Last update 04/08/2019

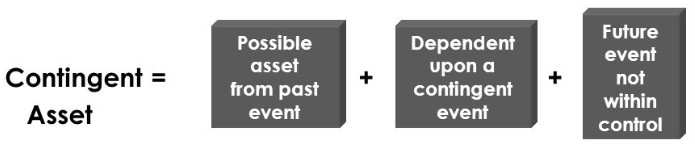

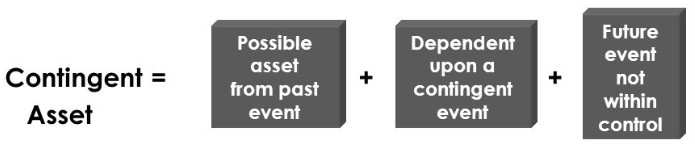

A contingent asset is a possible asset that arises from past events, and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

In short:

An example of a contingent asset may be a successful lawsuit claiming damages of another party of which outcome is unsecure. It cannot (yet) be shown as an asset on the balance sheet because it violates conservatism. However, footnote disclosure may be made.

Example disclosure – Contingent Asset

The case:

A mission is based in a country where the government has agreed to make facilities it owns available to the mission free of charge. Midway through the financial year, the mission receives information that the hotel complex it is renting appears to be owned by the government. The mission ceases rent payments immediately until the hotel complex establishes that it can rightfully charge rent. At year end, legal advice indicates that it is probable the mission does can recover rent payments made for the first half of the year and will not have to pay the unpaid amounts for the second half of the year.

The mission discloses a contingent liability for the unpaid rent for the second half of the year, as it still has a possible obligation that it may have to pay the rent.

But the mission has received legal advice that rent it has paid in the first half of the financial year for a hotel complex is more likely than not to be recoverable. In this circumstance, the mission discloses a contingent asset for the rent it paid for the first half of the year.