hide

Deferred tax calculations

Deferred tax calculations

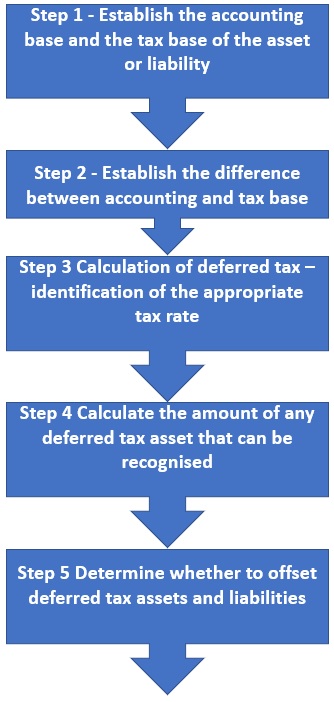

IAS 12 requires a mechanistic approach to the calculation of deferred tax. This narrative looks at the definitions in the standard and explains, through the use of a flowchart, how to navigate through the requirements of IAS 12.

The following flowchart summarises the steps necessary in calculating a deferred tax balance in accordance with IAS 12.

|

Step1 The accounting base is the carrying amount in the financial statements. The tax base has to be determined based on management intent and local tax laws and regulations. |

|

Step 2 If there is no difference between tax and accounting base, no deferred tax is required. Otherwise, a temporary difference arises. A temporary difference can be either a taxable or deductible temporary difference. |

|

|

Step 3 IAS 12 requires deferred tax assets and liabilities to be measured at the tax rates that are expected to apply in the period in which the asset is realised or the liability is settled, based on tax rates that have been enacted or substantively enacted by the end of the reporting period. |

|

|

Step 4 In order to recognise (include in the statement of financial position) a deferred tax asset, there must be an expectation of sufficient future taxable profits to utilise the deductible temporary differences. |

|

|

Step 5 Deferred tax assets and liabilities are required to be offset only in certain restricted scenarios. |

Step 1 – Establish the accounting base and the tax base of the asset or liability

Accounting for general purpose financial reporting for financial statements and determining the tax base for special purposes i.e. the preparation of for the tax return are two separate systems. However, they need to be reconciled to each other. The starting point is here.

Establishing the accounting base of the asset or liability

The accounting base of an asset or liability is simply the carrying amount of that asset or liability in the statement of financial position. In most cases, the determination of the accounting base of an asset or liability is straightforward, however IAS 12 requires the calculation of deferred tax to take into account the expected manner of recovery or settlement of assets and liabilities.

In some cases it might be necessary to consider splitting the carrying value of an asset between an amount to be recovered through use and an amount to be recovered through sale.

Determine the tax base of the asset or liability

This is explained through following the link – Determine tax base.

Example accounting and tax base/Example calculation deferred tax

An entity purchases an office-building on a location of 1,500m2 (including parking lots).

The broker/(certified) valuation expert has estimated the following allocation of the total transaction price of LC1,950,000:

|

Building (without ground and parking lots) |

750,000 |

|

|

Ground |

1,000,000 |

|

|

Parking lots |

200,000 |

|

|

Total |

1,950,000 |

At initial recognition the accounting and tax base are equal to the above mentioned amounts.

Accounting and tax treatment

- Ground is not depreciated for accounting and tax purposes.

- Buildings are depreciated in 40 years (or 2.5% per year) for accounting purposes, for tax purposes the building is depreciated in the first 10 years at 5% p.a., then from year 41 to 40 at 1.6667% p.a.

- The parking lots are depreciated in 20 years (or 5% per year) for accounting purposes, for tax purposes they are immediately expensed.

- The effective tax rate is assumed to be 25%.

