Last update 05/08/2019

Future economic benefits or service potential that has been contributed to the entity by parties external to the entity, other than those that result in liabilities of the entity, that establish a financial interest in the net assets/equity of the entity, which:

- Conveys entitlement both to

- distributions of future economic benefits or service potential by the entity during its life, such distributions being at the discretion of the owners or their representatives, and to

- distributions of any excess of assets over liabilities in the event of the entity being wound up; and/or

- Can be sold, exchanged, transferred, or redeemed.

As it happens, IFRS definitions have to be quite universal and without bias. This is why sometimes very normal transaction get difficult names. Contributions from owners are payments by (new or existing shareholders on newly issued shares or additional payments on already issued shares (existing shares). Off-course there are more owner-relations than shares, a member of a cooperative entity can also contribute to the members’ capital.

Equity is by definition the residual balance of all assets an entity owns and all the liabilities (and provisions) an entity owes to parties outside the entity.

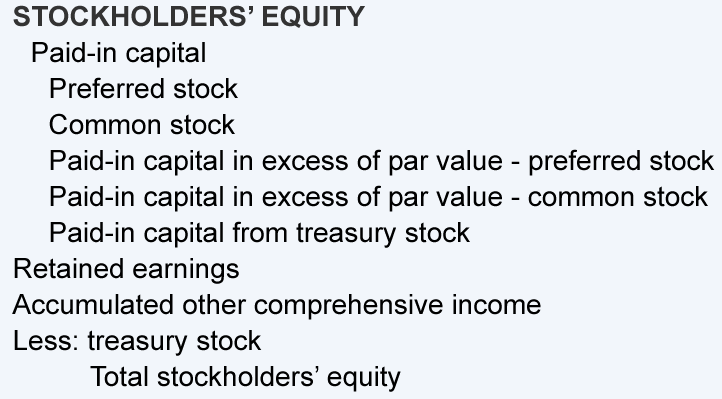

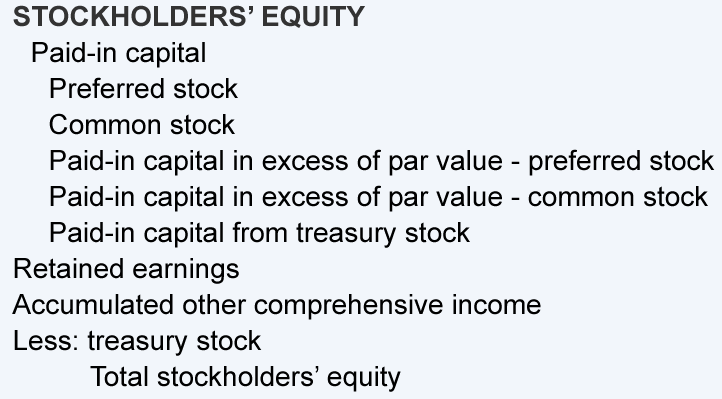

Contributed capital is know as paid-in capital, shares issued and paid (in full or part(s). Contributed capital is the total value of stock that shareholders have bought directly from the issuing company. It includes the money from initial public offerings (IPOs), direct listings, direct public offerings and secondary offerings – including issues of preferred stock. It also includes the receipt of fixed assets in exchange for stock and the reduction of a liability in exchange for stock.

Shares have a nominal (or par) value. If the amount paid (contributed) by existing or new shareholders (owners) exceeds the nominal value of the shares issued, this surplus is called ‘additional paid-in capital’ or ‘excess of par value’ (more US language) and recorded within equity but as a separated component. Additional paid-in capital is not specifically assigned to the shares it was paid upon at issue, paid-in capital is shared equally between all issued shares. This changes if and when there are different types of shares, such as preferred shares. Stock is the American English for shares….

Contributions from owners

Contributions from owners

Contributions from owners Contributions from owners Contributions from owners Contributions from owners Contributions from owners Contributions from owners