Last update 04/08/2019

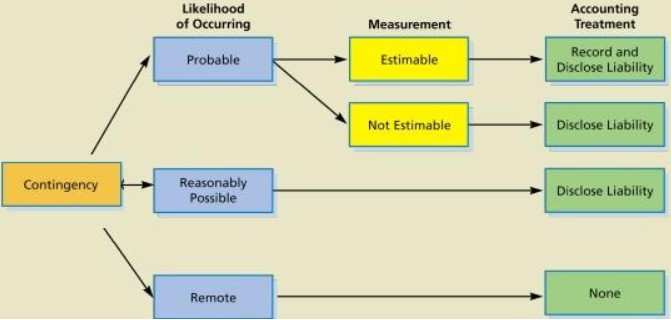

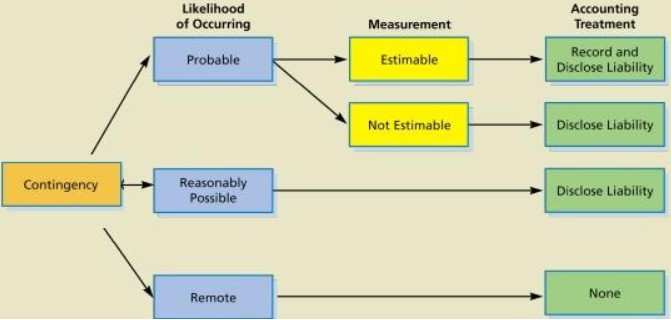

A contingent liability is:

- a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; or

- a present obligation that arises from past events but is not recognised because:

- it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or

- the amount of the obligation cannot be measured with sufficient reliability.

In short:

IFRS 3 Business combinations: Contingent liabilities

[IFRS 3 56] After initial recognition and until the liability is settled, cancelled or expires, the acquirer shall measure a contingent liability recognised in a business combination at the higher of:

- the amount that would be recognised in accordance with IAS 37; and

- the amount initially recognised less, if appropriate, the cumulative amount of income recognised in accordance with the principles of IFRS 15 Revenue from Contracts with Customers.

This requirement does not apply to contracts accounted for in accordance with IFRS 9.

Disclosure:

Contingent liabilities, such as guarantees and warranties, do not appear on balance sheet but need to be disclosed in the Notes to the financial statements to enable users to have a complete picture of the undertaking’s financial position.

Financial institutions

Banks usually have contingent liabilities to be reported. Banks issue a number of documents on behalf of clients for which they anticipate being reimbursed by clients. These include:

- Documentary and commercial letters of credit;

- Acceptances (time drafts endorsed by the bank);

- Standby letters of credit (also called demand guarantees).

There is a risk that the bank may not be repaid in full. As a result, such documents outstanding at the balance sheet date are listed as contingent liabilities.

Banks also issue guarantees for various purposes. Guarantees outstanding at the balance sheet date are also listed as contingent liabilities. Banks may not anticipate claims against the guarantees, but list them to recognise the risk that claims may arise.

IFRS 7 requires banks to disclose guarantees in additional ways:

Guarantees and IFRS 7 – collateral and other credit enhancements obtained

When an entity obtains financial or non-financial assets during the period by taking possession of collateral it holds as security, or calling on other credit enhancements ((examples of the latter being guarantees, credit derivatives, and netting agreements that do not qualify for offset in accordance with IAS 32)), and such assets meet the recognition criteria in other Standards, an entity shall disclose:

- the nature and carrying amount of the assets obtained; and

- when the assets are not readily convertible into cash, its policies for disposing of such assets, or for using them in its operations.

Guarantees and IFRS 7 – credit risk

Activities that give rise to credit risk and the associated maximum exposure to credit risk include, but are not limited to, granting financial guarantees. In this case, the maximum exposure to credit risk is the maximum amount the entity could have to pay if the guarantee is called on.

Loan commitments

Loan commitments are also listed as contingent liabilities. The bank has contracted to provide a loan to a client, but has yet to disburse some, or all, of the funds under the contract. Loan commitments include the amount of overdrafts that are not currently being used.

The bank must have facilities in place to finance the loans when they are to be disbursed.

IFRS 7 requires banks to disclose loan commitments in additional ways:

Loan commitments and IFRS 7 – scope of IFRS 7

IFRS 7 applies to recognised and unrecognised financial instruments. Recognised financial instruments include financial assets and financial liabilities that are within the scope of IFRS 9. Unrecognised financial instruments include some financial instruments that, although outside the scope of IFRS 9, are within the scope of IFRS 7 (such as some loan commitments).

Loan commitments and IFRS 7 – credit risk

Activities that give rise to credit risk and the associated maximum exposure to credit risk include, but are not limited to, making a loan commitment that is irrevocable over the life of the facility, or is revocable only in response to a material adverse change. If the issuer cannot settle the loan commitment net in cash, or another financial instrument, the maximum credit exposure is the full amount of the commitment. This is because it is uncertain whether the amount of any undrawn portion may be drawn upon in the future. When an entity is committed to make amounts available in installments, each installment is allocated to the earliest period in which the entity can be required to pay. For example, an undrawn loan commitment is included in the time band containing the earliest date it can be drawn down.

Loan commitments and IFRS 7 – interest rate risk

Interest rate risk arises on interest-bearing financial instruments recognised in the balance sheet (for example loans and receivables and debt instruments issued) and on some financial instruments not recognised in the balance sheet (for example some loan commitments).

Loan commitments and IFRS 7 – liquidity risk

IFRS 7 requires the entity to describe how it manages the liquidity risk inherent in the maturity analysis of financial liabilities. The factors that the entity might consider in providing this disclosure include, but are not limited to, whether the entity:

- expects some of its liabilities to be paid later than the earliest date on which the entity can be required to pay (as may be the case for customer deposits placed with a bank);

- expects some of its undrawn loan commitments not to be drawn.

Other contingent liabilities of banks include the outcome of lawsuits filed against the banks.