Last update 11/12/2019

Changes in significant accounting policies

Notes to the consolidated financial statements1

The basis of preparation comprises the notes to the financial statement relating to:

|

5. Changes in significant accounting policies2 The Group has initially applied IFRS 15 (see A) and IFRS 9 (see B) from 1 January 2018. A number of other new standards are also effective from 1 January 2018 but they do not have a material effect on the Group’s financial statements. Due to the transition methods chosen by the Group in applying these standards, comparative information throughout these financial statements has not been restated to reflect the requirements of the new standards, except for certain hedging requirements and separately presenting impairment loss on trade receivables and contract assets (see B). The effect of initially applying these standards is mainly attributed to the following:

|

|

|

5 – A. IFRS 15 Revenue from Contracts with Customers IFRS 15 establishes a comprehensive framework for determining whether, how much and when revenue is recognised. It replaced IAS 18 Revenue, IAS 11 Construction Contracts and related interpretations. Under IFRS 15, revenue is recognised when a customer obtains control of the goods or services. Determining the timing of the transfer of control – at a point in time or over time – requires judgement. |

|

|

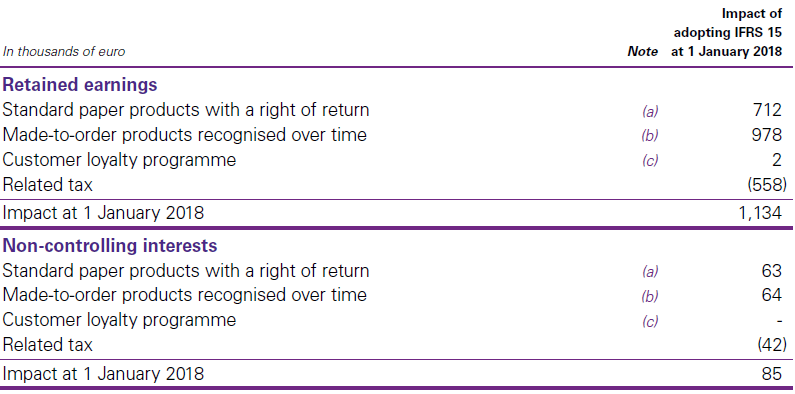

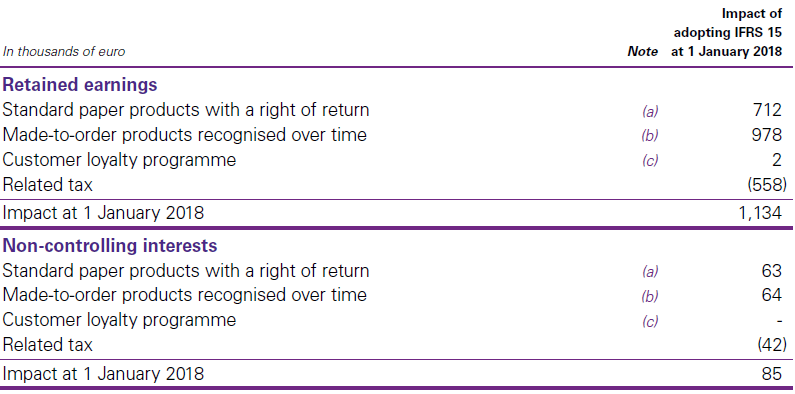

The Group has adopted IFRS 15 using the cumulative effect method (without practical expedients), with the effect of initially applying this standard recognised at the date of initial application (i.e. 1 January 2018). Accordingly, the information presented for 2017 has not been restated – i.e. it is presented, as previously reported, under IAS 18, IAS 11 and related interpretations. Additionally, the disclosure requirements in IFRS 15 have not generally been applied to comparative information.3 The following table summarises the impact, net of tax, of transition to IFRS 15 on retained earnings and NCI at 1 January 2018.

