Constructive obligations

Usually an obligation arises as a consequence of a binding contract or from a statutory requirement. An obligation may also arise from normal business practice, custom and a desire to maintain good business relations or act in an equitable manner.

Such obligations are termed “constructive obligations.” A constructive obligation is an expectation that is created by an established pattern of past practice, published policies or a sufficiently specific current statement the enterprise has indicated to other parties that it will accept certain responsibilities. As a result, the enterprise has created a valid expectation on the part of those other parties that will discharge those responsibilities.

Based on all this, other parties rightly expect the entity to take responsibility and fulfil its obligations accordingly. This may be a case when the entity has no legal obligation for environmental protection, but in line with its publicly-known practice it regularly eliminates environmental damage. As such the constructive obligation that comes from this business practice gets the same status as a contractual obligation.

For example, a constructive obligation arises from a restructuring scheme when the scheme is communicated to those who will be affected by it and when the implementation time is so close that the enterprise has no option but to implement.

The constructive obligation gets translated into a contractual obligation when the enterprise enters into binding contracts in the process of implementation of the scheme. However, the moment of creating the constructive obligation is the moment for recognition of a provision.

Similarly, a constructive obligation arises when the chairman of the board of directors announces the board’s decision to take up certain social responsibilities voluntarily and the announcement gets huge publicity in the media and it is communicated to the appropriate authority.

At this stage, the company cannot withdraw the commitment without hurting its reputation. Therefore, practically, it cannot avoid the obligation. The constructive obligation gets the same status as a contractual obligation when the enterprise enters into binding contracts in the process of implementing the board’s decision. However, the moment of creating the constructive obligation is the moment for recognition of a provision.

The definition – Recognition of provisions

Just for completeness sake, here are the criteria when an entity must recognise a provision, this is if, and only if [IAS 37.14]:

- a present obligation (legal or constructive) has arisen as a result of a past event (the obligating event);

- an outflow of economic benefit to settle the obligation is probable (“more likely than not”); and

- the amount of the obligation can be estimated reliably.

Voluntary retirement scheme

In many situations, a liability is recognised much before the firm enters into a binding contract. Let us take the example of a voluntary retirement scheme.

Usually, a voluntary retirement scheme implementation goes through six stages: “on principal” approval by the board

of directors; formulation of the draft scheme; approval of the draft scheme by the board of directors; discussion of the draft with the employees’ union and finalisation of the scheme; communication of the scheme to target employees; receipt of applications (offers) from employees; and acceptance of the applications resulting in a binding contract.

of directors; formulation of the draft scheme; approval of the draft scheme by the board of directors; discussion of the draft with the employees’ union and finalisation of the scheme; communication of the scheme to target employees; receipt of applications (offers) from employees; and acceptance of the applications resulting in a binding contract.

At which stage should a provision for voluntary retirement scheme be recognised in the balance sheet? Following the concept of constructive obligations, a provision should be recognised when the scheme is communicated to the employees [IAS 19.4(c)].

Often it is argued that it is difficult to reliably estimate the cash flow resulting from the voluntary retirement scheme until the applications from employees are received and accepted by the management. This is not tenable, because the CEO’s proposal before the board of directors already presents an estimate of the number of employees who will offer early retirement.

That estimate will be a best estimate or similar estimation model based on expectations of people willing to use the voluntary retirement scheme, based on similar situations, if considered necessary based on assessments by specialists.

Earnings management

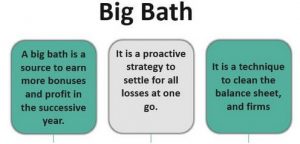

On the negative side, the practice of recognising constructive obligations provides significant opportunity for earnings management by overstating liabilities. The determination of the point in time when the constructive obligation should be recognised and estimation of the amount of the liability involves judgement.

In fact the scope for earnings management is much higher in case of recognition of provisions. A provision is a liability

of uncertain timing and amount. For example, the liability resulting from product warranty is surrounded by uncertainties. It is difficult to ascertain, at the balance sheet date, the parties who will report defects in the products sold and the amount of economic benefits that will flow out of the enterprise.

of uncertain timing and amount. For example, the liability resulting from product warranty is surrounded by uncertainties. It is difficult to ascertain, at the balance sheet date, the parties who will report defects in the products sold and the amount of economic benefits that will flow out of the enterprise.

However, by documenting the provision properly (as said many times with the use of specialists’ best estimates and facts regarding the expectations of the concerned environment of stakeholders) such uncertainties can be reduced.

Asset retirement obligation

Similarly, the estimation of asset retirement obligation (e.g. obligation to dismantle and remove the asset and restore the site) is surrounded by uncertainties [IAS 16.16].

Usually, the life of tangible fixed assets (e.g. an oil rig) is quite long, and the asset retirement obligation is settled much after the provision is made. Therefore, the estimation should take into account the expected state of technological and other environment at the time of settlement of the asset retirement obligation.

Moreover, the outflow of economic benefits to settle the obligation resulting from product warranty or asset retirement obligation depends on the strategy of the enterprise. The cost to settle the obligation using internal resources might be different from the cost that will be incurred if the company appoints an external agency to settle those obligations. Similarly, the cost will be different if an enterprise takes an insurance cover against the product warranty.

An enterprise discloses an obligation as contingent liability if it estimates that it is less likely that an outflow of economic benefits will result from the obligation. An obligation, which is more likely to result in outflow of economic benefits is also presented as contingent liability if the enterprise cannot estimate the amount with adequate reliability.

The difference between provision and contingent liability is thin. Whether the company should provide for an obligation or whether it will just be disclosed in footnotes depends on the management’s judgement regarding the probability of the obligation resulting in an outflow of economic benefits.

Joint ventures – transition from proportionate consolidation to the equity method

When changing from proportionate consolidation to the equity method, an entity recognises its investment in the joint venture as at the beginning of the earliest period presented. That initial investment is measured at the aggregate of the carrying amounts of the assets and liabilities that the entity had previously proportionately consolidated, including any goodwill arising from acquisition.

If the goodwill previously belonged to a larger cash-generating unit, or to a group of cash-generating units, the goodwill is allocated to the joint venture on the basis of the relative carrying amounts of the joint venture and the cash-generating unit or group of cash-generating units to which it belonged.

The opening aggregated balance of the above investment is regarded as its deemed cost at initial recognition.

If aggregating all previously proportionately consolidated assets and liabilities results in a net liability position, an entity assesses whether it has legal or constructive obligations in relation to the net liabilities and, if so, recognises the corresponding liability.

If it is concluded that there are no legal or constructive obligations in relation to the net liabilities the corresponding liability is not recognised, with an adjustment being made to retained earnings at the beginning of the earliest period presented. In such cases, disclosure is required that this approach has been followed, along with a note of the cumulative unrecognised share of losses of joint ventures as at the beginning of the earliest period presented and at the date at which IFRS 11 is first applied.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.