Last update 13/11/2019

Complete detection of all IFRS 3 intangibles explains it all, because detecting intangible assets can be a complex and challenging matter. Strategies to detect identifiable intangible assets vary depending on the facts and circumstances of the business combination and usually require a full review of the transaction. It is important to understand the business of the acquiree, what intangible resources it depends on and how these may translate into identifiable intangible assets. It should be possible to explain the acquired business in terms of the resources it uses to generate profits and how these are reflected in the acquiree’s assets and liabilities. In other words ask the question: what has been paid for?

Use the business case and transaction case to find intangibles

|

Points to think of or questions to ask yourself in the business case and the transaction case: |

|

Business case review

A thorough review of the acquiree’s business is the most important step in detecting intangible assets in a business combination. Understanding the business rationale for the combination from the perspective or the acquirer, the acquiree’s business resources and how the acquired business generates revenues provides the most useful insights into its intangible assets.

Review of financial information

A review of historical and prospective financial information is a safe starting point to understand the relative importance of non-current tangible assets, working capital (ie cash and cash equivalents, inventories and work in progress, trade receivables and payables) as well as financing arrangements. These assets are usually readily observable as they are included on the acquiree’s balance sheet.

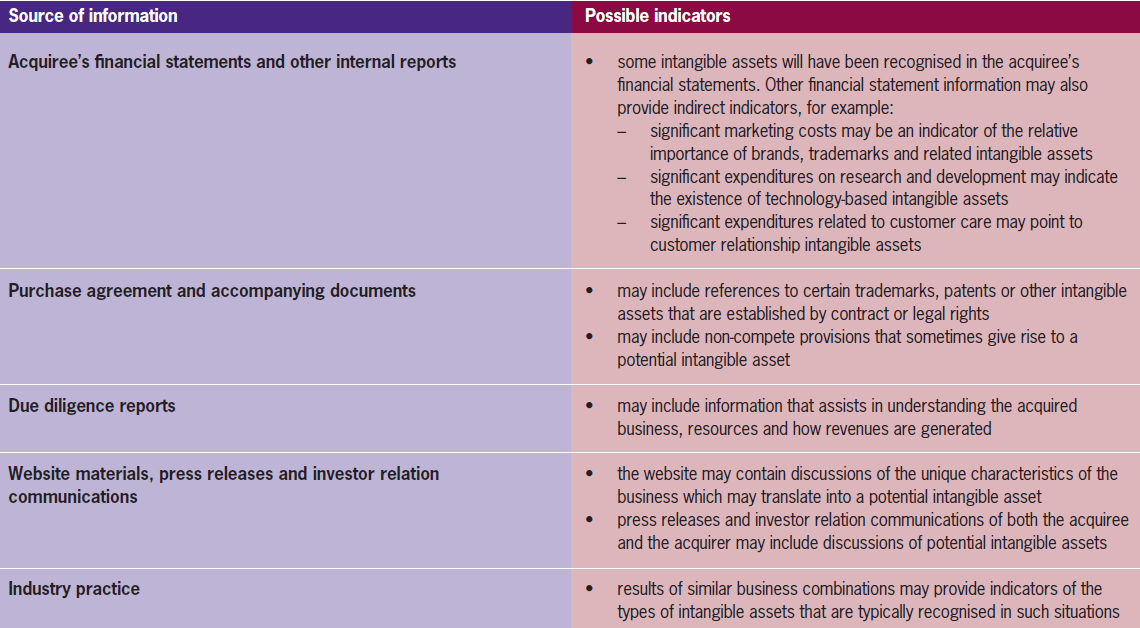

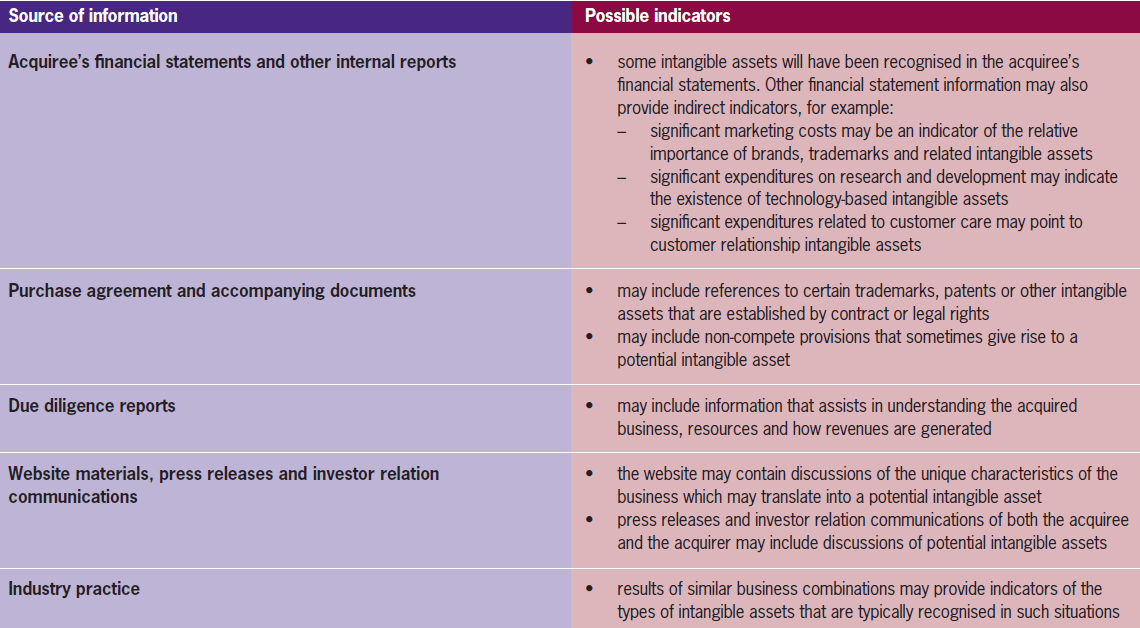

Intangible assets are often not included either in internal financial information used in the acquired business or in its published financial statements (if any). However, financial information is likely to provide important indirect indicators. For example, high marketing-related expenditure may be an indicator of the relative importance of trademarks and similar marketing-related intangible assets. If the entity incurs significant expenditure on research and development, it is likely to generate technology-based intangible assets. The relative significance of expenses that are related to customer care may point to the significant customer relationship intangible assets.

Characteristics of the acquired business