|

|

|

IFRS 15 C8 |

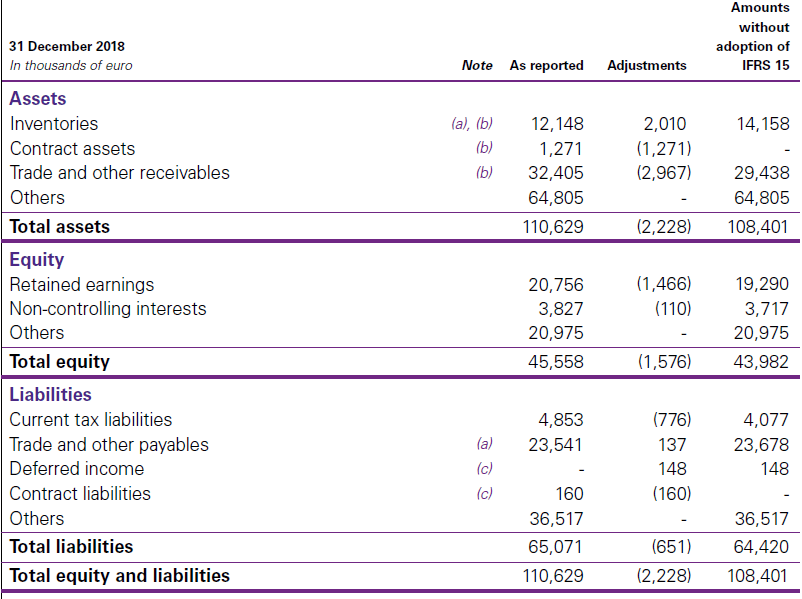

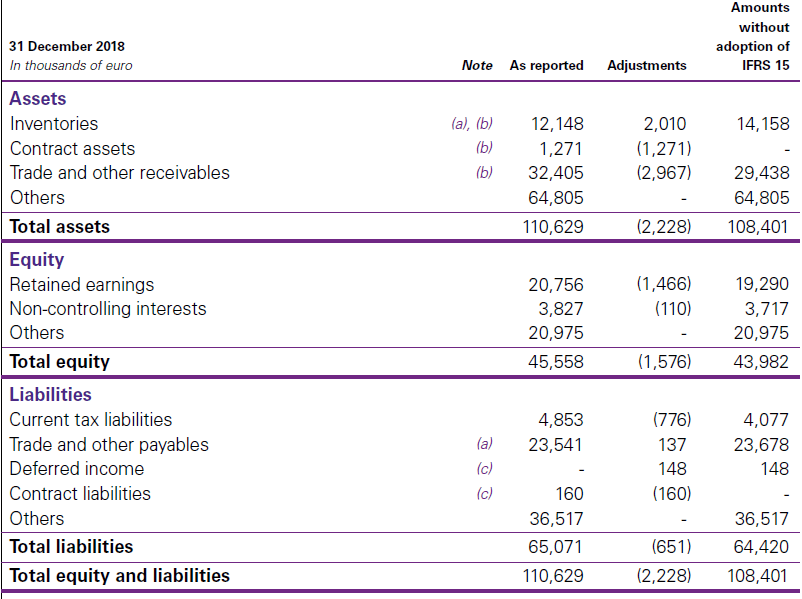

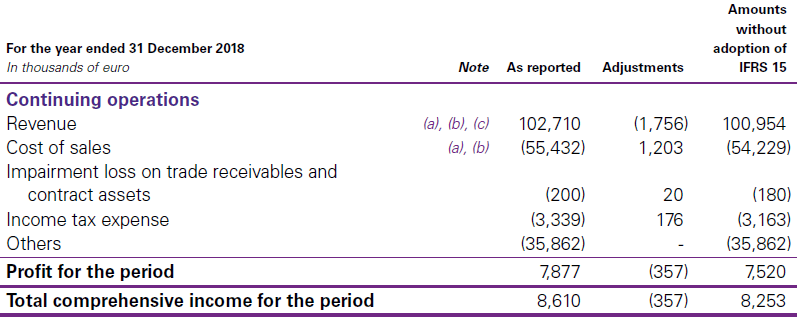

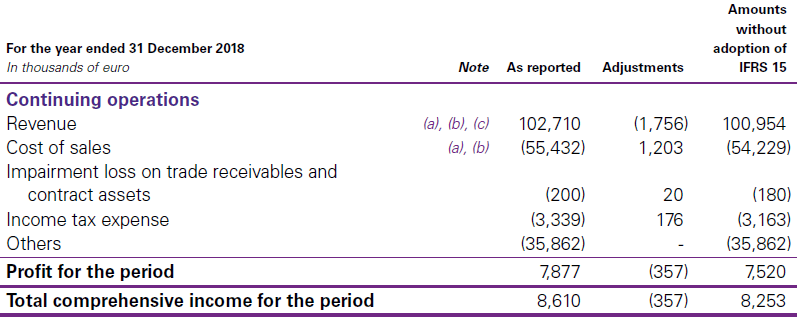

The following tables summarise the impacts of adopting IFRS 15 on the Group’s statement of financial position as at 31 December 2018 and its statement of profit or loss and OCI for the year then ended for each of the line items affected. There was no material impact on the Group’s statement of cash flows for the year ended 31 December 2018. Impact on the consolidated statement of financial position

Impact on the consolidated statement of profit or loss and OCI

a. Standard paper products: Under IAS 18, revenue for these contracts was recognised when a reasonable estimate of the returns could be made, provided that all other criteria for revenue recognition were met. If a reasonable estimate could not be made, then revenue recognition was deferred until the return period lapsed or a reasonable estimate of returns could be made. Under IFRS 15, revenue is recognised to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur. Therefore, for those contracts for which the Group was unable to make a reasonable estimate of returns, revenue is recognised sooner under IFRS 15 than under IAS 18. The impact of these changes on items other than revenue is a decrease in the refund liability, which is included in trade and other payables. In addition, there is a new asset for the right to recover returned goods, which is presented as part of inventory. b. Made-to-order paper products: Under IAS 18, revenue for made-to-order paper products was recognised when the goods were delivered to the customers’ premises, which was taken to be the point in time at which the customer accepted the goods and the related risks and rewards of ownership transferred. Revenue was recognised at that point provided that the revenue and costs could be measured reliably, the recovery of the consideration was probable and there was no continuing managerial involvement with the goods. Under IFRS 15, revenue for made-to-order paper products is recognised over time – i.e. before the goods are delivered to the customers’ premises. Therefore, for these products revenue is recognised sooner under IFRS 15 than under IAS 18. The impacts of these changes on items other than revenue are an increase in trade and other receivables, a new contract asset and a decrease in inventories. c. Customer loyalty programme: Under IAS 18, revenue was allocated between the loyalty programme and the paper products using the residual value method. That is, consideration was allocated to the loyalty programme based on the fair value of the loyalty points and the remainder of the consideration was allocated to the paper products. Under IFRS 15, a lower proportion of the consideration is allocated to the loyalty programme. Therefore, for customer loyalty points less revenue is deferred under IFRS 15 than under IAS 18. The impact of these changes on items other than revenue is a decrease in deferred income, which is now included in a new balance – i.e. contract liability. IFRS 15 did not have a significant impact on the Group’s accounting policies with respect to other revenue streams (see Notes 6 and 8). For additional information about the Group’s accounting policies relating to revenue recognition, see Note 8(D). 5 – B. IFRS 9 Financial Instruments |

