Contingently issuable POSs

Contingently issuable POSs are not specifically defined in IAS 33, but they are closely related to contingently issuable ordinary shares (see 5.10.10–80). These are POSs that are issuable for little or no cash or other consideration on the satisfaction of specified conditions. An example is a contingently issuable convertible instrument. [IAS 33.57]

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

EPS implications

Generally, by their nature contingently issuable POSs do not impact basic EPS. However, these instruments generally do impact diluted EPS and, similar to contingently issuable ordinary shares, their impact depends on the extent to which the specified conditions are met at the reporting date.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator is not affected, the denominator might or might not be affected. |

The numerator might or might not be affected, the denominator is affected. |

|

By their nature, contingently issuable POSs are generally ignored in basic EPS. This is because, on satisfying the specified conditions, POSs – as opposed to ordinary shares – will be issued, and these would not generally result in outstanding ordinary shares until they are exercised or otherwise converted. However, if any options that are contingently issuable can be exercised immediately for little or no further consideration, then the resulting options are included in the denominator from the vesting date (see 5.9.20). |

IAS 33 prescribes a two-step approach for determining whether a contingently issuable POS is included in diluted EPS. [IAS 33.57] Step i. Should the contingently issuable POS be assumed to be issuable? This is the same assessment as that for contingently issuable ordinary shares (see 5.10.20 and 5.10.40) – i.e. if the reporting date were the end of the contingency period, then would the POS be issuable? If the instrument passes the test in Step (i), then Step (ii) is applied. Step ii. What is the impact on diluted EPS? This is different from the requirements for contingently issuable ordinary shares. As opposed to including in the denominator the number of ordinary shares that would be issuable, the impact is determined based on the relevant guidance in IAS 33 for the type of POS in question – that is:

|

Dilutive or anti-dilutive?

Generally, whether a contingently issuable POS is dilutive or anti-dilutive depends on the type of resulting POS (see Chapters 5.9, 5.11 and 5.12). For example, a contingently issuable share option is generally dilutive if it is in-the-money – i.e. the exercise price (including the fair value of any goods or services to be supplied to the entity in the future) is lower than the average market price of the ordinary shares.

Case – Contingently issuable POSs |

||||||||||||||||||||||||||||

|

The following basic facts relate to Company P.

The following additional facts are also relevant for this example.

Workings – Year 1

The EPS computations for Year 1 are as follows.

|

Workings – Year 2

The EPS computations for Year 2 are as follows.

|

Basic EPS |

Diluted EPS |

|

1. Determine the numerator No adjustment is necessary. The numerator is 3,500,000. |

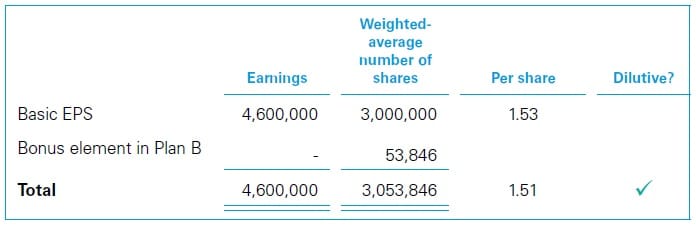

1. Identify POSs Options under both Plan A and Plan B are POSs. Because the options contain performance conditions, they are contingently issuable POSs. To determine whether they are included in diluted EPS, the two-step approach in 5.10.110 is followed. Step i. Should the contingently issuable POSs be assumed to be issuable? Although the cumulative earnings and price targets are not tested until the end of Year 3, if the end of Year 2 were the end of the contingency period, then the earnings target (for Plan A) would be met (cumulative earnings of 8,100,000 greater than 7,500,000) but the price target (for Plan B) would not be met (8% increase in share price compared with 1 January Year 1 – i.e. (41 – 38) / 38). Therefore, Plan A passes Step (i). |

|

2. Determine the denominator No adjustment is necessary. This is the case even if the vesting conditions are met, because ordinary shares would not be issued until the vested options are exercised and the options are not issuable for little or no further consideration. Also, there is no change in the number of outstanding shares during the year. The denominator is therefore 3,000,000. |

