Cancellations or settlements of equity instruments during the vesting period by the entity or by the counterparty are accounted for as accelerated vesting, and therefore the amount that would otherwise have been recognised for services received is recognised immediately. (IFRS 2.28(a), IG15A.Ex9)

Cancellation by employee

Cancellations by the employee can occur because the employee waives the share-based payment for their own reasons. In our experience, this does not occur often in practice (see case – Voluntary cancellation by employee below). Cancellations will occur more often as a consequence of the employee choosing not to meet a non-vesting condition that is part of the share-based payment arrangement (see case – Cancellation by employee due to failure to meet non-vesting condition below). Failure to meet such a non-vesting condition is treated as a cancellation. (IFRS 2.28A, BC237B)

Case – Voluntary cancellation by employee |

|

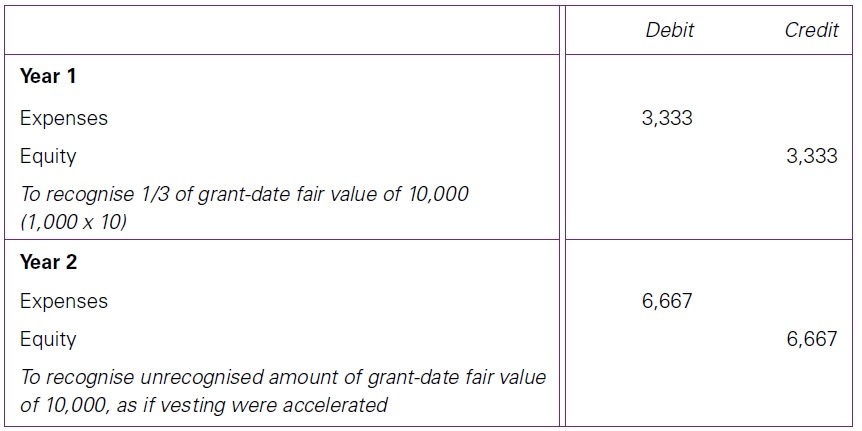

On 1 January Year 1, Company B grants 1,000 share options to its CEO, subject to a three-year service condition. A share option has a grant-date fair value of 10. B expects the CEO to satisfy the service condition, which they do. In Year 2, the CEO waives the entitlement to share options in difficult economic times. B accounts for the transaction as follows.

The example illustrates that the principle of accelerated vesting applies even if the employee voluntarily cancels an unvested share-based payment. |

Case – Cancellation by employee due to failure to meet non-vesting condition |

|

On 1 January Year 1, Company C grants 1,000 shares for no consideration to one employee, subject to a three-year service condition and a requirement for the employee to acquire and hold another 1,000 shares until vesting date (a non-vesting condition; ‘participation shares’). If the employee sells the participation shares during the vesting period, then they do not receive the share-based payment. The grant-date fair value of the equity instruments granted considering the effect of the non-vesting condition is 10. In Year 2, the employee sells the participation shares. C accounts for the share-based payment in the same way as for the case – Voluntary cancellation by employee above – i.e. the unrecognised grant-date fair value is recognised in Year 2. |

Cancellation by entity

If the entity cancels a grant of a share-based payment, then employees may expect compensation for the cancellation. (IFRS 2.BC233)

Payments made in exchange for the cancellation are accounted for as repurchases of an equity interest to the extent that the payment does not exceed the fair value of the equity instruments granted, measured at the repurchase date. (IFRS 2.28(b), 29)

If the payment made in exchange for the cancellation exceeds the fair value of the equity instruments granted, then the excess is recognised as an expense. The same principles apply to a repurchase of vested equity instruments. (IFRS 2.28(b), 29)

Case – Cancellation by employer with compensation payment |

|

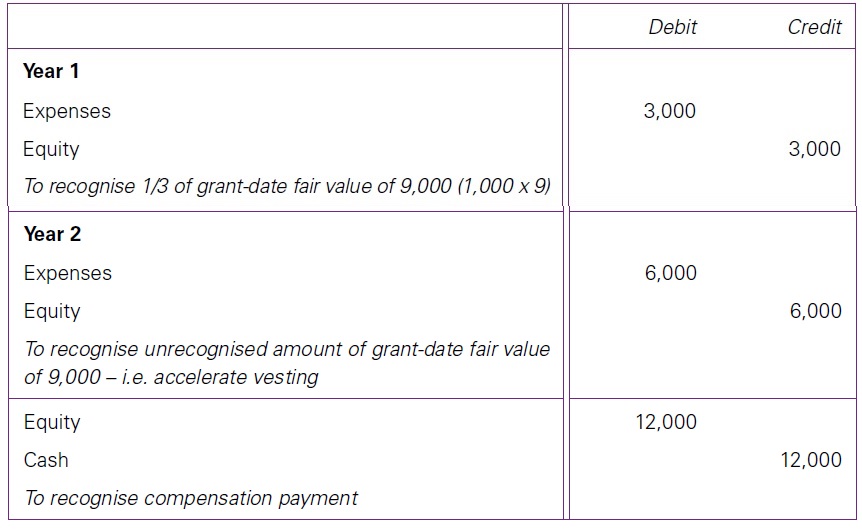

On 1 January Year 1, Company D grants 1,000 share options to an employee, subject to a three-year service condition. The grant-date fair value of a share option is 9. At the end of Year 2, when the fair value of a share option is 18, D offers to cancel the arrangement by paying a pro rata cash compensation based on the current fair value that reflects the proportion of the services provided to the services required under the plan. The offer amounts to 12,000 (1,000 x 18 x 2/3) and the employee accepts; payment is made immediately. D accounts for the transaction as follows.

