IFRS 16 Variable lease payments

Variable lease payments that depend on an index or rate are initially included in the lease liability using the index or rate as at the commencement date of the lease (IFRS 16.27(b)).

Context of this narrative

In IFRS 16 Leases several conditions are included in the calculation/measurement of the lease liability. The payments included in the measurement and remeasurement of the lease liability comprise:

- amounts expected to be payable under a residual value guarantee;

- the exercise price of an option to purchase the underlying asset that the lessee is reasonably certain to exercise;

- payments for terminating the lease unless it is reasonably certain that early termination will not occur;

- variable lease payments that depend on an index or rate (see below payments that depend on an index and payments that depend on a rate); and

- fixed payments (including in-substance fixed payments), less any lease incentives receivable (IFRS 16.27).

In contrast, the following payments are excluded from the lease liability:

- variable lease payments that depend on sale or usage of the underlying asset (see below); and

- payments for non-lease components, unless the lessee elects to combine lease and non-lease components (see Lease and non-lease components) (IFRS 16.15, BC135, BC168–BC169).

Variable lease payments that depend on an index or rate

This approach applies to, for example, payments linked to a consumer price index (CPI), payments linked to a benchmark interest rate (e.g. LIBOR) or payments that are adjusted to reflect changes in market rental rates (IFRS 16.28).

Reassessment of the lease liability

After the commencement date, lessees are required to remeasure the lease liability to reflect changes to the lease payments arising from changes in the index or rate. Any remeasurement is generally adjusted against the right-of-use asset (IFRS 16.36(c), IFRS 16.39).

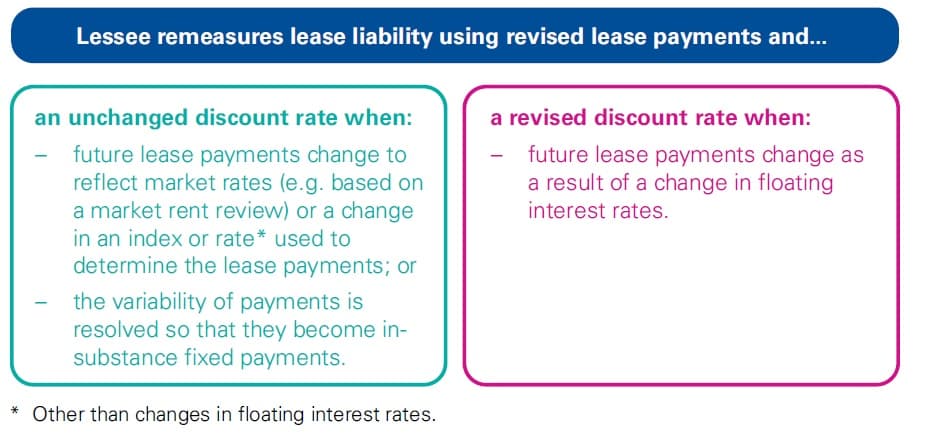

Lessees reassess the lease liability by discounting the revised lease payments in the following scenarios (IFRS 16.42(b), IFRS 16.43, IFRS 16.B42).

Payments that depend on an index

On lease commencement, variable lease payments that depend on an index are measured using the index as at the commencement date of the lease (IFRS 16.27(b)).

When the change in future lease payments is a result of a change in an index (or rate), the lessee remeasures the liability using an unchanged discount rate (IFRS 16.42(b), IFRS 16.43).

Worked example – Payments that depend on an indexIFRS 16.27–28, IFRS 16.39, IFRS 16.42(b), IFRS 16.43, IFRS 16.IE6 |