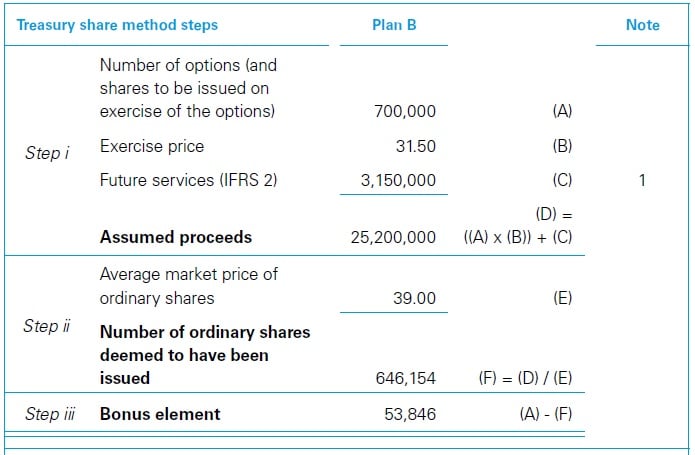

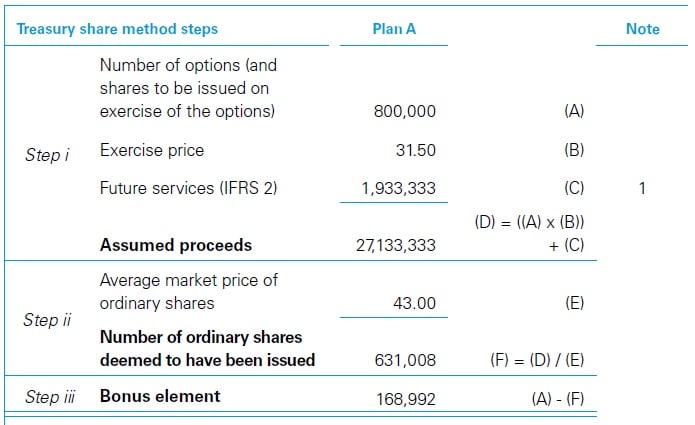

2. For each POS, calculate EPIS Because only the share options under Plan A passed Step (i), Step (ii) now applies only for these options. Step ii. What is the impact on diluted EPS? Because the contingently issuable POSs are options, the impact on diluted. EPS is determined using the treasury share method. Potential adjustment to the numerator for EPIS: No adjustment is required because the options are equity-settled (see 5.17.60). Potential adjustment to the denominator for EPIS: The adjustment is determined using the treasury share method, as follows.

Note 1. In this step, proceeds include the fair value of future services to be rendered by the employee for the remaining period not vested. P applies Approach 1 in Example 5.17 and the assumed proceeds are the unearned IFRS 2 expense at 31 December Year 2: 7.25 x 800,000 x 1/3 = 1,933,333. |

|

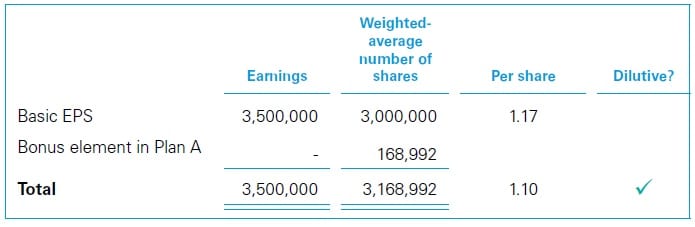

3. Determine basic EPS Basic EPS = 3,500,000 / 3,000,000 = 1.17 Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs Contingently issuable POSs |

3. Rank the POSs This step does not apply, because the options under Plan A are the only class of POSs considered. |

|

4. Determine basic EPS from continuing operations Basic EPS is 1.17 (see Step 3 of basic EPS computation). |

|

|

5. Identify dilutive POSs and determine diluted EPS The options under Plan A are dilutive because no adjustment to the numerator for EPIS is required and the aggregate amount of the exercise price plus the fair value of future services to be rendered is lower than the average market price of an ordinary share during the period.

Accordingly, P includes the impact of the Plan A in diluted EPS. Diluted EPS = 1.10 |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.