|

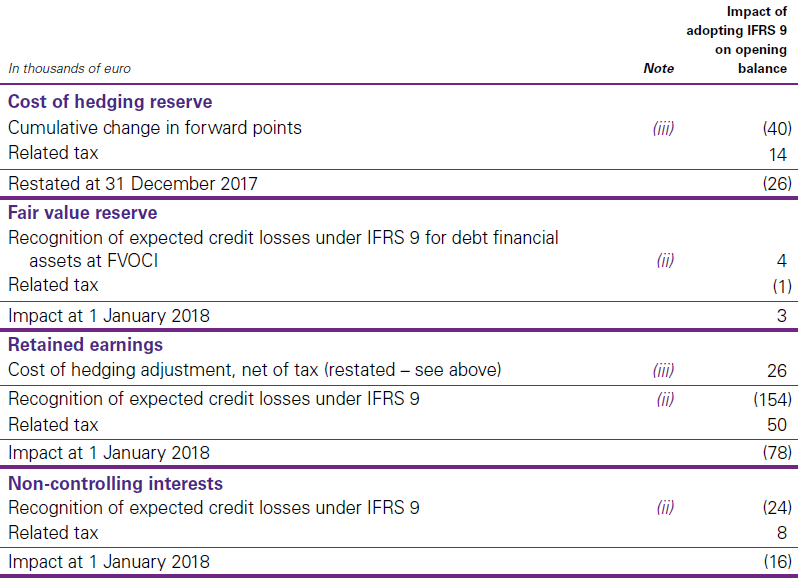

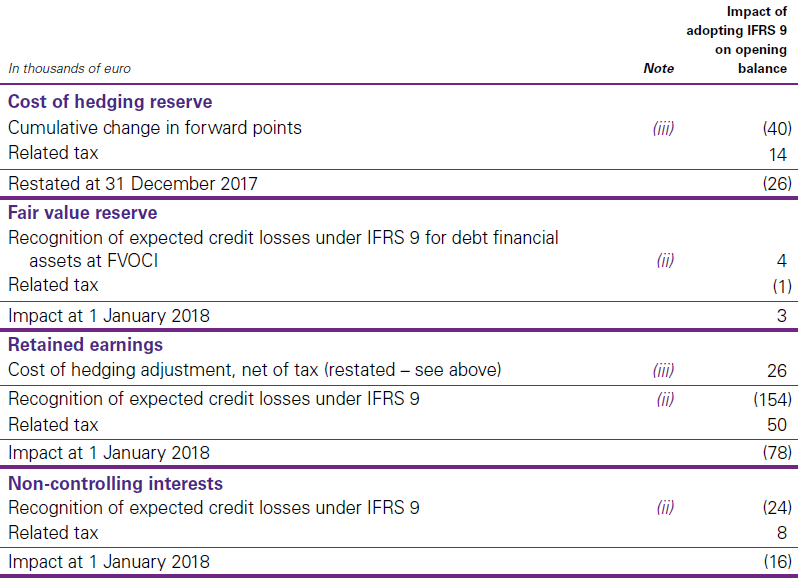

IFRS 9 sets out requirements for recognising and measuring financial assets, financial liabilities and some contracts to buy or sell non-financial items. This standard replaces IAS 39 Financial Instruments: Recognition and Measurement. As a result of the adoption of IFRS 9, the Group has adopted consequential amendments to IAS 1 Presentation of Financial Statements, which require impairment of financial assets to be presented in a separate line item in the statement of profit or loss and OCI. Previously, the Group’s approach was to include the impairment of trade receivables in other expenses. Consequently, the Group reclassified impairment losses amounting to €30 thousand, recognised under IAS 39, from ‘other expenses’ to ‘impairment loss on trade receivables and contract assets’ in the statement of profit or loss and OCI for the year ended 31 December 2017. Impairment losses on other financial assets are presented under ‘finance costs’, similar to the presentation under IAS 39, and not presented separately in the statement of profit or loss and OCI due to materiality considerations. Additionally, the Group has adopted consequential amendments to IFRS 7 Financial Instruments: Disclosures that are applied to disclosures about 2018 but have not been generally applied to comparative information. The following table summarises the impact, net of tax, of transition to IFRS 9 on the opening balance of reserves, retained earnings and NCI (for a description of the transition method, see (iv)).