|

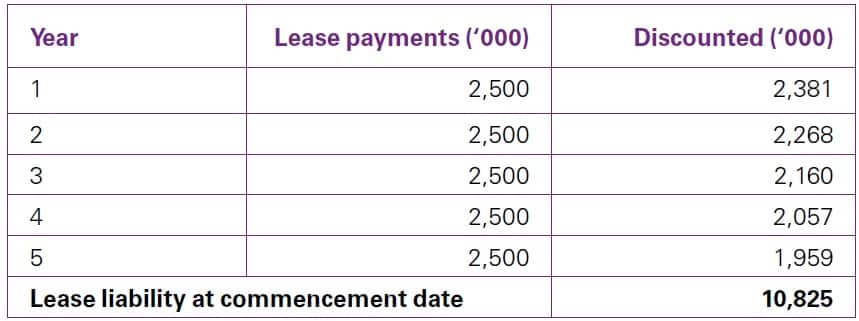

Company Y rents an office building. The lease term is five years and the initial annual rental payment is 2.5 million. Payments are made at the end of each year. The rent will be reviewed every year and increased by the change in the CPI. The discount rate is 5%. Initial measurement of the lease liability To measure the lease liability on commencement, Y assumes an annual rental of 2.5 million.

Subsequent measurement of the lease liability During Year 1, the CPI increases from 100 to 105 (i.e. the rate of inflation over the preceding 12 months is 5%). Because there is a change in the future lease payments resulting from a change in the CPI, which is used to determine those lease payments, Y needs to remeasure the lease liability. At the end of Year 1, Y calculates the lease payment for Year 2 as 2.6 million (2.5 million x (105 / 100)). Accordingly, Y remeasures the lease liability as follows. The subsequent remeasurement of the lease liability is adjusted against the right-of-use asset.

|

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Worked example – Amortisation of lease liability and change in payment linked to an index |

