Last update 13/12/2019

Direct participating contracts – Insurance contracts with direct participation features are insurance contracts that are substantially investment-related service contracts under which an entity promises an investment return based on underlying items. [IFRS 17 B101] Hence, they are defined as insurance contracts for which:

IFRS 17 B101 a) The contractual terms specify that the policyholder participates in a share of a clearly identified pool of underlying items.

Includes any contract which creates a contractual obligation linked to underlying items.

- Explicit contractual terms

- Includes regulatory requirements

However, measurement based on expected cash flows (not contractually-specified cash flows). Not dependent on holding of underlying assets, e.g. could be related to an indexed fund. Obligations need not be to current generation of policyholders. Measurement of contracts using the variable fee approach.

|

Examples |

Note |

|

Unit-linked products |

Choices of funds are transparent and clearly identified to policyholders |

|

Universal Life Products |

No clearly identified underlying items |

What is the underlying?

IFRS 17 B106 The pool of underlying items referred to in paragraph B101 (a) (see a) above) can comprise any items, for example a reference portfolio of assets, the net assets of the entity, or a specified subset of the net assets of the entity, as long as they are clearly identified by the contract. An entity need not hold the identified pool of underlying items.

IFRS 17 BC245 ….The Board decided the underlying items do not need to be a portfolio of financial assets….

…..seems to be quite an open definition!!

IFRS 17 B101 b) The entity expects to pay to the policyholder an amount equal to a substantial share of the returns from the underlying items

- Unit Linked products: 100% of fund return

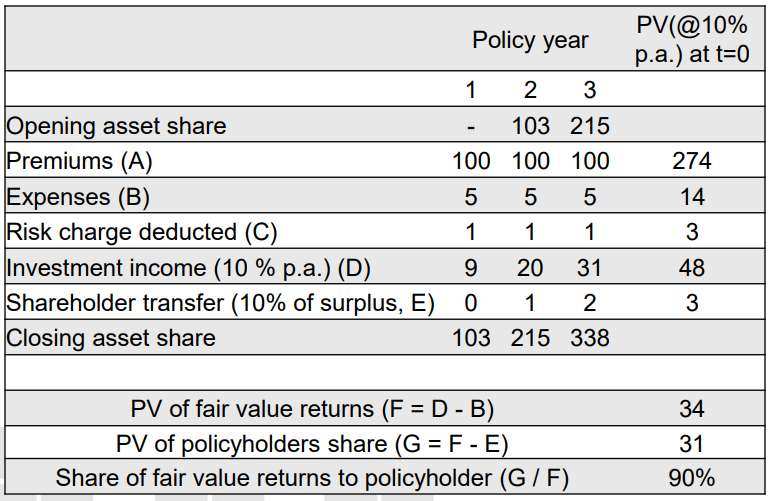

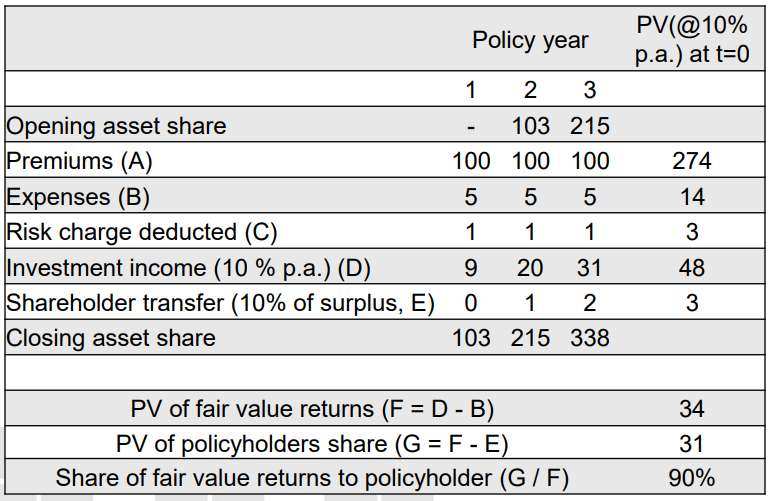

- Participating products: e.g. 90% policyholder fund’s surplus

Here are two schools of thought on how to calculate the return to the policy holder:

- Underlying items are simply the assets of the par fund – so that the fair value return on the underlying items is nothing but the investment return on those assets

- Underlying items are all forms of surplus – so that the fair value return on the underlying items includes investment returns, but also profits from mortality, expenses, lapsation etc

An example of the second assessment is as follows:

IFRS 17 B101 c) A substantial proportion of the cash flows the entity expects to pay to the policyholder should be expected to vary with the cash flows from the underlying items.

- Unit Linked products: Death benefit = Max(Fund Value, Sum Assured)

- Participating products: Reversionary Bonus, Terminal Bonus

Again two ways to approach this assessment:

- Under participating contracts, if the underlying fair value changes by an amount A, then the policyholder’s return increases by 90% x A. Therefore B101(c) may be satisfied (assuming guarantees have not bitten – see next below).