The review of financial information should be accompanied by a full commercial analysis of the acquired business:

- the product portfolio may provide further useful insights into the existence and characteristics of technology-based intangible assets. If current or new products are based on what is sometimes referred to as ‘core technology’ or a common ‘product platform’, then further analysis should assess the role of the underlying technology

- the relative importance of branding or other marketing strategies needs to be assessed to determine the existence of marketing-related intangible assets such as trademarks, brands, logos or similar assets

- an analysis of the customer base is usually carried out to determine whether identifiable customer relationship intangible assets exist. Whether the customers are known to the business, their behaviour and loyalty may all be considered in detecting a related intangible asset

- where a business depends on specific rights of use, such as access to license agreements or rare supplies of raw material, then this may indicate supplier-related contractual intangible assets. Examples are long-term energy or metal supply agreements. Permits to operate or service-specific assets such as a hydroelectric power plant, a TV station or simply a property under a lease contract are also examples of specific rights of use (amongst many other examples)

- if business locations are crucial, for example if the acquired business is a retailer, then this may also indicate value. However, in cases other than operating lease contracts, this is generally not an identifiable intangible asset, but a measurement element of the underlying property

- the acquiree’s workforce is also often considered a key asset of the business under review. The existence of a well-trained and organised team saves the acquirer from having to hire and train the people necessary to run the business and thus represents future economic benefits. Nevertheless, recognition of the assembled workforce is specifically prohibited under IFRS 3 B37 and IAS 38 15. The workforce may however affect the fair value measurement of other intangible assets

- industry-specific intangible assets may be identified by assessing the relevance of assets typically found in a specific economic environment. For example, customer ‘core deposits’ may be a typical example for an intangible asset commonly found in financial institutions. Other industries may rely on copyrighted material, such as pictures or photographs or similar ‘artistic intangibles’.