|

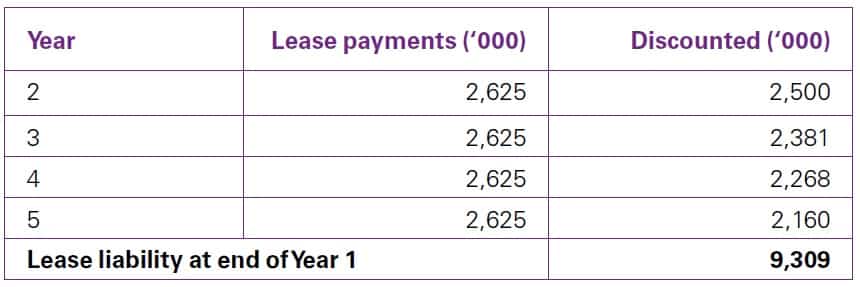

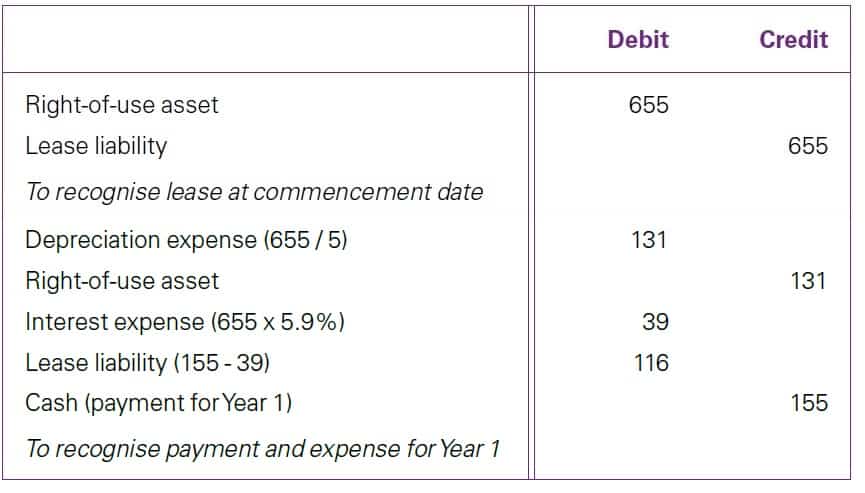

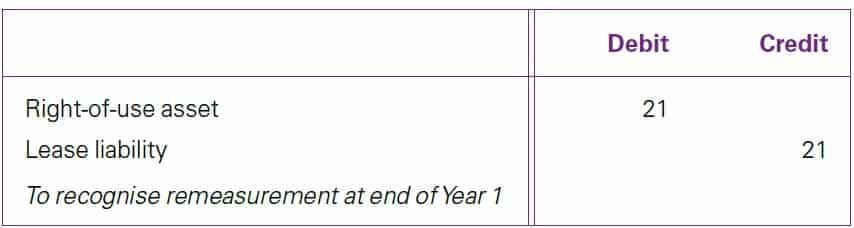

Lessee Y enters into a lease for a five-year term with Lessor L for a retail building, commencing on 1 January. Y pays 155 per year, at the end of each year. Y’s incremental borrowing rate is 5.9%. Additionally, the lease contract states that the lease payments for each year will increase on the basis of the increase in the CPI for the preceding year. At the commencement date, the CPI for the previous year is 120 and the lease liability is 655, based on annual payments of 155 discounted at 5.9%. Assume that initial direct costs are zero and there are no lease incentives, prepayments or restoration costs. Y records the following entries for Year 1.

Subsequent reassessment of lease liability at end of Year 1 At the end of Year 1, the CPI increases to 125. Y calculates the revised payments for Year 2 and beyond, adjusted for the change in CPI as 161 (155 x 125 / 120). Because the lease payments are variable payments that depend on an index, Y adjusts the lease liability to reflect the change based on an unchanged discount rate. The adjustment is calculated as the difference between the original lease payments (155) and the reassessed payment (161) over the remaining four-year lease term, discounted at the original discount rate of 5.9%.

|

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Case – Variable lease payments dependent on an indexEntity Q enters into a ten-year lease of a property with annual payments of CU5,000 payable at the beginning of each year. The agreement specifies that the lease payments will increase every two years based on the increase in the consumer price index for the preceding 24 months. The Consumer Price Index at commencement is 125. Entity Q estimates its incremental borrowing rate at 5% per annum; i.e. the fixed rate at which it could borrow for the amount equivalent to the value of the right-of-use asset for the same term and in the same currency. Resulting accounting under IFRS 16 Leases At the end of year two, the lease liability is CU33,932, being the present value of the eight remaining payments of CU5,000. The consumer price index is 135, and the rental payment for year three is set at CU5,400, being “CU5,000 X 135 / 125”. Because there is a change in the future lease payments, Entity Q remeasures the lease liability to reflect the net present value of the eight remaining payments of CU5,400, discounted at the original discount rate of 5%. This increases the lease liability by CU2,714. This is the difference between the lease liability of CU33,932 and the remeasured liability of CU36,646. A corresponding adjustment is made to the right-of-use asset. |

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Food for thought – What common types of indices do lease payments depend on? |

|

In practice, it is common for lease agreements to include periodic rent review clauses that depend on a published index. These clauses adjust contracted lease payments to reflect changes in inflation measures and other factors.

|

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

When does the guidance apply? |

||||||

|

The guidance described above applies only when the lease payments depend on the future – i.e. uncertain – level of an index. It does not apply to fixed uplifts designed to reflect expected changes in an index. Consider two different rent adjustment clauses, as follows.

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments |

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

What if a rent review mechanism contains an embedded derivative?IFRS 16.BC81 |

|

Under IFRS, derivatives embedded in a lease that are considered not closely related to the lease host have to be separated and accounted for under IFRS 9 Financial Instruments. This is because although IFRS 16 includes requirements for features of a lease that may meet the definition of a derivative (e.g. options), the new standard was not developed with accounting for derivatives in mind. As an example, a lease agreement with variable lease payments adjusted for two times the change in CPI needs to be separated and accounted for under IFRS 9 because the feature is considered leveraged. Conversely, an inflation-indexed embedded derivative in a lease contract may be considered closely related to the lease if:

In this case, the feature is not separated and, instead, the whole payment is accounted for under IFRS 16. |

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Payments that depend on a rate

Consistent with payments that depend on an index, variable lease payments that depend on a rate are initially measured using the rate as at the commencement date of the lease (IFRS 16.27(b), IFRS 16.39, IFRS 16.42(b)).