Assessment of accounting and tax base:

-

Ground

The accounting and tax base are equal LC 1,000,000, as a result there is no deferred tax asset or liability, -

Buildings

|

Year/event |

Accounting base |

Difference |

P&L Tax effect debit (credit) at 25% |

Tax effect asset (liability) at 25% |

||

|

1 Cost |

1,000,000 |

1,000,000 |

– |

– |

– |

|

|

-25,000 |

-50,000 |

25,000 |

-6,250 |

|||

|

975,000 |

950,000 |

-25,000 |

6,250 |

|||

|

-25,000 |

-50,000 |

25,000 |

-6,250 |

|||

|

950,000 |

800,000 |

50,000 |

12,500 |

|||

|

-25,000 |

-50,000 |

25,000 |

-6,250 |

|||

|

750,000 |

500,000 |

250,000 |

62,500 |

|||

|

11 Depreciation |

-25,000 |

-16,670 |

-8,330 |

2,082 |

||

|

725,000 |

483,330 |

241,670 |

60,418 |

|||

| ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈≈ ≈ ≈ ≈≈ ≈ ≈ ≈ ≈ ≈ | ||||||

|

25,000 |

16,670 |

8,330 |

-2,082 |

|||

|

40 Depreciation |

-25,000 |

-16,670 |

-8,330 |

2,082 |

||

|

– |

– |

– |

– |

|||

-

Parking lots

The accounting and tax base at initial recognition are the same LC200,000. Only for accounting purposes the parking lost are expensed and for tax purposes depreciated at 5% p.a.

|

Year/event |

Accounting base |

Difference |

P&L Tax effect debit (credit) at 25% |

Tax effect asset (liability) at 25% |

||

|

1 Expense |

200,000 |

-50,000 |

||||

|

1 Capitalisation |

200,000 |

|||||

|

– |

-10,000 |

10,000 |

2,500 |

|||

|

– |

190,000 |

190,000 |

-47,500 |

|||

| ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈ ≈≈ ≈ ≈ ≈≈ ≈ ≈ ≈ ≈ ≈ |

||||||

|

– |

10,000 |

-2,500 |

||||

|

– |

-10,000 |

10,000 |

2,500 |

|||

|

– |

– |

– |

– |

|||

Step 2 – Establish the difference between accounting and tax base

If there is no difference between tax and accounting base, no deferred tax is required. Otherwise, a temporary difference arises. A temporary difference can be either a taxable or deductible temporary difference.

Case – A taxable temporary difference |

|

Company A holds an item of property, plant and equipment which has a carrying value of CU7,000 and a tax base of CU4,000 at the reporting date. There is a temporary difference of CU3,000. As the carrying value of the asset is higher than the deductions that will be available in the future, this is, therefore, a taxable temporary difference. |

Case – A deductible temporary difference |

|

Company A contributes to a defined contribution pension scheme. At the year end Company A has recognised an accrual of CU5,000. In the country where Company A is domiciled, contributions to the scheme are taxed on a cash basis, the tax base of this liability is nil and there is a temporary difference of CU5,000. As a tax deduction will be available in the future when these contributions are paid to the scheme, this is a deductible temporary difference. |

Exempt temporary differences

A deferred tax liability should be recognised for all taxable temporary differences. However, IAS 12.15 prohibits the recognition of deferred tax on taxable temporary differences that arise from:

- the initial recognition of goodwill or

- the initial recognition of an asset or liability in a transaction which:

- is not a business combination and

- at the time of the transaction, affects neither accounting profit nor taxable profit (tax loss).