Management’s judgment

The business model review should be complemented by management’s judgment. The acquirer’s management usually has post-combination objectives and may already have identified the acquiree’s resources – both tangible and intangible – in developing its post-combination strategy. This may not directly ‘translate’ into the general requirements for identifiable intangible assets under IFRS 3, but nevertheless draws out key elements of the acquired business that represent value for the acquirer. It may also be helpful to take into account the judgment of the acquiree’s management team as it has experience with the business model and existing key inputs that may be ‘translatable’ into identifiable intangible assets.

The transaction case

The purchase agreement that affects the business combination is usually a very important source in finding potential identifiable intangible assets. The agreement and its accompanying annexes and disclosure documents will usually refer to specific trademarks, patents and other intangible assets that are established by contractual or other legal rights. Legal, accounting and commercial due diligence reports (if available) are also likely to contain important references. For example, often times there are information memorandums prepared on the target business. Additionally, any Board approval documents may be useful as reference materials.

The detection of identifiable intangible assets depends on the context of the acquisition. Useful sources to detect identifiable intangible assets in the context of a business combination are for example:

Both parties to a business combination may have also expressed their views on potential intangible assets in external documents that relate to the combination. It may therefore also be necessary to review website material and press releases of both the acquirer and the acquiree. These tend to point out unique characteristics of the business under review, which in turn may translate into identifiable intangible assets. Where records are not readily available from the acquired business, it may also be helpful to contact the relevant authorities to ensure the completeness of potential intangible assets that are legally protected through a registration (such as trademarks or patents).

The acquiree may have reported various intangible assets in its pre-combination financial statements. This is clearly a useful indicator of identifiable intangible assets but further analysis will be required. Typically, intangible assets recorded by the acquiree will be purchased assets that meet the contractual-legal criterion. However, some items recorded by the acquiree may not qualify for recognition in accordance with IFRS, as follows:

- Some GAAPs require or allow, for example, the recognition of start-up costs – these do not meet the definition of an asset under IFRS

- Goodwill previously recognised by the acquiree should also not be taken into consideration.

Conversely, some assets that have been fully depreciated or amortised by the acquiree may still be in use and meet the definition of identifiable intangible assets.

Determining which identifiable intangible assets require measurement

A complete review of the acquired business’s intangible assets is necessary to enable proper implementation of IFRS 3. However, not every identifiable intangible asset needs to be measured and recognised individually:

- some assets are grouped with other assets on the basis of the specific requirements in IFRS 3 and IAS 38

- similar identifiable assets may also be combined for practical reasons or to avoid double-counting

- some identifiable intangible assets may be considered immaterial.

Groups of intangible assets

Generally, all identifiable intangible assets that are acquired in a business combination are measured independently. Nevertheless, intangible assets that do not meet the contractual-legal criterion for identifiability but are otherwise separable from the acquired entity may sometimes only be separable as a group with (an)other tangible or intangible asset(s). This situation may cause problems in measuring the individual fair value of the intangible asset reliably. In these circumstances, the group of assets may be treated as a single asset for accounting purposes, including fair value measurement (IAS 38 36).

Interdependencies of core technology and customer relationship assets |

|

In a business combination, both a customer relationship intangible asset and core technology are detected as identifiable intangible assets. The core technology is used to generate income from ongoing customer relationships. The customer relationships, on the other hand, cannot be used to generate any income that does not relate to the core technology. Analysis:In this scenario a detailed assessment is required to determine whether these resources need to be combined for accounting (and measurement) purposes or whether they are two separable assets. |

A similar principle applies to certain groups of complementary assets that comprise a brand. In accordance with IAS 38 37 the acquirer combines a trademark or a service mark and other related intangible assets into a single identifiable intangible asset if the individual fair values of the complementary assets are not measurable reliably on an individual basis. IFRS also permits a combined approach for groups of complementary intangible assets comprising a brand even if fair values of individual intangible assets in the group of complementary assets are reliably measurable provided the useful lives are similar (IAS 38 37).