The lease liability is subsequently remeasured if the variable lease payments change as a result of a change in the relevant rate (e.g. LIBOR). IFRS 16 Variable lease payments

The lessee remeasures the liability using an unchanged discount rate when the change in future lease payments results from a change in a rate, with the exception of floating interest rates (IFRS 16.42(b), IFRS 16.43).

In the case of a floating interest rate, the lessee revises the discount rate for the change in the interest rate.

|

Worked example – Payments that depend on a rate: Initial measurement and subsequent remeasurement |

|

Lessee C enters into a five-year lease of a car. The lease payments are paid at the beginning of each year and are determined as follows.

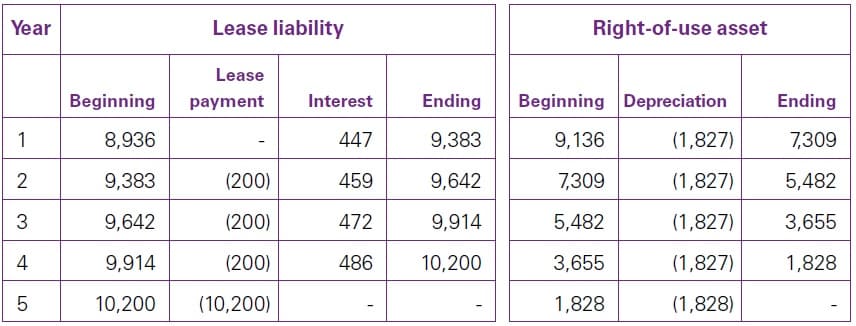

Initial measurement of the lease liability On commencement, C determines the lease liability as follows.

At commencement, C makes the payment for Year 1 and then measures the lease liability and right-of-use asset as follows.

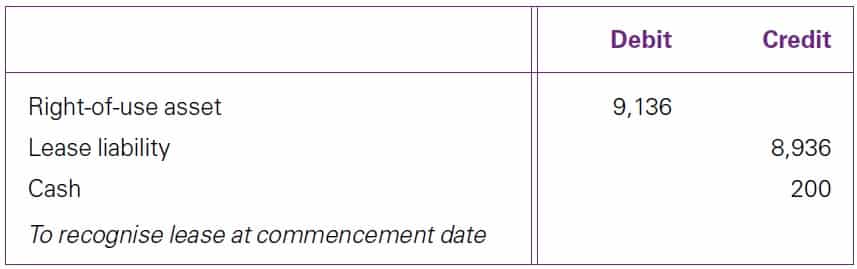

At commencement, C records the following entry.

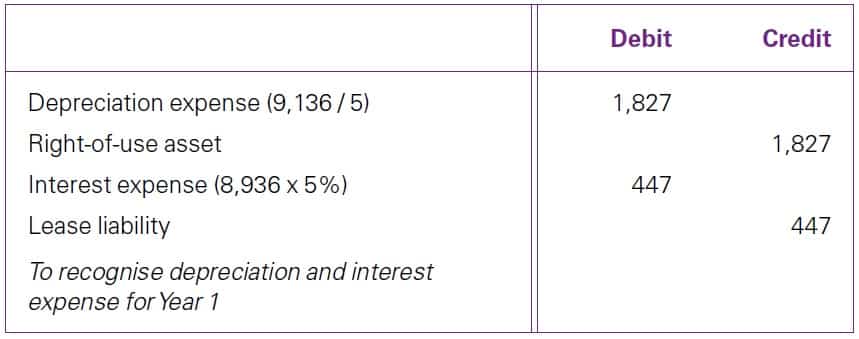

At the end of year 1, C records the following entries.