Case – Goodwill |

|

Company A purchases Company B. Goodwill of CU150,000 arises on the acquisition. In the country where Company A is domiciled, no tax deduction is available in the future for this goodwill because it only arises in the consolidated financial statements and tax is assessed on the basis of Company A’s separate financial statements. There is a taxable temporary difference of CU150,000. However, in accordance with the initial recognition exemption in IAS 12.15 deferred tax is not recognised on that taxable temporary difference. |

Case – Initial recognition of an asset |

|

Company A purchases an item of property, plant and equipment for CU200,000. In the country where Company A is domiciled, no tax deduction is available for this asset either through its use or on its eventual disposal. There is therefore a taxable temporary difference of CU200,000 on initial recognition of the asset. Assuming that the asset was not purchased in a business combination, the resulting deferred tax liability would not be recognised in accordance with IAS 12.15. |

Case – Impact of temporary differences arising in a business combination |

|

If the asset above had been recognised in the consolidated financial statements as a result of a business combination, a deferred tax liability would be recognised on the resulting taxable temporary difference. The effect of this would be to increase goodwill by an equal amount. |

Deductible temporary differences

A deferred tax asset is recognised for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized.

However, IAS 12.24 prohibits the recognition of a deferred tax asset if that asset arises from the initial recognition of an asset or liability in a transaction that:

- is not a business combination and

- at the time of the transaction, affects neither accounting profit nor taxable profit (tax loss).

Case – Exempt deductible temporary difference |

|

Company A purchases an item of property, plant and equipment for CU100,000. Tax deductions of CU150,000 will be available for that asset in accordance with the tax legislation in the country where Company A is domiciled. There is therefore a deductible temporary difference of CU50,000. As this temporary difference arose on the initial recognition of an asset, that was not acquired as part of a business combination, no deferred tax should be recognised. |

Tracking exempt temporary differences

As explained above, IAS 12 prohibits the recognition of deferred tax on temporary differences in certain situations, for example on temporary differences that arise on the initial recognition of goodwill. IAS 12 prohibits the recognition of deferred tax on such temporary differences either on the initial recognition or subsequently (IAS 12.22(c)).

Case – Tracking exempt temporary differences |

– Temporary difference arose on initial recognitionIn the 3 cases for Exempt temporary differences above, a taxable temporary difference of CU150,000 arose on the initial recognition of goodwill. As this arose on the initial recognition of the goodwill, no deferred tax was recognised. At the end of the first year after acquisition, an impairment of CU75,000 has been recognised against goodwill. The carrying value of this goodwill is therefore CU75,000, the tax base is still nil. Therefore, at the year-end there is a taxable temporary difference of only CU75,000. However, this difference is the unwinding of the initial temporary difference and in accordance with IAS 12 no deferred tax is recognised on this temporary difference either on initial recognition of the asset or subsequently. |

– Temporary difference arose after initial recognitionCompany A purchases the trade and assets of Company C. Goodwill of CU250,000 arises on the acquisition. In the country where Company A is domiciled, tax deductions of CU250,000 are available in the future on goodwill that arises in the individual company accounts of A. Accordingly, at initial recognition there is no temporary difference. At the end of the year, no impairment has been charged on this goodwill. In the tax computation for the year, a deduction of CU5,000 has been allowed. The tax base of the goodwill is therefore CU245,000 (CU250,000 – CU5,000). There is therefore a taxable temporary difference of CU5,000 relating to this goodwill. As this temporary difference did not arise on the initial recognition of goodwill, a deferred tax liability must be recognised. |

Exempt temporary differences on investments in subsidiaries, branches and associates, and interests in joint arrangements

The standard also includes exemptions for recognising deferred tax on temporary differences associated with investments in subsidiaries, branches and associates, and interests in joint arrangements. See IAS 12.39 and IAS 12.44 for the text.

