

- Motion pictures, music, and other forms of media and entertainment

- Franchises

- Patents, trademarks, and copyrights.

In addition to a promise to grant a license (or licenses) to a customer. Those promises may be explicitly stated in the contract or implied by an entity’s customary business practices, published policies, or specific statements. As with other types of contracts, when a contract with a customer includes a promise to grant a license (or licenses) in addition to other promised goods or services, an entity identifies each of the performance obligations in the contract (as per above diagram).

If the promise to grant a license is not distinct from other promised goods or services in the contract in accordance with the identification criteria, an entity should account for the promise to grant a license and those other promised goods or services together as a single performance obligation (‘bundling’)

Examples of licenses that are not distinct from other goods or services promised in the contract include the following:

- A license that forms a component of a tangible good and that is integral to the functionality of the good

- A license that the customer can benefit from only in conjunction with a related service (such as an online service provided by the entity that enables, by granting a license, the customer to access content).

See also: The IFRS Foundation

Distinct goods

stinct goods or services

stinct goods or services