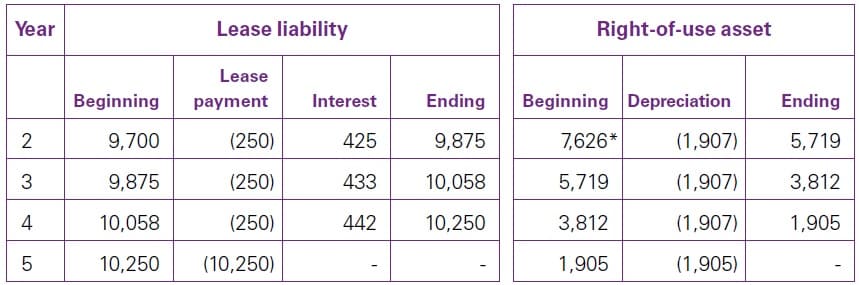

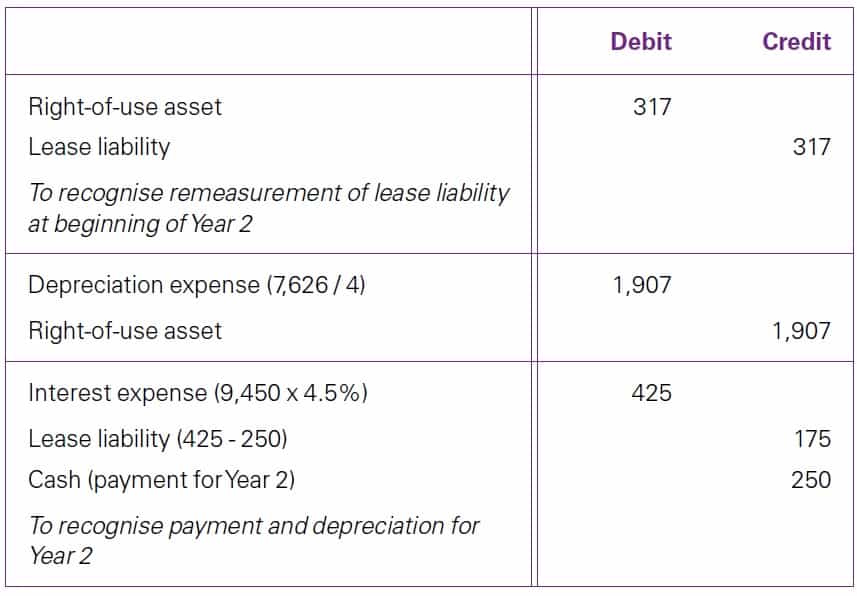

At the beginning of Year 2, LIBOR increases to 2.5%. Using a revised discount rate of 4.5%, B remeasures the lease liability and right-of-use asset, and then makes payment for Year 2.

Subsequent reassessment of the lease liability – Year 2 Because the lease payments are determined using LIBOR at the date of payment, the lease payment for Year 2 is 250 (10,000 x 2.5%). C records the following entries during Year 2.