Complementary assets comprising a brand |

|

The cutting edge ‘¥Ð’ core technology is considered an identifiable intangible asset in a business combination. All of the acquiree’s products are based on ‘¥Ð’ and the technology is also advertised to customers under the ‘¥Ð’ brand using a website that is accessible under www.yd.com. The ‘¥Ð’ brand is protected against third-party use by a registered trademark and no other technology can be reasonably marketed using this trademark. The www.yd.com domain name is also registered. It is expected that when ¥Ð technology is withdrawn from the market, then the trademark and the domain name will both be of little or no value. The remaining useful life of the three different intangible assets is expected to be similar. Analysis:Given the fact pattern, the acquirer concludes that neither the trademark nor the domain name would be reliably measurable without taking into account the core technology they relate to. The core technology, the trademark and the domain name are therefore considered a single identifiable intangible asset. |

Other combinations of assets with similar economic characteristics

Although IFRS refers to combining intangible assets only in limited circumstances (as described above), judgment is required in practice to determine the appropriate level of aggregation. This is sometimes referred to as the ‘unit of account’ issue. In the absence of specific guidance on unit of account issues, it may be appropriate to extend the approach set out for brands to groups of similar assets in general.

Materiality considerations will often justify treating large groups of similar assets (eg customer relationship assets) on a portfolio basis. However, in determining whether separate identifiable intangible assets may be similar enough to be measured on a combined basis consideration should be given to:

- general characteristics of the intangible assets under review

- related services and products

- functionality and/or design and other shared features of the intangible assets

- similar legal or regulatory conditions that affect the intangible assets

- geographical regions or markets

- the economic lives of the assets.

Depending on the facts and circumstances, it may be preferable to combine similar assets for measurement purposes and subsequent accounting.

These factors may result in reporting different intangible assets on a combined basis (or even combinations of intangible and tangible assets). Material, identifiable intangible assets should not however be combined with goodwill. If similar intangible assets are combined for measurement purposes they should in our view also be accounted for subsequently on the same combined basis.

The acquirer entity should not measure the intangible assets on a combined basis and then disaggregate them for subsequent amortisation purposes.

Different patents relating to same technology |

|

A number of different patents which all relate to the same technology are identified in a business combination. It is concluded that the patents contribute to the same income stream. The patents also have similar remaining useful lives and are therefore considered as a portfolio. As a result, the entity then measures, recognises and subsequently accounts for the underlying core technology rather than a number of different intangible assets. |

Customer bases in separate markets |

|

SalesCorp is active in the North American market as well as in the European market. SalesCorp’s customers in North America are independent from its customers in Europe. SalesCorp also provides different products to its different groups of customers. Given these circumstances, and providing that the asset definition and the identifiability criteria are met, it is decided that SalesCorp has two customer bases that should be accounted for as separate identifiable intangible assets. |

Materiality considerations

It is not necessary to measure the fair value of specific intangible assets if they are demonstrably immaterial. Both qualitative and quantitative factors should be considered in evaluating materiality. Indicators of materiality (or immateriality) might include:

- the function of the identifiable intangible asset in the business model – can the business model be explained without the intangible asset?

- will the acquired entity ‘maintain’ the subject asset – ie will it incur significant expenditure necessary to protect its value, and will it monitor relevant rights?

- the remaining useful life of the intangible asset. Extended remaining useful lives may result in future economic benefits that are not available in the short term and which are therefore not immediately perceptible. Future economic benefits of the intangible asset under review may nevertheless be material.