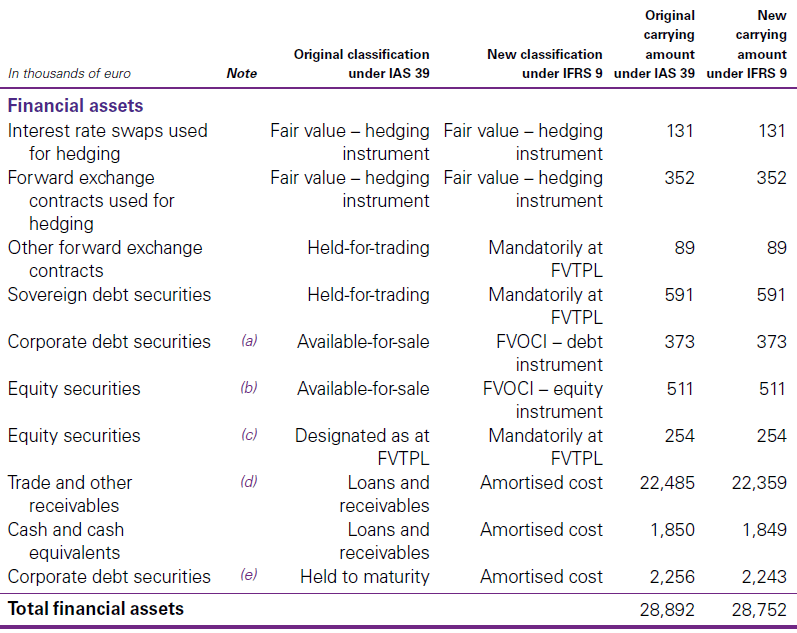

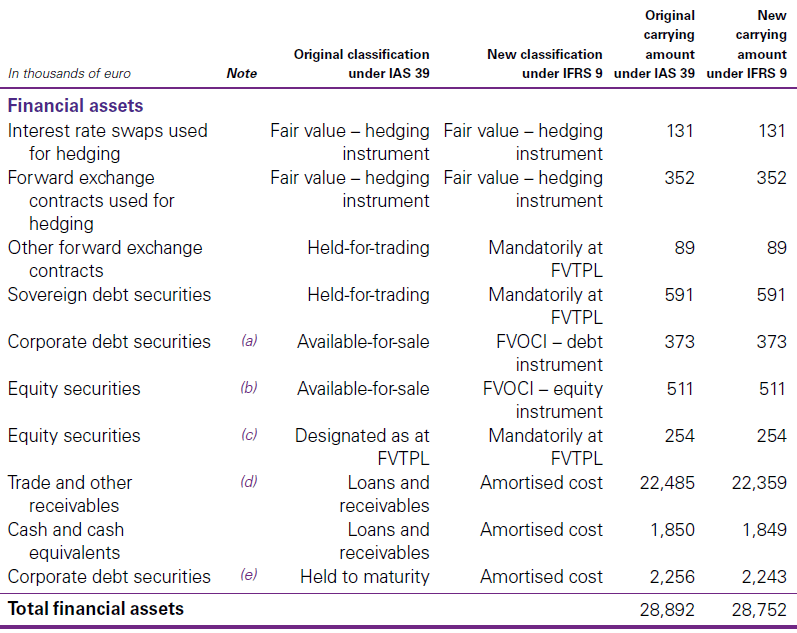

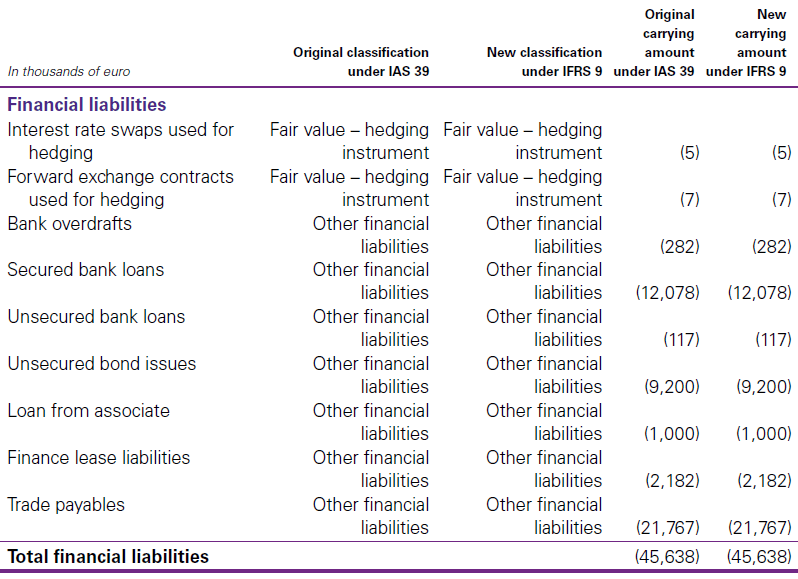

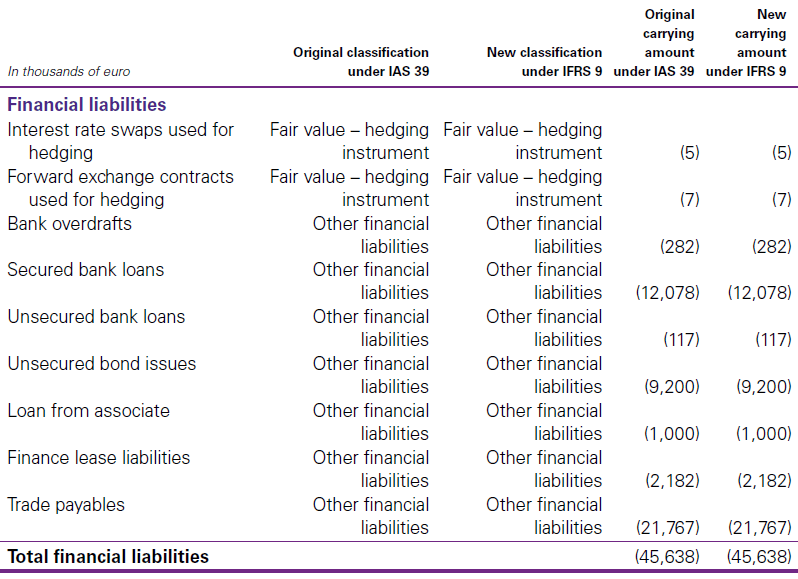

5 – B – i. Classification and measurement of financial assets and financial liabilities IFRS 9 contains three principal classification categories for financial assets: measured at amortised cost, FVOCI and FVTPL. The classification of financial assets under IFRS 9 is generally based on the business model in which a financial asset is managed and its contractual cash flow characteristics. IFRS 9 eliminates the previous IAS 39 categories of held to maturity, loans and receivables and available for sale. Under IFRS 9, derivatives embedded in contracts where the host is a financial asset in the scope of the standard are never separated. Instead, the hybrid financial instrument as a whole is assessed for classification. IFRS 9 largely retains the existing requirements in IAS 39 for the classification and measurement of financial liabilities. The adoption of IFRS 9 has not had a significant effect on the Group’s accounting policies related to financial liabilities and derivative financial instruments (for derivatives that are used as hedging instruments, see (iii)). For an explanation of how the Group classifies and measures financial instruments and accounts for related gains and losses under IFRS 9, see Note 45(O)(ii). |