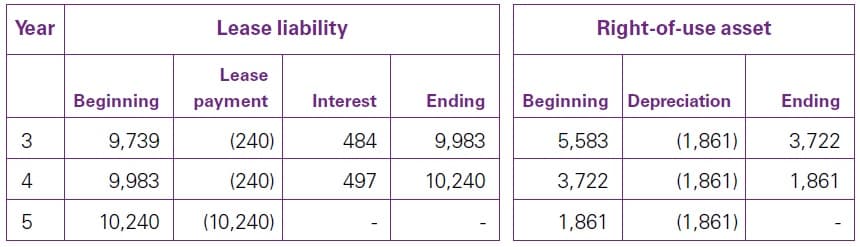

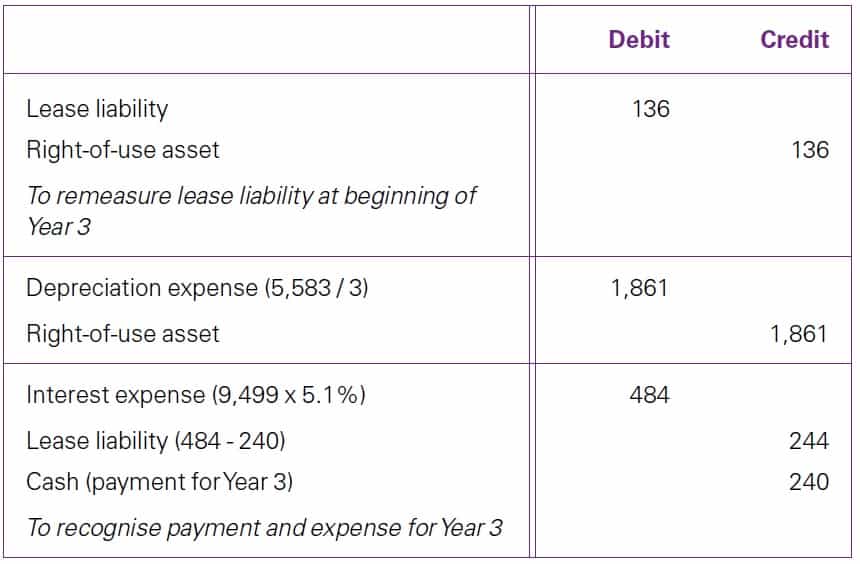

Subsequent reassessment of the lease liability – Year 3 At the start of Year 3, LIBOR decreases to 2.4% and C’s discount rate is revised to 5.1%. C remeasures its lease liability and right-of-use asset, and then makes payment for Year 3.

During year 3, C records the following entries.

|

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Lessor considerations

There are no differences in the identification of lease payments for lessees and lessors regarding lease payments that depend on an index or a rate, though the accounting consequences may be different due to the different accounting models for lessees and lessors.

Payments that depend on sales or usage

Variable lease payments that depend on sales or usage of the underlying asset are excluded from the lease liability. Instead, these payments are recognised in profit or loss in the period in which they occur (IFRS 16.BC168–BC169).

Worked example – Payments that depend on usage |

| Lessee B enters into a 15-year lease of a wind farm. The lease payments are based on usage.

Forecasts show that lease payments for the ‘expected case’ are 1 million per annum, and historical climate data indicate that lease payments for the ‘extreme low case’ are 700,000 per annum. To determine the payments to include in the lease liability, B considers the following.

B concludes that although it is unlikely that the lease payments will fall below the ‘extreme low case’, the contract does not include any unavoidable lease payments. Therefore, the lease liability is measured at zero. |

Worked example – Variable lease payments linked to sales |

|

Entity Q enters into a ten-year lease of a property with annual payments of CU5,000 payable at the beginning of each year. The agreement specifies that the lease payments will increase every two years based on the increase in the consumer price index for the preceding 24 months. The Consumer Price Index at commencement is 125. Entity Q estimates its incremental borrowing rate at 5% per annum; i.e. the fixed rate at which it could borrow for the amount equivalent to the value of the right-of-use asset for the same term and in the same currency. Entity Q is also required to make variable lease payments equal to 0.1% of sales generated from the leased property. At commencement, the lease liability is measured at the same amount as in the first case above. This is because the additional lease payments, while variable, are linked to future sales rather than an index or rate. As a result, they do not meet the definition of lease payments under IFRS 16 and are not included in the measurement of the lease liability or the right-of-use asset. Resulting accounting under IFRS 16 Leases Variable lease payments |

Worked example – Variable payments that are not directly proportional to sales |

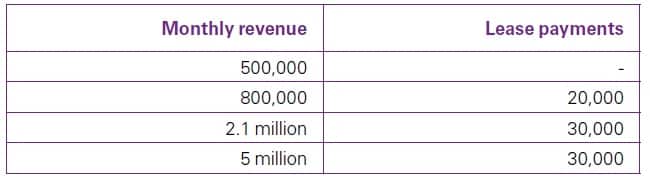

| Company X leases a space for a new store. Historically, X’s stores generate an average of 900,000 in revenue per month.

The monthly lease payments for the new store are determined with reference to staggered sales targets as follows.

For example, in the following scenarios, the lease payments are as follows.

X considers the following in evaluating whether the variable lease payments are in-substance fixed.

X concludes that even though the lease payments are not directly proportional to sales (i.e. not determined as a percentage of sales), the lease payments are still variable (i.e. there is no in-substance fixed minimum) and depend on sales. The existence of a historical average or similar benchmark also does not create a fixed minimum. Accordingly, X excludes the monthly lease payments from its measurement of the lease liability and measures the lease liability at the commencement of the lease as zero. |

Worked example – Lease of steel kegs at no cost |

|

Company B is a producer of beer that delivers goods sold to its customers in re‑useable steel kegs. The customer has an obligation to return the kegs to B. As a part of B’s arrangement with its customer (Restaurant R), B provides R with the steel kegs at no cost. In return, R agrees to the following arrangement.