Case – Temporary differences on investments in subsidiaries and associates |

– Taxable temporary difference on investment in subsidiaryCompany A purchased Company B on 1 January 20X1 for CU300,000. By 31 December 20X1 Company B had made profits of CU50,000, which remained undistributed. No impairment of the goodwill that arose on the acquisition had taken place. Based on the tax legislation in the country where Company A is domiciled, the tax base of the investment in Company B is its original cost. In the consolidated accounts of Company A, a taxable temporary difference of CU50,000 therefore exists between the carrying value of the investment in Company B at the reporting date of CU350,000 (CU300,000 + CU50,000) and its tax base of CU300,000. As a parent, by definition, controls a subsidiary it will be able to control the reversal of this temporary difference, for example through control of the dividend policy of the subsidiary. Therefore, deferred tax on such temporary differences is generally not provided unless it is probable that the temporary difference will reverse in the foreseeable future. In certain jurisdictions, no tax is charged on dividends from investments and on profits from disposal of investments. Therefore, in accordance with the definition of the tax base of an asset and the tax legislation in such jurisdictions, the tax base of such an asset would equal its carrying value. As noted, tax legislation varies from one jurisdiction to another. As such, a detailed understanding of the applicable tax laws is necessary. |

– Probable sale of a subsidiarySame facts as in Taxable temporary difference on investment in subsidiary above. However, as of 31 December 20X1, Company A has determined that the sale of its investment in Company B is probable in the foreseeable future. For the purpose of this example, the provisions of IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’ are ignored. The taxable temporary difference of CU50,000 is expected to reverse in the foreseeable future upon Company A’s sale of its shares in Company B. This triggers the recording of a deferred tax liability in the consolidated accounts of Company A as of the reporting date. The measurement of deferred tax should reflect the manner in which Company A expects to recover the carrying amount of the investment. Assuming that the capital gains tax rate on sale of shares is 10%, a deferred tax liability of CU5,000 (CU50,000 × 10%) should be recorded. In determining the appropriate tax rate to use, the legal form of the disposal of the investment (either as sale of the shares or share of the subsidiary’s trade and net assets) should be considered as varying tax rates may apply depending on the nature of the transaction. In addition, the legal form of the transaction may affect whether the temporary difference of CU50,000 will, in fact, reverse. |

– Taxable temporary difference on investment in an associateCompany A purchases an interest in Associate C on 1 January 20X2 for CU450,000. By 31 December 20X2 Associate C had made profits of CU75,000 (Company A’s share), which remained undistributed. No impairment of the investment in Associate C was required at 31 December 20X2. Based on the tax legislation in the country where Company A is domiciled, the tax base of the investment in Associate C is its original cost. A taxable temporary difference of CU75,000 therefore exists between the carrying value of the investment in Associate C at the reporting date of CU525,000 (CU450,000 + CU75,000) and its tax base of CU450,000. As Company A does not control Associate C it is not in a position to control the dividend policy of Associate C. As a result, it cannot control the reversal of this temporary difference and deferred tax is usually provided on temporary differences arising on investments in associates. |

Step 3 Calculation of deferred tax – identification of the appropriate tax rate

IAS 12 requires deferred tax assets and liabilities to be measured at the tax rates that are expected to apply in the period in which the asset is realised or the liability is settled, based on tax rates that have been enacted or substantively enacted by the end of the reporting period.

Although it will be clear when a law has actually been enacted, determining whether a tax rate has been substantively enacted by the end of the reporting period following the announcement of a change in the rate is a matter of judgement. The decision should be based on the specific facts and circumstances concerned, in particular the local process for making and amending the tax laws. Some of the factors to be considered include:

- the legal and related processes in the jurisdiction for the enactment of any changes in tax law

- the status of proposed tax changes and the extent of the remaining procedures to be performed and

- whether those remaining procedures are administrative or ceremonial formalities which can be perfunctorily performed.

In 2005, the IASB noted at its February board meeting that it was supportive of the substantive enactment principle on the basis that it would be achieved when the steps remaining in the process will not change the outcome.

For example, in certain jurisdictions, substantive enactment is only deemed to occur when the tax bill is signed by the head of state while in others, the government’s announcement of the new tax rates may be considered a substantive enactment although formal enactment may occur in a later period.

As the rate to be used is that applicable to the period in which the temporary difference is expected to reverse, some scheduling of the realisation of deferred tax assets and liabilities might be required.