Consideration of materiality |

|

An entity acquires a patent in a business combination. The patent meets the definition of an asset and also the contractual legal-criterion for identifiability. However, the patent protects outdated technology that is almost irrelevant for products and services in the relevant markets at the date of acquisition. Furthermore, the patent protection will expire in less than two years from the date of acquisition. It is therefore concluded that the patent’s fair value is immaterial. |

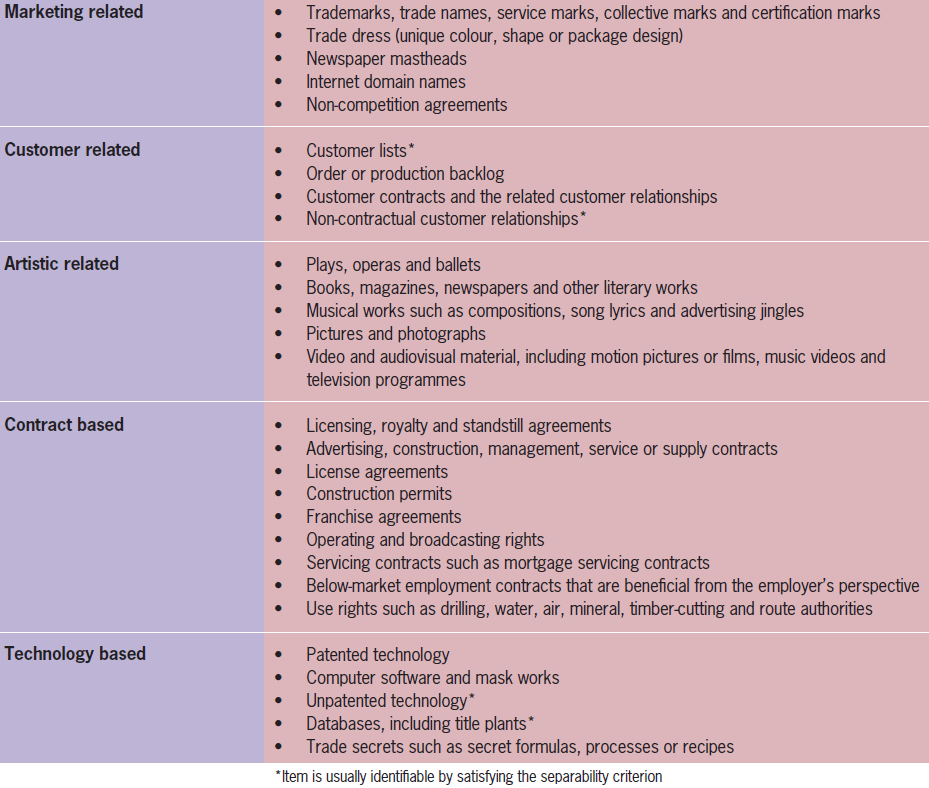

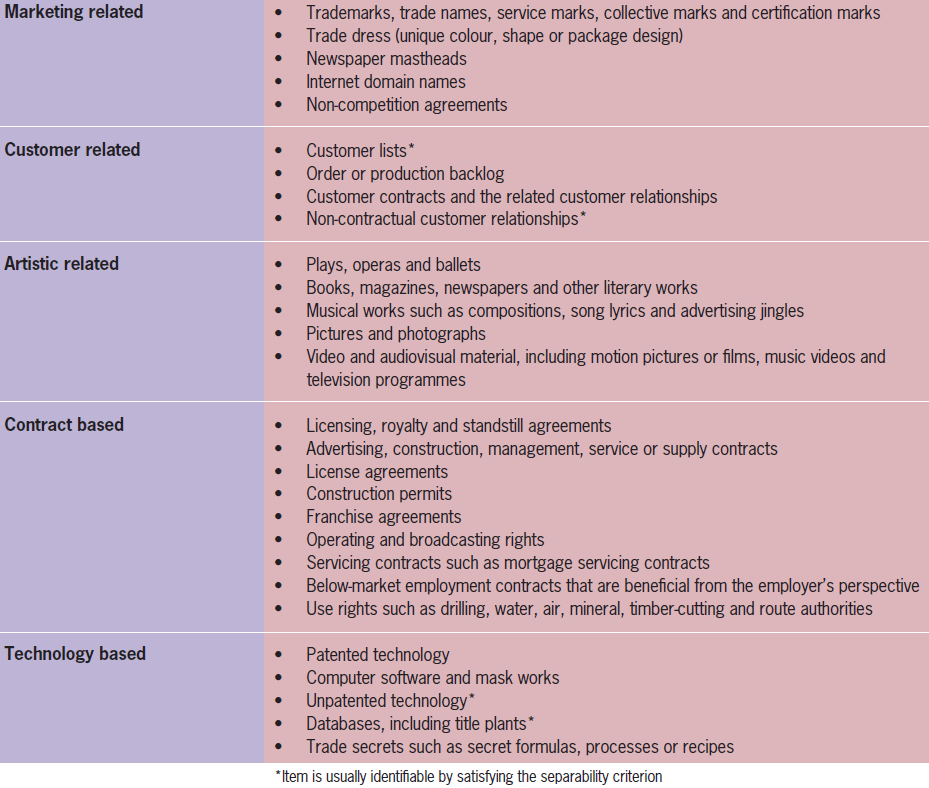

Common identifiable intangible assets

These steps describe general approaches for detecting identifiable intangible assets in a business combination. Practitioners also often ask for a ‘checklist’ of the intangible asset types most commonly identified in business combinations. Any such checklist should be treated with a degree of caution. Best practice is to maintain a wide focus in the detection phase so that relevant identifiable intangible assets are not overlooked. The intangibles to be identified vary in each case and depend greatly on the industry of the acquired business and the circumstances of the business combination.

Despite the limitations of any checklist, a list of common examples can help to focus the analysis and provide an indication of possible end results. Accordingly, ‘Case value intangibles in a business combination’ discusses a number of intangible asset types that are commonly detected in business combinations, including customer relationships, trademarks or non-compete agreements (and common measurement methods used to estimate their fair values).