|

|

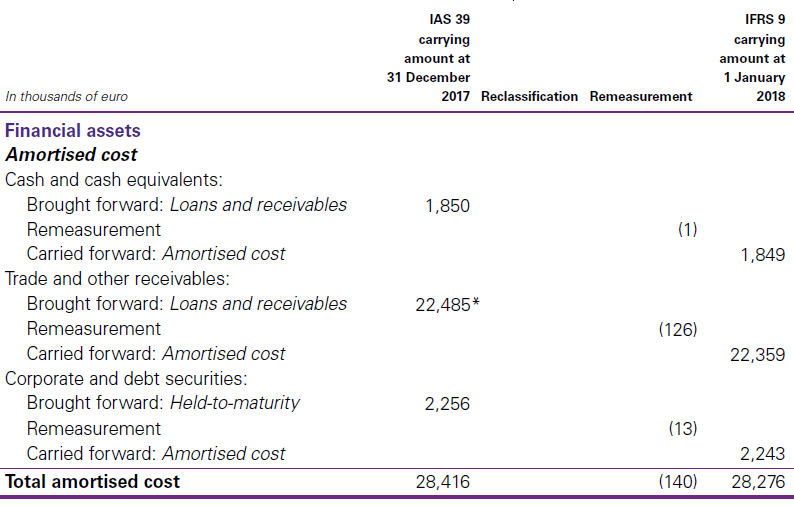

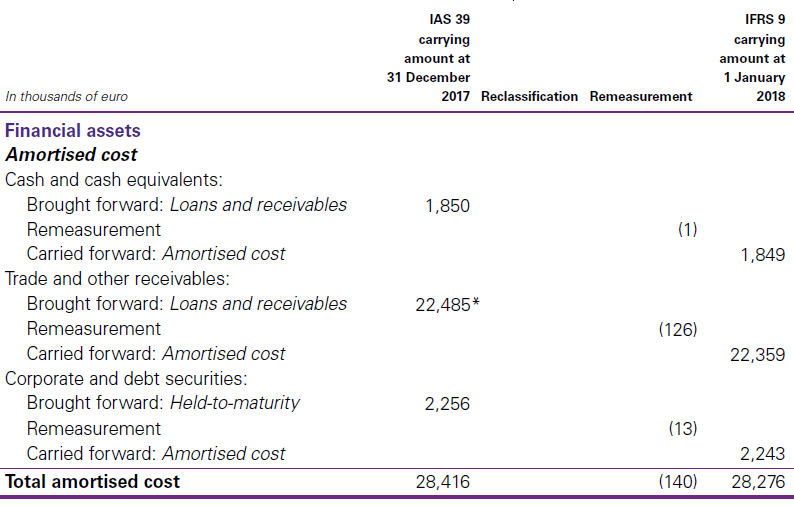

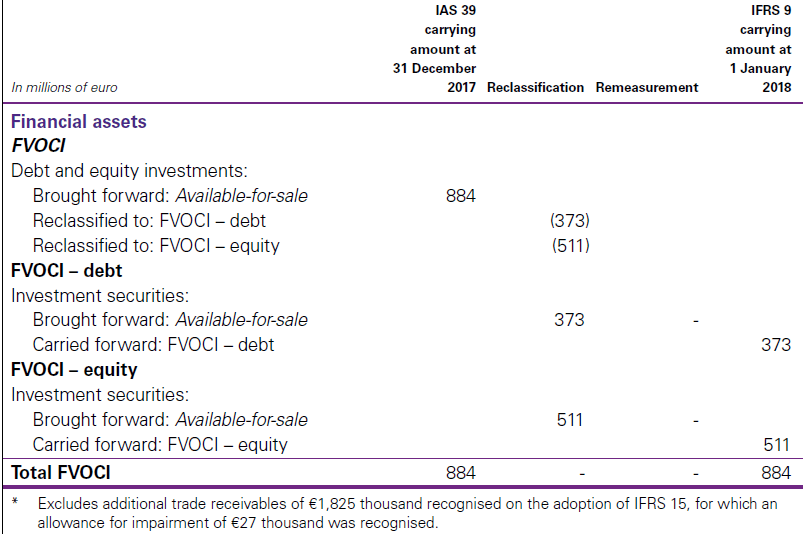

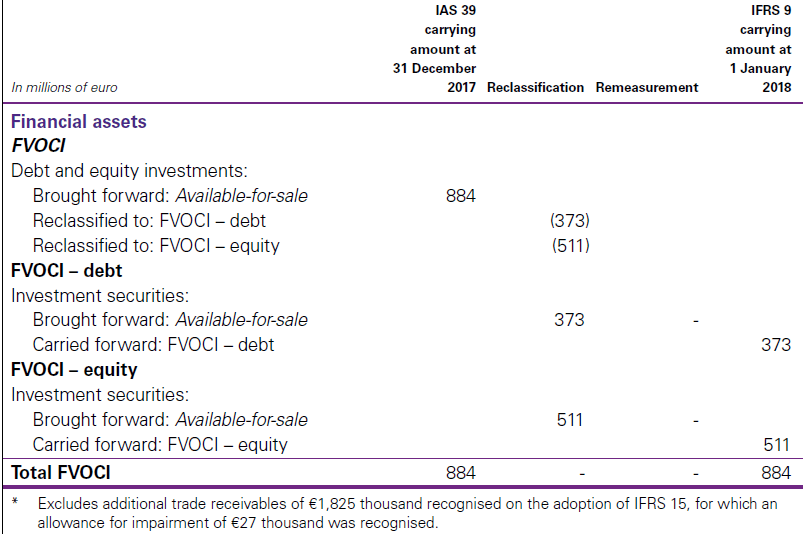

The following table and the accompanying notes below explain the original measurement categories under IAS 39 and the new measurement categories under IFRS 9 for each class of the Group’s financial assets and financial liabilities as at 1 January 2018. The effect of adopting IFRS 9 on the carrying amounts of financial assets at 1 January 2018 relates solely to the new impairment requirements.

|

|

|

(a) The corporate debt securities categorised as available-for-sale under IAS 39 are held by the Group’s treasury unit in a separate portfolio to provide interest income, but may be sold to meet liquidity requirements arising in the normal course of business. The Group considers that these securities are held within a business model whose objective is achieved both by collecting contractual cash flows and by selling securities. The corporate debt securities mature in one to two years and the contractual terms of these financial assets give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. These assets have therefore been classified as financial assets at FVOCI under IFRS 9. On transition to IFRS 9, an allowance for impairment of €4 thousand was recognised as a decrease in opening retaining earnings and an increase in fair value reserves at 1 January 2018. Changes in significant accounting policies (b) These equity securities represent investments that the Group intends to hold for the long term for strategic purposes. As permitted by IFRS 9, the Group has designated these investments at the date of initial application