B and R conclude that:

To determine whether the payments are variable or in-substance fixed payments, B and R consider the following.

Accordingly, R measures the lease liability at the commencement date as zero and recognises amounts allocated to the lease component in profit or loss as the transactions occur. R has the option to elect the recognition exemptions for short-term and low-value leases. In practice, it’s likely that both recognition exemptions could apply to a lease of beer kegs; however, R may still be required to provide disclosures under IFRS 16. The recognition exemption does not apply to B. |

Worked example – Lease payments based on output of solar plant |

| Utility Company C enters into a 20-year contract with Power Company D to purchase electricity produced by a new solar farm.

C and D assess that the contract contains a lease. There are no minimum purchase requirements, and no fixed payments that C is required to make to D. However, C is required to purchase all of the electricity produced by the solar plant at a price of 10 per unit. C notes that it is highly probable that the solar plant will generate at least some electricity each year. However, the whole payment that C makes to D varies with the amount of electricity produced by the solar farm – i.e. the payments are fully variable. Therefore, C concludes that there are no in-substance fixed lease payments in this contract. C recognises the payments to D in profit or loss when they are incurred. |

IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments

Food for thought – Could a lessee’s lease liability differ from the amount that it expects to pay? |

|

Yes – as described above, lease payments that depend on a variable other than an index or rate are not included in a lessee’s lease liability unless they meet the definition of an ‘in-substance fixed lease payment’ (see In-substance fixed payments). Where payments based on future activities of the lessee (i.e. on performance or usage) are avoidable and contain genuine variability, it is inappropriate to impute an ‘in-substance fixed minimum’ lease payment. This is because even if a ‘bottom slice’ of payments is highly likely to be paid, the payments still depend on an underlying variability. Identifying an in-substance minimum would create practical difficulties – e.g. identifying the point in the distribution of possible outcomes judged to be ‘in-substance fixed’, and determining how to apply the reassessment guidance. Accordingly, there may be a significant difference between the amounts that a lessee expects to pay and the lease liability that it recognises. |

Case – Variable lease payments becoming fixed

Entity S enters into a four-year lease for a specialised photocopier. The lease payments are CU500 per month if the copier is used to produce 100,000 copies or less over the lease term. If the copier is used to make more than 100,000 copies, then the monthly rental is adjusted to CU700 per month (which is applied from the commencement of the lease).

The copier exceeds 100,000 copies at the start of year three. At this point Entity S is required to make a catch-up payment of CU4,800. The remaining payments are adjusted upwards to CU700 per month.

Resulting accounting under IFRS 16 Leases

On commencement the lease liability is based on lease payments of CU500 per month.

At the start of year three the catch-up payment is recorded in profit or loss. The right-of-use asset and lease liability are adjusted for the increase of CU 200 per month for the remaining lease term (on a discounted basis). This is because these payments have become in-substance fixed payments.

Closing case – Property tax payments

A contract to lease a building specifies that the lessee must reimburse the lessor for property taxes paid. While this tax will ultimately be paid by the lessee, it isn’t a tax obligation of the lessee because the taxing authority imposes the tax on the lessor, as owner of the property.

The lessee needs to ascertain whether this represents a lease payment and, if so, whether it is variable based on an index or a rate and therefore should be included when calculating the right-of-use asset and lease liability.

Resulting accounting under IFRS 16 Leases

This represents a lease payment. Whether or not it is included in the lease liability will depend on whether it represents a variable payment based on an index or rate, and the exact wording used in the lease agreement to describe the payment will be key. There are mixed views within the marketplace on this issue. While the answer will ultimately be driven by the facts and circumstances specific to each situation, judgement will be required and as a result we expect some diversity in practice to arise.

Also read: the CPA Journal

IFRS 16 Variable lease payments

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.