Last update 24/08/2019

IFRS 10 Definition

The financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.

Parent – An entity that controls one or more entities.

The other types of financial statements are unconsolidated financial statements (or company accounts) and combined financial statements.

Single economic entity concept

The concept of a single economic entity is illustrated in the example below:

|

Example – Single economic entity concept A subsidiary buys an asset from a third party for CU 100. It subsequently sells the asset on to its parent for CU 130. The subsidiary records a profit of CU 30 and the parent records an asset of CU 130 in its separate financial statements. If the parent and subsidiary are viewed as being a single entity, all that has happened is that this single entity has bought an asset for CU 100 from a third party. This is what would be shown in the parent’s consolidated financial statements. So upon consolidation the CU 30 would be eliminated. |

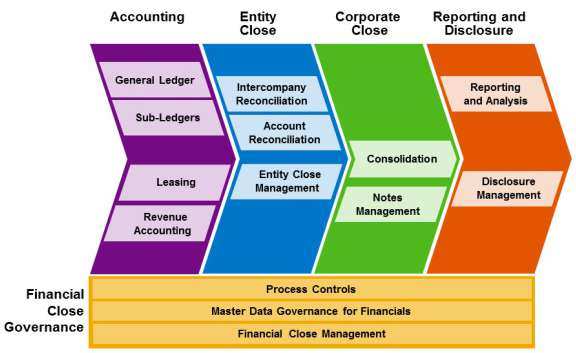

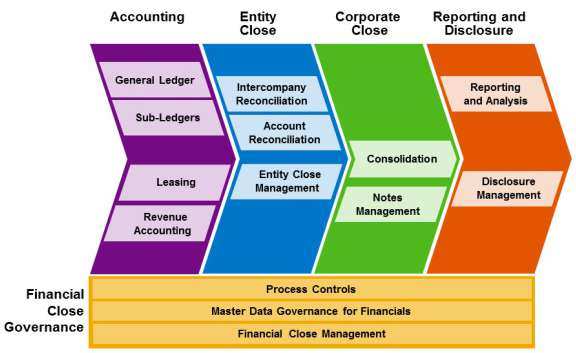

The (financial) consolidation process

The detailed ‘mechanics’ of the consolidation process vary from one group to another, depending on the group’s structure, history and financial reporting systems. IFRS 10 and much of the literature on consolidation are based on a traditional approach to consolidation under which the financial statements (or, more commonly in practice, group ‘reporting packs’) of group entities are aggregated and then adjusted on each reporting date. Larger groups using enterprise reporting systems may prepare consolidated financial information in a more real time and automated manner. However, the traditional approach still serves to illustrate the underlying concepts.

|

Consolidation Step-by-Step |

Issues |

|

|

Step 1 – combine financial statements of each group entity |

|

|

|

Step 2 – eliminate intra-group transactions and balances |

|

|

|

Step 3 – eliminate the parent’s investment in each subsidiary and recognise goodwill and other business combination-related adjustments |

|

|

|

Step 4 – allocate comprehensive income and equity to non-controlling interests (NCI) |

|

Subsidiary expected to be liquidated

If a subsidiary (that is still controlled by the parent) is expected to be liquidated and its financial statements are prepared on a non-going concern basis, but the parent is expected to continue as a going concern, then the consolidated financial statements should be prepared on a going concern basis. The subsidiary should continue to be consolidated until it is liquidated or otherwise disposed of.

Consolidated financial statements

Consolidated financial statements

Consolidated financial statements Consolidated financial statements Consolidated financial statements Consolidated financial statements Consolidated financial statements Consolidated financial statements