For EPS purposes, contingently issuable ordinary shares are ordinary shares issuable for little or no cash or other consideration on the satisfaction of specified conditions in a contingent share agreement. [IAS 33 Definition]

This narrative builds on the basic principles introduced in EPS or earnings per share, and sets out the specific basic and diluted EPS implications of the following types of instrument(s).

These conditions do not include service conditions under IFRS 2 Share-based Payment and the passage of time. Therefore, shares that are issuable subject only to the passage of time, and unvested shares and options that require only service for vesting, are not considered contingently issuable. A different set of requirements applies to shares that are subject only to a service condition for vesting (see Unvested ordinary shares and EPS). [IAS 33.21(g), IAS 33.24, IAS 33.48]

Contingently issuable ordinary shares, as discussed in this chapter, are commonly seen in the context of share-based payment arrangements with performance conditions (including market and non-market performance conditions), or contingent consideration in business combinations. Additional considerations in the context of share-based payment arrangements are set out in EPS Impact and Share-based payments.

Although it is not specifically defined in IAS 33, a related class of instruments is contingently issuable POSs (see Contingently issuable ordinary shares).

EPS implications

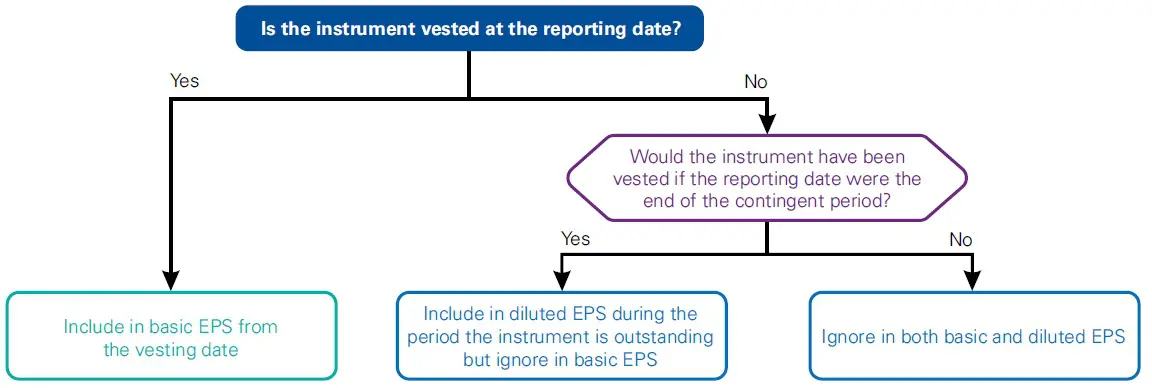

Generally, whether contingently issuable ordinary shares impact basic and diluted EPS depends on the extent to which the specified conditions are met at the reporting date. Understanding the accounting for these instruments is also relevant, because it determines whether their assumed conversion would have a consequential effect on profit or loss.

These conditions are tested at the reporting date and do not reflect expectations about the future. In other words, if the specified conditions would not be met if the reporting date were the end of the contingency period, then the contingently issuable ordinary shares are ignored in diluted EPS even if it is probable that the conditions will be met afterwards. This EPS treatment is different from the way in which similar conditions are accounted for under IFRS 2 (see EPS Impact and Share-based payments).

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator is not affected, the denominator might or might not be affected. |

The numerator might or might not be affected, the denominator is affected. |

|

By definition, contingently issuable ordinary shares are issuable for little or no further consideration on the satisfaction of specified conditions. Accordingly, they are included in the denominator from the vesting date – i.e. the date when all conditions are met (see EPS implications). This is irrespective of whether the ordinary shares may be issued at a later date. [IAS 33.24]

|

To the extent that they are not yet taken into account in basic EPS, contingently issuable ordinary shares are POSs. The potential adjustment to the numerator depends on the accounting for the contingently issuable ordinary shares under IFRS 2 or IAS 32 Financial Instruments: Presentation, which is driven by their manner of settlement, similar to options (see EPS Implications). An example of a contingently issuable ordinary share that requires a numerator adjustment is contingent consideration in a business combination classified as a financial liability. If the effect would be dilutive, then the number to be included in the denominator is based on the number of ordinary shares that would be issuable if the reporting date were the end of the contingency period. In this case, it is included from the beginning of the period (or from the date of the contingent share agreement if this is later). Restatement is not permitted in a later period if the conditions are not met when the contingency period actually expires. [IAS 33.52] |

Dilutive or anti-dilutive?