In this case, there is no additional expense to account for when the payment is made because the payment of 12,000 does not exceed the fair value of the equity instruments granted measured at repurchase date of 18,000 (1,000 x 18). |

For a discussion of a failure to provide service because of the termination of an employee’s employment by the employer, see Forfeiture or cancellation.

Accelerated amount

As indicated in the introduction above, the amount recognised when a share-based payment is cancelled is the amount that would otherwise have been recognised over the remainder of the vesting period if the cancellation had not occurred. The standard is not clear about what is meant by “the amount that otherwise would have been recognised for services received over the remainder of the vesting period” – i.e. whether it refers to the number of instruments that could have vested or that were expected to vest. (IFRS 2.28(a))

In our view, an entity should choose an accounting policy, to be applied consistently, to follow either of the following approaches. (IFRS 2.27)

- The share-based payment is recognised as if the service and the non-market performance conditions were met for the cancelled awards – i.e. those not forfeited already. This approach is supported by the wording in IFRS 2 that requires recognition for those equity instruments that were granted unless those equity instruments do not vest (Approach A).

- The amount that would have been recognised is based on an estimate on the date of cancellation – i.e. estimating how many instruments are expected to vest at the original (future) vesting date. This approach is based on the view that on an ongoing basis the entity would have recognised only the grant-date fair value of those instruments that were expected to vest (Approach B).

|

|

|

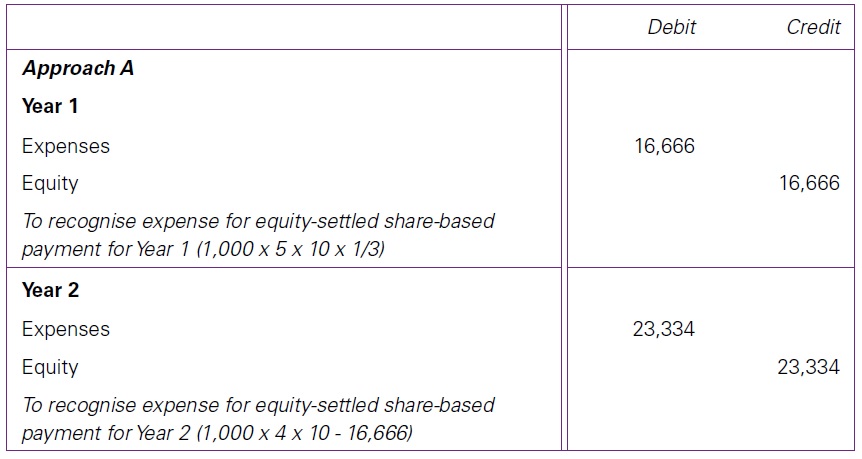

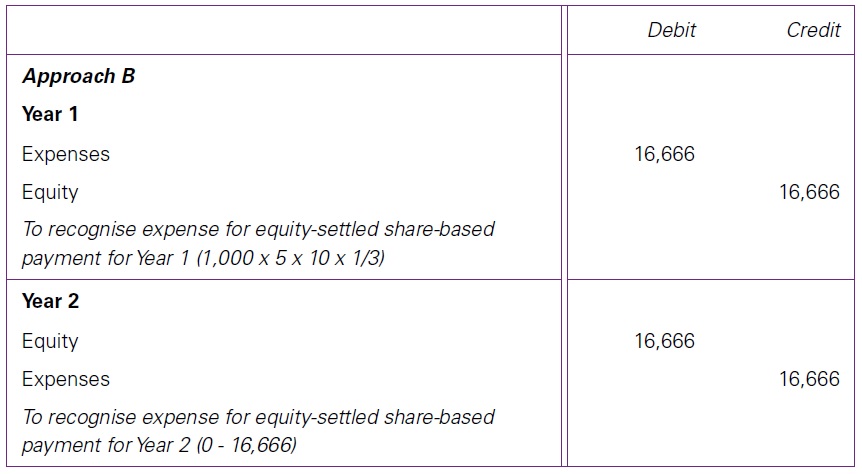

On 1 January Year 1, Company E grants 1,000 share options to each of its five employees, subject to a three-year service condition and a profit target. The grant-date fair value of a share option is 10. At grant date, E expects all five employees to stay employed and the profit target to be met. At the end of Year 2, one employee has already left and three of the remaining four employees are expected to remain employed. However, E no longer expects the profit target to be met and cancels the share-based payment. E accounts for the transaction as follows.

Under Approach A, the grant-date fair value of the equity instruments granted is recognised, except for those granted to the employee who has already left.

Under Approach B, the previously recognised portion of the grant-date fair value of the equity instruments is reversed, because no equity instruments would have been expected to meet the non-market performance condition under the original terms, estimated at the date of cancellation. Because E estimates at the cancellation date that the share-based payment would have been forfeited, the share-based payment expense is trued up to an estimate of zero. |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments Cancellation of employee share-based payments