Case – Identification of the appropriate tax rate |

|

Company A is preparing its financial statements for the year ended 30 June 20X1. Company A intends to sell an item of property, plant and equipment which has an associated taxable temporary difference of CU100,000. The tax rate applicable to Company A for the year ended 30 June 20X1 is 24%. Company A expects to sell the property, plant and equipment in 20X2. There is a proposal in the local tax legislation that a new corporation tax rate of 23% will apply from April 1, 20X2. In the country where Company A is domiciled, tax laws and rate changes are enacted when the president signs the legislation. The president signed the proposed tax law on 18 June 20X1. As the proposed tax law was signed, it is considered to be enacted. Therefore, if Company A expects to sell the asset before the new tax rate becomes effective, a rate of 24% should be used to calculate the deferred tax liability associated with this item of property, plant and equipment. Alternatively, if Company A does not expect to sell the asset until after 1 April 20X2, the appropriate tax rate to use is 23%. |

Step 4 Calculate the amount of any deferred tax asset that can be recognised

In order to recognise (include in the statement of financial position) a deferred tax asset, there must be an expectation of sufficient future taxable profits to utilise the deductible temporary differences. Economic benefits in the form of reductions in tax payments will flow to the entity only if it earns sufficient taxable profits against which the deductions can be offset.

Therefore, an entity recognises deferred tax assets only when it is probable that taxable profits will be available against which the deductible temporary differences can be utilised.

IAS 12.28-31 contain guidance on when sufficient taxable profits are expected to arise. IAS 12.28 states that it is probable that taxable profit will be available against which a deductible temporary difference can be utilised when there are sufficient taxable temporary differences relating to the same taxation authority and the same taxable entity which are expected to reverse:

- in the same period as the expected reversal of the deductible temporary difference or

- in periods into which a tax loss arising from the deferred tax asset can be carried back or forward.

When there are insufficient taxable temporary differences relating to the same taxation authority and the same taxable entity, a deferred tax asset is recognised to the extent that:

- it is probable that the entity will have sufficient taxable profit relating to the same taxation authority and the same taxable entity in the same period as the reversal of the deductible temporary difference, or in the periods into which a tax loss arising from the deferred tax asset can be carried back or forward or

- tax planning opportunities are available to the entity that will create taxable profit in appropriate periods.

Management will need to use their judgement in estimating whether there will be sufficient taxable profits in the future to recognise a deferred tax asset. Management will also need to make estimates about the expected timing of reversal of the deductible and taxable temporary differences when considering whether a deferred tax asset can be recognised.

Case – Timing of reversal |

|

At 31 December 20X1, Company A has deductible temporary differences of CU45,000 which are expected to reverse in the next year. Company A also has taxable temporary differences of CU50,000 relating to the same taxable Company and the same tax authority. Company A expects CU30,000 of those taxable temporary differences to reverse in the next year and the remaining CU20,000 to reverse in the year after. Company A must therefore recognise a deferred tax liability for the CU50,000 taxable temporary differences. Separately, as CU30,000 of these taxable temporary differences are expected to reverse in the year in which the deductible temporary differences reverse, Company A can also recognise a deferred tax asset for CU30,000 of the deductible temporary differences. Whether a deferred tax asset can be recognised for the rest of the deductible temporary differences will depend on whether future taxable profits sufficient to cover the reversal of this deductible temporary difference are expected to arise. At present both the deferred tax liability and the deferred tax asset must be recognised. Whether this deferred tax asset and deferred tax liability can be offset is considered in the next step. |