Generally, the status of the specified conditions at the reporting date decides whether a contingently issuable ordinary share is considered in diluted EPS and whether it is dilutive. However, for contingently issuable ordinary shares that are accounted for as liabilities under IFRS 2 or IAS 32, the numerator adjustment could vary (see above) and therefore could affect whether the instruments are regarded as dilutive.

Contingencies related to earnings or similar target

Example condition: Ordinary shares are contingently issuable subject to achieving and maintaining a specified amount of earnings or a similar target – e.g. cost savings.

General principle: If an entity attains the specified amount of earnings or the similar target in a particular reporting period but is also required to maintain the level of earnings (or similar targets) for an additional period, then the additional shares issuable are only considered in the denominator for diluted EPS. The number of additional shares included is based on the number of ordinary shares that would be issued if the amount of earnings at the reporting date were the amount of earnings at the end of the contingency period. [IAS 33.53]

Scenario 1

Company B hires a consultant on 1 January Year 1 to evaluate its operating costs and recommend ways to reduce them. The consultancy agreement includes the following performance targets.

- If operating costs are reduced by at least 350 in Year 1 or Year 2, and the cost reduction is sustained in the following year, then the consultant will receive 1% of B’s issued ordinary shares.

- If operating costs are reduced by at least 700 in Year 1 or Year 2, and the cost reduction is sustained in the following year, then the consultant will receive 2% of B’s issued ordinary shares.

The status of the performance targets and the EPS implications are set out below.

|

Reporting date |

Performance against condition |

Basic EPS implications |

Diluted EPS implications |

|

End of Year 1 |

200 cost savings achieved in the year |

The contingent share agreement is ignored because none of the specified conditions is met. |

The contingent share agreement is ignored because none of the specified conditions would be met if the end of Year 1 were the end of the contingency period. |

|

End of Year 2 |

400 cost savings achieved in the year |

The contingent share agreement is ignored because only one part of the specified conditions is met. The cost savings exceed 350 but the savings have not been sustained. |

1% of outstanding shares issuable under the contingent share agreement are included in the denominator from the beginning of Year 2 because the relevant conditions would be met if the end of Year 2 were the end of the contingency period. |

|

End of Year 3 |

500 cost savings achieved in the year |

Cost savings exceeding 350 were achieved in Year 2 and sustained in Year 3. Shares issued under the contingent share agreement (1% of outstanding shares) are included in the denominator from the vesting date, which would be the reporting date. |

1% of the outstanding shares issuable under the contingent share agreement are added to the denominator in diluted EPS for the period they are outstanding until the vesting date (the date the shares are included in basic EPS) because the relevant conditions are met at the reporting date. Therefore, the 1% of shares is included in diluted EPS from the beginning of Year 3 until the end of Year 3, when they vest. |

Example condition: Ordinary shares are contingently issuable subject to achieving a specific future market price for the entity’s ordinary shares.

General principle: In such cases, the number of additional shares included in the denominator for diluted EPS is based on the number of ordinary shares that would be issued if the market price at the reporting date were the market price at the end of the contingency period. In our view, even if the share price has declined below the trigger level after the reporting date but before the financial statements are authorised for issue, then the share price at the reporting date is still used as the trigger in the calculation of the diluted EPS for the period. [IAS 33.54]

Scenario 2

Company C enters into a share-based payment agreement with an employee on 1 January Year 1. The employee will receive 100,000 of C’s shares for each 10% increase in market price of the shares on 31 December Year 3 compared with 1 January Year 1.