- A further condition may be tested – whether the amount of benefit that is variable is a substantial portion of the overall benefits given to the policyholder. If bonuses are a small component of overall benefits, then B101(c) is not satisfied.

Adjustments to the assessment:

There are some implicit assumptions used to establish: “Policyholders return = Return on assets less some deductions”

| Implicit assumption | Reference to IFRS 17 Insurance contracts |

| Guarantees have not bitten | IFRS 17 B107 – Need to assess on a probability weighted basis |

| Target is to deliver the asset share (or something similar) to a policyholder | IFRS 17 B103/IFRS 17 B68 –Need to reflect mutualisation (see further below) in the assessment |

Assess probabilistically

… and now it even gets more technical, bare with me ……

IFRS 17 B107 …An entity shall…assess the variability in the amounts in paragraphs B101(b) and B101(c): … on a present value probability-weighted average basis, not a best or worst outcome basis…

|

Scenario |

Share of fair returns passed to policyholders |

Probability of scenario |

| Return on assets exceeds guaranteed benefits |

90% |

1 – p |

| Return on assets is less than guaranteed benefits |

0% – benefits are fully guaranteed |

p |

|

Probability guarantee bites (p) |

Share of fair returns passed to policyholders |

IFRS 17 B101 (b) /(c) satisfied? |

| 5% – ‘low guarantee’ | 90% x (1-p) + 0% x p = 86% |

Yes |

| 50% – ‘high guarantee’ | 90% x (1-p) + 0% x p = 45% |

No |

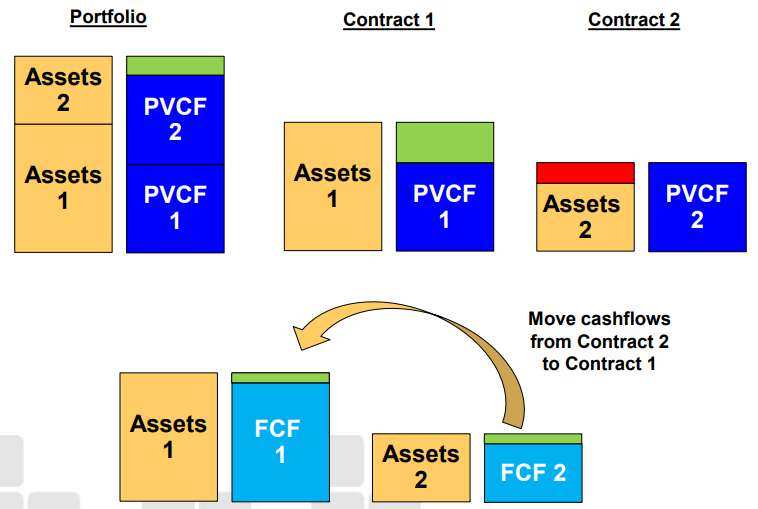

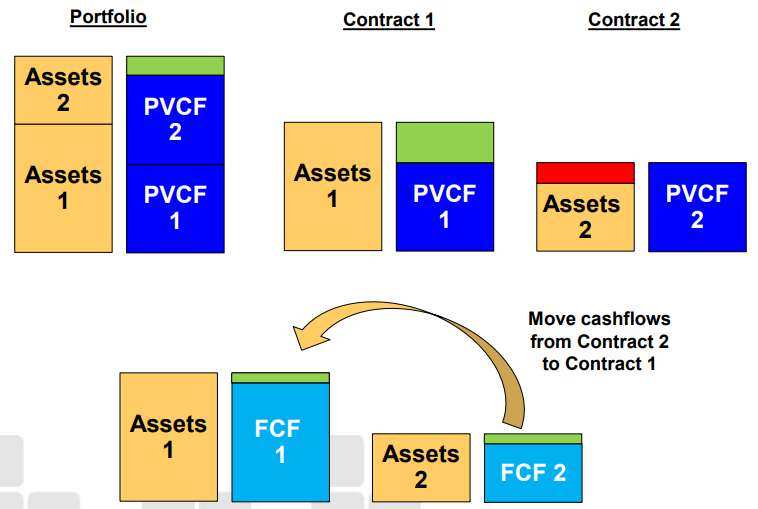

Mutualisation

IFRS 17 B68 …. The fulfilment cash flows of each group reflect the extent to which the contracts in the group cause the entity to be affected by expected cash flows, whether to policyholders in that group or to policyholders in another group. Hence the fulfilment cash flows for a group:

- include payments arising from the terms of existing contracts to policyholders of contracts in other groups, regardless of whether those payments are expected to be made to current or future policyholders; and

- exclude payments to policyholders in the group that, applying (a), have been included in the fulfilment cash flows of another group.

Or in a picture:

See also: The IFRS Foundation

Direct participating contracts

Direct participating contracts

Direct participating contracts Direct participating contracts Direct participating contracts Direct participating contracts Direct participating contracts