Case – Different types of tax losses |

|

Company A has an item of property, plant and equipment which is expected to be sold. When this asset is sold, a capital tax loss of CU50,000 will crystallise, ie there is an associated deductible temporary difference of this amount. Company A also has taxable temporary differences of CU75,000 associated with its trade operations expected to reverse in the same period as the deductible temporary difference. In certain jurisdictions, tax authorities may not allow the offset of capital losses against trading profits. Therefore in such cases, in considering whether the deferred tax asset associated with the item of property, plant and equipment can be recognised, the taxable temporary differences associated with Company A’s trade operations must be ignored. Hence, in the absence of other information that would allow the offset, a deferred tax liability must be recognised for the CU75,000 of taxable temporary differences and no deferred tax asset can be recognised for the deductible temporary difference. |

Unused tax losses and unused tax credits

The general principle in IAS 12 is that a deferred tax asset is recognised for unused tax losses and unused tax credits to the extent that it is probable that future taxable profit will be available against which the unused tax losses and unused tax credits can be utilised.

The criteria for the recognition of deferred tax assets for unused tax losses and unused tax credits are the same as those arising from deductible temporary differences. However, the standard also notes that the existence of unused tax losses is strong evidence that future taxable profit may not be available.

As a result, the standard requires that where an entity has a history of recent losses, the entity recognises a deferred tax asset arising from unused tax losses or unused tax credits only to the extent that the entity has sufficient taxable temporary differences or there is convincing other evidence that sufficient taxable profit will be available against which the unused tax losses or unused tax credits can be utilised by the entity.

This assumes that local tax legislation allows companies to apply unused tax losses and unused tax credits to future taxable profit.

Case – Unused tax losses |

|

At 31 December 20X1, Company A has unused tax losses of CU75,000 and taxable temporary differences of CU25,000 relating to the same taxation authority. Company A has been loss making for the last two years. In the absence of convincing evidence that there will be sufficient taxable profits against which the deductible temporary differences can be realised, a deferred tax asset is only recognised to the extent of the taxable temporary differences. Therefore a deferred tax asset is recognised for CU25,000 of the unused tax losses and a deferred tax liability is recognised for the CU25,000 taxable temporary differences. The next step considers whether the resulting deferred tax asset and deferred tax liability should be offset in the statement of financial position. |

There is further guidance in Deferred tax assets on assessing whether the recovery of deferred tax assets is probable.

Step 5 Determine whether to offset deferred tax assets and liabilities

Deferred tax assets and liabilities are required to be offset only in certain restricted scenarios.

Deferred tax assets and liabilities must be recognised gross in the statement of financial position unless:

- the entity has a legally enforceable right to set off current tax assets against current tax liabilities and

- the deferred tax assets and the deferred tax liabilities relate to income taxes levied by the same taxation authority on either:

- the same taxable entity or

- different taxable entities which intend either to settle current tax liabilities and assets on a net basis, or to realise the assets and settle the liabilities simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered (i.e. a tax consolidation unit).

Case – Deferred tax asset and liability in the same company |

|

Company A has a recognised deferred tax asset of CU30,000 and a recognised deferred tax liability of CU65,000, both relating to income taxes levied by the same taxation authority. Company A has a right to set off its current tax assets against its current tax liabilities. Company A should recognise a net deferred tax liability of CU35,000, as the entity has a legally enforceable right to offset current tax assets and liabilities and the deferred tax asset and liability relate to income taxes levied by the same taxation authority on the same taxable entity. |

Case – Deferred tax asset and liability in different companies in the same group |

|

Company A has a recognised deferred tax asset of CU30,000. Company A has a subsidiary Company B with a recognised deferred tax liability of CU65,000. Company A also has a legally enforceable right to offset current tax assets and liabilities. The recognised deferred tax asset and deferred tax liability both relate to the same taxation authority. As the deferred tax asset and liability do not relate to the same taxable entity, management must consider whether these taxable entities either intend to settle current tax liabilities and assets on a net basis or to realise the assets and settle the liabilities simultaneously. This will generally not be the case unless Company A and Company B are part of a tax group and where the local tax jurisdiction allows a group of companies to file tax returns on a consolidated basis. |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations

Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations

Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations Deferred tax calculations