as measured at FVOCI. Unlike IAS 39, the accumulated fair value reserve related to these investments will never be reclassified to profit or loss. Changes in significant accounting policies (c) Under IAS 39, these equity securities were designated as at FVTPL because they were managed on a fair value basis and their performance was monitored on this basis. These assets have been classified as mandatorily measured at FVTPL under IFRS 9. Changes in significant accounting policies (d) Trade and other receivables that were classified as loans and receivables under IAS 39 are now classified at amortised cost. An increase of €126 thousand in the allowance for impairment over these receivables was recognised in opening retained earnings at 1 January 2018 on transition to IFRS 9. Additional trade receivables of €1,825 thousand were recognised at 1 January 2018 on the adoption of IFRS 15, for which an allowance for impairment of €27 thousand was recognised (see (ii) below). These were not included in the table above. Changes in significant accounting policies (e) Corporate debt securities that were previously classified as held-to-maturity are now classified at amortised cost. The Group intends to hold the assets to maturity to collect contractual cash flows and these cash flows consist solely of payments of principal and interest on the principal amount outstanding. An increase of €13 thousand in the allowance for impairment was recognised in opening retaining earnings at 1 January 2018 on transition to IFRS 9. |

|

|

IFRS 9 7.2.15 |

The following table reconciles the carrying amounts of financial assets under IAS 39 to the carrying amounts under IFRS 9 on transition to IFRS 9 on 1 January 2018.

