Last update 04/08/2019

An enhancing qualitative characteristic that enables users to identify and understand similarities in, and differences among, items.

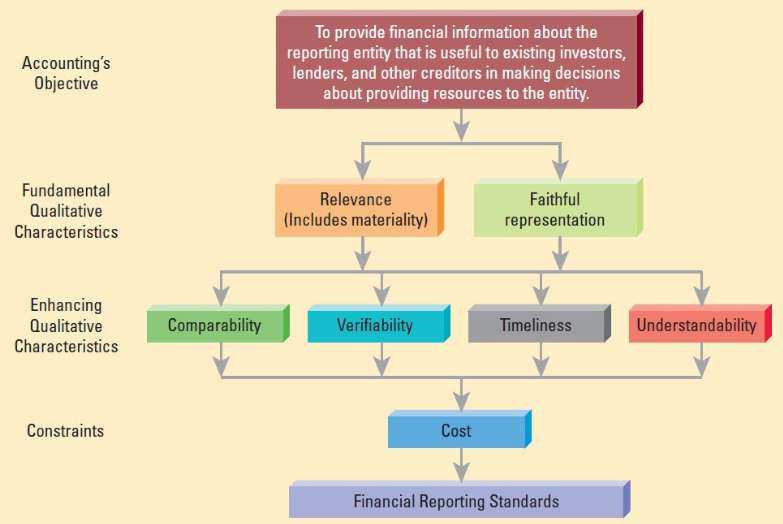

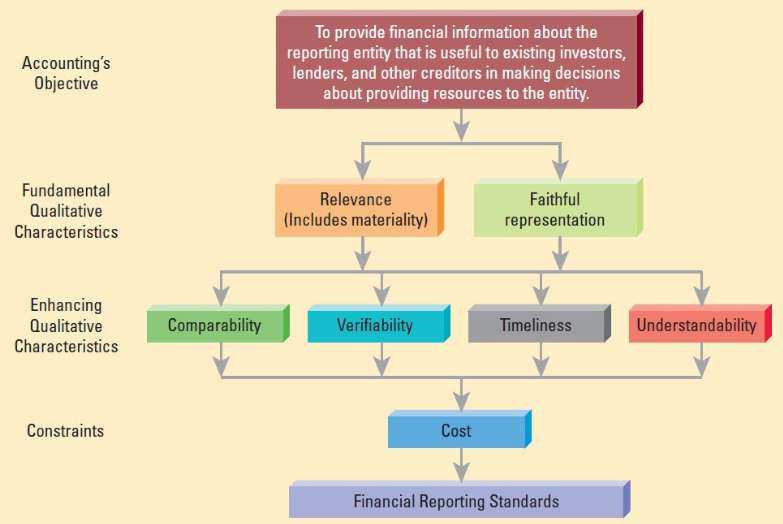

The Conceptual Framework provides the following guidance [Conceptual Framework 2.24 – 2.29]:

Users’ decisions involve choosing between alternatives, for example, selling or holding an investment, or investing in one reporting entity or another. Consequently, information about a reporting entity is more useful if it can be compared with similar information about other entities and with similar information about the same entity for another period or another date.

Comparability is the qualitative characteristic that enables users to identify and understand similarities in, and differences among, items. Unlike the other qualitative characteristics, comparability does not relate to a single item. A comparison requires at least two items. Consistency, although related to comparability, is not the same. Consistency refers to the use of the same methods for the same items, either from period to period within a reporting entity or in a single period across entities. Comparability is the goal; consistency helps to achieve that goal.

Comparability is not uniformity. For information to be comparable, like things must look alike and different things must look different. Comparability of financial information is not enhanced by making unlike things look alike any more than it is enhanced by making like things look different. Some degree of comparability is likely to be attained by satisfying the fundamental qualitative characteristics. A faithful representation of a relevant economic phenomenon should naturally possess some degree of comparability with a faithful representation of a similar relevant economic phenomenon by another reporting entity.

Although a single economic phenomenon can be faithfully represented in multiple ways, permitting alternative accounting methods for the same economic phenomenon diminishes comparability.

Comparability in financial reporting measurements has at least four aspects.

- Consistency in the treatment of different items and different transactions.

- Comparability of information across different reporting entities.

- Consistency across reporting entities in the measurement of similar items and

similar transactions. - Comparability over time.

The third item on the list may appear to be implied by the second. But at present, while different entities’ reported numbers may well be comparable in the sense that they use the same measurement basis, they may nonetheless measure similar items at different amounts – because the items have different historical costs, for example.

Comparability is not an overriding objective. There is often a trade-off between comparability and other desirable qualities of financial reporting information. For example, it is often sensible for accounting requirements to change, which reduces comparability over time. And information that is cost-effective for one company may not be for another.

Comparability

Comparability

Comparability Comparability Comparability Comparability Comparability Comparability