The following amounts are the market prices for the relevant dates:

- 1 January Year 1: 100

- 31 December Year 1: 105

- 31 December Year 2: 125

- 31 December Year 3: 118.

The status of the performance targets and the EPS implications are set out below.

|

Reporting date |

Performance against condition |

Basic EPS implications |

Diluted EPS implications |

|

End of Year 1 |

5% increase in the price of the share [(105 / 100) – 1] |

The contingent share agreement is ignored because the specified condition is not met. |

The contingent share agreement is ignored because no shares would be issued if the market price at 31 December Year 1 were the market price at the end of the contingency period. |

|

End of Year 2 |

25% increase in the price of the share [(125 / 100) – 1] |

The contingent share agreement is ignored because the specified condition is not met. The calculation of the increase in the price of the share is based on the price at 31 December Year 3. |

200,000 shares issuable under the contingent share agreement are included in the denominator from the beginning of Year 2 because this would represent the number of ordinary shares that would be issued if the market price at 31 December Year 2 were the market price at the end of the contingency period. |

|

End of Year 3 |

18% increase in the price of the share [(118 / 100) – 1] |

100,000 shares issued under the contingent share agreement are included in the denominator from the vesting date, which would be the reporting date (31 December Year 3). |

100,000 shares issuable under the contingent share agreement are included in the denominator for the period that they are outstanding until the vesting date (the date the shares are included in basic EPS – i.e. 31 December Year 3) because the relevant condition is met at the reporting date. |

Example condition: Ordinary shares are contingently issuable subject to achieving and maintaining future earnings and future prices of the ordinary shares.

General principle: In such cases, the number of additional shares included in the denominator for diluted EPS is based on both conditions – i.e. earnings and the market price at the reporting date. Additional shares are not included in the denominator for diluted EPS unless both conditions are met. [IAS 33.55]

Other contingencies

Example condition: Ordinary shares are contingently issuable subject to a condition other than earnings or market price – e.g. the opening of a specific number of retail stores.

General principle: In such cases, the additional shares issuable are included in the denominator for diluted EPS according to the status at the reporting date. [IAS 33.56]

Scenario 3

(based on Illustrative Example 7 in IAS 33)

Company D enters into an agreement related to a business combination on 1 January Year 1 in which it would be required to issue 5,000 additional shares for each new retail site opened during Year 1.

- On 1 May Year 1, D opens a new retail site.

- On 1 September Year 1, D opens another new retail site.

The EPS implications are set out below.

|

Reporting date |

Performance against condition |

Basic EPS implications |

Diluted EPS implications |

|

End of Year 1 |

Two new retail sites opened during Year 1 |

Because the condition is met during the year, additional shares are included in the denominator for basic EPS from the date on which the condition is met – i.e. 5,000 from 1 May and 5,000 from 1 September. |

Because the status of the condition at the reporting date is the opening of two new retail sites, additional shares are included in the denominator for diluted EPS from the beginning of the period to the date on which they are included in the denominator for basic EPS – i.e. 5,000 from 1 January to 30 April and 5,000 from 1 January to 31 August. |

|

|

||||||||||

|

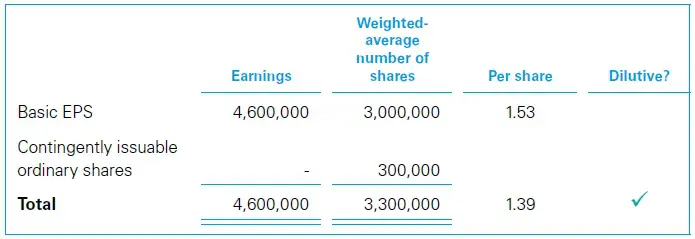

The following basic facts relate to Company P.

The following facts are also relevant for this example.

WorkingsThe EPS computations for Year 1 are as follows.

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.