Illustrative examples within IFRS 3 IE 18 – 44

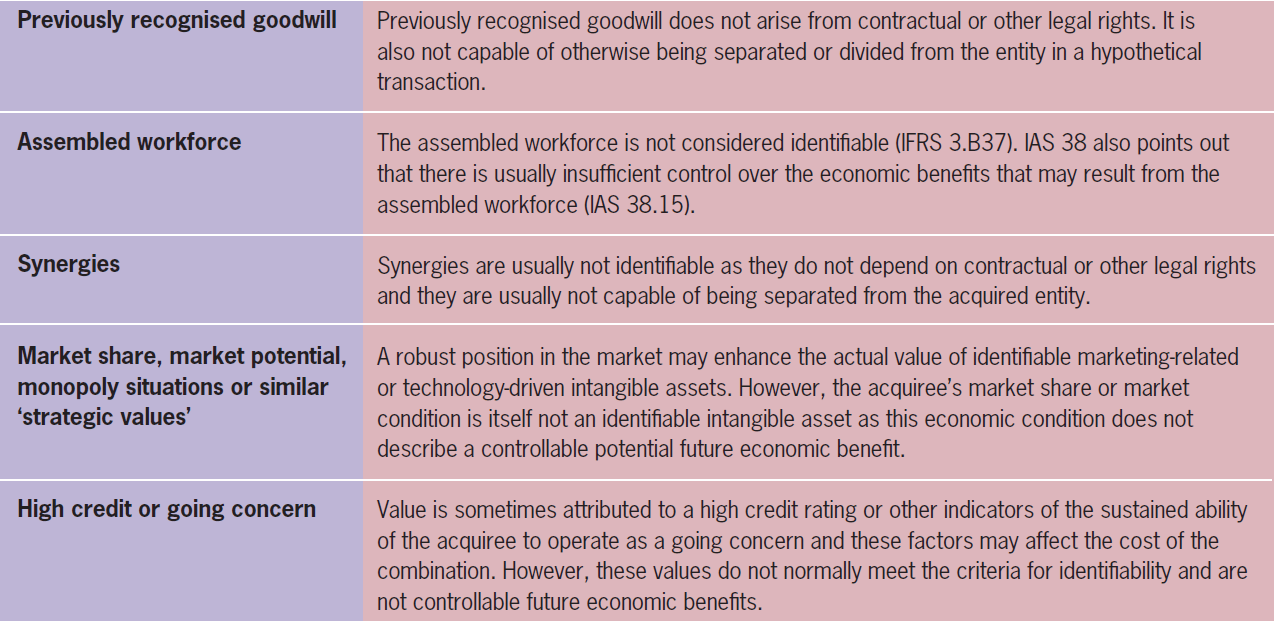

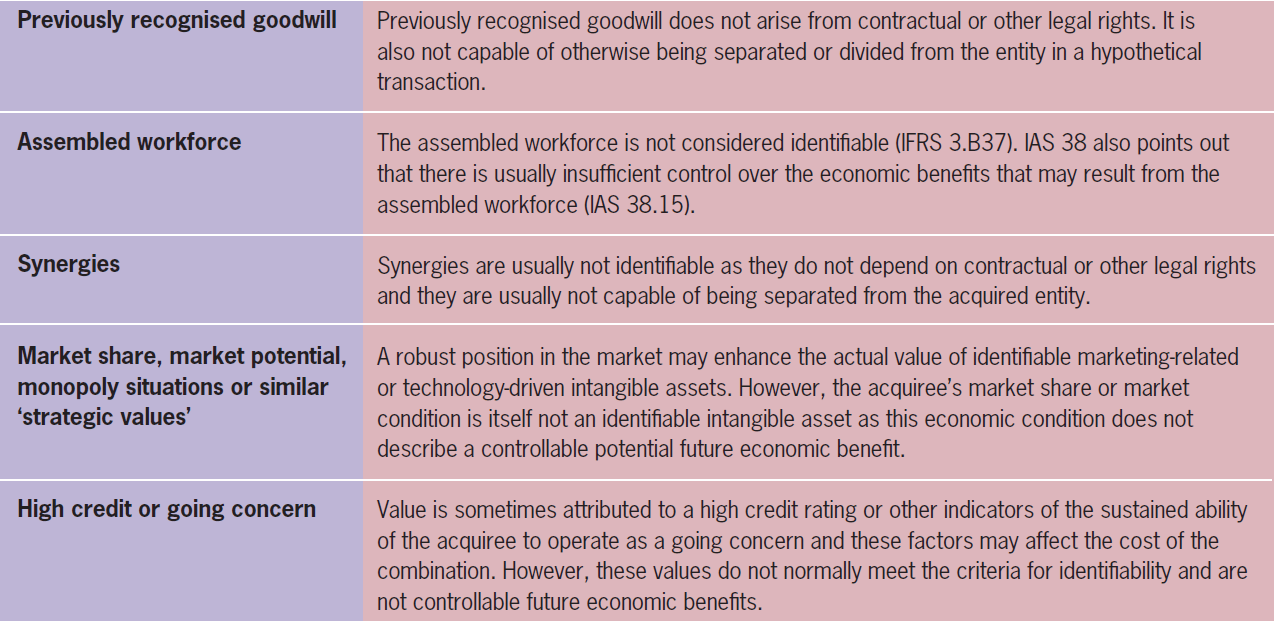

Economic benefits that usually do not constitute identifiable intangible assets

Other resources are commonly found in business combinations but do not meet the definition of an identifiable intangible asset. As such, they may affect the value of other assets, liabilities and contingent liabilities or they are simply included in goodwill. Normally, they would however not be recognised as identifiable intangible assets:

While these items are usually not recognised separately from goodwill under IFRS, they may still be important or even essential to the acquired business. Some of these items (the assembled workforce for example) may need to be valued in order to determine the values of other assets that do need to be recognised.

See also: The IFRS Foundation