|

|

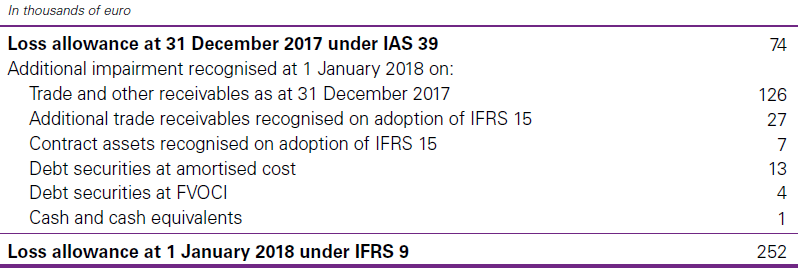

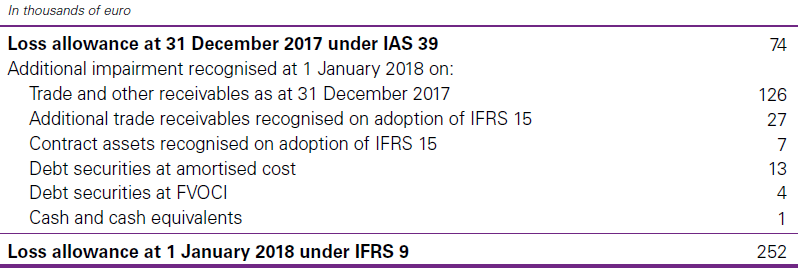

5 – B – ii. Impairment of financial assets Changes in significant accounting policies IFRS 9 replaces the ‘incurred loss’ model in IAS 39 with an ‘expected credit loss’ (ECL) model. The new impairment model applies to financial assets measured at amortised cost, contract assets and debt investments at FVOCI, but not to investments in equity instruments4. Under IFRS 9, credit losses are recognised earlier than under IAS 39 – see Note 45(R)(i). For assets in the scope of the IFRS 9 impairment model, impairment losses are generally expected to increase and become more volatile. The Group has determined that the application of IFRS 9’s impairment requirements at 1 January 2018 results in an additional allowance for impairment as follows. Changes in significant accounting policies |

|

|

|

|

|

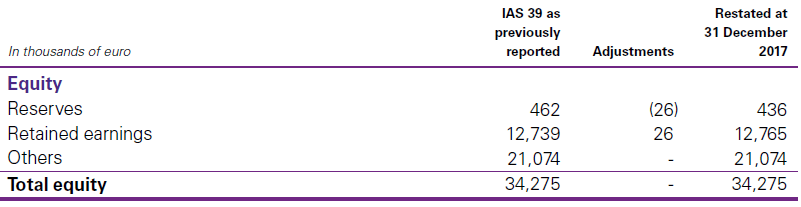

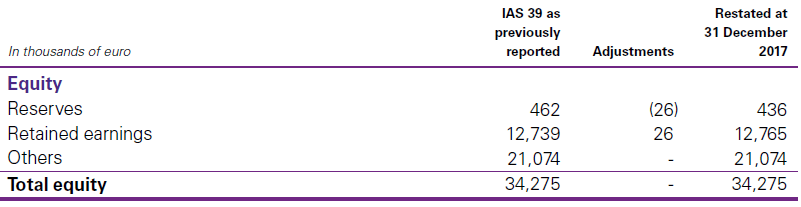

Additional information about how the Group measures the allowance for impairment is described in Note 32(C)(ii). Changes in significant accounting policies 5 – B – iii. Hedge accounting Changes in significant accounting policies The Group has elected to adopt the new general hedge accounting model in IFRS 9. This requires the Group to ensure that hedge accounting relationships are aligned with its risk management objectives and strategy and to apply a more qualitative and forward-looking approach to assessing hedge effectiveness. The Group uses forward foreign exchange contracts to hedge the variability in cash flows arising from changes in foreign exchange rates relating to foreign currency borrowings, receivables, sales and inventory purchases. The Group designates only the change in fair value of the spot element of the forward exchange contract as the hedging instrument in cash flow hedging relationships. Changes in significant accounting policies The effective portion of changes in fair value of hedging instruments is accumulated in a cash flow hedge reserve as a separate component of equity. Under IAS 39, the change in fair value of the forward element of the forward exchange contracts (‘forward points’) was recognised immediately in profit or loss. However, under IFRS 9 the forward points are separately accounted for as a cost of hedging; they are recognised in OCI and accumulated in a cost of hedging reserve as a separate component within equity. Under IAS 39, for all cash flow hedges the amounts accumulated in the cash flow hedge reserve were reclassified to profit or loss as a reclassification adjustment in the same period as the hedged expected cash flows affected profit or loss. However, under IFRS 9, for cash flow hedges of foreign currency risk associated with forecast inventory purchases, the amounts accumulated in the cash flow hedge reserve are instead included directly in the initial cost of the inventory item when it is recognised. The same approach also applies under IFRS 9 to the amounts accumulated in the cost of hedging reserve. Changes in significant accounting policies For an explanation of how the Group applies hedge accounting under IFRS 9, see Note 45(O)(v). Changes in significant accounting policies |

|

|

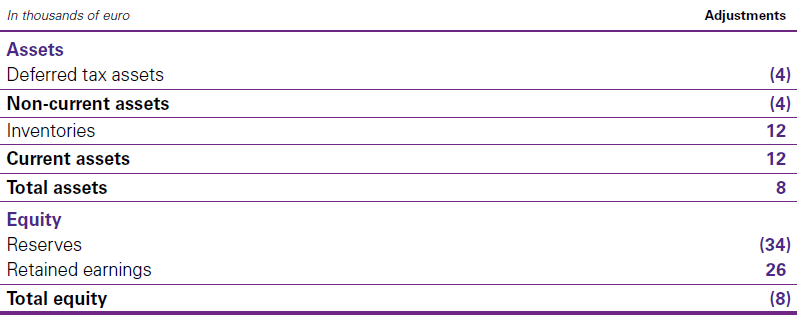

Retrospective application of the costs of hedging approach has had the following effects (net of tax) on the amounts presented for 2017 (for a description of the transition method, see (iv) below). Consolidated statement of financial position – 31 December 2017 Changes in significant accounting policies

