Last update 06/01/2020

Accrued benefit – the amount of a participant’s benefit obligation (i.e. his/her right to a retirement pension at a certain moment in time) (whether or not vested) in a pension plan as of a specific date that is determined in accordance with the terms of the retirement plan and based on compensation (if applicable) and years of service to that date.

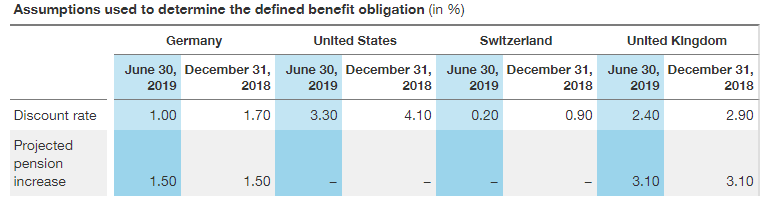

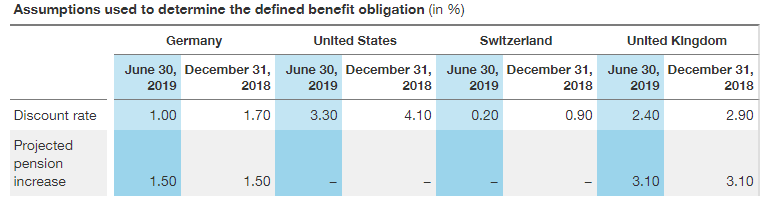

The actuary calculates the expected future pension payments for each participant in the plan using the company’s participant data and plan provisions. These future benefit payments consider the individual’s compensation and service history, and when that individual might be expected to die, quit, become disabled or retire. The amount of this obligation is determined based on a number of assumptions, including the following:

- Estimated future pay raises Accrued benefit

- Estimated employee mortality rates Accrued benefit

- Estimated interest costs

- Estimated remaining employee service periods

- Amortization of prior service costs

- Amortization of actuarial gains or losses

The amount of this liability is then reduced to its present value to derive the pension benefit obligation. This amount is then compared to the current funding of a plan to determine how much additional funding is needed. This examination is useful for determining the future payout obligations of a business.

Defined benefit pension schemes

Accrued benefits only arise in defined benefit pension schemes

A defined benefit plan provides members with a defined pension income when they retire. These are usually workplace pensions arranged by your employer. They’re sometimes called ‘final salary’ or ‘career average’ pension schemes, depending on how rights to a retirement pension are granted.

What a participant receives

How much retirement pension a participant receives depends on your pension scheme’s rules, not on investments or how much you’ve paid in. Workplace schemes are usually based on a number of things, for example your salary and how long you’ve worked for your employer.

The pension provider will promise to give you a certain amount each year when you retire.

Disclosure of assumptions a defined benefit obligation

See also: The IFRS Foundation