Last update 23/12/2019

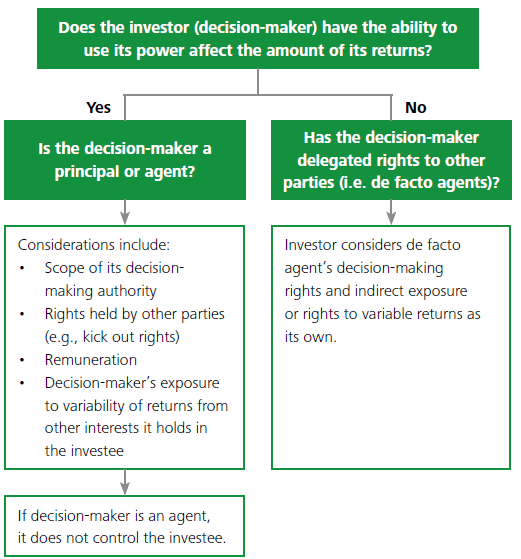

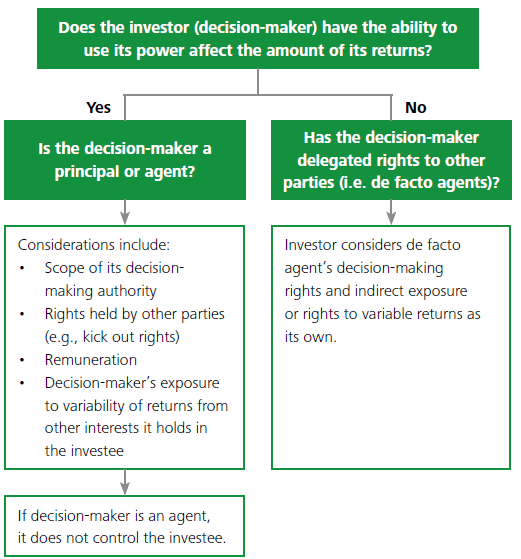

Agency relationships in consolidation – An investor with decision making rights has to determine whether it is a principal or an agent. An ‘agent’ is defined as ‘a party primarily engaged to act on behalf and for the benefit of another party or parties (the principal(s)) and therefore does not control the investee when it exercises its decision making authority’.

Thus, sometimes a principal’s power may be held and exercisable by an agent, but on behalf of the principal. An investor that is an agent does not control an investee when it exercises decision making rights delegated to it. Agency relationships in consolidation

Principal versus Agent Agency relationships in consolidation

To determine whether a decision maker is an agent, it shall consider the overall relationship between itself, the investee being managed and other parties involved with the investee. ALL the following factors also need to be considered unless a single party holds substantive rights to remove the decision maker without cause. Agency relationships in consolidation

|

Scope of decision making authority

|

Rights held by other parties Substantive rights may affect the decision maker’s ability to direct relevant activities

|

|

|

Remuneration The greater the magnitude of and variability associated with the decision maker’s remuneration in relation to the returns expected, the more likely that the decision maker is a principal. A decision maker cannot be an agent unless the following conditions are present

|

Decision maker’s returns from other interests in the investee A decision maker shall consider its exposure to variability of returns from its other interests in the investee in assessing whether it is an agent, in doing this the following are considered

|

As a further clarification of the Principal versus Agent assessment the following example is provided: Agency relationships in consolidation

| Pluto owns 68% of Jupiter and the remaining 32% is owned by Mars.

Pluto appoints Mars which is a management company to run its investment entity Jupiter. Mars is paid fixed and performance fees in relation to the services provided. This, in combination with the return on investment creates exposure to variability in return. Pluto has the right to remove Mars as the management company of Jupiter if it so wishes. Conclusion: Pluto has power as Pluto has substantive rights to remove Mars if it so wishes therefore Mars is an agent and not a principal therefore Mars would not need to consolidate Jupiter. |

In summary – Agency relationships in consolidation:

See also: The IFRS Foundation