At 31 December 2017, the Group held no inventory whose purchase had been subject to hedge accounting. Changes in significant accounting policies |

|

|

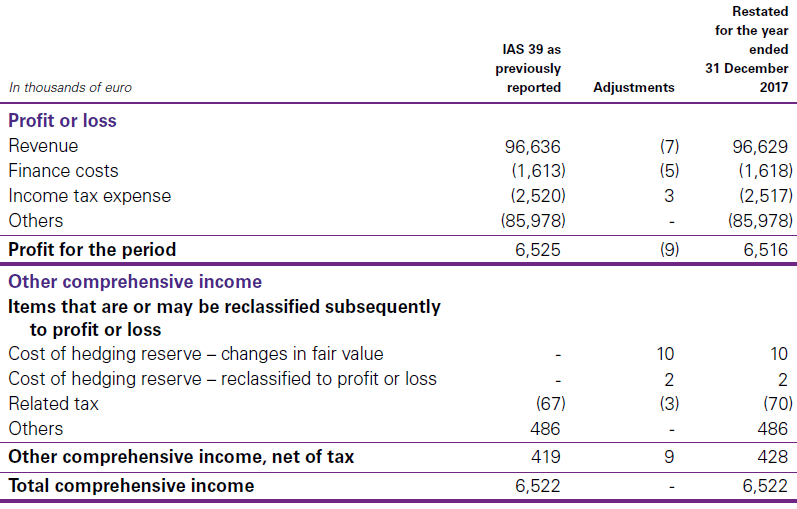

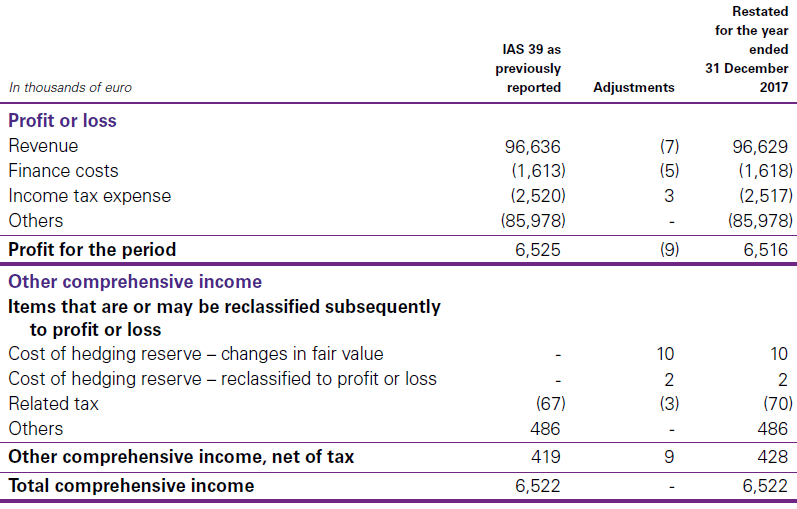

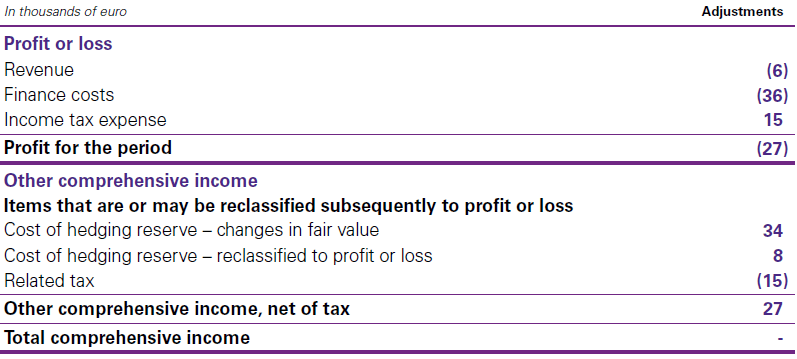

Consolidated statement of profit or loss and other comprehensive income – For the year ended 31 December 2017

|

|

|

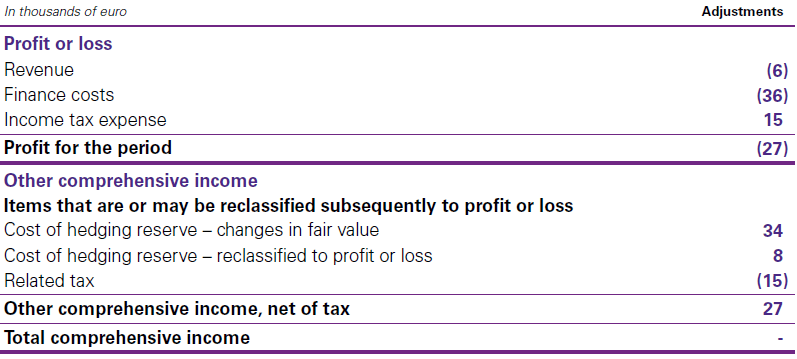

The application of the costs of hedging approach and of the change in policy to include cash flow hedging gains or losses in the cost of inventory had the following effects (net of tax) on the amounts presented for the year ended 31 December 2018. Changes in significant accounting policies Consolidated statement of financial position – 31 December 2018 Changes in significant accounting policies

Consolidated statement of profit or loss and other comprehensive income – For the year ended 31 December 2018

|

|

|

There is no material impact on the Group’s basic or diluted EPS for the years ended 31 December 2018 and 2017. 5 – B – iv. Transition Changes in significant accounting policies Changes in accounting policies resulting from the adoption of IFRS 9 have been applied retrospectively, except as described below.

|

See also: The IFRS Foundation

Continue reading: Performance for the year Changes in significant accounting policies